500 Startups

-

DATABASE (628)

-

ARTICLES (477)

Founder and CEO of Orain

Xavier Sans Serra is the founder and CEO of payment and interactive chat app and IoT hardware startup Orain. He is based in Barcelona, where he has worked since 2016. Prior to this, he founded two other tech startups: Knowxel, which has been in operation from 2013 to 2016, and Neqta, which operated from 2011 to 2013. Knowxel was a social network for seeking skilled people for one-off work projects while Neqta was a research project to develop hardware to power portable devices. Both companies were developed at the Autonomous University of Barcelona, where the initial development of Orain also took place. Sans holds two master's degrees from Barcelona's Ramon Llull University: one in Engineering and Telecommunications Engineering and the other in Networks and Telecommunications. Between 2010 to 2012, he was a member of the Electromagnetism and Communications Research Group at Ramon Llull University's La Salle campus, where he was involved in a research project on geomagnetically-induced currents, which led to publications in scientific journals.

Xavier Sans Serra is the founder and CEO of payment and interactive chat app and IoT hardware startup Orain. He is based in Barcelona, where he has worked since 2016. Prior to this, he founded two other tech startups: Knowxel, which has been in operation from 2013 to 2016, and Neqta, which operated from 2011 to 2013. Knowxel was a social network for seeking skilled people for one-off work projects while Neqta was a research project to develop hardware to power portable devices. Both companies were developed at the Autonomous University of Barcelona, where the initial development of Orain also took place. Sans holds two master's degrees from Barcelona's Ramon Llull University: one in Engineering and Telecommunications Engineering and the other in Networks and Telecommunications. Between 2010 to 2012, he was a member of the Electromagnetism and Communications Research Group at Ramon Llull University's La Salle campus, where he was involved in a research project on geomagnetically-induced currents, which led to publications in scientific journals.

CEO and co-founder of Capaball

Sixto Arias is a veteran entrepreneur based in Madrid. He graduated with a BA Communications degree from Complutense University in 1992.In 2001, he started his first venture as co-founder of Movilisto that was sold to London-based mobile value-added services group Itouch Plc in 2004. In 2007, he founded media planner Mobext that was sold to Havas Media six years later.He is an angel investor focusing on projects relating to AI, education, IoT and mobile. He was the managing partner of Conector Startup Accelerator in Madrid for over two years. He is also the founder of the Mobile Marketing Association in Spain.Arias currently runs two startups: digital innovation agency Made in Mobile that he founded in 2014 and edtech Capaball co-founded in 2018. As a digital marketing specialist and experienced lecturer, he also works as a professor at ESCP Europe in Madrid and University of Sergio Arboleda in Colombia.

Sixto Arias is a veteran entrepreneur based in Madrid. He graduated with a BA Communications degree from Complutense University in 1992.In 2001, he started his first venture as co-founder of Movilisto that was sold to London-based mobile value-added services group Itouch Plc in 2004. In 2007, he founded media planner Mobext that was sold to Havas Media six years later.He is an angel investor focusing on projects relating to AI, education, IoT and mobile. He was the managing partner of Conector Startup Accelerator in Madrid for over two years. He is also the founder of the Mobile Marketing Association in Spain.Arias currently runs two startups: digital innovation agency Made in Mobile that he founded in 2014 and edtech Capaball co-founded in 2018. As a digital marketing specialist and experienced lecturer, he also works as a professor at ESCP Europe in Madrid and University of Sergio Arboleda in Colombia.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

Co-founder, CTO of Meatable

Daan Luining is the Dutch co-founder and CTO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology, where he has worked since 2018. He is also a research director at the Cellular Agriculture Society in Leiden, a joint initiative for cell-based startups to share knowledge and to collaborate on projects to further scale the sector. Luining is also on the board of directors at the not-for-profit Cultured Meat Foundation that promotes sector innovation. His past posts have all been in the area of research, either as a researcher or a technician, and at the same time as completing studies. His last job was as a research strategist at New York-based New Harvest, a callular food rsearch funding body, where he worked for a year and met Dr. Kotter, the inventor of Meatable’s cellular technology. His research positions from 2009–15 were in the area of cell culture, mass spectrometry and DNA sequencing at the Maastricht University, University Medical Center Amsterdam, Utrecht University and Leiden University. Luining holds a master’s in biological sciences from Leiden University in the Netherlands.

Daan Luining is the Dutch co-founder and CTO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology, where he has worked since 2018. He is also a research director at the Cellular Agriculture Society in Leiden, a joint initiative for cell-based startups to share knowledge and to collaborate on projects to further scale the sector. Luining is also on the board of directors at the not-for-profit Cultured Meat Foundation that promotes sector innovation. His past posts have all been in the area of research, either as a researcher or a technician, and at the same time as completing studies. His last job was as a research strategist at New York-based New Harvest, a callular food rsearch funding body, where he worked for a year and met Dr. Kotter, the inventor of Meatable’s cellular technology. His research positions from 2009–15 were in the area of cell culture, mass spectrometry and DNA sequencing at the Maastricht University, University Medical Center Amsterdam, Utrecht University and Leiden University. Luining holds a master’s in biological sciences from Leiden University in the Netherlands.

CEO, founder of TherapyChat

Alessandro De Sario is CEO and founder of mental health startup TherapyChat, Spain’s number one online psychotherapy platform founded in 2016. He also works for TherapyChat’s investor, the Spanish VC and startup developer Next Chance Group, on other startups in their portfolio, such as the discount aggregator app Billionhands.Prior to starting TherapyChat, De Sario spent just over three years working in different food delivery entities associated with German VC and startup incubator Rocket Internet. He oversaw the development and launch of Rocket Internet’s food delivery operations in Latin America before these entities were sold to JustEat and Delivery Hero. He was also Head of Logistics at La Nevera Roja in Spain, which was later acquired by Delivery Hero. Before these roles, De Sario spent two years in investment banking and mergers and acquisitions at HSBC in London.De Sario holds three master’s degrees: one in management from ESCP Business School; one in science from City University, London; and one in business administration from the University of Turin, Italy. He lectures part-time on International Food and Beverage Management at ESCP Business School in Turin, Italy.

Alessandro De Sario is CEO and founder of mental health startup TherapyChat, Spain’s number one online psychotherapy platform founded in 2016. He also works for TherapyChat’s investor, the Spanish VC and startup developer Next Chance Group, on other startups in their portfolio, such as the discount aggregator app Billionhands.Prior to starting TherapyChat, De Sario spent just over three years working in different food delivery entities associated with German VC and startup incubator Rocket Internet. He oversaw the development and launch of Rocket Internet’s food delivery operations in Latin America before these entities were sold to JustEat and Delivery Hero. He was also Head of Logistics at La Nevera Roja in Spain, which was later acquired by Delivery Hero. Before these roles, De Sario spent two years in investment banking and mergers and acquisitions at HSBC in London.De Sario holds three master’s degrees: one in management from ESCP Business School; one in science from City University, London; and one in business administration from the University of Turin, Italy. He lectures part-time on International Food and Beverage Management at ESCP Business School in Turin, Italy.

Founded in October 2014 in Hangzhou, Demonow Capital focuses on local early stage internet startups. In order to better serve startups and entrepreneurs, Demonow set up an incubator to provide early stage startups with professional services.

Founded in October 2014 in Hangzhou, Demonow Capital focuses on local early stage internet startups. In order to better serve startups and entrepreneurs, Demonow set up an incubator to provide early stage startups with professional services.

Ship2B is an accelerator and investor for social impact startups and spin-offs. It acts principally in three sectors: health tech, social tech for vulnerable groups and climate technology. It also fosters networking alliances between startups and large companies, and has a network of high-level mentors available to assist startups.To date, Ship2B has invested €40m in 146 startups and spin-offs.

Ship2B is an accelerator and investor for social impact startups and spin-offs. It acts principally in three sectors: health tech, social tech for vulnerable groups and climate technology. It also fosters networking alliances between startups and large companies, and has a network of high-level mentors available to assist startups.To date, Ship2B has invested €40m in 146 startups and spin-offs.

Labeled "world’s most powerful startup incubator" by Fast Company, Y Combinator was established in 2005 as a seed accelerator. Since then, Y Combinator has funded over 1,850 startups with a combined valuation of over US$100 billion. Twice a year, Y Combinator invests US$150,000 per company across a large number of startups in exchange for a 7% stake. The startups then move to Silicon Valley for three months. Each cycle ends with a Demo Day, where the startups pitch to an invite-only audience of high-profile investors. Its most valuable startups to date are Airbnb, Stripe, Cruise, Dropbox and Coinbase.

Labeled "world’s most powerful startup incubator" by Fast Company, Y Combinator was established in 2005 as a seed accelerator. Since then, Y Combinator has funded over 1,850 startups with a combined valuation of over US$100 billion. Twice a year, Y Combinator invests US$150,000 per company across a large number of startups in exchange for a 7% stake. The startups then move to Silicon Valley for three months. Each cycle ends with a Demo Day, where the startups pitch to an invite-only audience of high-profile investors. Its most valuable startups to date are Airbnb, Stripe, Cruise, Dropbox and Coinbase.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Founded in 2014, EVERVC is a platform for startups and investors to seek financing and investing opportunities. As of 4Q2015, EVERVC had helped 170 startups to get investment of over RMB 900 million. It has invested in 40 startups, about 16 of which have received follow-up investment from prominent investors such as Matrix Partners China, NewMargin Capital, JD.com and Zhonglu VC.

Founded in 2014, EVERVC is a platform for startups and investors to seek financing and investing opportunities. As of 4Q2015, EVERVC had helped 170 startups to get investment of over RMB 900 million. It has invested in 40 startups, about 16 of which have received follow-up investment from prominent investors such as Matrix Partners China, NewMargin Capital, JD.com and Zhonglu VC.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Captii Ventures focuses on building Southeast Asian based startups by providing access to entrepreneurial expertise and experience to support business growth and development. It is a multi stage investor, with a special interest in mobile tech startups, marketplace platforms that facilitate better matching of supply and demand and in new media that disrupts traditional communication channels. It likes startups that use technology to solve age old problems.

Captii Ventures focuses on building Southeast Asian based startups by providing access to entrepreneurial expertise and experience to support business growth and development. It is a multi stage investor, with a special interest in mobile tech startups, marketplace platforms that facilitate better matching of supply and demand and in new media that disrupts traditional communication channels. It likes startups that use technology to solve age old problems.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Based in Berlin, Cherry Ventures was founded in 2012 to invest in startups across diverse sectors mainly in Europe including non-tech enterprises. With offices in London, Paris and Stockholm, the VC has invested in 53 startups and managed 12 exits. Initial investments range from €300,000 to €5m.In June 2019, a third fund “Cherry Ventures III” with €175m funding was launched to focus on providing seed funding for B2B and B2C startups. Recent investments in 2021 include the $6.2m seed round of Finnish cleantech Carbo Culture in April. The VC also acquired a stake in the $1.9m seed round of US Cloud-based product notification inbox, MagicBell, one of a handful of non-European startups in its portfolio.

Based in Berlin, Cherry Ventures was founded in 2012 to invest in startups across diverse sectors mainly in Europe including non-tech enterprises. With offices in London, Paris and Stockholm, the VC has invested in 53 startups and managed 12 exits. Initial investments range from €300,000 to €5m.In June 2019, a third fund “Cherry Ventures III” with €175m funding was launched to focus on providing seed funding for B2B and B2C startups. Recent investments in 2021 include the $6.2m seed round of Finnish cleantech Carbo Culture in April. The VC also acquired a stake in the $1.9m seed round of US Cloud-based product notification inbox, MagicBell, one of a handful of non-European startups in its portfolio.

Portugal's Prodsmart takes AI, IoT-based manufacturing to US factories

Smart factories can cut wastage by 80% and improve inventory, production and supply chains, tackling US$200 billion worth of losses

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Forward Fooding: Ranking the world's agrifood startups on success and sustainability

The collaborative platform has opened applications for its FoodTech500 global ranking of agrifood startups; counts over 7,000 startups and scaleups mapped so far

Ciweishixi: HR startup helps Chinese youth pursue rewarding careers

Ciweishixi uses the Western internship model to help young people discover their true passion, online and offline

Alodokter wants personalised healthcare on tap

The Indonesian healthcare startup recently got a US$9 million Series B funding for expansion.

Xu Jinghong: Champion of young entrepreneurs and high-tech startups

Under Xu Jinghong’s leadership, Tsinghua Holdings grew its assets sevenfold and incubated over 10,000 businesses. In his new role as VC investor, Xu wants to nurture startups into future global leaders

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

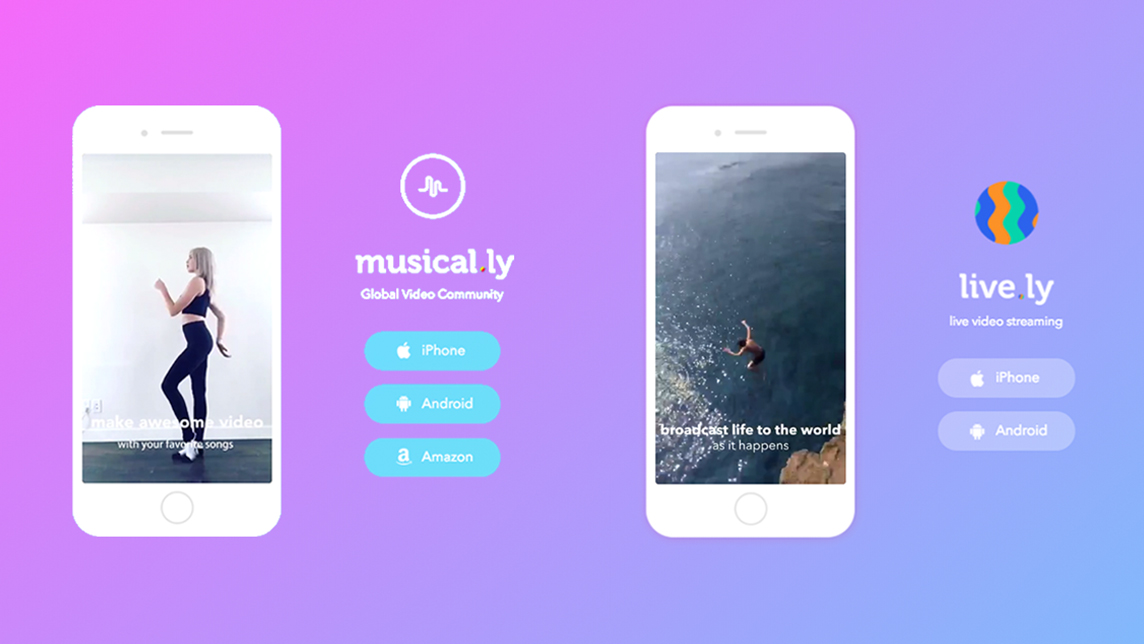

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Will China ride into a car-sharing future?

Chinese car-sharing startups face reckoning as more than 500 players crowd into a fast-growing, but young, market

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

SWITCH Singapore: Investors highlight Vietnam startup ecosystem's potential and resilience

The quality of Vietnam’s local talent remains one of its biggest strengths, but foreign investors also need to be patient and be familiar with the local regulatory landscape

This Chinese café startup aims to best Starbucks with “new retail” strategy

Luckin Coffee has gone from scratch to China’s first coffee shop unicorn in less than a year, pouring more than 5 million cups of coffee along the way

Cristina Fonseca: On a one-woman mission to make Portugal more innovative

The co-founder of Portugal's third unicorn, Talkdesk, is now an influential investor and AI authority

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sorry, we couldn’t find any matches for“500 Startups”.