The double whammy of the African swine flu and Covid-19 has oriented the global alternative protein industry toward China, the world’s most populous nation and largest meat consumer. Chloe Dempsey is one of them. The Australian research fellow at the Cellular Agriculture Society and fresh graduate of Yenching Academy of Peking University has lived in China for over four years.

With an interest in meat alternatives, Dempsey believes that future meat consumption in China will have a real impact on the rest of the world. Last year, she conducted an online survey of more than 1,000 persons across China about their acceptance of cultured meat, 17% of whom were from the food industry, including investors and startup entrepreneurs.

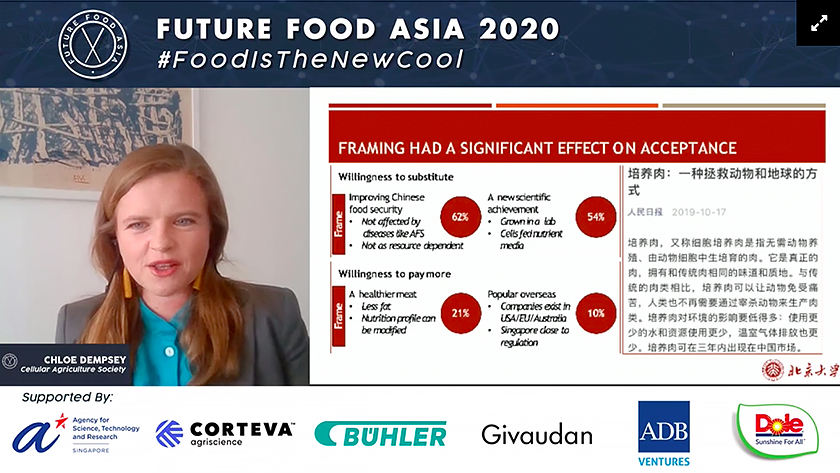

Dempsey spoke on the opening day of the weeklong Future Food Asia (FFA) 2020 online conference organized by ID Capital September 21–25, where she shared the floor with Lisa Sweet, Head of Future of Protein, Covid Response and Food-Health of the World Economic Forum, and presented some of her survey findings to the audience.

Although China is lagging a little behind western countries in consuming protein substitutes such as plant-based meat, both Dempsey and Sweet saw China as a potentially huge market. According to Sweet, China’s alternative meat market is currently valued at just under $1bn, but is expected to hit $21bn by 2025, making it the world’s largest market for protein alternatives.

Pork consumption in China dropped by 10% to 15% amid the local swine flu crisis, as consumers and food processors concerned about food safety shied away from the meat, estimated agri-focused Rabobank in June 2019. The bank later also said that swine flu wiped out 55% of China’s pigs in 2019 from 440m normally, with the market unlikely to recover until 2025. Food security has also become a pressing issue in the country of 1.4bn people, with the onset of Covid-19 and the ensuing nationwide lockdown, as well as various local natural disasters this year, severely pressuring crop production.

Open to trying new foods

Compared with plant-based meat, which has gained traction in China since last year, cultured meat is relatively new, and not yet commercially available. But it’s not a completely alien concept to the Chinese. According to Dempsey, about 40% of the respondents that took part in her survey had heard of cultured meat, and 70% of them were willing to try it. Interestingly, too, an online poll conducted during Dempsey’s FFA talk showed that 55% of the 77 voters were willing to give cultured meat a try.

But the respondents in Dempsey’s survey embraced the new technology or new product for different reasons. Of those, 62% were willing to switch to cultured meat as a substitute when it was presented as a solution for food security and a sustainable supply of protein, while 59% expressed acceptance when cultured meat was presented as a scientific achievement. In a similar way, nutritional benefits were the reason 21% of respondents were willing to pay a premium price for cultured meat, and 10% would do so because of its popularity abroad.

According to Dempsey, lower food neophobia and the tendency of Chinese consumers to try new foods, as well as the importance placed on nutritional benefits, are likely to contribute to the early adoption of cultured meat locally.

China has a “positive environment that could foster development” of cultured meat production, the researcher said, although she also conceded that "it’s not as if everyone in China is clamoring to have cultured meat, and there isn’t any company" producing cultured meat products yet.

Besides the relatively positive consumer attitudes, China also has a large highly educated population, especially in the sciences, as well as plentiful access to primary means of production that could lower the costs, Dempsey noted. Investors are also keen on exploring the opportunity, undoubtedly because China is an alluringly huge market for testing out the products.

Government policy matters as well. Although the Chinese government hasn’t publicly endorsed cultured meat, some insiders Dempsey interviewed were highly positive about the government’s attitude toward such food products.

Know your customer

Still, foreign players face a great hurdle: the lack of local market knowledge. Understanding Chinese consumers will help cultured meat producers better brand and market their products. “It’s important to know how different their consumers are,” Dempsey said.

In the US and Europe, consumers embrace cultured meat as an ethical choice – without the slaughtering of animals or consumption of animal meat, and with less carbon emissions produced – while for their Chinese counterparts, nutrition is the top consideration.

In terms of the specific product form, the Chinese consumers in Dempsey’s survey felt most comfortable with the idea of consuming cultured meat as processed meat, for instance, in a pack of sausages; followed by meat stuffing and meat on the bone.

Product naming can be a major issue, too. Right now, both plant-based meat and cultured meat are called “man-made meat” in China. It would be necessary to differentiate between the two when cultured meat is available in the Chinese market. Dempsey said experts had pushed for names like “factory meat,” arguing that such a name would prove popular among Chinese consumers. But her respondents didn’t think so at all; instead, they preferred terms like “cultivated meat” or “clean meat.”

Food quality mistrust

The Chinese’s strong lack of trust in food is also among the challenges that would have to be tackled. “When I walk into a supermarket in Australia, I inherently trust the products I see on the shelves," Dempsey said, "that’s not necessarily the case in China.” In the country, where food fraud has been rampant, consumers tend to be suspicious of things that are not natural. One respondent compared cultured food to plastic surgery, saying “it makes me uncomfortable.”

Such attitudes might change with a better understanding of culture meat. About 85% of respondents in Dempsey’s survey wanted to know more about the food and technology, and once given the information, they actually showed significantly higher levels of acceptance. Currently, the Chinese media tends to present cultured meat as a lab technology, which sounds exciting but is far from enough to lure the locals into choosing cultured meat.

In order to win consumers’ trust, brands need to engage better with the public by providing more details about cultured meat, such as products’ nutrition profiles. China Plant-based Foods Alliance, which also advocates cultured meat, is currently doing such work, seeking to educate consumers through events and publications.

In the meanwhile, businesses outside of the country would have to win the trust of China’s government, which would demand 100% certainty that their cultured meat products are entirely safe before they be allowed to launch in the market. Impossible Foods is still awaiting approval from the Chinese regulatory authorities to enter the market, as its plant-based meat products include genetically modified substances. And that, Dempsey said, would most likely also face overseas players targeting China’s cultured meat market.