Korea

-

DATABASE (25)

-

ARTICLES (36)

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

CFO, CMO and co-founder of RecyGlo

Initially trained as an electrical engineer at Thanlyin Technological University in 2009, Okka Phyo Maung went on to obtain a joint degree in American studies, sustainable and green tech from Colorado State University and Daejeon University in South Korea. He also provided research and technical support for two local universities while studying in Korea.In 2013, he went to study at Vesalius College in Brussels and graduated in business administration in 2017. While living in Brussels, he gained work experience as a data analyst at Management Centre Europe and was a cost consultant at Bridgewater Consulting.In Myanmar, he has worked as a project coordinator for the construction of telecoms towers in 2013. He was also an advisory consultant for accounting firm EY’s financial due diligence projects. In 2018, he began working full-time as the CFO and CMO of RecyGlo, Myanmar’s first waste management and recycling tech company.

Initially trained as an electrical engineer at Thanlyin Technological University in 2009, Okka Phyo Maung went on to obtain a joint degree in American studies, sustainable and green tech from Colorado State University and Daejeon University in South Korea. He also provided research and technical support for two local universities while studying in Korea.In 2013, he went to study at Vesalius College in Brussels and graduated in business administration in 2017. While living in Brussels, he gained work experience as a data analyst at Management Centre Europe and was a cost consultant at Bridgewater Consulting.In Myanmar, he has worked as a project coordinator for the construction of telecoms towers in 2013. He was also an advisory consultant for accounting firm EY’s financial due diligence projects. In 2018, he began working full-time as the CFO and CMO of RecyGlo, Myanmar’s first waste management and recycling tech company.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

Co-Founder and CEO of Qraved

Korean-born, US-raised Steve Kim graduated from Yonsei University in South Korea and holds an MBA from INSEAD in Singapore. Steve worked in Mirae Asset Securities for two years before pursuing his graduate degree. Post-MBA, Steve worked in various Internet companies including Zalora and Rocket Internet before launching Qraved. Currently, he is also a partner at technology development company Imaginato.

Korean-born, US-raised Steve Kim graduated from Yonsei University in South Korea and holds an MBA from INSEAD in Singapore. Steve worked in Mirae Asset Securities for two years before pursuing his graduate degree. Post-MBA, Steve worked in various Internet companies including Zalora and Rocket Internet before launching Qraved. Currently, he is also a partner at technology development company Imaginato.

Co-founder and CEO of Halal Local

Muhammad Senoyodha Brennaf has been building businesses since his time as a computer science and information engineering undergraduate at Inha University, South Korea. Between 2010 and 2014, he sold SIM cards and cellphones to foreigners, while being engaged in an export-import business. In 2015, Senoyodha pursued a master's in Advanced Computer Science at Manchester University, UK before returning to Indonesia a year later to establish Astrajingga, the app development startup behind travel listing platform Halal Local.

Muhammad Senoyodha Brennaf has been building businesses since his time as a computer science and information engineering undergraduate at Inha University, South Korea. Between 2010 and 2014, he sold SIM cards and cellphones to foreigners, while being engaged in an export-import business. In 2015, Senoyodha pursued a master's in Advanced Computer Science at Manchester University, UK before returning to Indonesia a year later to establish Astrajingga, the app development startup behind travel listing platform Halal Local.

Simone Investment Managers specializes in real estate and alternative assets management. It has property investments in South Korea and abroad in USA and Europe.

Simone Investment Managers specializes in real estate and alternative assets management. It has property investments in South Korea and abroad in USA and Europe.

CEO and founder of M Mandarin

Dou received her master's degree in International Chinese Language Education from Shandong University in 2014. She worked in the TCSL (Teaching Chinese as a Second Language) sector for over 10 years, including as a TCSL teacher at the Confucius Institute in South Korea, as product manager at the Confucius Institute Headquarters and the Open University of China and as teacher at Shandong University. Before founding Funnybean Technology, parent company of M Mandarin, in 2016, she helped design the app Hello HSK - a platform for foreigners to learn and prepare for the HSK tests.

Dou received her master's degree in International Chinese Language Education from Shandong University in 2014. She worked in the TCSL (Teaching Chinese as a Second Language) sector for over 10 years, including as a TCSL teacher at the Confucius Institute in South Korea, as product manager at the Confucius Institute Headquarters and the Open University of China and as teacher at Shandong University. Before founding Funnybean Technology, parent company of M Mandarin, in 2016, she helped design the app Hello HSK - a platform for foreigners to learn and prepare for the HSK tests.

The venture capital arm of semiconductor and telecom equipment giant Qualcomm is a San-Diego investor focusing on VR, robotics, IoT, cloud and digital health companies in the US, Europe, Israel, China, Korea and India.

The venture capital arm of semiconductor and telecom equipment giant Qualcomm is a San-Diego investor focusing on VR, robotics, IoT, cloud and digital health companies in the US, Europe, Israel, China, Korea and India.

H&CK Partners is a private equity firm based in South Korea. Its expertise primarily lies in the South Korean and Southeast Asian markets, with a focus on small to mid-sized deals (US$10-100 million).

H&CK Partners is a private equity firm based in South Korea. Its expertise primarily lies in the South Korean and Southeast Asian markets, with a focus on small to mid-sized deals (US$10-100 million).

CTO of NutraSign

Enrique Alcázar Garzas holds a double bachelor's degree in Computer Science and Business Administration from Carlos III University in Madrid. He spent one year as an exchange student at Hanyang University in South Korea and returned home to work as an R&D intern for app development at a Spanish startup Natureh in 2016. He is the co-founder and CTO of blockchain startup Lingotts. The full stack blockchain developer also works on various projects at Grant Thornton and Santander Technology’s innovation lab. He co-founded NutraSign in 2018 and is in charge of the company's app and blockchain development as CTO.

Enrique Alcázar Garzas holds a double bachelor's degree in Computer Science and Business Administration from Carlos III University in Madrid. He spent one year as an exchange student at Hanyang University in South Korea and returned home to work as an R&D intern for app development at a Spanish startup Natureh in 2016. He is the co-founder and CTO of blockchain startup Lingotts. The full stack blockchain developer also works on various projects at Grant Thornton and Santander Technology’s innovation lab. He co-founded NutraSign in 2018 and is in charge of the company's app and blockchain development as CTO.

Founded in 1996, LB Investment (formerly LG Venture Investment) is supported by LG, the Korean conglomerate, and developing into a private equity fund investment company. It focuses on venture investments in Korea and China, and investments in medium and large companies.

Founded in 1996, LB Investment (formerly LG Venture Investment) is supported by LG, the Korean conglomerate, and developing into a private equity fund investment company. It focuses on venture investments in Korea and China, and investments in medium and large companies.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

Innovative Sports Investment (ISIN) focuses on the eSports sector, backing startups that develop disruptive technologies for athletes and investors through seed investment rounds. Led by Javier Morales, Ander Iñarrairaegui and Javier Colás, the firm also has international offices in Japan, South Korea, India, the US and Argentina.

Innovative Sports Investment (ISIN) focuses on the eSports sector, backing startups that develop disruptive technologies for athletes and investors through seed investment rounds. Led by Javier Morales, Ander Iñarrairaegui and Javier Colás, the firm also has international offices in Japan, South Korea, India, the US and Argentina.

Formation Group aims to create a bridge between Silicon Valley and Asian technology companies. It currently has three offices, in the US, South Korea and Singapore. So far it only has six known portfolio companies, including ride-hailing firm Gojek, grocery shopping company Honestbee, and retail experience technology firm Memebox.

Formation Group aims to create a bridge between Silicon Valley and Asian technology companies. It currently has three offices, in the US, South Korea and Singapore. So far it only has six known portfolio companies, including ride-hailing firm Gojek, grocery shopping company Honestbee, and retail experience technology firm Memebox.

TPG-SV China Ventures is a joint investment venture established in September 2018 by SoftBank Ventures Korea and private equity group TPG. With a fund of $300m, the VC is managed by TPG’s China team in the TMT industry and seeks early-stage investment opportunities in internet, technology and media.

TPG-SV China Ventures is a joint investment venture established in September 2018 by SoftBank Ventures Korea and private equity group TPG. With a fund of $300m, the VC is managed by TPG’s China team in the TMT industry and seeks early-stage investment opportunities in internet, technology and media.

- 1

- 2

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Alodokter wants personalised healthcare on tap

The Indonesian healthcare startup recently got a US$9 million Series B funding for expansion.

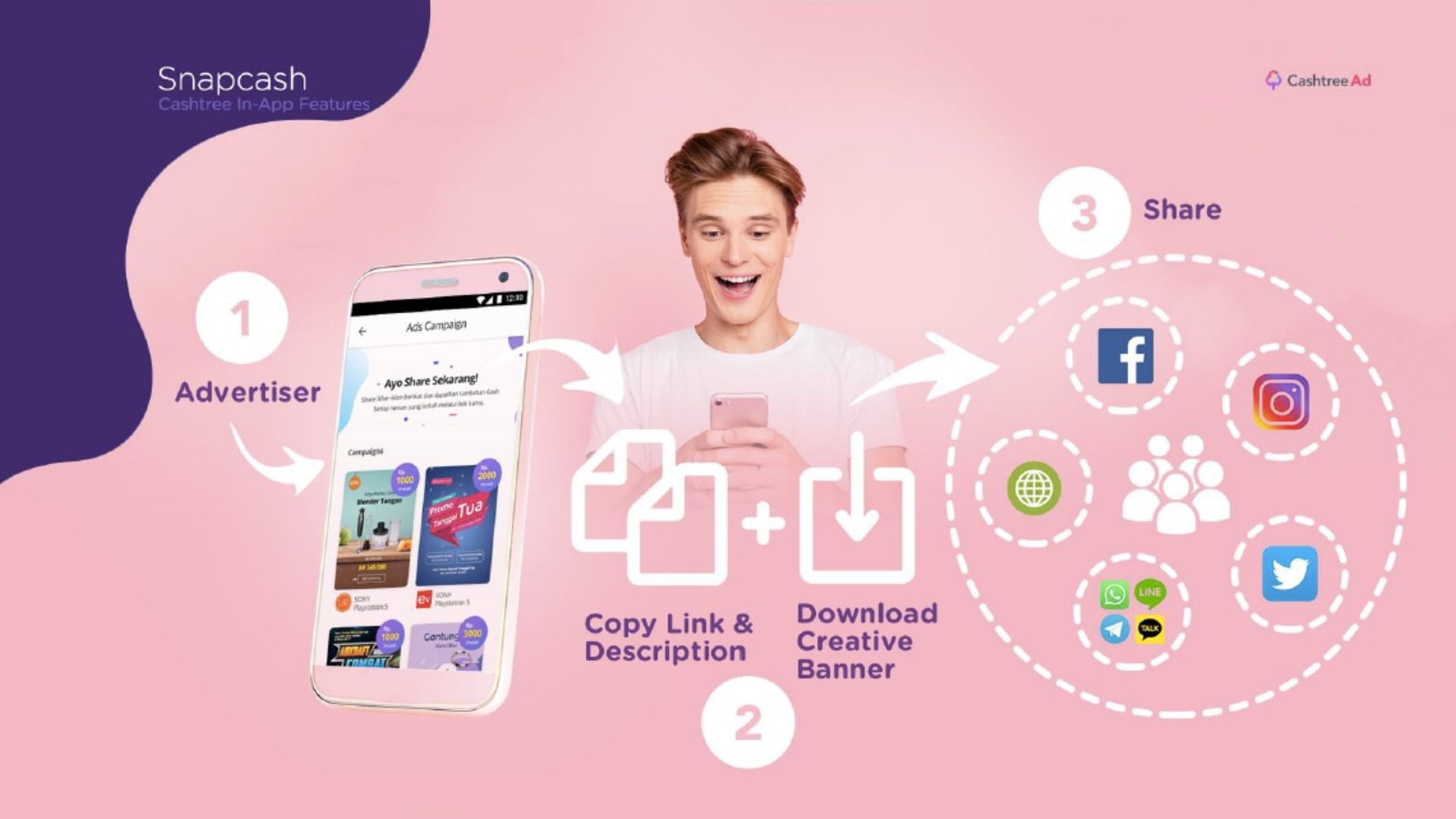

Cashtree combines locksreen ads and rewards-based marketing to help businesses go viral

The Indonesian mobile advertising platform encourages users to share ads on social media and WhatsApp so they go viral

SWITCH Singapore: Investors highlight Vietnam startup ecosystem's potential and resilience

The quality of Vietnam’s local talent remains one of its biggest strengths, but foreign investors also need to be patient and be familiar with the local regulatory landscape

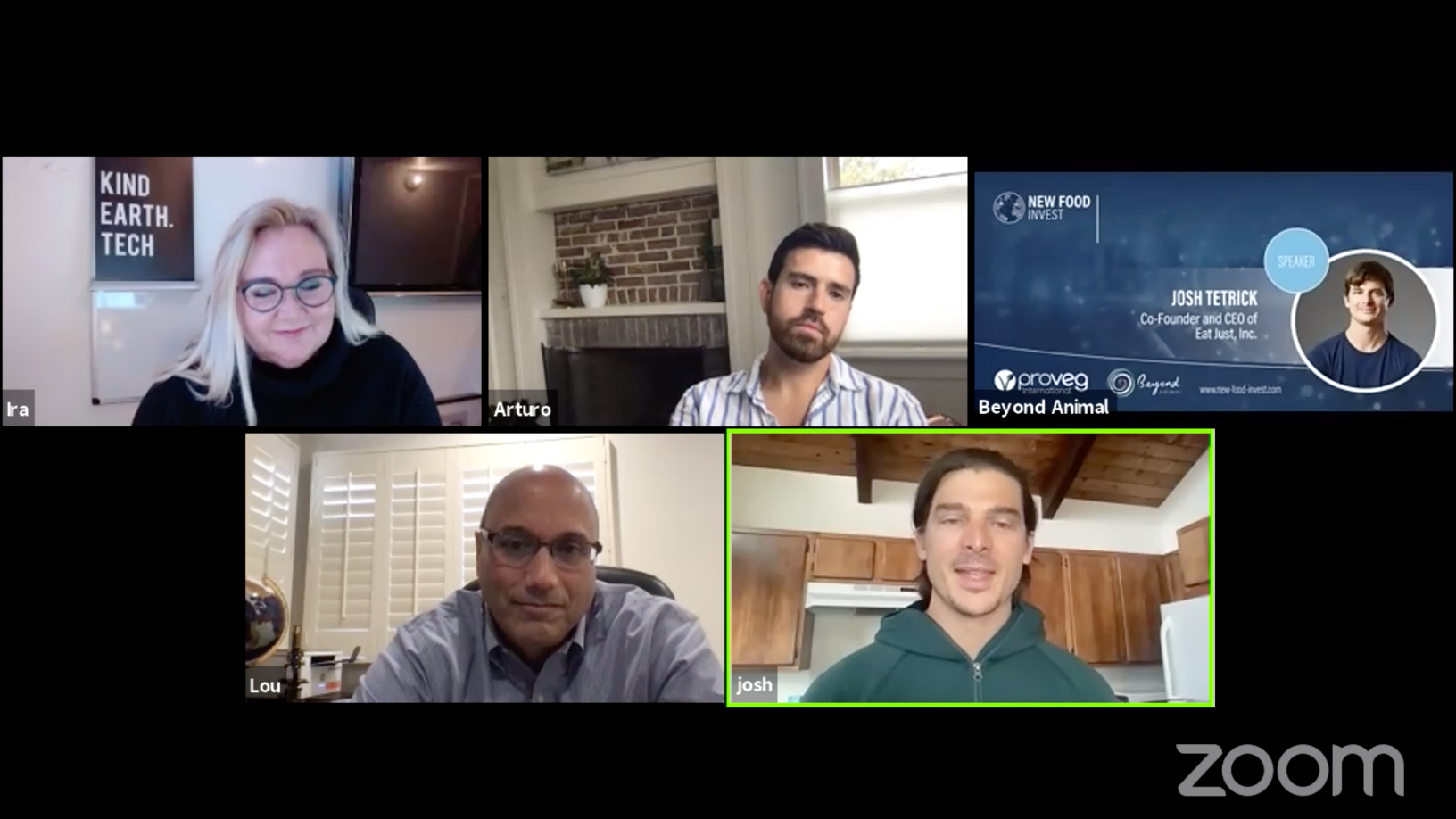

New Food Invest: Challenges of growing an alt-protein startup

Founders of three alt-protein startups in the US share what motivated them to start, their personal experiences growing the businesses, getting funding and finding strategic partners

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

HighPitch 2020: Waste management play Octopus, digital concierge service Izy win Makassar battle

Both startups have scored strong traction despite the weight of Covid-19; they are also expanding and keen to explore new opportunities

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

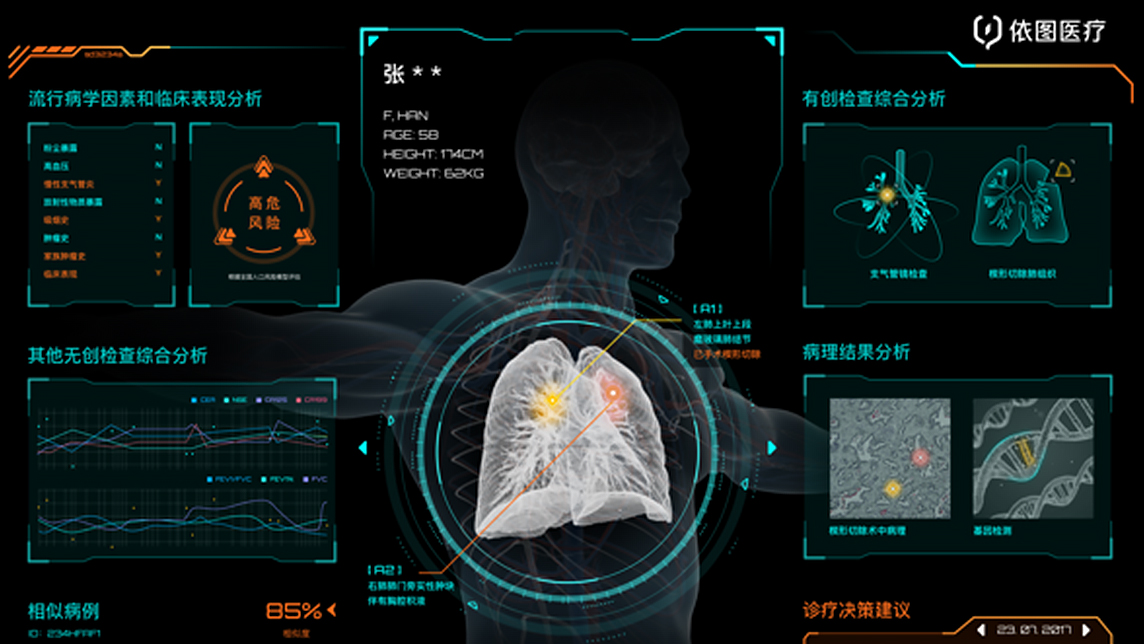

YITU takes smart healthcare to the next level

AI programs developed by this Chinese medtech startup provide more accurate diagnoses by reading medical images in conjunction with patients’ medical records

Zymvol Biomodeling: In the footsteps of Chemistry Nobel Prize winner Frances H. Arnold

Startup founded by scientists helps industries discover and develop enzymes cheaply through computer-driven innovation

This e-retailer uses influencers to sell niche brand cosmetics in high-growth markets

Huajuan Mall is a popular makeup e-mall for young women in smaller Chinese cities, turning little-known local brands into big hits

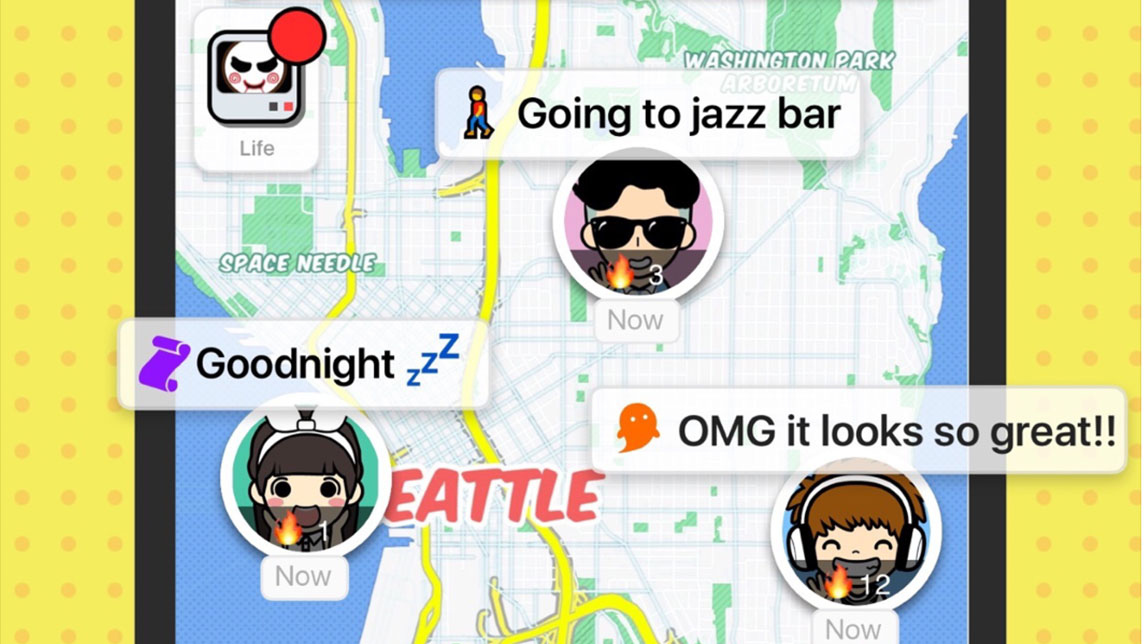

"Spot" your friends, live chat and share music with this social mapping app

Spot, a new challenger to China's WeChat, is using pop-up song lyrics to entice youths to live chat and play games

ZendMoney: Putting cash back into the pockets of Indonesian migrant workers

ZendMoney's unique remittance concept has already helped 90,000 migrant workers send money back home

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Sorry, we couldn’t find any matches for“Korea”.