Not long ago, word that Yuanfudao, once the world’s most valuable edtech startup, had turned to selling down coats set the Internet abuzz in China. The company had posted job openings for fashion designers on recruitment portals viewed by many. In response, Yuanfudao clarified it was indeed staging a pivot – but only to B2B education. The garment gig was a small investment as part of diversification, it said.

Ever since the Chinese authorities banned companies from making money tutoring students in national curriculum subjects in late July, Yuanfudao accelerated its business transformation, unveiling its new B2B brand Feixiang Planet in October. Still in the R&D and testing phase, Feixiang Planet sets to provide education platforms and products to governments and schools, aiming for equality in education and personalized learning.

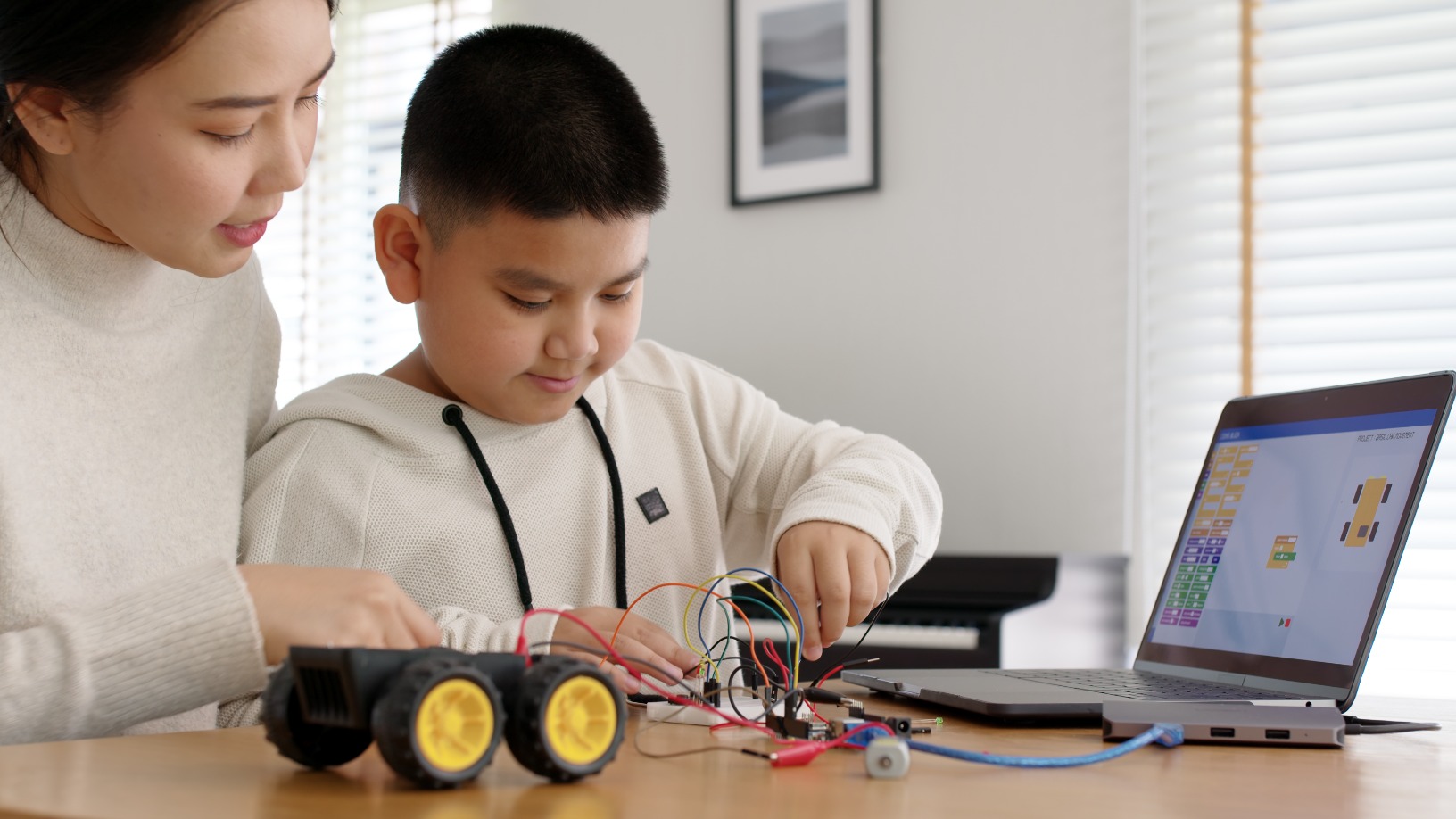

Before the edtech crackdown, Yuanfudao had already zoomed in on “quality-oriented education,” a buzzword in China that signals creative, analytical learning, as opposed to rote learning that has been the norm here, launching a STEAM teaching app, Pumpkin Science, end-July. But like other private tutoring firms offering quality-oriented education products, such as NYSE-listed New Oriental, the segment remains only a tiny fraction of Yuanfudao’s overall business.

Layoffs and pivots are now common among Chinese edtech companies once focused on after-school tutoring. Yuanfudao has cut nearly 40,000 employees in the last two months. New Oriental, which is currently shifting entirely to quality-oriented education, announced on October 25 the closure of its K9 subject training business and is reportedly going to fire 40,000 staff by the year-end.

"The education and training market will shrink from RMB 1tn to RMB 300bn [because of the country's regulations on the after-school tutoring market]," said Derek Li, Chairman and founder of Squirrel AI, a fast-growing edtech startup.

Pivoting for survival

Since August, New Oriental has set up several quality-education “growth centers" in a small number of cities including Beijing, Nanjing and Hangzhou to offer courses in art, science, reading, speech and sports. In September, its growth center in Beijing partnered Nie Weiping Go Academy, founded by the famous Go player Nie Weiping, to offer courses on the strategy board game to kids aged 4–10.

New Oriental is not the only fan of Go. Zuoyebang, the homework app unicorn, recently launched Go courses for kids from first to sixth grade. Its other quality-oriented courses include coding, art, speech and drama, and penmanship.

Elsewhere, the former English-language tutoring app VIPKID has introduced a range of AI-based courses to help students develop critical thinking skills based on the Common Core State Standards adopted in the US, which describe what students should know and be able to do in each subject in each grade.

Education analyst Chen Liteng is skeptical. Parents, he thinks, are spending too much on quality-oriented education, which requires long-term commitment, “high costs and indeterminate progress."

Besides quality-oriented courses aimed at students, some, like Yuanfudao, are targeting the B2B market with education products for institutional clients like schools, corporates and governments. Squirrel AI, an incumbent in theB2B market specialized in AI-enabled personalized learning, attracted investments even during the edtech crackdown. Its technological capabilities in AI-powered adaptive learning appeal to investors and tech giants. The startup currently owns 97 utility patents, 64 of which are around AI adaption. Every year, half of its spending is on algorithm development.

Squirrel AI secured a nearly 9-digit-RMB Series C1 funding round in July, and an undisclosed amount in its C2 round this October. The company has said it’s in the process of raising another funding round. Three investors from the last two rounds, namely Greenland Holding Group, Suzhou Wujiang Orient State-Owned Capital Investment Management and CITIC Securities, are either state-owned or state-controlled.

Smart education opportunities

Compared with other edtech players like Yuanfudao and Zuoyebang, which directly sell to individual school-age students, Squirrel AI has provided its AI adaptive learning system to state schools since 2017 while offering after-school tutoring to kids via its own and franchisees’ brick-and-mortar centers. Its products have been deployed in about 60,000 state schools, serving over 20m users that account for 75% of its total user base. About 93% of its revenue comes from the technical services it provides to schools and SaaS subscriptions.

Squirrel AI’s intelligent adaptive learning products have also been integrated into Alibaba Cloud’s smart education platform via DingTalk which is widely used by schools for communication between schools and parents, enabling teachers to offer personalized tutoring to their students. It has already signed agreements with Alibaba, Tencent and Intel for strategic cooperation to provide AI-powered adaptive teaching tools.

Meanwhile, the market for self-learning assistance devices, which Li described as the new generation textbooks that can replace schoolbags in the future, will possibly grow from RMB 10bn to RMB 200bn as self-learning is becoming more important. Squirrel AI is about to launch self-learning assistance devices in the forms of desktop and tablet, loaded with its original tutoring videos, within this year.