Norway

-

DATABASE (8)

-

ARTICLES (15)

Founder of Xiaohongshu (RED)

Beijing Foreign Studies University graduate formerly employed at Bertelsmann AG and Norway Supreme Group. Miranda Qu was also the only Chinese judge at the 2014 InnoApps Huawei EU-China App Hackathon.

Beijing Foreign Studies University graduate formerly employed at Bertelsmann AG and Norway Supreme Group. Miranda Qu was also the only Chinese judge at the 2014 InnoApps Huawei EU-China App Hackathon.

Norway-based Katapult Accelerator focuses on technology-based startups targeting environmental and societal causes. Katapult's three-month accelerator program offers training and mentorship opportunities across a range of technologies including AI, blockchain and IoT, along with access to funding and investors. The company has recently teamed up with New York's ERA accelerator to help Katapult's startups expand to the US.

Norway-based Katapult Accelerator focuses on technology-based startups targeting environmental and societal causes. Katapult's three-month accelerator program offers training and mentorship opportunities across a range of technologies including AI, blockchain and IoT, along with access to funding and investors. The company has recently teamed up with New York's ERA accelerator to help Katapult's startups expand to the US.

Co-founder and CEO of Pundi X

Computer Data Communications graduate from Malaysia Zac Cheah is an Erasmus Mundus scholar with a master’s in Computing from Sweden’s KTH Royal Institute of Technology and a master’s in Security and Mobile Computing from the Norwegian University of Science and Technology.After his master’s graduation in 2008, Zac joined Opera Software AS in Norway and Opera Oupeng in China. He left Opera in 2013 to co-found Cross platform HTML5 games developer Wozlla in China. In 2016, Zac moved to Indonesia and co-founded payments app Pundi-Pundi. He became the CEO of Pundi X in September 2017.

Computer Data Communications graduate from Malaysia Zac Cheah is an Erasmus Mundus scholar with a master’s in Computing from Sweden’s KTH Royal Institute of Technology and a master’s in Security and Mobile Computing from the Norwegian University of Science and Technology.After his master’s graduation in 2008, Zac joined Opera Software AS in Norway and Opera Oupeng in China. He left Opera in 2013 to co-found Cross platform HTML5 games developer Wozlla in China. In 2016, Zac moved to Indonesia and co-founded payments app Pundi-Pundi. He became the CEO of Pundi X in September 2017.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

The Oslo-born venture capital company, Northzone VC, has offices in Norway, Sweden, London and New York, and was founded in 1996. It has invested in more than 130 companies globally, across a spectrum of sectors, and at different stages, and has around €1 billion under investment currently. It has seen nine IPOs from its portfolio and manages nine funds. It has been lead investor in almost 70 rounds and has seen 30 exits to date.

The Oslo-born venture capital company, Northzone VC, has offices in Norway, Sweden, London and New York, and was founded in 1996. It has invested in more than 130 companies globally, across a spectrum of sectors, and at different stages, and has around €1 billion under investment currently. It has seen nine IPOs from its portfolio and manages nine funds. It has been lead investor in almost 70 rounds and has seen 30 exits to date.

CEO of Nido Robotics

Roy Petter Dyrdahl Torgersen studied maritime navigation at Austevoll Fagskule School and later nautical sciences at the University of Stord/Haugesund in Norway. With 12 years of experience in the petro-maritime, scientific research and underwater mining prospection sectors, Torgersen also holds a Class 1 navigation license and has been a captain in the Merchant Navy in Singapore. Inspired by the potential of small submarine robots borne from his professional experience and passion for diving, Torgersen established Nido Robotics, where he is currently chairman and CEO.

Roy Petter Dyrdahl Torgersen studied maritime navigation at Austevoll Fagskule School and later nautical sciences at the University of Stord/Haugesund in Norway. With 12 years of experience in the petro-maritime, scientific research and underwater mining prospection sectors, Torgersen also holds a Class 1 navigation license and has been a captain in the Merchant Navy in Singapore. Inspired by the potential of small submarine robots borne from his professional experience and passion for diving, Torgersen established Nido Robotics, where he is currently chairman and CEO.

Adevinta Ventures is the investment arm of the Norway-based Adevinta, a local digital marketplace group operating in 15 countries in Europe, Latin America and North Africa, with 1.5bn monthly visitors. Its leading local brands include Leboncoin in France, InfoJobs in Spain, Subito in Italy and Jofogás in Hungary. In Spain, where its headquarters is in Barcelona, the company includes an umbrella of successful online classified platforms such as Infojobs, Fotocasa, Habitaclia, Milanuncios and Vibbo, counting over 18m active users.Adevinta Ventures invests in startups focused on marketplace and platform space specifically in verticals such as mobility, education and real estate. The fund typically invests in Series A and B rounds backing them also with marketing and data support as well as mentorship. Initial investments go up to €5m with follow-on capacity.

Adevinta Ventures is the investment arm of the Norway-based Adevinta, a local digital marketplace group operating in 15 countries in Europe, Latin America and North Africa, with 1.5bn monthly visitors. Its leading local brands include Leboncoin in France, InfoJobs in Spain, Subito in Italy and Jofogás in Hungary. In Spain, where its headquarters is in Barcelona, the company includes an umbrella of successful online classified platforms such as Infojobs, Fotocasa, Habitaclia, Milanuncios and Vibbo, counting over 18m active users.Adevinta Ventures invests in startups focused on marketplace and platform space specifically in verticals such as mobility, education and real estate. The fund typically invests in Series A and B rounds backing them also with marketing and data support as well as mentorship. Initial investments go up to €5m with follow-on capacity.

Norfund is the sovereign investment fund of Norway, established by the parliament in 1997 and owned by the Ministry of Foreign Affairs. The company has committed NOK 28.4bn in investments into 170 projects in developing countries as of 2020. Norfund has regional offices in Thailand, Costa Rica, Kenya, Mozambique and Ghana to support its activities in Asia, Africa and Latin America. In Asia, its core investment targets are Indonesia, Cambodia, Laos, Vietnam, Myanmar, Bangladesh and Sri Lanka. Norfund primarily invests in three key areas: clean energy, agriculture and fintech. The fund has invested in solar power projects and various food companies in India and various African countries. In Asia, Norfund has invested in Amartha, an Indonesian P2P lending fintech company providing loans to women-led microbusinesses. Norfund also invests in other venture funds, such as Southeast Asia-focused Openspace Ventures Fund III, to expand and diversify their portfolio.

Norfund is the sovereign investment fund of Norway, established by the parliament in 1997 and owned by the Ministry of Foreign Affairs. The company has committed NOK 28.4bn in investments into 170 projects in developing countries as of 2020. Norfund has regional offices in Thailand, Costa Rica, Kenya, Mozambique and Ghana to support its activities in Asia, Africa and Latin America. In Asia, its core investment targets are Indonesia, Cambodia, Laos, Vietnam, Myanmar, Bangladesh and Sri Lanka. Norfund primarily invests in three key areas: clean energy, agriculture and fintech. The fund has invested in solar power projects and various food companies in India and various African countries. In Asia, Norfund has invested in Amartha, an Indonesian P2P lending fintech company providing loans to women-led microbusinesses. Norfund also invests in other venture funds, such as Southeast Asia-focused Openspace Ventures Fund III, to expand and diversify their portfolio.

SWITCH Singapore: Xpeng expects strong China EV growth after 3Q rebound, launches overseas expansion

Welcoming foreign player entry as potential boost to EV adoption, Xpeng President Brian Gu also notes attractiveness of overseas markets, especially Europe

Portugal looks to its marine heritage to create an oceantech leader

Portugal is tapping oceantech disruption to create new value out of its blue economy, with strong government push

Beemine Lab: Nurturing the fast-growing CBD cosmetics market

The first biotech company in Spain to produce CBD-rich cosmetics, The Beemine Lab is in a market poised to reach nearly $1bn by 2024, or 10% of the total skincare market

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

SWORD Health: Reinventing the wheel for physiotherapy

AI-powered healthcare tech brings relief to overworked and understaffed physiotherapy providers

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

SWORD Health nabs Portugal's second biggest Series A round within one year

SWORD Health's AI-based physiotherapy solution has just clinched $9m from Khosla Ventures and Founders Fund, ringing in a total of $17m in Series A funding

UpHill: Helping doctors put the latest research into practice

Born out of practitioners’ difficulty in keeping up with latest treatments and protocols, UpHill now includes guidance on Covid-19

Plantruption: Transforming Irish seaweed into sustainable alt-protein seafood

Using abundant local seaweed as highly nutritious, eco-friendly alternatives to fish, the Dublin-based startup is gearing up to tap into new markets in Europe and the US

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

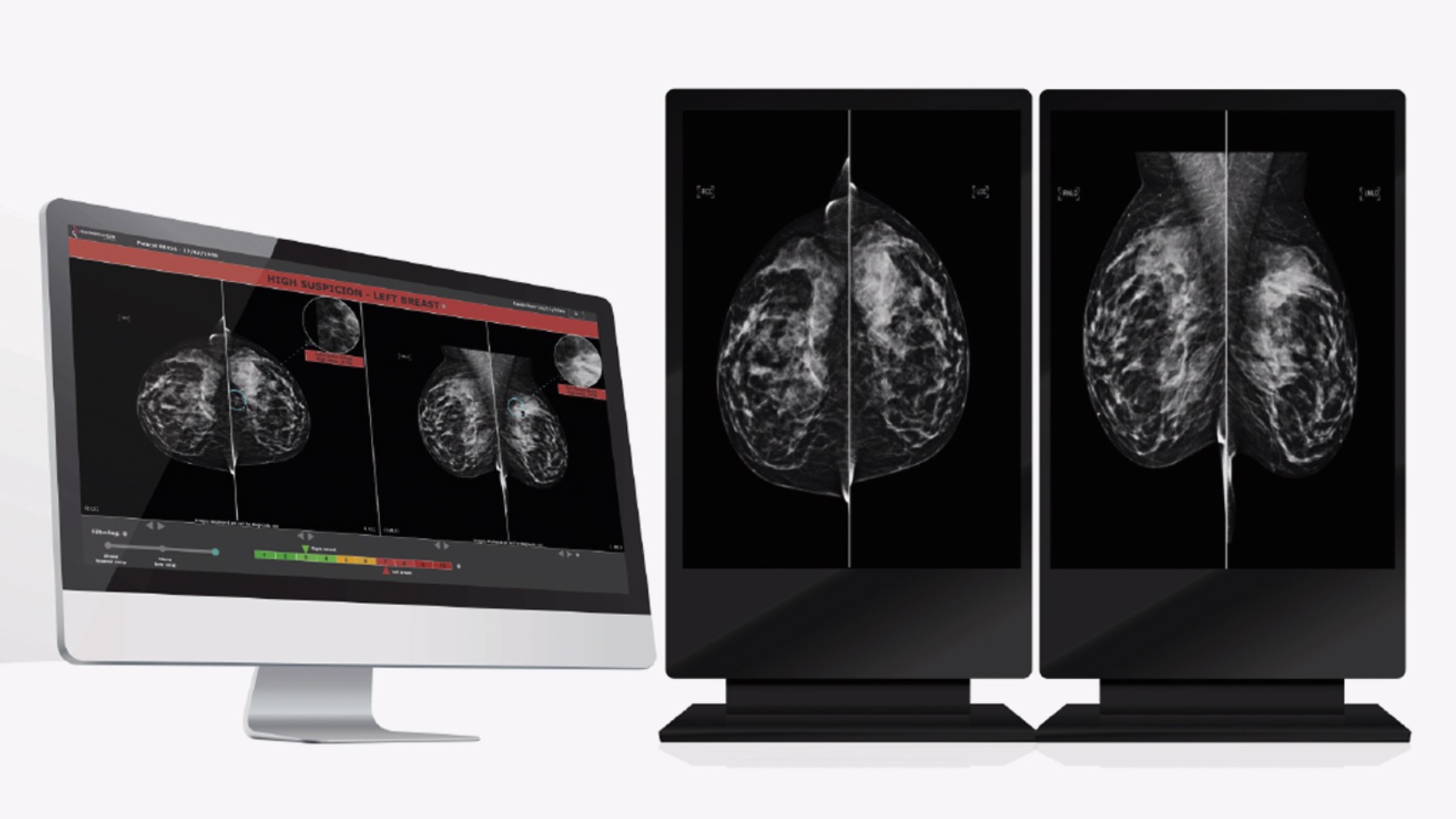

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

Early Charm Ventures: Taking research from the labs to the real world

Instead of investing money, the venture studio gets hands-on, co-running companies with top scientists and their cutting-edge research

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Sorry, we couldn’t find any matches for“Norway”.