Lithium batteries are used widely to power EVs for zero-emission mobility and store renewable energy, such as wind and solar power. They also play an important role in reducing dependence on fossil fuels and cutting greenhouse gas emissions. However, if these batteries are not recycled properly at the end of their usable lives, they might not necessarily be a better option.

Currently, retired lithium batteries with 30–80% remaining capacity are repurposed to power street lights, low-speed EVs and other devices. Those with less than 30% are bound for disposal or recycling. While the metals in used lithium batteries can be recovered and recycled, it is technologically challenging and costly. At present, almost no lithium is recovered in the EU because it is not considered cost-effective. This is in contrast to the 90–100% rate of recycling of lead-acid batteries in Europe.

This is where Botree Cycling comes in. Founded in 2019 by CEO Lin Xiao, who holds a PhD in environmental engineering and technology, the startup helps clients recycle spent lithium batteries on-site through an ultra-short closed-loop process with battery dismantling, metal extraction and separation equipment, enabling the recycling of over 90% critical metals in retired lithium batteries to battery-grade materials. To date, Botree has submitted nearly 50 patent applications.

“If new energy industries continuously consume ore resources and generate spent batteries, they would essentially be no different from conventional cars that burn fossil fuels,” said Lin, a former academic at the Chinese Academy of Sciences and an entrepreneur since 2011. “Ores are more scarce than oil, and discarded batteries have a bigger impact on our environment than exhaust emissions,” he added.

The market has responded positively. Botree has landed 10 B2B clients, including battery recycling corporations, EV makers, energy storage and battery companies, and generated an 8-digit RMB revenue in 2020. According to Lin, overseas clients accounted for over half of Botree’s customers, partly due to China’s ban on importing waste and European regulation on the disposal of used batteries.

The company has secured seed and pre-Series A funding in 2019 and May 2021 respectively, raising an 8-digit RMB sum in each round from investors including Casstar, Jixing, Miracleplus and BlueRun Ventures.

Versatile techniques

In November 2020, Botree launched a new separation system. When operated at an industrial scale, it can reduce extraction costs by about 40%. Its dismantling process enables the recovery of metals with fewer impurities, especially for recovered aluminum, the impurity concentration of which can be lower than 0.1%.

Recycling spent batteries in bulk requires dismantling equipment compatible with most of the battery types in the market. In addition, various techniques are required to extract and separate different metals such as nickel, cobalt and lithium. Enclosed in shipping containers, Botree’s flexible modules help customers quickly configure and build custom battery dismantling and recycling lines. Its separation equipment, for example, can be installed and put into operation in just seven days.

“Versatility in the front-end and differentiation in the back-end makes the technique and equipment R&D more difficult,” Lin said. To revamp the conventional method of EV battery recycling and laterite nickel extraction, which is a lengthy and costly process, Botree has built a 1,700 sqm R&D center for fundamental research and a 2,000 sqm workshop in Suzhou for continuous testing of its separation system.

Botree’s R&D team includes experienced experts in material science, environmental protection, chemistry, metallurgy and policy compliance, trained at the Chinese Academy of Sciences, Belgium’s KU Leuven and Japan’s Waseda University. Botree staff have over a decade’s experience in lithium batteries and related materials. They have been involved in the design, construction or operation of 60% of China's battery or battery component production lines.

Besides selling its business customers recycling equipment with annual capacities ranging from 1,000–10,000 tons, Botree also provides consultancy services in technology, equipment design and manufacturing, and on-site operations and maintenance.

Botree also offers value-added services, including carbon tracking, materials traceability and lifecycle assessment for batteries, and hopes to lend its expertise in the future to the design of a new generation of batteries that are better for the environment.

Market potential

According to the China Automotive Technology and Research Center, around 25 GWh or over 200,000 tons of batteries have hit retirement age in China alone. This is estimated to increase to 116 GWh or 780,000 tons by 2025. By then, China’s market for recycling decommissioned batteries is expected to exceed RMB 50bn.

At the same time, the global quest for carbon neutrality through the electrification of transportation and use of energy storage in electricity grids has driven a surge in demand for batteries, which is expected to increase 14-fold by 2030.

Lithium batteries are the fastest-growing amongst all battery types because of their superior performance. However, the increasing demand for lithium batteries has already triggered the shortage of battery materials, including lithium, nickel and cobalt, resulting in skyrocketing prices. The price of cobalt, for instance, has jumped 40% so far this year to $28.5 per pound and is expected to increase to $40 by 2024.

“The potential market for battery recycling is huge; we are still at a very early stage. Unlike industries such as chips and lithium battery manufacturing where Chinese companies have followed their foreign peers, battery recycling presents an opportunity for them to take the lead from the beginning,” Lin said.

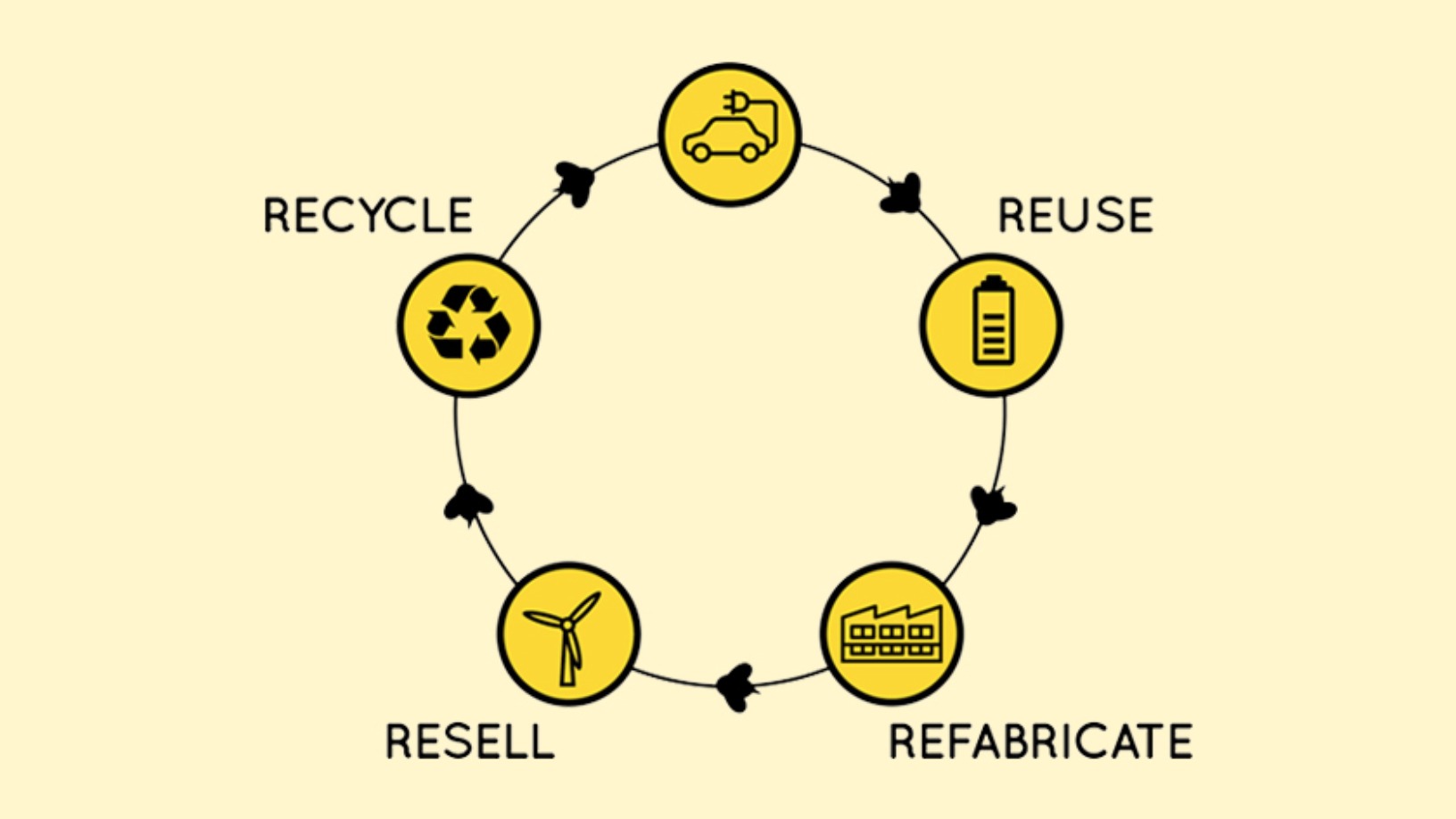

“We can build a closed-loop value chain for new energy, which connects the energy, resources, materials and transportation industries.”