It can be hard to wrap your head around your financial situation – your savings, investments and debts – and how to plan for major life events, like buying a house or sending your children to college. Yet, sound financial advice can be hard to find and many advisors charge a hefty sum for their services. Singapore-based BetterTradeOff is trying to change this with its online financial advisory tools.

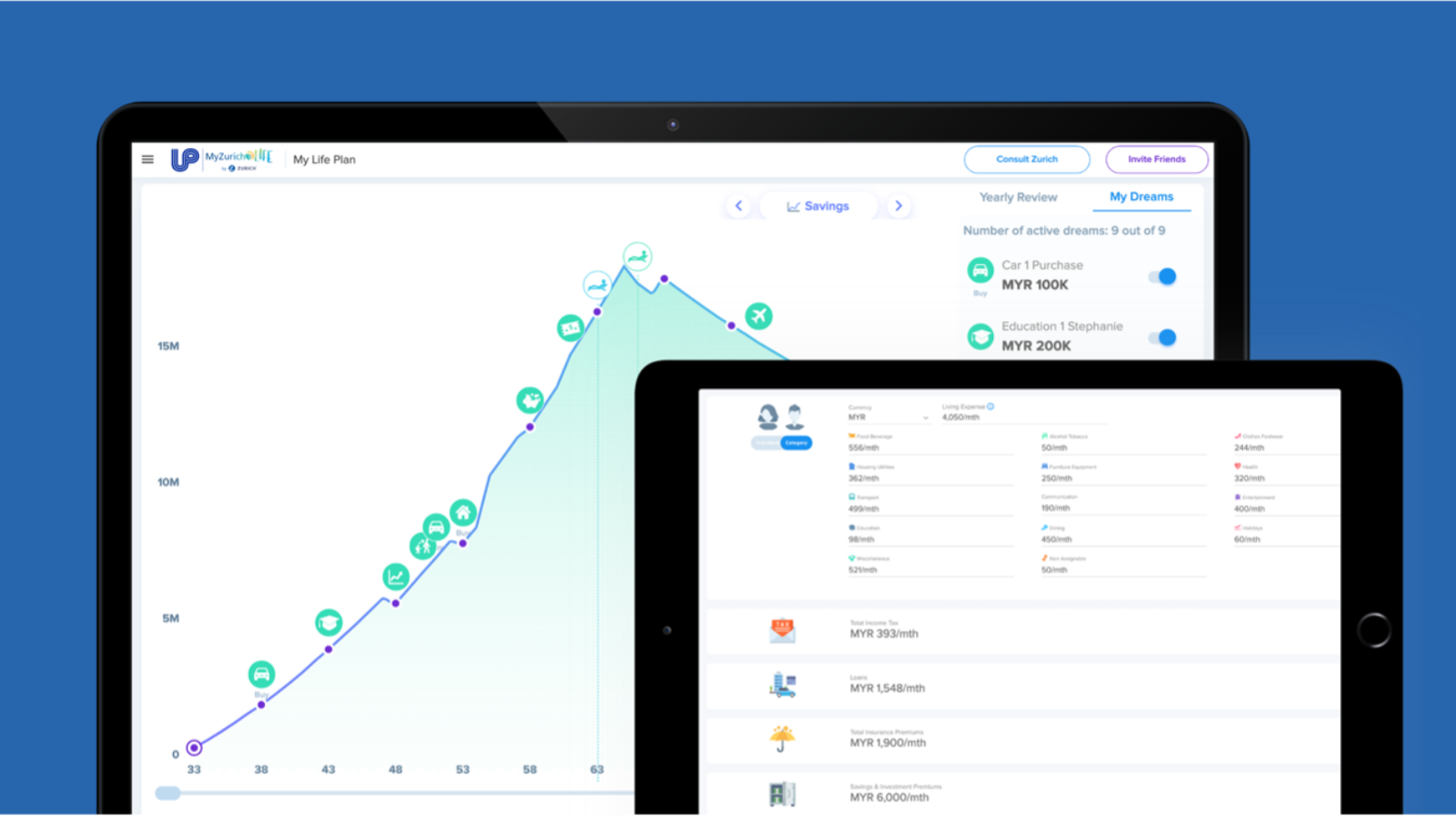

Using simple graphs backed by financial models, BetterTradeOff’s users can quickly visualize their financial situation and see how various life events can affect it. In Singapore, the company released Up, a free financial planning tool for anyone, along with a SaaS version for financial advisors, monetized through referral and subscription fees. In March, BetterTradeOff launched Up | MyZurichLife in partnership with Zurich Malaysia and earlier this week it launched SC Goals Planner, a similar product made for Standard Chartered clients.

CEO and co-founder Laurent Bertrand told CompassList in an interview that when he established BetterTradeOff in 2015, financial advisory products that were available in the market were either too complicated for most people or too simple to be truly useful. “You either go through all the different elements, like savings, investments and tax, which is a very slow and painful process, or you use a very simplified calculator that won’t help you make a decision," he said.

To avoid creating an over-simplified product, BetterTradeOff develops its financial models with major financial institutions, like banks and insurance companies. Following its product launches in Singapore and Malaysia, BetterTradeOff is planning to expand to other Southeast Asian markets and Australia.

To date, BetterTradeOff has raised $2.9m from undisclosed investors. The company will be raising $1.5m through a convertible note issue in June and a further $10m in exchange for equity by the end of 2021. The funds will be used to improve its application programming interface (API), launch new products and services and expand into Australia.

Drag and drop

When customers first use Up, they provide basic information about their financial situation. This includes the number of family members and dependents, joint income and estimated expenses, as well as saving and investing habits. Up processes the data and generates a graph showing how the person’s wealth would change over the years. If the user adds a desired retirement age, it will also project how long their funds would last.

Financial advisory products in the market were either too complicated or too simple to be truly useful

Users can add specific life events at any point on the graph to see how they would affect their financial situation. For example, if a user wanted to send their child to a local university in five years, they only need to drag the right icon and drop it on the graph. With user-provided information and historical data collected by BetterTradeOff, the system can estimate the cost of that decision and how it would affect the funds left over in the future. Events and decisions like going on a vacation or buying a new home can also be dragged and dropped on a graph.

The drag-and-drop feature can also help users understand the impact of emergencies and negative events. “Let’s say you had a car accident and have to leave your family behind or if you have a critical illness and lose your job. You need to understand what would happen to your dependents and what kinds of protections you can get to keep them safe,” Bertrand said.

According to Bertrand, users can create a basic financial plan in less than 15 minutes. They can also customize their plans by providing more details. They can, for example, input detailed breakdowns of their expenses and investments and get suggestions from Up on how to maximize available tax reliefs and other benefits. Up can also show projections based on how the family would grow over the years, as the parents grow older and the children pursue further education.

B2B and B2C models

BetterTradeOff’s product development began with a collaboration with major financial institutions, such as banks and insurance companies to ensure that its products reflect local factors that can influence income, expenses, and investing habits. These factors include local tax rates, mandatory savings or contributions like Singapore’s Central Provident Fund (CPF) payments, as well as variations in the cost of healthcare and education.

“[In 2015,] many of the solutions in the market were too product-focused; they were looking at one financial product and trying to help people decide how well it fits their needs,” said Bertrand, who headed UBS Wealth Management Asia-Pacific before launching BetterTradeOff.

The initial product development took 14 months. After piloting the product with major institutions, BetterTradeOff developed Up for individual users and Up Adviser for financial advisory companies. Up is free to use but BetterTradeOff earns a referral fee from financial advisory companies and financial institutions if a client uses Up.

Financial advisory companies and independent agents pay a subscription fee to use Up Adviser. According to Bertrand, seven financial advisory companies in Singapore are already using the service but he declined to name them.

BetterTradeOff also provides white-label solutions for financial institutions that want to use Up for their clients. Up | MyZurichLife and SC Goals Planner are two such products. BetterTradeOff charges a basic project fee as well as recurring fees for its white-label products. The fees depend on how the product is customized to fit the client’s needs. For example, “Up | MyZurichLife” can recommend various Zurich products and allows the user to contact a Zurich agent for financial advice.

New features during Covid-19

While Bertrand declined to specify the number of clients that are using BetterTradeOff’s products, he said that between April and July 2020, there was a 264% increase in registered users on Up compared to the previous four-month period. Bertrand said the pandemic might have created a greater sense of urgency to understand one’s financial situation.

“We decided to push new features very quickly [during the pandemic],” he added. “We are helping people understand what would happen if they lose their job and what they can do about it. We also provided a list of online resources to help people in this situation.

“For example, some people might have decided to buy property before, but now they need to understand whether they can still afford it if they lose their job. What if they can’t find a good job within six months or a year? Depending on their situation, they might actually still be able to afford it or maybe they cannot and therefore have to be more cautious.”

Outside Singapore and Malaysia, BetterTradeOff has worked with financial institutions in Hong Kong, the Philippines, and the UAE. “These companies have very large client bases, and are able to bring the benefits of our product to a large number of their customers," Bertrand said.

BetterTradeOff plans to use the funds from its convertible notes issue to improve the company’s API to keep up with current and future demand and to launch a product for financial advisors in Malaysia. It also plans to launch its service in Australia, where it has already received a license to provide financial products.

“As a company based in Singapore, expanding to other Southeast Asian countries is a natural move. But we don’t want to restrict ourselves," Bertrand said. “Launching in Australia will be a great market test for our efforts to go global, especially when it comes to entering the US market."