“The most important thing in financial planning is to avoid losses, especially losses that you can never recover from,” said Harshet Lunani. To the CEO and co-founder of Qoala, one of Indonesia's first insurtech startups, that's why insurance is important to the average consumer – to cover one's financial risks in life, from losing money due to mishaps like missed flights or dropping one's phone, to the more expensive costs of accidents and serious illnesses.

“When your risks are covered, you'll have more peace of mind and can focus on making decisions that can lead to bigger returns,” he said in an interview.

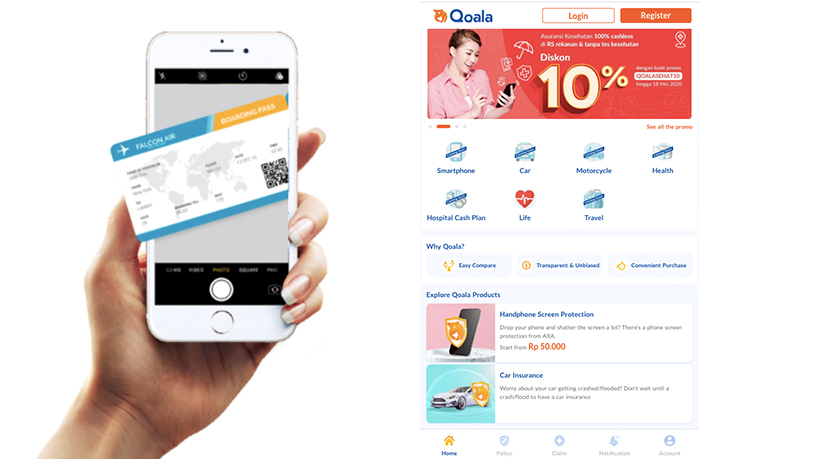

Founded in 2018 by Lunani and ex-Traveloka executive Tommy Martin, Qoala managed to sell 2m insurance policies last year after completing its pilot run in March 2019. Lunani says most of the policies sold were for travel, gadget protection and logistics, via Qoala's various partner online marketplaces and travel agencies. The claims process is automated. Clients only need to submit a photo of travel documents like a passport to support a claim that can be processed “within minutes,” he said.

In spite of the coronavirus crisis that has hurt investments and startup funding since late February, Qoala was able to secure Series A funding of $13.5m in April. The funding comes at a crucial time for Qoala, and will boost its cash reserves during what is now expected to be a prolonged global recession. The monies will also enable the firm to boost hiring, improve its technology and deepen partnerships with insurance companies. That leading VCs Sequoia Capital India, SeedPlus and Centauri Fund have placed their bets on Qoala also reflects investors' confidence in the strong growth potential of insurtech in Indonesia.

According to a report published by Google in 2019, the market for digital insurance in Southeast Asia is forecast to grow to $8bn by 2025, from $2bn in 2019. Indonesia's insurance industry grew 8% in 2019 in terms of premiums, according to local financial authority OJK.

More interestingly, Qoala also plans to enable users to help others buy insurance through its app. Users could serve as conventional insurance agents, helping prospective clients to buy policies on Qoala and earn commission.

On the supply side, the startup currently works with more than 20 insurance companies, including AXA Mandiri, Tokio Marine and Great Eastern, to provide customized microinsurance policies for travel, electronics and last-mile transportation for online shopping. More recently, it began offering insurance for healthcare, cars and motorcycles and P2P lending.

Automated claim applications

Qoala launched its first product, travel insurance, after a six-month trial. During the company's early days, the team also researched the market to better understand the insurance products out there and to build stronger relationships with their insurance and travel partners.

Qoala then expanded into providing insurance for gadget protection and e-commerce deliveries, working with various platforms to offer better insurance choices to their customers. Selling through the e-commerce platforms would also help Qoala's insurance partners improve their service to their customers.

Overall it’s been OK, but ‘OK’ is not where we want to be

“If you’re used to buying flights from a platform like Traveloka and get the insurance from them, I can’t tell you to get insurance from somewhere else,” Lunani said, explaining why Qoala chose to sell insurance via the OTA. “What we can do is to provide the best travel insurance deals on that same platform. Customers can continue buying their flights from the same platforms as before and get the best-in-class insurance.”

Where Qoala shines, he added, is the company’s ability to help insurers to sell their products through new technology channels and customize existing products to fit customer needs. To do this, the team researches products from prospective insurance partners and provides suggestions to modify their products for selling online.

Qoala also seeks to offer more affordable and personalized insurance coverage directly to local consumers through its app. The customization targets the needs of customers buying from e-commerce, hotel and travel booking platforms such as Tokopedia, Shopee, PegiPegi and RedBus. Customers can also submit insurance claims easily by uploading photos using the app. Qoala's automatic claim processing system uses proprietary ML tech to detect fraudulent claims.

By reaching e-commerce marketplaces and other platforms via Qoala, insurance companies get new distribution channels and can sell more policies. “Getting integrated with the new tech platforms can be a challenge for insurers who tend to operate their own legacy systems," Luani said. “This is an opportunity for us because technology and customer service are now more important than ever.”

Limitations of one-off claim payments

Travel and logistics insurance can easily transition into online versions because “the main purchase is something else,” Lunani said. Clients are less price-conscious because the insurance cost is way cheaper than the purchases insured. For bigger-ticket products such as life insurance, people still prefer to compare options from various providers and need insurance advisors to guide them through the more complex application process.

Qoala’s new mobile app will help users to select the best policies for their individual needs by reviewing the various options offered by Qoala partners for vehicle and health insurance. Other popular “big ticket” insurance also includes policies for gadget protection. The company also offers a hospitalization cash plan that pays a daily amount of money when the client is hospitalized.

However, the majority of the products sold through Qoala are policies with one-off payments. Although these are ideal for travel and gadget purchases, it can put people off from buying more expensive products such as car insurance. “We’d love to offer more regular-payment products. But Indonesia is a bit behind on that. If we can enable more recurring-payment products on our platform, it can really expand the industry and provide more flexibility to customers,” said Lunani.

Getting integrated with the new tech platforms can be a challenge for insurers

Diversified from travel

Doing business during the Covid-19 pandemic has not been easy for many industries across the board, including insurance providers. Restrictions on travel and work-from-home recommendations from the authorities have adversely affected consumer confidence and resulted in spikes of unemployment in diverse sectors worldwide.

Qoala, too, hasn't been spared. Notably, it's been selling a lot less travel and tourism insurance, as customers delayed buying travel tickets.

“Of course there are fluctuations, like falling demand for travel insurance and non-essential gadgets. But overall our business is quite diversified in terms of product lines and channels,” Luani said.

“Overall it’s been OK, but ‘OK’ is not where we want to be,” he continued. “It’s unfortunate that at a time when people are becoming increasingly aware of the importance of insurance, they can’t get it because they have to spend money on essentials.”

Still, Lunani is confident of winning the necessary support from investors who, like him, have taken the long view for insurtech. “We'd like to work with investors who can provide advice while also giving the company the space it needs to grow.” Qoala will aim for faster growth, coming out of the pandemic in a better position to attract more clients, he added.