French startup Qairos Energies has developed a pyro-gasification technique that converts biomass such as industrial hemp into green hydrogen and methane. It involves shredding the hemp and burning it at high temperatures, releasing gas from which liquid carbon dioxide, biogas and hydrogen can be extracted.

The system requires 40% less water and electricity than electrolysis of water — currently, the most common technique used to produce green hydrogen — while producing 12 times more hydrogen. The process also produces natural fertilizer and can be adapted to other biomasses such as algae. The company is planning a business model based on a circular economy partnership with local farmers.

“Today, the best water electrolyzers produce around 300 kg a day of hydrogen," Qairos Energies CEO Jean Foyer told CompassList in a recent interview. “My test site at Le Mans [in Sarthe, in northwest France] is going to produce 3.6 tons per day, so 12 times more."

Pyro-gasification has traditionally been fuelled by wood and coal (so-called grey hydrogen because CO2 is released in the extraction process). Qairos Energies says it has optimized pyro-gasification by adapting it to green raw materials, delivering zero carbon emissions from the production of hydrogen and other products.

Having raised €700,000 in a Series A round in September 2020 from family, friends and Foyer’s savings, Qairos Energies is now working with KPMG to raise a €19m Series B round in capital and bonds, which it expects to close before this summer, to enable the construction later this year of its first green-hydrogen producing factory at Le Mans.

Breaking the price barrier

Green hydrogen is a key pillar of global strategies to reduce carbon emissions to net-zero by 2050. It is set to replace fossil fuels in carbon-intensive industrial processes such as in the steel and chemical sectors and powering public transport networks, road freight and private vehicles.

The EU, for example, has outlined a hydrogen strategy that projects the share of hydrogen in the block’s energy mix will rise from 2% in 2018 to 13–14% by 2050. The strategy estimates investments in hydrogen production in the EU will amount to €180bn–470bn, in addition to the significant investments required to adapt end-user sectors to the use of hydrogen.

However, the price of green hydrogen remains a major barrier to its widespread take-up. In the EU, hydrogen produced from renewable sources costs €2.5–5.5 per kg, compared to an estimated €1.5 per kg for fossil fuel-based hydrogen. The EU estimates that as supply and demand increase over the next decade, the price of green hydrogen will come down to €1.1–2.4 per kg compared to an estimated €2–2.25 for low carbon fossil-based hydrogen.

“In the beginning, I am going to sell methane mostly while we wait for the usages of hydrogen to catch up. In four, five, 10 years, my hydrogen will be cheaper because the factory machines will have been amortized by the sale of methane, so we will be able to lower the price,” Foyer said.

The other barrier is distribution. Large industrial players and public and private transport networks remain several years away from converting to hydrogen power. French national railways operator SNCF, for example, does not expect to launch commercial operation of hydrogen-powered trains until 2025.

However, Qairos Energies is predicting fast, enduring growth based on its production process and business model. “The strategy, the economic model, is to say that hydrogen is not for today, but we have to start to produce it now to be competitive tomorrow,” Foyer said.

Agriculture meets electrification

Formerly an engineer working in the global automotive sector, Foyer said the idea to use industrial hemp to produce green hydrogen came from discussions with his agricultural neighbors in Sarthe. “They told me that a major problem they faced was the quality of the soil they had inherited from their parents, who had been forced into intensive farming practices to increase yields,” Foyer said.

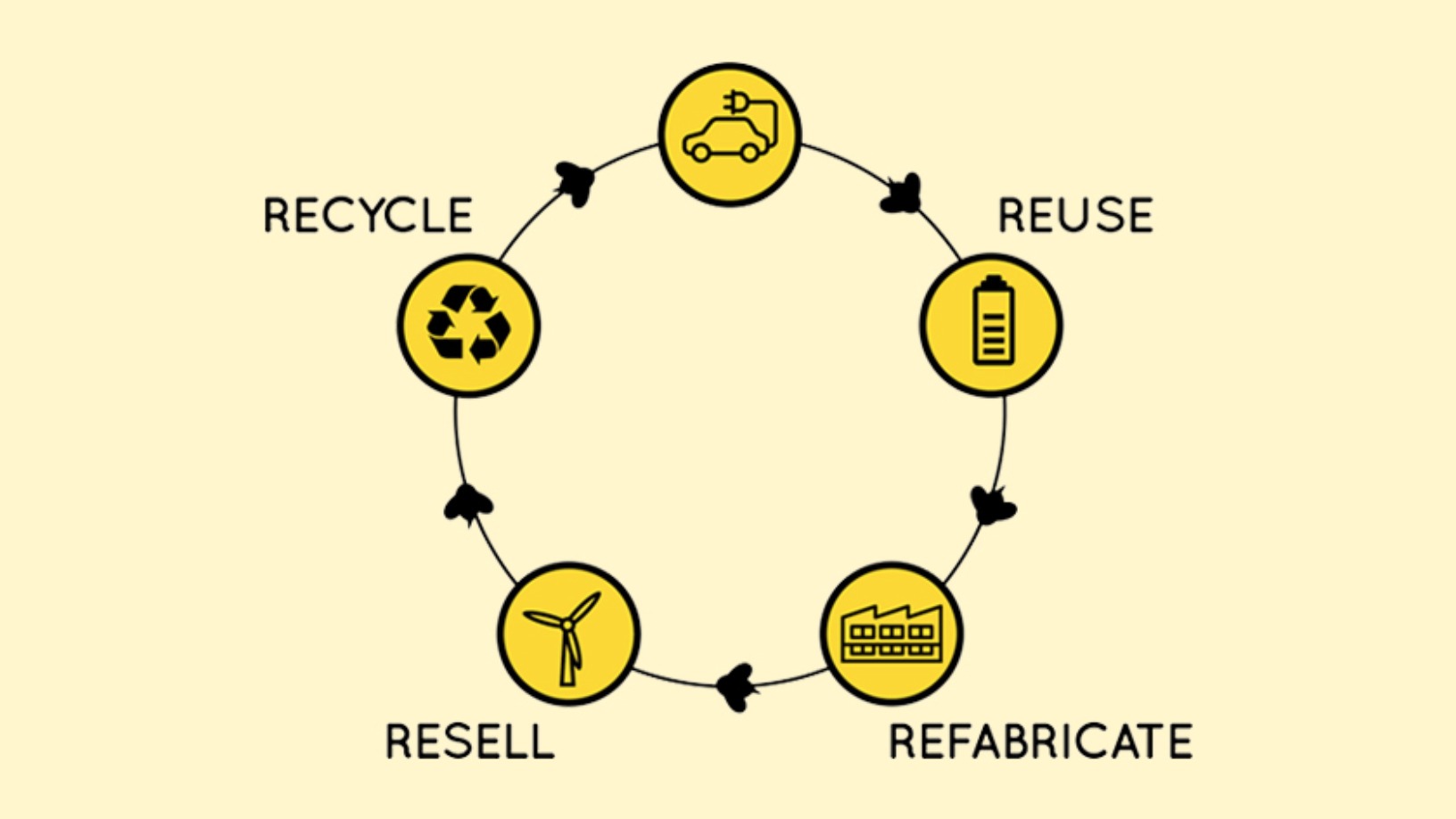

Those discussions coincided with turbulent times in France, following the election of President Emmanuel Macron in 2017, the rise of the “yellow vests” protests for economic justice in 2018 and 2019, and the growing movement towards a circular economy. “It was also a time when the automotive sector was undergoing a lot of structural changes. The EU had imposed quotas on carbon dioxide produced by cars, and manufacturers were beginning to build electric vehicles,” Foyer said.

Hydrogen is not for today, but we have to start to produce it now to be competitive tomorrow

Foyer describes his concept as merging the worlds of agriculture and electrification. Cultivated from April to August, industrial hemp is widely recognized for its benefits as a cover crop in crop rotation. The plant is also naturally resistant to pests and predators, while its strong root system reduces erosion, loosens the soil, and delivers high quantities of biomass to nourish the soil.

Foyer plans to encourage local farmers within a 35 km radius of the factory to plant hemp as a rotation crop and has begun signing five-year contracts for hemp supply by the ton. He says the factory will require 1,000 ha of hemp to be planted within a 35 km radius or 100 farmers to sign up to the plan. So far in Sarthe, some 200 are interested, Foyer said.

Another four factories

While many farmers are keen to join the project, others are still unconvinced of its viability, given the factory is yet to be built, but Qairos Energies is undaunted. “They all want to increase their yields. We say to them, if you plant hemp, that we will purchase and that will enable you to have 15% more on your wheat crop. Are you interested? They are certainly going to say yes,” Foyer said.

According to Foyer, the company has already been contacted by potential clients, including local authorities and national industrial players, and has plans to develop a further four factories in the northwest region of France. It is also in negotiations with several European countries to plant industrial hemp and replicate the project further afield.

The first production site will employ 29 people round the clock, seven days a week, and produce up to 450 Nm3 of methane an hour or 3.6 tons of hydrogen and food-grade liquid CO2 per day. The Le Mans site will produce 40 GWh per year, enough to power 3,300 homes per year. The company’s vision is to increase production to 200 GWh per year in 2025 and 8 TWh per year from 100 sites in France by 2035.

With a patent pending on its hemp pyro-gasification technique, the company says the process can both be scaled up to produce larger quantities of hydrogen and adapted to other biomasses present regionally, such as algae in Brittany. However, Foyer is reluctant to divert his R&D teams to new projects.

“We know [the technique] can work with silver grass or linen or green algae, and there is no technical problem; it’s just an adaptation of the formula that is required. But today, we are 100% focused on launching the site at Le Mans,” he said.