She can crack jokes in 30 languages, regale you with anecdotes and share fun stories with your kids. She’s strong, too, able to carry 30kg on her back. And best of all, you can watch videos embedded in her stomach via an interactive screen.

Her name is Reem and she’s part of a family of "humanoids for rent" being built by PAL Robotics, a company that has become a figurehead for the emerging robotics scene in Barcelona and the Catalonia region.

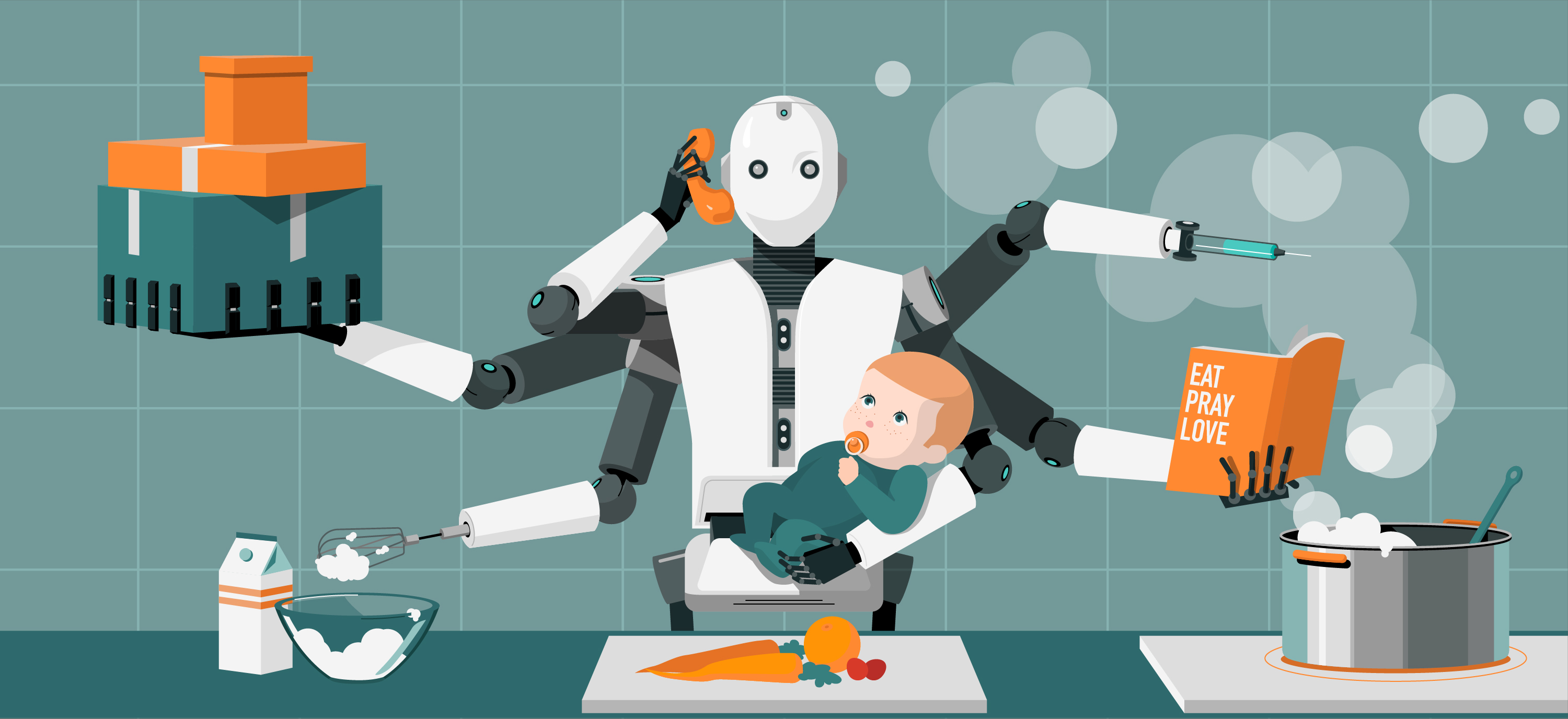

Having started out building robots to play chess, PAL has created a fleet of machines for research, industry and leisure. Its other robots include Talos, another humanoid designed for complex tasks in difficult industrial terrain; Tiago, which can perform a variety of everyday chores and challenge a company’s research; and Tiago Base, a modular trunk which scuttles around warehouses to perform logistical work.

PAL is just one of dozens of robotics companies that have been founded in Barcelona and its surrounding region over recent years. According to