Already a key issue in Asia, where nearly half a billion of undernourished people live, food security is going to come under even greater pressure as the region will house 70% of the world's largest cities, accounting for 60% of global consumption, by 2030. And by 2050, Asia will account for half the world's population, yet with only one quarter of the planet's arable land.

As a solution, both public and private sector players have turned to technologies – mainly artificial intelligence, big data analytics, Internet of Things and robotics – so that food production can continue in a more sustainable, productive and efficient way. These were key findings shared at the panel discussion, “How Digital Is Transforming Agriculture: Post Pandemic Opportunities and Challenges for Development,” during the Singapore Week of Innovation and TeCHnology (SWITCH) 2020.

The problem has become even more pressing as this year, the number of people going hungry could surge by as many as 130.2m because of the Covid-19 pandemic hurting food supply, Dejan Jakovljevic, Deputy Director, IT Division, of the UN’s Food and Agriculture Organization (FAO), told the panel. The pandemic, he said, disrupted global food production, supply chains and market access, leading to a sharp drop in the supply of perishable produce.

“The entire food supply chain was under enormous stress and with many interruptions. If we add on top of that, that there has been a dynamic of natural disasters and different disasters, it only compounds the issues.”

The shrinking rural workforce is another urgent issue facing many of the key agriculture production areas. “The percentage of rural workforce has decreased by 25–30% over the last 20 years,” John Friedman, Asia Director of AgFunder & GROW Accelerator, said, speaking in the panel. David Chandra, Senior Director of Microsoft Technology Center and Armen Harutyunyan, Senior Advisor, Sustainable and Digital Agriculture, at the UNDP Global Centre For Technology, Innovation And Sustainable Development, were also present.

Despite the exciting developments of new agrifood tech like vertical farming and cell-based meat, most of the food needed to feed the global population – set to reach 10bn by 2050 – still relies on yields in the field. Technology offers a tremendous accelerator to overcome at least some of these challenges, Friedman said. “Farmers couldn’t cultivate crops or harvest in the field during the pandemic, but technologies like automation and robotics can solve the issue.”

Challenges in empowering smallholders

By now, much of the daily operations that previous generations of farmers had had to deal with, such as spraying and seeding, can be automated, allowing farmers to work and live in a healthier and safer environment.

However, in many cases, the challenge is not about the availability of technology. “We see too many tech choices,” said Jakovljevic. “There are still some barriers when we go to smallholder farmers and try to implement [tech solutions] in the field.” According to the FAO, some 450m smallholder farmers still operate in Asia, producing up to 80% of the continent’s food supply.

Connectivity remains a big issue. “Smallholders in rural areas, especially in developing countries, still don't have access to data services,” Jakovljevic said. Even with the necessary tools, like smartphones, many farmers still need help to take advantage of tech solutions. “We need to invest in the knowledge and literacy of the farmers.” This way, they have both the gadgets and the understanding of how to use them, key to successfully transitioning from a labor-intensive farm to a knowledge-driven one.

Farm size can be an obstacle as well, as farms owned by smallholders are not big enough for digital practices such as precision farming, he pointed out. Farmers in different areas need different support, and there is no one-size-fits-all approach.

“We need to figure out different approaches to help them benefit from technological innovations,” said Jakovljevic. The key is to figure out the basic needs, which are “connectivity and capacity building.”

While tech companies are coming up with different methods and solutions for the agrifood sector, Jakovljevic calls for extra attention to these issues, in particular, how to ensure their transfer to the developing countries, and to the smallholder farmers.

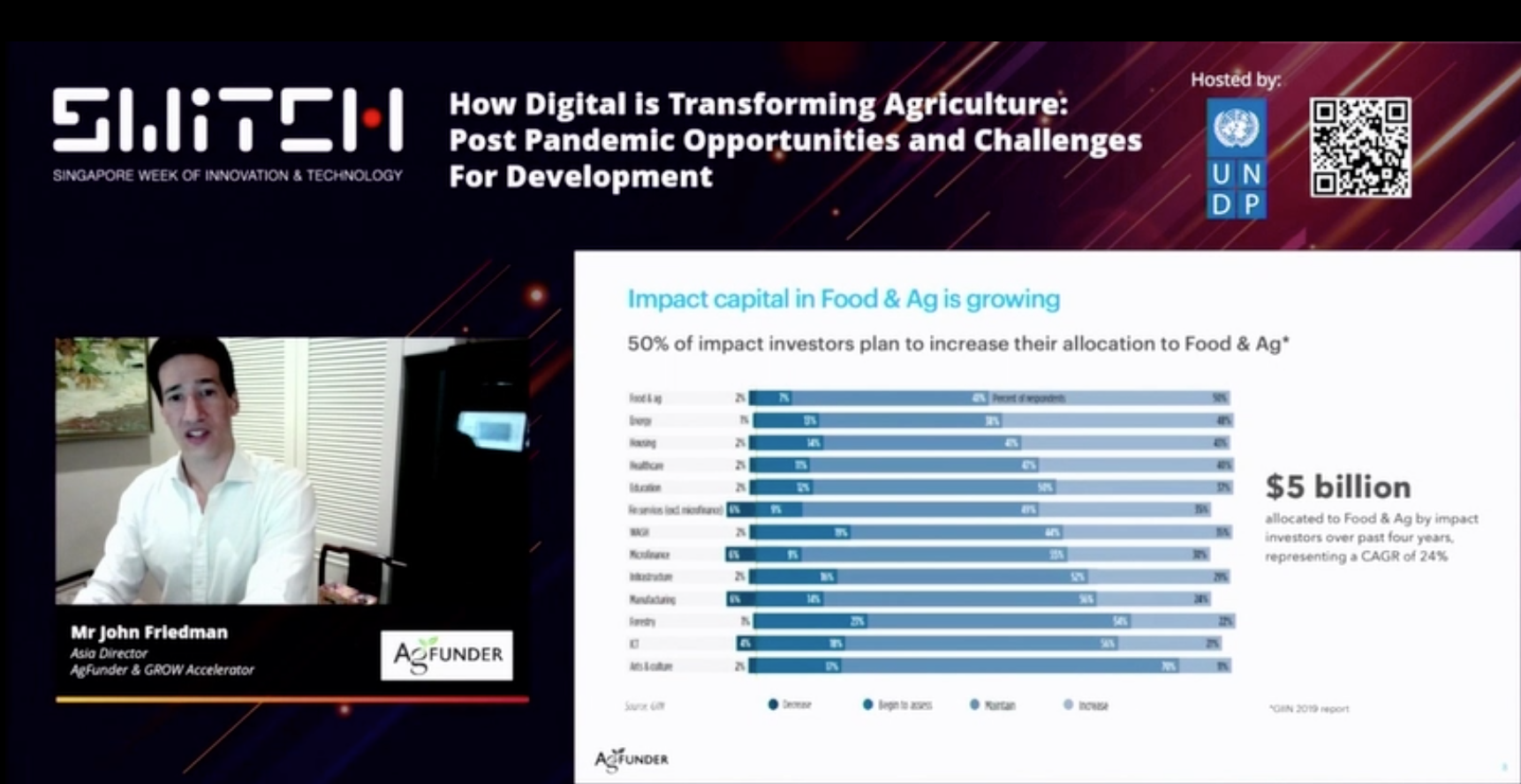

Friedman, speaking on behalf of AgFunder, an active venture investor in agrifood tech with a portfolio of 40 investments, also considers investment as another powerful tool to drive changes in the global food and agriculture system.

Investment as catalyst

“Asia’s food system is ripe for change, with innovation and investment in great demand,” Friedman said. The agrifood tech scene in Southeast Asia is still in its infancy, however.

“It wasn't until the last couple of years that we saw a real surge in investment dollars moving into this space,” he noted. "2019 saw an increase of about 33% in investment dollars and 41% in deal volume from the previous year, with the majority of the deal making activity taking place that's at the seed stage.

“Based on the numbers we observed so far, we are excited to see another record-breaking year in 2020 despite the Covid impact.”

Consumer-focused downstream sectors dominated investor interest in the recent years, vastly overshadowing upstream solutions close to the farm. Investments in the upstream currently comprise less than 20% of the investments in Southeast Asian agritech.

However, according to Friedman, the most promising technologies in the coming decade come from the midstream supply chain sector, as startups create innovation solutions “to distribute and transport products, as well as improve efficiencies in the middle ground.”

“There is a lot going on in the upstream side – from plant genomics and new production methods – and in consumer end,” he said. “The midstream is ripe for transformation driven by either traceability solutions or cold chain solutions.” Since 30% of the foods are lost or wasted worldwide, food wastage is another area that AgFunder is watching closely. “We are seeing solutions through improved distribution efficiencies and cold chains.”

Despite the progress, there is still a lot of catching up to do. “We're still in the very early stages of startup innovation within the agrifood tech space here in Southeast Asia,” Friedman said. “The more developed markets are several years ahead of us. There is a lot to be done in these traditional agricultural markets and there's a lot to look forward to.”

Food is a $4tn market in Asia alone. “The need for an opportunity to be part of its transformation is very much at hand,” said Friedman.

“We will continue to focus on delivering both solid commercial returns as well as measurable measurable impact through our investments, no matter it's improving price transparency and access to market for smallholder farmers, or novel processing to upcycle food waste into sustainable packaging.”