15K Angels

DATABASE (25)

ARTICLES (26)

Angels Capital is an investment vehicle created by Juan Roig as part of the Marina of Companies network in Valencia. Its mission is to grow startups within the Lanzadera accelerator, as well as external projects that facilitate the creation of a strong entrepreneurial ecosystem in Valencia. Angels Capital has 13 current investment projects, seven of which it is lead investor in and, since 2014, it has invested €15.5 million in capital. Recent investments include a €1 million venture round for cloud-based workflow platform SheetGo, and €360,000 in seed funding for bank aggregation system Afterbanks.

Angels Capital is an investment vehicle created by Juan Roig as part of the Marina of Companies network in Valencia. Its mission is to grow startups within the Lanzadera accelerator, as well as external projects that facilitate the creation of a strong entrepreneurial ecosystem in Valencia. Angels Capital has 13 current investment projects, seven of which it is lead investor in and, since 2014, it has invested €15.5 million in capital. Recent investments include a €1 million venture round for cloud-based workflow platform SheetGo, and €360,000 in seed funding for bank aggregation system Afterbanks.

Formerly known as Tribeca Angels, the New York-based Tribeca Early Stage Partners was established in 2014 by John McEvoy. The firm's network of 50 entrepreneurs and business leaders specialize in institutional finance and enterprise technology. Tribeca focuses on early-stage investments in fintechs and ERPs, especially those based in the New York area. Initial investment per startup ranges from US$500,000 to US$1 million. It has invested in 15 startups and managed two exits, Cola and James.

Formerly known as Tribeca Angels, the New York-based Tribeca Early Stage Partners was established in 2014 by John McEvoy. The firm's network of 50 entrepreneurs and business leaders specialize in institutional finance and enterprise technology. Tribeca focuses on early-stage investments in fintechs and ERPs, especially those based in the New York area. Initial investment per startup ranges from US$500,000 to US$1 million. It has invested in 15 startups and managed two exits, Cola and James.

Bynd Venture Capital (formerly Busy Angels)

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Founder, CEO of Bewe (formerly MIORA)

Ballesteros is one of Spain's most prominent serial entrepreneurs and business angels, and the man behind some of the most successful acquisitions in Spain and Latin America. Cabify, Woom Fertility and co-investments with Seaya Ventures form part of his investment portfolio. His first entrepreneurial experience started in 1997 with online classified ads platform Ocioteca.com and MundoSalud (acquired by Sanitas of Bupa Group). One of his biggest successes has been on-demand food delivery platforms, SinDelantal in Spain and SinDelantal Mexico, both acquired by Just Eat in 2013 and 2015, respectively. He is currently sole founder of Bewe SaaS for beauty and wellness professionals.

Ballesteros is one of Spain's most prominent serial entrepreneurs and business angels, and the man behind some of the most successful acquisitions in Spain and Latin America. Cabify, Woom Fertility and co-investments with Seaya Ventures form part of his investment portfolio. His first entrepreneurial experience started in 1997 with online classified ads platform Ocioteca.com and MundoSalud (acquired by Sanitas of Bupa Group). One of his biggest successes has been on-demand food delivery platforms, SinDelantal in Spain and SinDelantal Mexico, both acquired by Just Eat in 2013 and 2015, respectively. He is currently sole founder of Bewe SaaS for beauty and wellness professionals.

PadeInvest is involved in early-stage investments to accelerate the growth of Spanish startups. The angel investor consortium was named the Best Business Angels Network of 2013 by the Spanish Association of Business Angels (AEBAN).Based in Madrid, PadeInvest was established in 2010 by 35 IESE Business School students from the PADE’10 program for investment activities of tech startups. Its network comprises professionals in business management across multiple industry sectors.

PadeInvest is involved in early-stage investments to accelerate the growth of Spanish startups. The angel investor consortium was named the Best Business Angels Network of 2013 by the Spanish Association of Business Angels (AEBAN).Based in Madrid, PadeInvest was established in 2010 by 35 IESE Business School students from the PADE’10 program for investment activities of tech startups. Its network comprises professionals in business management across multiple industry sectors.

Headquartered in Murcia, Spain, Aurorial is part of e-commerce group PcComponentes. Aurorial focuses on Spanish-based startups at the seed capital stage, investing between €50,000 and €100,000 with other funds and experienced business angels.

Headquartered in Murcia, Spain, Aurorial is part of e-commerce group PcComponentes. Aurorial focuses on Spanish-based startups at the seed capital stage, investing between €50,000 and €100,000 with other funds and experienced business angels.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

The investment fund was established in 1998 by Luis Martín Cabiedes, one of the most prominent business angels in Spain. The VC provides funds for early-stage growth of internet and technology ventures in Spain, acting initially as a business angel and then becoming a venture capitalist for future funding rounds.

The investment fund was established in 1998 by Luis Martín Cabiedes, one of the most prominent business angels in Spain. The VC provides funds for early-stage growth of internet and technology ventures in Spain, acting initially as a business angel and then becoming a venture capitalist for future funding rounds.

PNV Capital is a seed investment fund in Proença-a-Nova, Portugal, co-invested by Busy Angels. The fund is worth about €770,000 and invests an average of about €100,000 per project, with a cap at €200,000.this is all frmo the previous write up as they have no webpage still!

PNV Capital is a seed investment fund in Proença-a-Nova, Portugal, co-invested by Busy Angels. The fund is worth about €770,000 and invests an average of about €100,000 per project, with a cap at €200,000.this is all frmo the previous write up as they have no webpage still!

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Seedrocket 4Founders Capital is a business accelerator based in Barcelona. Established in 2017, it has invested in 60 startups including six exits. The accelerator provides promising startups with initial funding of €30,000–€50,000. Additional finance of up to €700,000 per company may also be available for the lifetime of the investment, in conjuction with other business angels and partners.

Seedrocket 4Founders Capital is a business accelerator based in Barcelona. Established in 2017, it has invested in 60 startups including six exits. The accelerator provides promising startups with initial funding of €30,000–€50,000. Additional finance of up to €700,000 per company may also be available for the lifetime of the investment, in conjuction with other business angels and partners.

REDangels is a Portuguese angel investor enterprise that specializes in pre-seed and seed investments in Portuguese and European startups across various sectors. There are 56 business angels working for REDangels which currently has 26 startups in its portfolio. It most recent investments include the seed rounds of sound design CGI software company Sound Particles and digital identity lifestyle manager Loqr.

REDangels is a Portuguese angel investor enterprise that specializes in pre-seed and seed investments in Portuguese and European startups across various sectors. There are 56 business angels working for REDangels which currently has 26 startups in its portfolio. It most recent investments include the seed rounds of sound design CGI software company Sound Particles and digital identity lifestyle manager Loqr.

Founded in 2015, the Porto-based Betwixt Ventures is no longer active. The venture capital fund manager and advisory firm specialized in early-stage investments in Portuguese tech startups. It invested in startups vetted by other business angels, or co-invested with other VC partners and private investors. The focus of the investments was to fill in the funding gap between seed and Series A rounds.

Founded in 2015, the Porto-based Betwixt Ventures is no longer active. The venture capital fund manager and advisory firm specialized in early-stage investments in Portuguese tech startups. It invested in startups vetted by other business angels, or co-invested with other VC partners and private investors. The focus of the investments was to fill in the funding gap between seed and Series A rounds.

Arthur Kosten is an adviser for Booking.com and other companies like Festicket and eVentures Africa Fund. He was the former CMO and co-founder of Booking.com. Together with other business angels and VCs, he generally invests about US$200,000 to US$1 million in various marketplace platforms for expansion in Europe. He is also an investor and board member of rentalcars.com, catawiki.com, treatwell, 8fit.com, festicket and healthcare.com.

Arthur Kosten is an adviser for Booking.com and other companies like Festicket and eVentures Africa Fund. He was the former CMO and co-founder of Booking.com. Together with other business angels and VCs, he generally invests about US$200,000 to US$1 million in various marketplace platforms for expansion in Europe. He is also an investor and board member of rentalcars.com, catawiki.com, treatwell, 8fit.com, festicket and healthcare.com.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

- 1

- 2

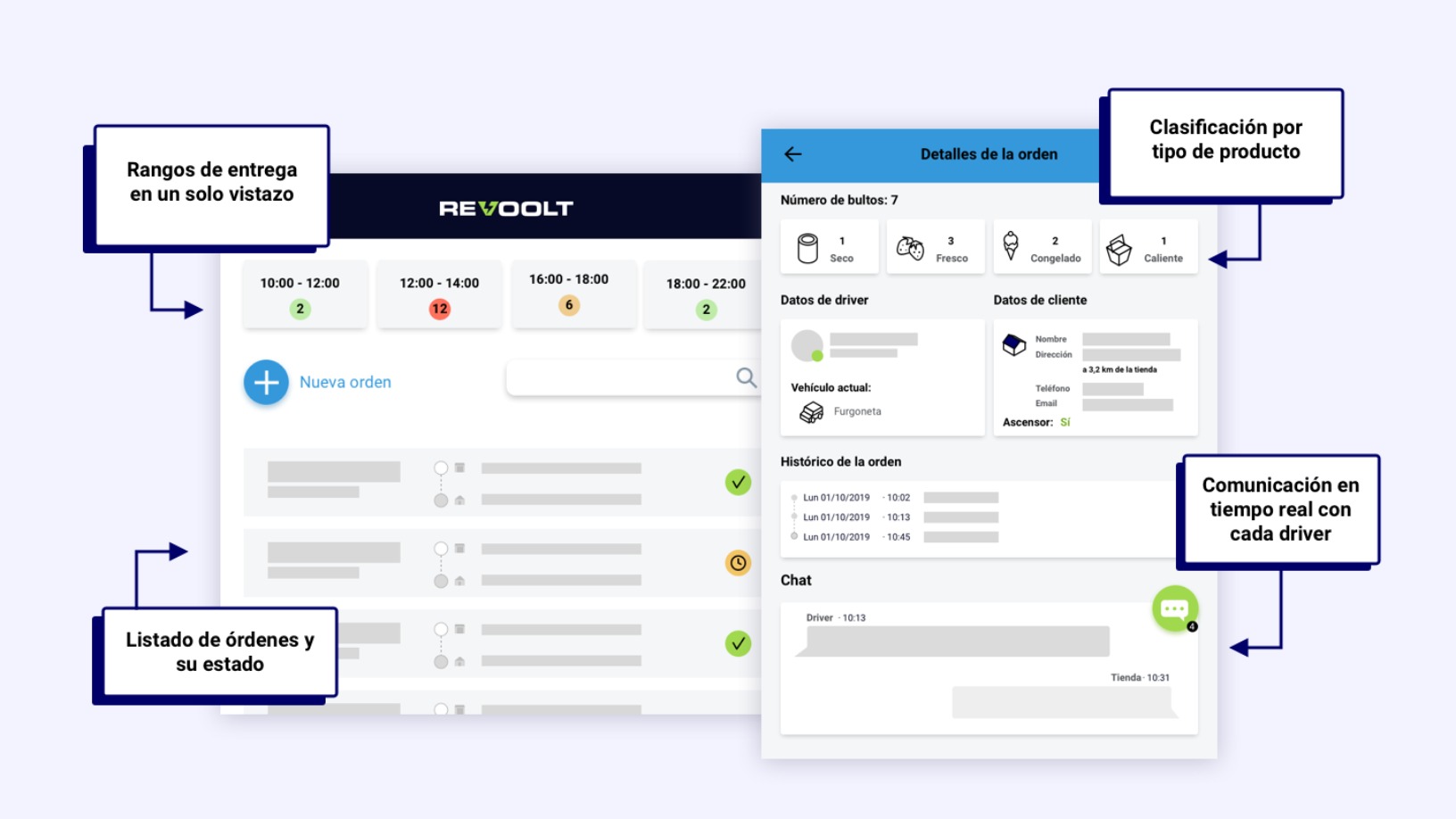

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

Airhopping: Breakthrough in the OTA sector for millennials

Offering cheap and flexible multi-destination flight packages is helping the platform become the go-to reservation agent for budget travelers

EXCLUSIVE: Mexico’s Trendier invests in Chicfy as part of €1 million deal

Spain's most popular secondhand fashion marketplace and media darling gets lifeline as it struggles financially to stay afloat

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Tuvalum: Fast-growing vertical marketplace for used quality bikes

Banking on organic reach, Tuvalum has set its sights on a €40 billion market

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

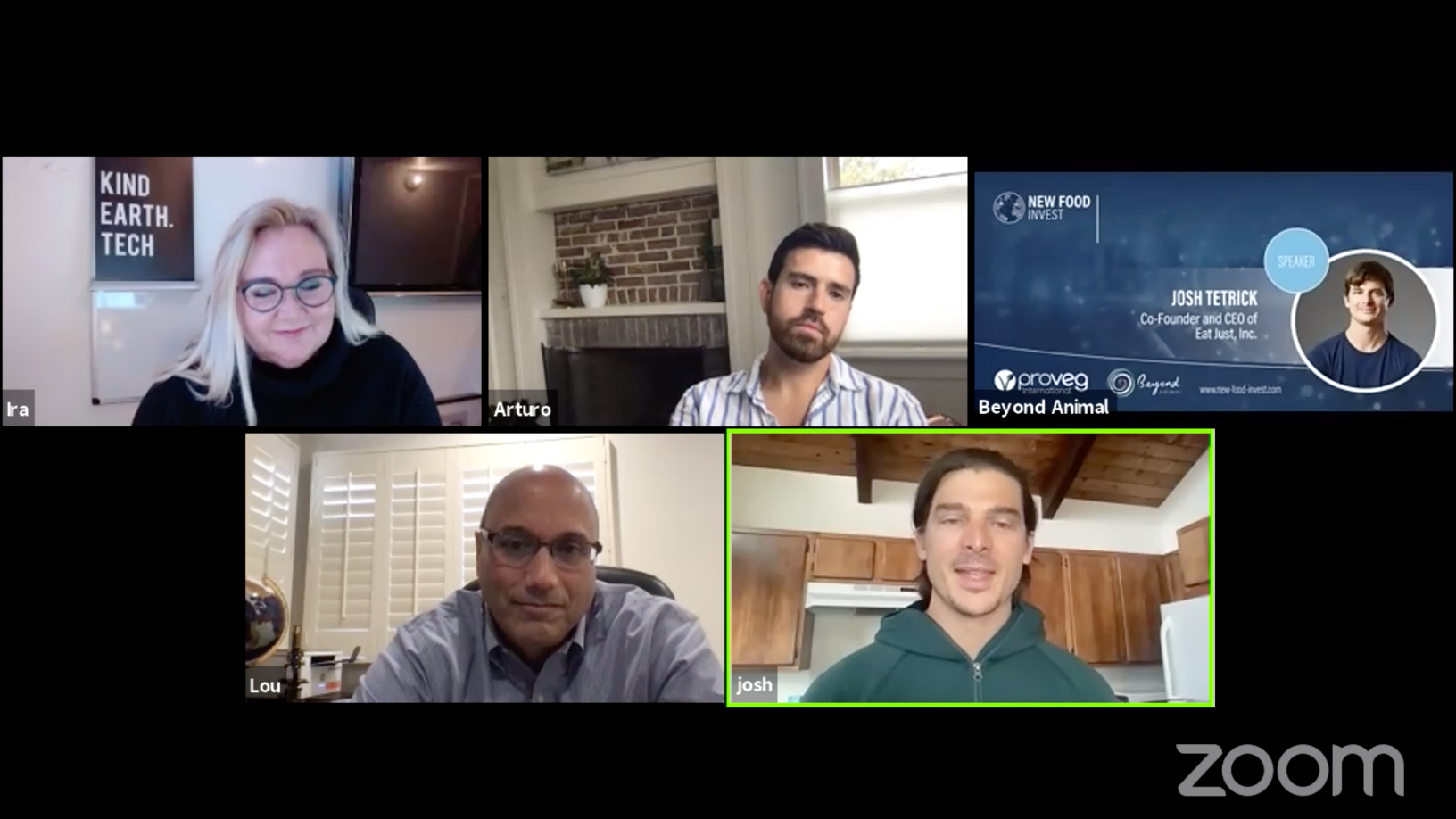

New Food Invest: Challenges of growing an alt-protein startup

Founders of three alt-protein startups in the US share what motivated them to start, their personal experiences growing the businesses, getting funding and finding strategic partners

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

FluroSat: Combining satellite imagery and farm data to predict crop issues

This year’s Future of Food Asia winner offers a crop management software that can be used with existing agritech platforms, adding value with machine learning, and is even used for sustainability reporting

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

CloudGuide: Bringing museum tourism into the 21st century

CloudGuide, an app hosting official multimedia content from museums and tourist attractions, seeks post-seed funding to scale in Europe

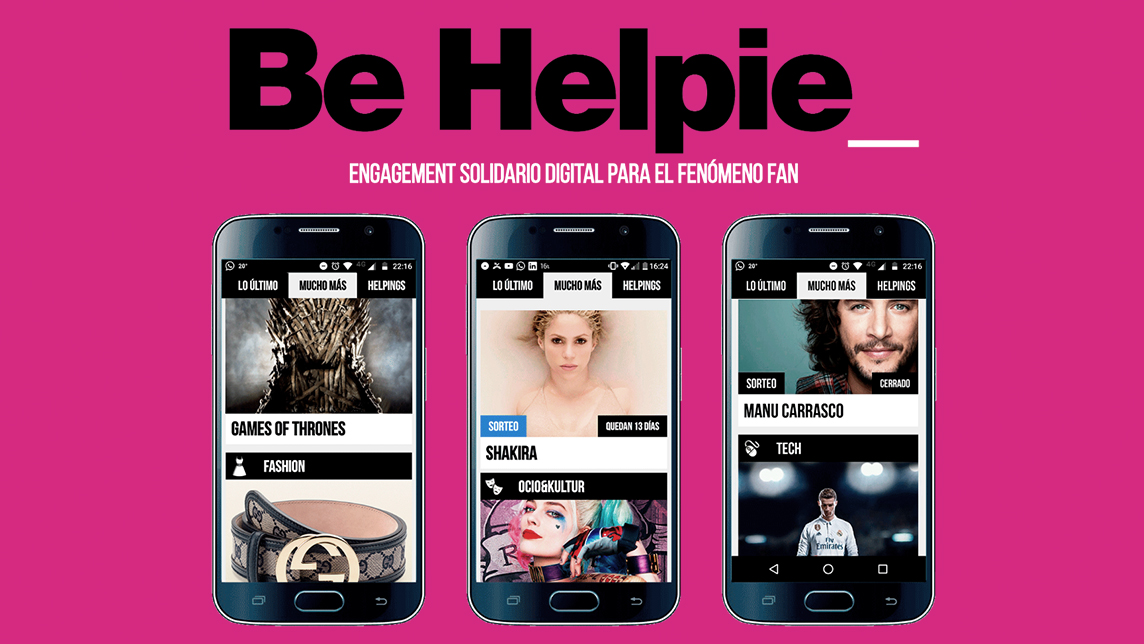

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

Didimo: Creator of "digital humans" secures €6.2m in seed funding

Portuguese startup Didimo aims to humanize online interactions with its disruptive 3D technology

Ecojoko: Using AI, real-time data to save electricity

The French startup’s energy-saving assistant and mobile app show how much electricity is being used and how much can be saved for every household appliance

Spanish AI startups unleash the power of virtual assistants

More Spanish deep technology firms are shifting the paradigms in human-machine interactions, overhauling customer experience

- 1

- 2

Sorry, we couldn’t find any matches for“15K Angels”.