Imagine robots driving long-haul trucks 24/7 across Asia to Europe along transcontinental superhighways built under China's Belt and Road infrastructure development plan. Armed with US$200m Series D funding, AI-tech unicorn TuSimple is set to roll out autonomous commercial trucks by 2020.

Tackling the acute shortage of truck drivers and other supply chain logistics issues across borders is no mean feat, even for unicorns. According to McKinsey & Co, autonomous trucking will most likely occur in four waves. Platooning of trucks, with a human driver in the lead truck of the interlinked convoy, is expected to be commercially adopted by 2025. This will be followed by limited use of various autonomous features, with each stage gradually reducing costs for businesses. Full automation of trucks is expected to be achieved by no earlier than 2027.

Founded in Beijing, TuSimple has wasted no time in getting a foothold in the US, where trucking companies are grappling with high operating costs and a shortage of available drivers. In 2016, CTO and co-founder Hou Xiaodi and senior scientist Huang Zehua relocated overseas to lead TuSimple Inc's first R&D center in San Diego, California. In August 2017, an engineering facility and truck depot was set up in Tucson, Arizona. Heading the US enterprise as CPO is experienced hands-on tech engineer Chuck Price, who had previously held management positions with Tradescape, Peloton and Oracle Corp.

With industry competitors like Embark and Starsky Robotics all racing ahead to commercialize and embed autonomous driving systems for road logistics and supply chains, TuSimple is banking on strategic partnerships with truck manufacturers like Peterbilt and Navistar to be the first major commercial player. Tech firm Nvidia also owns 3% of TuSimple, its first investment in a Chinese startup.

Laser focus

"Autonomous driving is one of the most complex AI systems humans have ever built," said Hou, one of China's most highly cited experts on computer vision in the last decade. "After three years of intense focus to reach our technical goals, we have moved beyond research into the serious work of building a commercial solution."

When TuSimple was founded in August 2015, the startup's R&D was focused on the application of image recognition technology for internet advertising. Clients included Sina.com and Sina Weibo, the popular Twitter-style microblogging platform. But soon afterward, the team decided to pivot TuSimple from adtech to autonomous driving.

The major challenge was looking for growth opportunities. "We wanted a project that takes us longer than three years to finish," Hou said in an interview with Sina.com in 2016. "We had already developed a system that enabled our product manager to operate deep learning features with a simple mouse click. But that leaves little to the imagination regarding the technology application."

Another co-founder, Chen Mo, who is now TuSimple's CEO, also believed that the company's image analysis technology would not be developed to its full potential within the advertising industry alone. Autonomous driving was chosen because it requires higher precision. Unlike for other self-driving players like Waymo and Baidu, the mapping technology LiDAR is not central in TuSimple's sensing technology to detect objects on the road. LiDAR is also not viable for large-scale commercialization due to its high cost. The hardware for a complete LiDAR system costs over US$200,000. The US$80,000 price tag for the distance measurer alone costs more than many car models.

TuSimple's computer vision capabilities stem from its camera-sensor system, now known as “robotruck cameras”. The robotruck system allows self-driving trucks to detect and track objects as far as 1,000 meters away, at least three times the distance that can be detected by LiDAR. Both radar and LiDAR only play a supportive role for close encounters, such as changing lanes. The TuSimple system currently costs RMB 400,000 but is expected to drop to as low as RMB 180,000 in two years' time.

Commercial opportunities

Autonomous trucking is faster to commercialize compared with self-driving passenger cars – another reason the co-founders decided to go for the driverless-truck manufacturing sector.

"First, routes between large depots are mostly fixed, which greatly simplifies autonomous mapping. Second, land freight transport mostly happens on highways or suburban settings, where transportation is relatively easier than in dense urban areas," Huang, who is TuSimple's vice president of engineering, said at an event at US university UCLA sponsored by Chinese mediatech Synced in 2016. "Freight companies today operate on low profit margins due to fierce market competition. Autonomous driving can help them to save labor costs to get higher margins."

Huang has been working on computer vision R&D since 2010. During his tenure as research associate at Carnegie Mellon University from 2012 to 2015, he has participated in the development of GM’s Super Cruise hands-free driving system that was used in the Cadillac CT6.

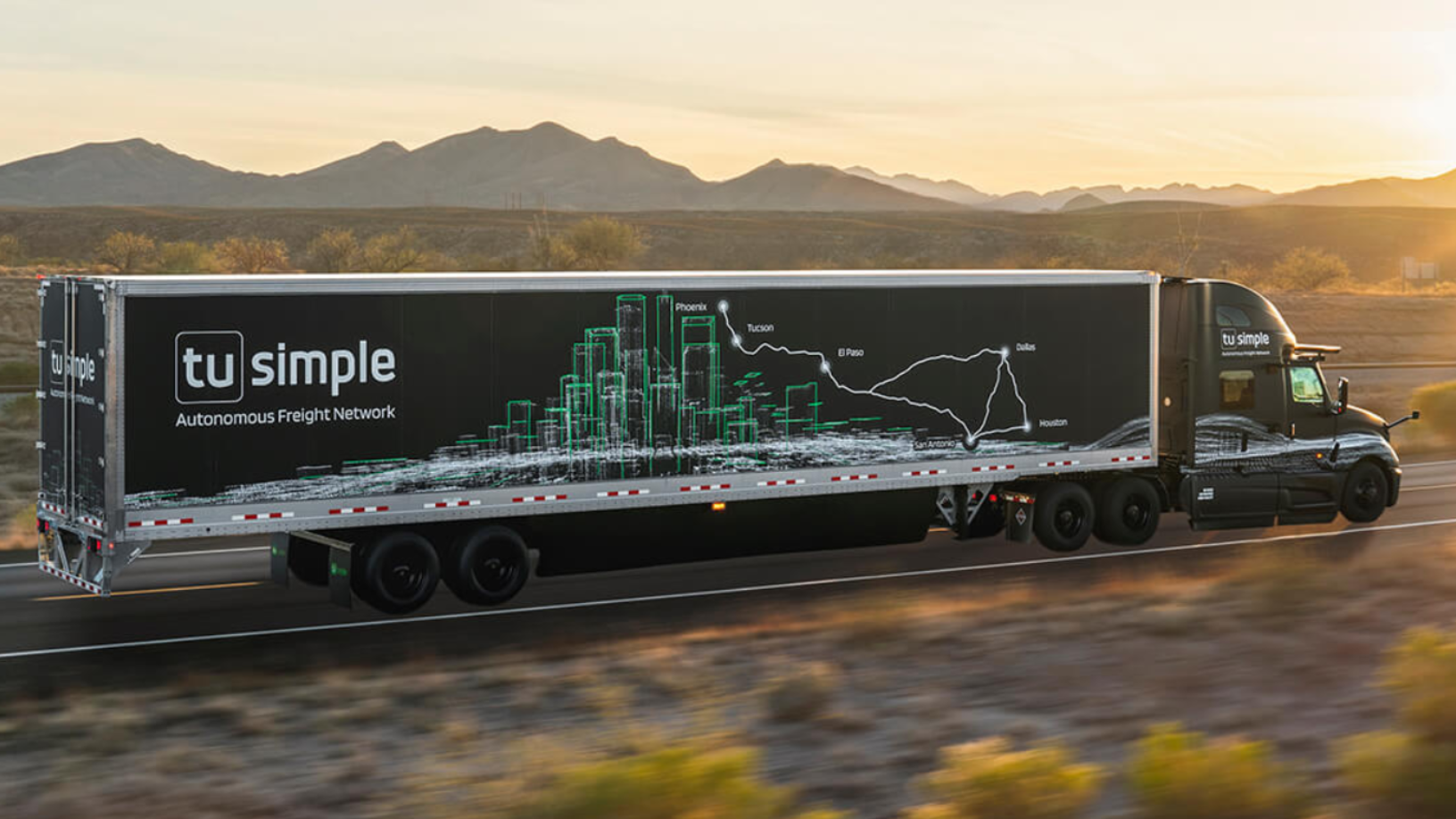

In June 2019, TuSimple successfully finished a two-week self-driving truck test from Phoenix to Dallas for the US Postal Service, with no traffic incidents. This followed several road tests on California's interstate system of up to 1,000 miles long. The company now plans to have a 50-truck fleet for long-haul commercial operations in the US by the end of 2019.

Meanwhile in China, TuSimple will focus on using the technology for drayage operations and hauling cargo at ports, where there is huge unmet demand for transportation, according to Chen, the CEO. A 300-day trial operation at Caofeidian Port, Hebei Province, has just been completed. TuSimple has also completed its first Chinese public road test, a 30-km route in the port area of Shanghai. It is also applying for a demo operation route in Shanghai to trial autonomous driving on domestic highways.

Today, each TuSimple autonomous truck features two human occupants: a safety driver with a US commercial driver's license, ready to manually take over the driving of the vehicle if needed, and an engineer who sits next to the human driver, who monitors the robotruck's autonomous operational system and real-time performance. TuSimple's ambitious goal is for both humans to be out of the truck by 2020.