Singapore will be the launchpad of Australian proptech investor and accelerator Taronga Ventures’s RealTechX Impact program next year, evolving from its current RealTechX program to focus on better environmental, social and governance (ESG) outcomes in real estate and construction.

Earlier this month, Taronga Ventures launched the Singapore edition of RealTechX, which started in Australia two years ago. With 12 startups shortlisted, the Singapore program marks the first time RealTechX has expanded beyond its home country and runs till December 2021.

Anchoring the program in Singapore, which is also its Asia headquarters, would give the firm greater access to the global market, Avi Naidu, Managing Partner of Taronga Ventures, told CompassList in an interview. "At our core, we look at technologies that would be relevant to an Asian customer base, but we also think about solutions coming from the US and Europe.

“Besides Southeast Asia, we look at countries like China, South Korea and Japan in North Asia, as well as Australia and New Zealand. It's a multi-market global program that will have physical roots in Singapore and Australia; quite possibly in Japan and in the US as well," he said.

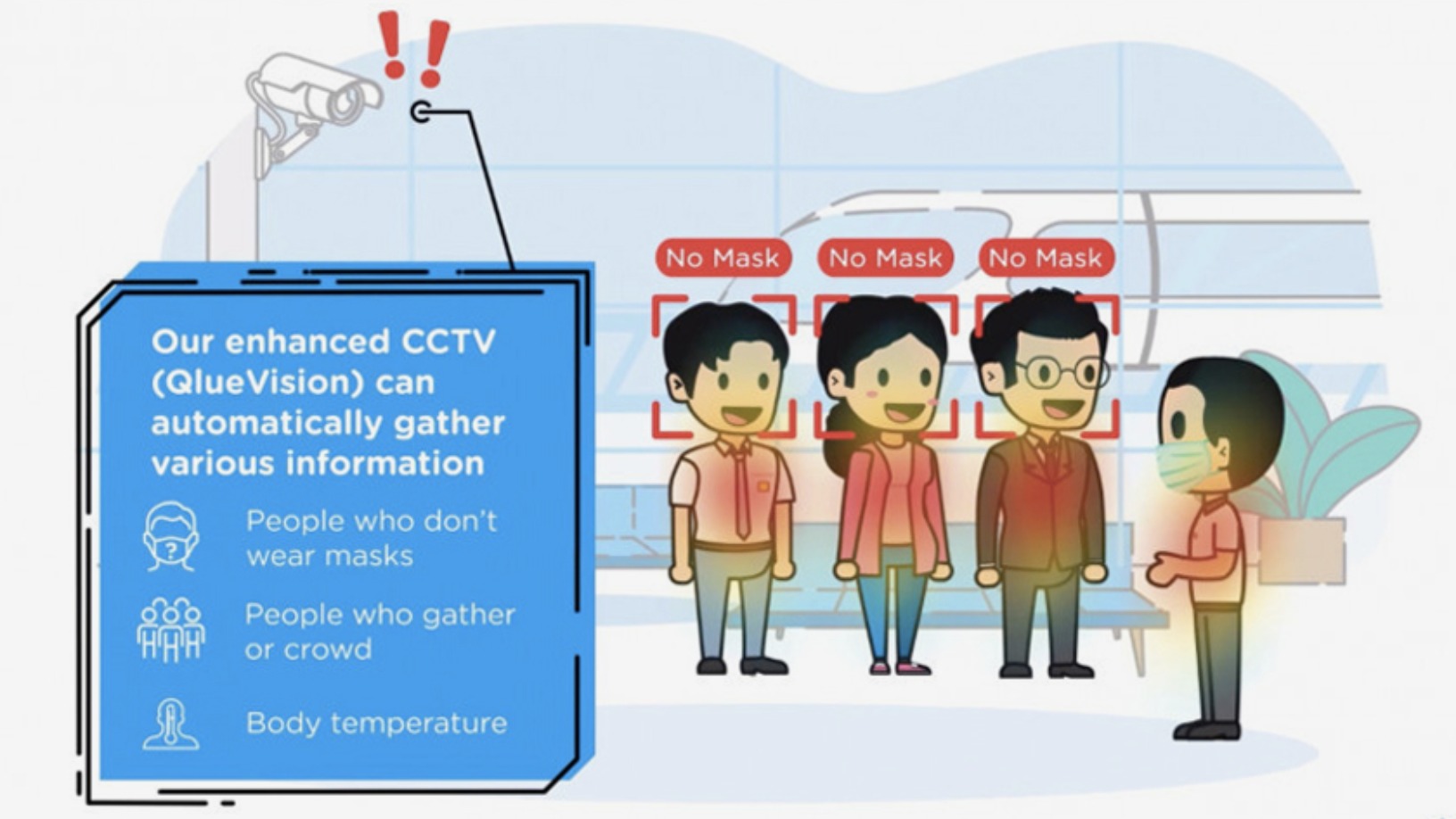

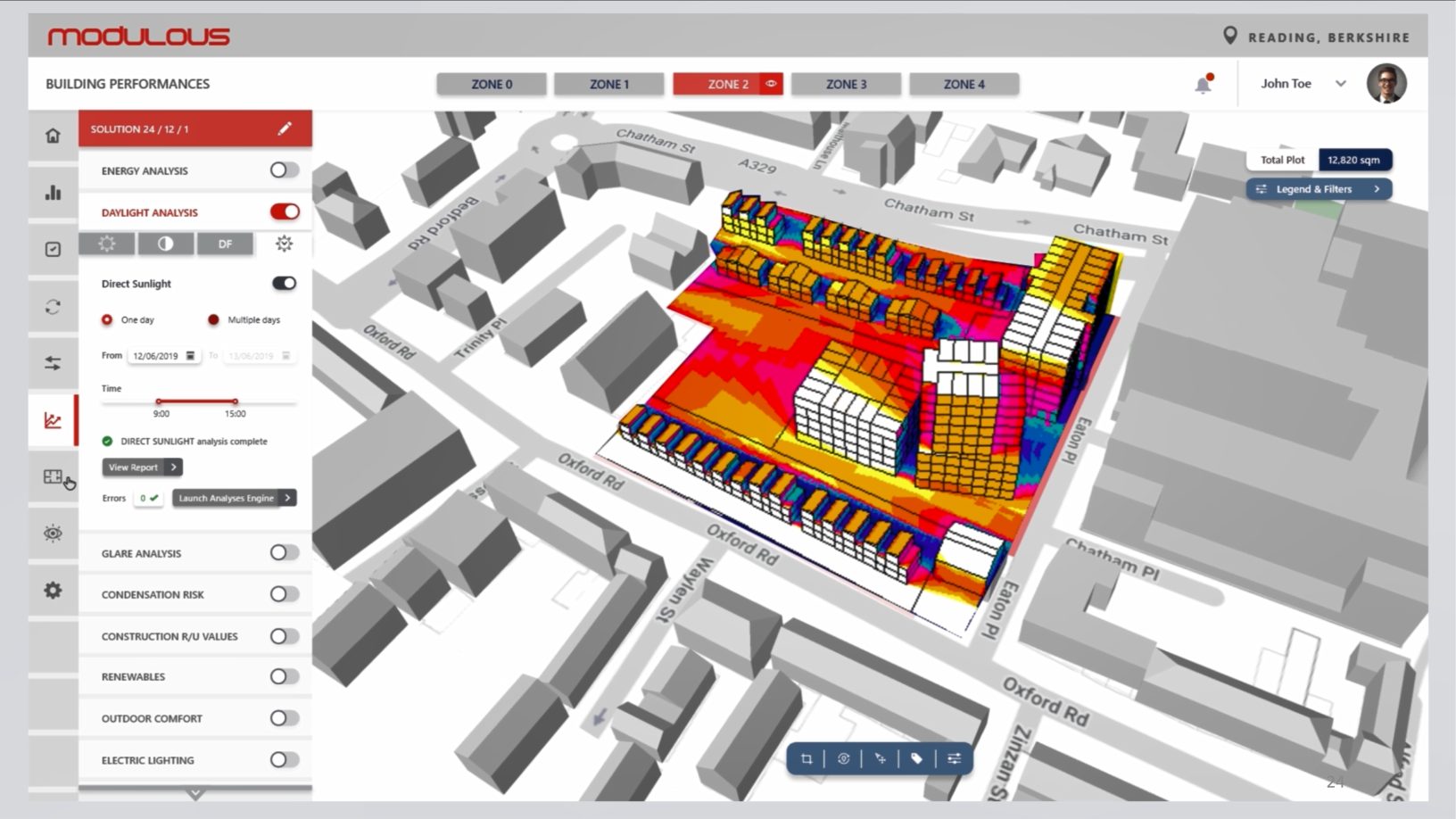

The startups for the Singapore program include construction management software Hubble, building information modeling (BIM) collaboration platform VRCollab, smart city monitoring platform Qlue and wastewater treatment company Hydroleap. Seven of 12 startups are Singapore-based, with the rest from South Korea, the UK, the US and Australia. The startups will be working with industry partners like Mitsubishi Corporation, Nomura Real Estate Development and CapitaLand to launch pilot projects and build more market-ready products.

Way back in 2015, when starting Taronga Ventures, co-founders Naidu and Jonathan Hannam foresaw a structural shift was imminent after consultancy KPMG predicted that venture capital flows into the built environment sector would reach $20bn by 2020. “The sector reached that point two years after KPMG made that prediction,” Naidu said.

Taronga Ventures has invested in startups like US-based OpenSpace, which allows construction managers to remotely survey worksites in 3D; Australian company Allume Energy, which builds solar power systems for apartments and residential buildings; and Singapore- and Hong Kong-based residential rental management startup Dash Living.

In April 2021, Taronga Ventures reportedly raised $48m for its Real Tech Ventures Fund to invest in real estate companies in Asia, out of the $100m targeted. Naidu said the amount raised is actually higher, but he declined to elaborate. “At this stage, we have not made public the fund amount, but we generally like to make $5m-odd investment in each company,” he said.

Building industry links

Startups accepted to the RealTechX program aren’t guaranteed investments. As the core activities revolve around direct collaboration between the participants and Taronga Venture’s industry partners, only growth-stage, revenue-generating companies are accepted.

The Real Tech Ventures Fund invests separately from the RealTechX accelerator. “If you put in such restrictions [for RealTechX], you’re not attracting the best companies. Rather, you’re only attracting companies that need capital,” Naidu said, explaining the omission of funding by the RealTechX accelerator.

The gap in the market is connections to industry leaders

Taronga Venture’s industry partners come from various sectors within the built environment industry, from real estate giants like PGIM, Lendlease, CapitaLand and Nomura Real Estate Development, to communications and tech companies like Microsoft, Google and Verizon.

“The gap in the market is connections to industry leaders, who are [the startups’] ultimate customers, so they can better understand how to communicate with them and eventually scale,” Naidu said.

RealTechX also enables startups to connect with public sector agencies, which are potential clients. The Singapore program, for example, includes companies like Neighbourlytics, SmartClean and Qlue, which provide government agencies with surveillance and monitoring tools to track pollution, urban traffic, and even crime.

“Governments are conscious of building their cities safely and efficiently, and they also want to build more connected cities,” Naidu said.

The Department of Industry, Innovation and Science in Australia has supported RealTechX; so has Enterprise Singapore for the Singapore chapter. Both agencies offer financial support, networking and relationship-building.

To select which startups will join its program, RealTechX consults its industry partners to determine the types of products and services they need. “We look at the solutions that our partners are willing to champion and adopt, and we use that matrix to select the companies that will go through ultimately,” Naidu said.

Covid-driven shifts

Naidu predicts that as a result of the pandemic, companies will change the way they see and use spaces, both office and retail. “People used to go to the office every day to work, but in the future, they will go there to do more high-value activities.” Routine tasks and meetings, even social interaction, can be done remotely with new technologies.

Owners and operators of retail spaces will need to adapt to online shopping. Covid-19 “has brought a lot more people, [even] the older generation, toward online purchases, and many of them have found the experience easy and quite frictionless. But that’s not to say that people are going to use the built environment less. They’re no longer going to go somewhere just to buy something; they want higher-value experiences,” he said.

A number of companies from RealTechX are working to transform the management of office and retail spaces. WorkClub, which participated in the program from January–May 2020 in Australia, provides flexible workspaces through co-working and pay-per-use space leasing. Another company called SpaceCube, which joined the Australian program earlier this year, takes a different approach with modular buildings that can be relocated and repurposed as needed.

There are also startups like Omnyfy, which helps retailers build online versions of their physical store experiences, and Darabase, which allows building owners to manage and monetize augmented reality (AR) assets within their property.

Naidu noted signs of “pent-up demand” reinvigorating the construction market after a year of scaled-back building activity, although new Covid-19 outbreaks or government-imposed restrictions may dampen this recovery. “Being long-term industries, construction and development thrives on certainty. We will have to see what happens in the Northern Hemisphere markets in the coming winter.”

More than just ESG goals

Over 90% of Taronga Ventures's investments and pipeline are in ESG-related technologies. Although green technologies like energy optimization and solar power systems often require higher initial investments, the energy savings and data collected from such systems contribute to higher property valuations.

Among the companies that Taronga Ventures has supported in these verticals is Switch Automation, which provides building operators with tools to monitor energy usage and automate power-saving measures. Another company, called CarbonCure, goes even further, using CO2 to produce stronger concrete mixes. Taronga Ventures invested in CarbonCure last September in a round led by Amazon’s Climate Pledge Fund.

“About 39% of all global carbon emissions come from the built environment, and about 11% of that comes from the construction process itself. There's a real opportunity for us to influence carbon emission in the built environment,” Naidu said.

We want to bring a sense of diversity into our program

Going forward, Taronga Ventures wants to work with companies that champion social and safety improvements in the construction sector. Worker safety will be a major focus, as there are still “over 100,000 people dying needlessly" in construction sites globally, Naidu said.

“There is still an under-representation of women in construction and real estate, as well as pay and gender gaps. We want to bring a sense of diversity into our program,” he added.

According to Naidu, companies in the Southeast Asian construction market are looking beyond efficiency and costs and placing more importance on transparency and compliance. Compliance with safety rules, in particular, is approaching the levels seen in Western markets. "In the upcoming RealTechX program, you will see companies like Hubble, which help drive greater compliance from construction workers, as well as greater transparency for the general contractors to see how their sites are operating."

At the same time, Naidu is wary of the mushrooming of startups in real estate and building. “As the asset class grows and the technology proliferates, you have to be more judicious about what you choose to invest in,” he said. “There is a lot of noise around what technologies can be delivered to the market, and we have to spend a lot of time cutting through that.”

He added that while Taronga Ventures hasn’t yet shunned any particular vertical, the firm is cautious about startups that offer specific local solutions but lack the flexibility to scale outside of its origin market.

“For example, there are many startups in China that can grow well within the huge market, but they only address specific regulatory challenges, like cloud computing and intellectual property,” Naidu said. “We’re less inclined to invest in such companies because we look for solutions that can be adopted across many different countries.”

UPDATE: A previous version of this article included information about Taronga Ventures’s ESG-related investments from April 2021. This has been updated.