In 2020 global investments in alt-protein startups surpassed $3b, a record that signaled a milestone in the sector’s history. American entrepreneurs are riding on the industry’s momentum, eager to bring, at a global scale, tasty, affordable and sustainable foods that resemble animal-based ones.

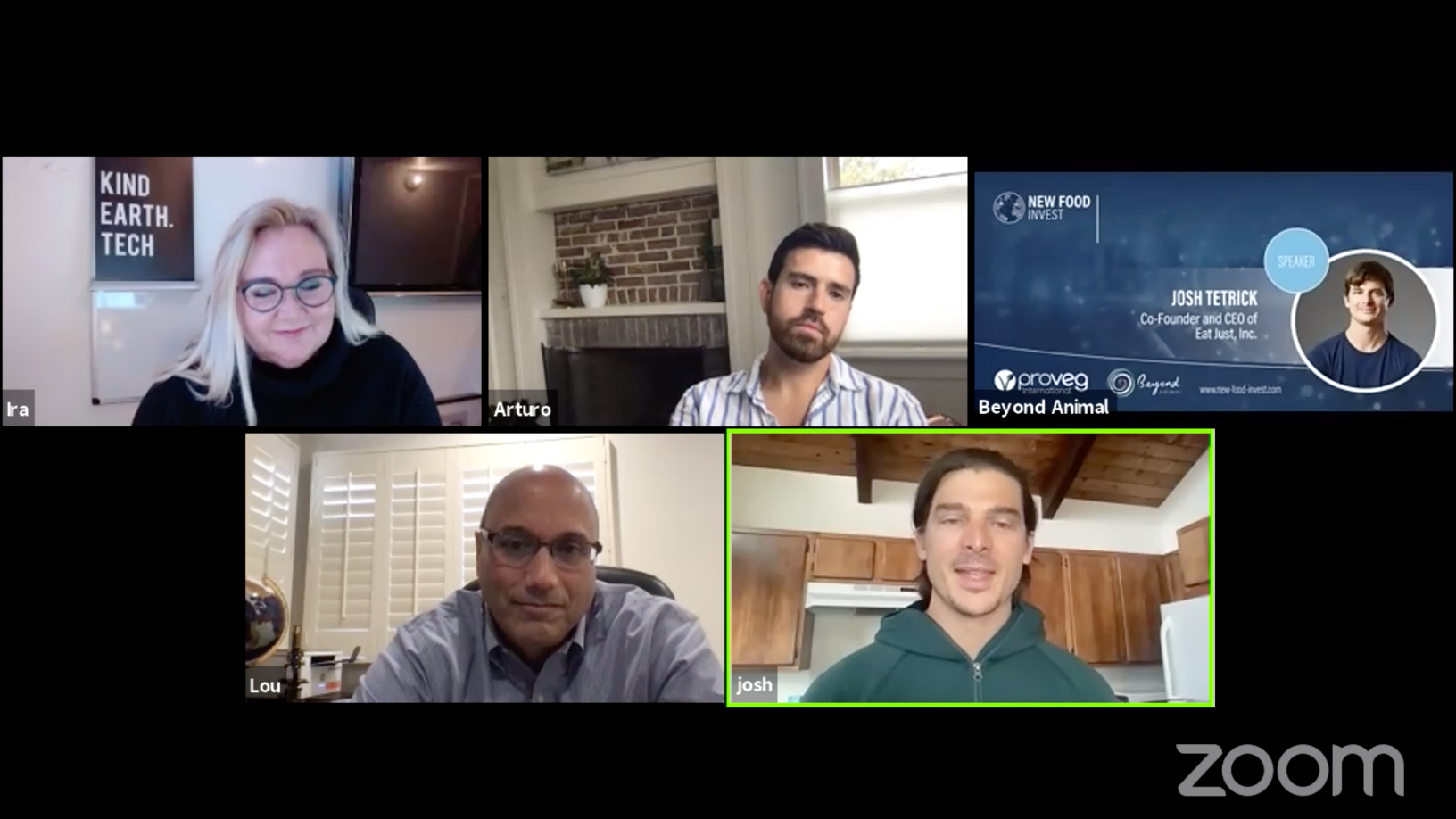

In a panel discussion at the New Food Invest virtual conference on March 8, founders of three US-based alt-protein startups shared their personal experiences of how foodtech impacted their lives and how its evolution is changing the future of our food supply chain and consumption habits. The conference was organized by ProVeg and Beyond Animal to bring international plant-based and cultivated food startups together with investors and VCs.

The panel comprised: Josh Tetrick, CEO and co-founder of Silicon Valley-based Eat Just, the maker of plant-based eggs; Arturo Elizondo, CEO and founder of the fermentation technology leader Clara Foods; and Lou Cooperhouse, CEO and co-founder of the cell-based seafood startup BlueNalu. The discussion was moderated by Ira van Eelen, co-founder of Kind Earth Tech and daughter of Willem van Eelen, inventor of the first lab-grown meat.

Below is an extract from the panel discussion, edited for length and clarity.

Eelen: In the beginning, you guys needed funding, how did you go about it? Where did you get it?

Cooperhouse: When I started BlueNalu, it was really all about thinking the same way investors think; about the total addressable market. I was fascinated by the technology around manufacturing animal products without animals, using their cells instead, but what got me even more excited was, how you can overlay that technology with the appropriate market opportunity. The global demand for seafood is increasing year after year and it's [now] the highest per capita consumption we've ever seen and we're going to see even more fish consumption. [But] we have a fundamental supply chain gap, which is increasingly compromised by microplastics and environmental pollutants. Seafood is the most vulnerable and fragile supply chain on the planet. I began the company with a strategy in mind: to create a supply chain solution for a variety of different finfish species, not a single product, but a fillet category. We are looking to displace today's environmental footprint, with seafood being shipped 10,000 miles from Southeast Asia to New York or London, where you have 30% bycatch and a 60% yield, instead of 100% yield from a factory 100 miles away. With that kind of thought process, we’ve been successful in raising funding early on with a very different financial strategy. New Crop Capital was our first investor that came in our seed round. Conferences such as Future Food Tech and GFSI were the places where the connections were made and where we found like-minded investors looking at ESG. That was the beginning of a series of successful fundraising.

Arturo Elizondo: We dumbed-down science and technology as much as possible. At the end of the day, a lot of the investors, especially in the early days, invest in the idea, in the vision and in your dream. For me, it was really important to translate the science, I didn't come from a technical background and so, by definition, I had to translate the science for myself and then for our investors. It was really helpful to be able to actually build a pitch deck and an easy-to-read business plan. Then there was the taste; technology is great but we're ultimately building food products that people consume. We built prototypes after two months of funding the company, and it was really great to showcase the dream and the vision we had. We knew we had to have something for people to taste right off the bat, and that was really the only way to truly believe in us. We've were also the first company to come out of IndieBio in San Francisco. It was really helpful to be within an ecosystem of founders and investors that were already plugged into the biotech scene.

Then there was the taste; technology is great but we're building food products that people consume

Josh Tetrick: Doing the kind of meat we do, without killing an animal, is capital intensive; there's no getting around that fact. It initially required us to put our heads down, not necessarily raise a lot of capital, but to use the capital from the existing operations to invest and show a proof of concept. If we build a scalable technology of cultivated meat, and we approach regulators in the appropriate way, as we did with SFA in Singapore, we get the approval to move things forward towards actually selling.

How long it took you from actually having an idea that you presented, to then having something that you can actually show? How have the current investors shifted from your original investors; how is that different?

Arturo Elizondo: They definitely have changed a lot and I think it really depends on the stage you are in. We've been around for over six years and the space has changed fundamentally. When I founded the company it was only Impossible Meat, Eat Just, Perfect Day, Beyond Meat, and now there are many more companies in the space and it's been really exciting to see also how investors and venture capital have followed suit. Initially, we had investors that were much more believing in the dream and the vision, those that we call angels and super angels in Silicon Valley. In our second round of financing, as we built more prototypes and deepened the technology, we looked at more technology investors. In the next rounds of financing during the prototype sampling and commercialization phase, as we had really taken a lot of technology risk off the table, and our products were starting to enter the market, we actually brought on a whole group of strategic investors; hence no longer VC funds or angel investors, but food companies.

We ultimately positioned Clara Foods as a B2B protein platform. We want to enable the entire ecosystem, whether it's a startup looking to build food 2.0 or big established companies like Kellogg's, General Mills and McDonald's, trying to really come up with options that are both delicious, sustainable and ethical for consumers. We're not doing it alone, because ultimately if we want to see the impact that we want to, and to see it as fast and as soon as possible, we had to partner with the biggest companies in the world to drive that kind of impact. One of the most public partnerships that we have is Ingredion. They are in 120 different countries, selling to different food companies. They see where plant proteins’ gaps are and how we can leverage synthetic biology to create proteins that can form, bond or gel two, three or four times as current animal or plant versions can produce today. This [partnership] allowed us to focus a lot more in co-developing products with some of these companies. As we continue growing and commercializing our products, there will also come a new whole class of investors that can help us scale the business and expand globally.

Lou Cooperhouse: We want to make a demand-driven seafood model. There's a very extraordinarily diverse seafood infrastructure around the world. Our approach has been to create partners globally. From a financial point of view, my strategy was to work with partners on these fronts: supply chain, sales and marketing, and distribution. We are pleased we brought on, in our Series A round, Nutreco and Griffith Foods on the supply chain side. Nutreco, based in the Netherlands, is one of the largest suppliers of aquaculture feed in the world. This industry needs to move as we gain economies of scale from farmer-grade to food-grade and with Nutreco’s assistance we can clearly get there. US-based Griffith Foods is a major supplier to food companies that would help us to embrace some of the sensory attributes that our products would require; similarly, Pulmuone in South Korea, Sumitomo Corporation of America and Rich Products Ventures in our $20m Series A round and in our more recent $60m financing, in which Thai Union, arguably the third-largest seafood company in the world, participated. All these partners are helping us on the supply chain and in understanding seafood consumption patterns, but also the regulatory climate in which our products can be approved.

How did you become food technology guys?

Lou Cooperhouse: My dad was a military officer and my mom was a teacher, but I was studying for a master’s in microbiology at the time. And, I was trying to pay the bills working the third shift at a subsidiary of Campbell Soup while Campbell was launching a brand new group of perishable foods. So I decided to change my degree from microbiology to food science. I became a very early pioneer in perishable foods, when shelf life was the name of the game, as much as product quality and safety.

Arturo Elizondo: I had no idea of what food science was. I never thought about where my food was coming from. I'm from Texas and I'm Mexican and so like any good Texan I had my barbecue every Sunday. And like any good Mexican, I had my two extra breakfasts every morning. Animal protein was such a huge part of my life but I never really thought about where it was coming from until I saw a video online from PETAabout factory farmers and particularly the slaughterhouses. It just blew my mind how incredibly little I knew about what I was putting in my body. I also knew that I wanted to have as much of an impact as possible in the world, and I thought the government was actually going to be the best way for me to make a difference.

It just blew my mind how incredibly little I knew about what I was putting in my body

So I started off my career in government at the USDA in the Food Safety Inspection Service. I realized that we have this incredible appetite for animal protein. I changed my diet completely and I began reading and researching all these different technologies, how we use plants and fermenters and cells to make new products and I just fell in love with it. I was infatuated with the idea of how I can support this movement and how can I be a part of it without really knowing how I was going to do it. I never thought I would be an entrepreneur. I went to Silicon Valley to actually invest and deploy capital to some of these companies, but I soon realized that there weren't that many companies in the space and we actually needed more to really drive this [change]. So I left DC and booked a one-way ticket to San Francisco. I had no job, no place to stay, but I knew that at least I had to give it a shot, trying to make a difference.

Josh Tetrick: I was spending a little time in South Africa trying to try to help some kids and I was reading a book called "The Fortune at the Bottom of the Pyramid." The premise of that book is: if you want to solve the world's most urgent problem, whether it's getting kids off the street into the school or accurate farming, use the energy of capitalism. It's a force. You can use it to degrade the poor reefs or you can use it to help ocean ecosystems. It really touched me. I decided to use all that energy, along with our co-founder Josh Paul, to start Eat Just. Starting a company and building it is not easy; it’s complicated, it is rough and it's challenging. It will test you and will pull you, but if you're up for it, it will be the best thing you ever did.

If you advise anybody to start a company right now and he needs money, what would you advise him to go into – deep tech or would you advise him to just go and make another plant-based hamburger?

Josh Tetrick: I think that sometimes when we think about the challenges of the food system we ended up thinking that every solution needs to be a deep tech solution. I don't think that needs to be the case. I wouldn't necessarily just encourage the tech but I would encourage them to think about the myriad of pain points and problems and suffering of our current food system, and all sorts of ways to get about helping it.

Is there a certain point at which you think you need specific strategic investors, or is that something you don't really need?

Josh Tetrick: I think at all points in your company's lifecycle it is smart to think about strategy; it just depends on what your technology is, what your approach is and what your business model is. We’ve partnered with a large company called SBC, the third-largest food company in South Korea. SBC is going to take care of the downstream manufacturing and distribution of JUST Eat in Korea before the end of the year. Having invested in us and having equity in the company, as real owners, energizes [them] to manufacture and distribute faster. I don't think there's any particular point in time where you don't need a strategic investor.

Arturo Elizondo: I think you have to be really careful. it's great to have big partners on board, but they're also going to be shareholders, which comes with responsibility as well. Being really mindful of that is important.

Lou Cooperhouse: We're starting to see large multinational food and pharma companies getting into this space, not just making investments but starting their own companies. It's good for all of us. It just demonstrates that this industry is on fire. We are at the beginning of a supply chain’s transformation.

CompassList is an official media partner of New Food Invest 2021.