50 Partners

-

DATABASE (289)

-

ARTICLES (450)

Established in 2006, European private equity firm Vitruvian Partners focuses on asset-light companies in its targeted sectors. The firm has a successful track record with more than 85 transactions completed. Vitruvian Partners invests £25 million to over £150 million in companies typically valued at £50 million to over £500 million.

Established in 2006, European private equity firm Vitruvian Partners focuses on asset-light companies in its targeted sectors. The firm has a successful track record with more than 85 transactions completed. Vitruvian Partners invests £25 million to over £150 million in companies typically valued at £50 million to over £500 million.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Headquartered in London, Apax Partners was founded in 1969. It is one of the biggest private equity funds in Europe. Apax Partners has offices in New York, Hong Kong, Mumbai, Tel Aviv, Munich and Shanghai. The Shanghai office opened in 2008. Apax Partners currently manages over US$50 billion in assets and invests mainly in the sectors of technology & telecommunications, healthcare and consumer products.

Headquartered in London, Apax Partners was founded in 1969. It is one of the biggest private equity funds in Europe. Apax Partners has offices in New York, Hong Kong, Mumbai, Tel Aviv, Munich and Shanghai. The Shanghai office opened in 2008. Apax Partners currently manages over US$50 billion in assets and invests mainly in the sectors of technology & telecommunications, healthcare and consumer products.

Owned by French investment group Eurazeo, Idinvest Partners was founded in 1997 in Paris, France, as AGF Private Equity and operated as part of German multinational Allianz until 2010, when it became an independent entity. With additional offices in Madrid, Frankfurt, Shanghai and Dubai, Idinvest manages €8bn in assets and has invested in around 4,000 companies, with 75 exits. It specializes in private equity and venture capital financing of European small and mid-size startups and has been named Best Private Equity Team by Deloitte in its 2012 Technology Fast 50 Awards. The company was acquired by Eurazeo in April 2018.

Owned by French investment group Eurazeo, Idinvest Partners was founded in 1997 in Paris, France, as AGF Private Equity and operated as part of German multinational Allianz until 2010, when it became an independent entity. With additional offices in Madrid, Frankfurt, Shanghai and Dubai, Idinvest manages €8bn in assets and has invested in around 4,000 companies, with 75 exits. It specializes in private equity and venture capital financing of European small and mid-size startups and has been named Best Private Equity Team by Deloitte in its 2012 Technology Fast 50 Awards. The company was acquired by Eurazeo in April 2018.

Mountain Partners is a global company builder that has managed more than 90 investments in IT-based startups. Mountain Partners supports companies from incubation to growth stages to go global.

Mountain Partners is a global company builder that has managed more than 90 investments in IT-based startups. Mountain Partners supports companies from incubation to growth stages to go global.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Co-founder of Jimaisong

Former co-founder of Nasdaq-listed eFuture Zou Hongjun helped built the supply chain IT systems of over 50% of China’s top 100 chain-store enterprises. The Chongqing University graduate also has years of experience in fresh food e-commerce.

Former co-founder of Nasdaq-listed eFuture Zou Hongjun helped built the supply chain IT systems of over 50% of China’s top 100 chain-store enterprises. The Chongqing University graduate also has years of experience in fresh food e-commerce.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

European venture capital firm Advent Venture Partners was established in 1981.

European venture capital firm Advent Venture Partners was established in 1981.

Asabys Partners is a VC firm based in Barcelona and invests mainly in the healthtech and biopharma industries. Backed by Sabadell Bank, the VC now has offices in Spain, UK, Switzerland and Israel. Asabys Partners aims to accelerate technology breakthroughs in the fields of science and medicine by supporting a network of industry experts and talent.Asabys started operations in 2019 and is currently fundraising its first fund, Sabadell Asabys Health Innovation Investments, with a target size of €70m and Banc Sabadell as anchor investor. Main areas of investment include Biopharma, MedTech and Digital Therapeutics.

Asabys Partners is a VC firm based in Barcelona and invests mainly in the healthtech and biopharma industries. Backed by Sabadell Bank, the VC now has offices in Spain, UK, Switzerland and Israel. Asabys Partners aims to accelerate technology breakthroughs in the fields of science and medicine by supporting a network of industry experts and talent.Asabys started operations in 2019 and is currently fundraising its first fund, Sabadell Asabys Health Innovation Investments, with a target size of €70m and Banc Sabadell as anchor investor. Main areas of investment include Biopharma, MedTech and Digital Therapeutics.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

EatTasty: Portugal's sustainable meal delivery service has arrived in Spain

EatTasty's different and more sustainable business model turns the on-demand food delivery sector on its head

Shrimp-farming data made easy: Interview with JALA’s CEO Liris Maduningtyas

Indonesian agritech startup JALA managed to overcome the hurdles caused by lack of experience after participating in accelerator programs. It is now taking the next steps to better products

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

In a united move, Portuguese startups fight to mitigate Covid-19 impact in unprecedented crisis

As strong growth of previous years falters, Portugal's startups were quick to mobilize themselves to detail the help they would need from the state to deal with their biggest challenge yet

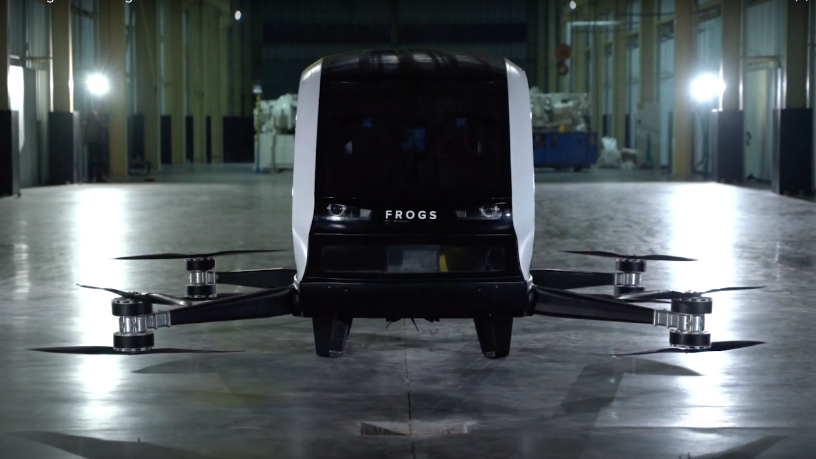

FROGS: Overcoming challenges to launch Indonesia's first drone-taxi for daily commutes

The Yogyakarta-based startup backed by UMG Idealab seeks more technical resources to launch Indonesia's first homegrown “flying taxi,” after the success of its agritech drones

Bewe: From LatAm to the US, scaling fitness and wellness business globally post-Covid

Serial entrepreneur Diego Ballesteros’s latest venture Bewe seeks to disrupt the lucrative US wellness and fitness market with more competitive pricing

Amid Covid-19, contactless smart mailbox startup Mayordomo eyes €75m revenue by 2024

Mayordomo's Smart Point app-locker system helps consumers get the best deals online while minimizing CO2 emissions from multiple vendors’ last-mile deliveries

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

Kathy Xu stays ahead of the curve in China's VC scene

Dubbed “Queen of VC” in China, Xu has spotted great companies that others were not quite interested in, like Chinese online retail giant JD.com

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

P2P lender Investree collaborates with eFishery to provide loans for aquaculture SMEs

Access to quick financing would be a welcome relief to fish farmers, whose incomes have been battered by Covid-19, but can’t get bank loans

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Sorry, we couldn’t find any matches for“50 Partners”.