According to McKinsey, the current market for identity-verification-as-a-service is worth close to US$10 billion globally. With the industry predicted to even double by 2022, opportunities abound for those who have managed to muscle in on the burgeoning market and gain the necessary trust and traction to scale up.

One such company is Ecertic Digital Solutions, Spain's market leader in digital signatures and identities. Ecertic offers customized solutions for online identity verification, digital signatures, electronic contracts and notifications. Its proprietary biometric solutions, such as Optical Character Recognition (OCR), enable many organizations to overcome the difficulties of online verification in a today's digitalized world.

CompassList recently interviewed Raúl Tapias Herranz, the CEO and founder of Ecertic Digital Solutions, to find out what's in store for businesses and customers in the digital world.

How did you get the inspiration to start Ecertic Digital Solutions in November 2015?

Four years ago, when I was the marketing director at the oil company Galp Energia, we were deciding on the company's digital transformation project. I was commissioned to coordinate the team to look for a solution. There were not many on the market at that time. But we managed to select a group of people who had developed some simple and highly adaptable software with the characteristics that we were looking for. At first, we wanted to develop a small solution. But in the end, we went all the way with them.

The perception of the value of what we had achieved – and that it was a business opportunity – came to me after a lecture I gave on the project in the Vodafone Auditorium. It was so successful that I decided to leave my career in the energy sector after 17 years and move to the technology sector.

Ecertic Digital Solutions was started because many companies have no idea of what to do in terms of digital transformation. The group of technologists I was working with before had already created the software and was starting to commercialize it as an alternative digital transformation solution. So, we already had the software and a chairman when we started the company.

You have two products or services, the electronic signature and digital identity. Could you tell us about them?

The digital or electronic signature technology enables someone to sign traditional paper documents online without being physically present. A person can digitally sign the online contracts, for example, and still comply with the legal requirements of paper contracts.

As for advantages, an electronic signature has greater traceability and can be done electronically in real time from anywhere like Australia, Japan or Europe. And, it is impossible to modify any document subject to an electronic signature without notification of the other parties concerned within the chain. The biggest potential for this application is in contracts, whether between companies or between companies and consumers. The signature is scanned, uploaded to a CRM and its access is controlled.

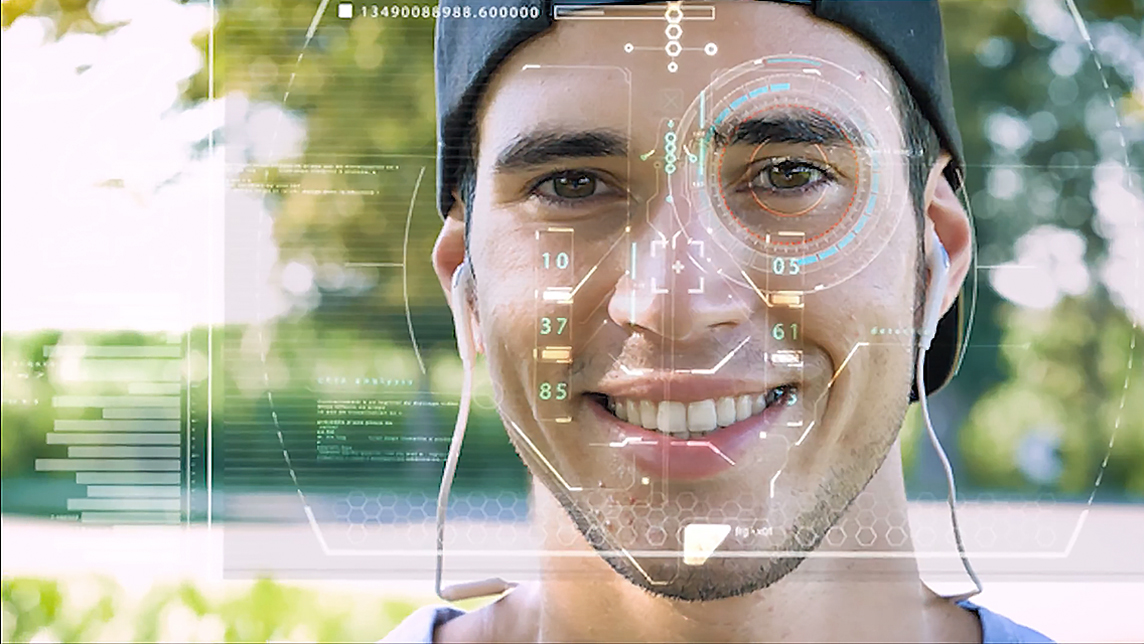

The digital identity service enables users to know if the person who they are dealing with online is really the person they claim to be. We call our product “Know your Digital Customer.” For this purpose, we use reading and image analysis, as well as facial recognition via photo from an identity document that was previously submitted electronically to create the digital identity of that person. If we cannot see a person, then a digital certificate is accessed through a digital key that acts like the fingerprint. With a unique digital identity established, the user can control the type of data to be shared with other people and avoid transferring unnecessary data.

What type of technology do you use?

We use different technologies, from digital signatures to face biometrics and image analysis, AI, machine learning, the blockchain, automated management, barcode readers and BIDI which is a system similar to a two-dimensional barcode based on data matrix and QR code technology.

Do you see your solutions as an alternative to smart contracts?

Smart contracts are based on blockchain technology and constitute execution orders. They don't have as much detail as traditional contracts and contracts signed digitally. With digital signatures, the complete document including the regulations and all the conditions of the contract are signed. Smart contracts are also written in code and cannot be read and understood by normal people.

Do you offer legal advice to clients?

Frequently. We don't give them general legal advice, but many times, we advise them on how to start the digitalization process and also on the current regulations like GDPR (General Data Protection Regulation). Sometimes it is process consulting and other times legal consulting, or both. In short, we show them how to streamline the procedures of the company to be digitalized, the legal requirements to be followed and how to combine both for the complete process.

Both the digital signature and digital identity are legally valid anywhere in the world. The tools are technologically compatible with non-EU countries. But we need to study the legislation in each location and give clients specific solutions adapted to their needs outside the EU.

On the other hand, principles like the Pareto rule are used where we advise the client to focus on the 20% that produces 80% of the results. The ideal digital solution should satisfy the main needs of the target audience as much as possible.

For example, if the signatories are physically present (but not together in person) then the electronic signature method can be used. If they are not present, then a digital signature code is better.

What kind of clients are you targeting and how are sales so far?

Our total sales in 2017 were €400,000.

We target medium-sized to large companies as we use a pay-per-use system at €1 or less per transaction. Therefore, we don't target companies that use our services only occasionally. We need large transaction volumes to be profitable. Hence the need to target large companies. Our clients are cross-sector and include Santander Bank, Gilmar, Bein Sports, Aplazame, Salesland, Leroy Merlin, Galp Energía, Bestinver, Acciona, Oney, Compass Group, CNP Partners and Lycamobile.

We also offer end-to-end solutions that include services like online contracting, GDPR, customer updates, HR digitalization, Loyalty Club onboarding and sourcing of financial products and suppliers.

Do you currently face competitors? What hurdles and high points have you experienced to date?

Yes, our competitors are national because digital transformation is a fairly local issue. There is only one international competitor Locusan, the rest are local companies. We have developed our own biometric technology and digital business solutions to be selected as one of the 26 most promising fintech startups worldwide by the financial services industry's Money 20/20 event. We already have three Ibex35 and 10 multinational clients – after only three years in business – are supported by funding of over €530,000 and a team of 14.

Initially, the difficulties for any startup will be the lack of size and credibility. That's why it was complicated when we started pitching our digital technology to potential clients. To overcome this handicap, we realized we needed to get "medals," the same as soldiers. So, we began to present our technology to different accreditation bodies. Ecertic was chosen as one of the tech companies to be promoted by the Spanish High Council of Chambers of Commerce. We are also the only ones in this field that have been audited by B-Trust on electronic signatures for the last three years. The "medals" helped us to have greater credibility at meetings with clients.

Ecertic was recently selected to participate in Money 20/20. What does this mean to you?

It is good when a company is selected from a large number of entities. It is recognition. But for Money 20/20, we were ranked globally as one of the 26 startups with the biggest future in the fintech industry. That's why it was especially satisfying for us personally and also to represent Spain worldwide.

Ecertic was also chosen as one of 10 Spanish startups to join the Spain Tech Center's Spring 2018 Immersion Program in Silicon Valley. The company was also among the 30 startups at the Spanish national stand in the Mobile World Congress 2018 in Los Angeles. All these are great. Being among the 100 finalists of the South Summit 2018 in Madrid was great too. All the recognition a company receives is positive since it increases credibility to become better known in the market.

What are your future plans? Is expansion limited by legal differences in other nations?

Our expansion strategy is to target the less developed digital transformation sector in Spain, where currently only less than 5% of the organizations have digitalized systems. In other words, the possibilities are enormous. The natural way for Spanish companies is to start expanding within the Spanish market before going into Europe, Latin America and the US.

That is the international expansion that we are doing, and also the most common in the sector. We will consolidate our business in the Spanish market by securing clients that will benefit from our range of biometric digital solutions. Our expansion overseas is usually organic. We work with different multinationals based in Spain and we expand with them, accompanying them to other countries. For example, one of our clients has operations in 21 countries, another in 15 countries. By servicing them, we have our natural expansion.

There are no limitations specifically related to legislation. One of the advantages we have is that the EU legislation is the most advanced in these areas and therefore, so is the Spanish. This is why the national legislators in Latin America are looking to Europe regarding electronic signatures. US legislation is not as advanced in this area.

How do you see the contracts of the future?

In the current world of traditional paper contracts, there is always someone who identifies the signatories, checks the documentation and then witnesses the signing of the documents. Therefore, every time you need to sign a contract with a company, you have to do the same. In the future, digital identities will become the norm. Each person is identified only once in the digital cloud, and this will be enough for all contracts and other verifications.

In addition, once the identifications have been created and verified, the owners of the digital identities can control their own data as they wish. They only need to send the relevant data required each time a contract is made with any party. In this way, the companies will have the correct information as requested. The holders of the digital identities do not have to reveal all their data, giving them total agility, transparency and information security.