500 Startups

-

DATABASE (628)

-

ARTICLES (477)

500 Startups is a global venture capital seed fund and startup accelerator based in Silicon Valley.

500 Startups is a global venture capital seed fund and startup accelerator based in Silicon Valley.

CMO and co-founder of Natural Machines / Foodini

Lynette Kucsma has an MBA and BSc Marketing. She has worked in the technology and consumer goods sectors, including a marketing and communication role in Fortune 500 companies like Microsoft.Based in Barcelona, she is passionate about healthy eating and technology. In 2012, Kucsma co-founded Natural Machines to design food-grade home appliances for both B2B and B2C customers. The company recently launched a 3D food printer equipped with laser-cooking technology.Kucsma was named by CNN as one of “7 tech superheroes” to watch. She also mentors startups in the hardware and IoT space.

Lynette Kucsma has an MBA and BSc Marketing. She has worked in the technology and consumer goods sectors, including a marketing and communication role in Fortune 500 companies like Microsoft.Based in Barcelona, she is passionate about healthy eating and technology. In 2012, Kucsma co-founded Natural Machines to design food-grade home appliances for both B2B and B2C customers. The company recently launched a 3D food printer equipped with laser-cooking technology.Kucsma was named by CNN as one of “7 tech superheroes” to watch. She also mentors startups in the hardware and IoT space.

Alpha Startups was founded by Xu Siqing, former managing director of WI Harper China, and Jiang Yameng, former co-managing partner of Sinovation Ventures. It offers customized services to each project in which it invests. Alpha Startups provides the startups it invests in with three to six months of free workspace and helps them receive follow-on financing.

Alpha Startups was founded by Xu Siqing, former managing director of WI Harper China, and Jiang Yameng, former co-managing partner of Sinovation Ventures. It offers customized services to each project in which it invests. Alpha Startups provides the startups it invests in with three to six months of free workspace and helps them receive follow-on financing.

Demium Startups is a startup incubator with offices in Madrid, Barcelona and Valencia. It has two other branches: Demium Games that focuses on the video-gaming sector and Oarsis, oriented to startups working on VR/AR-related technology.

Demium Startups is a startup incubator with offices in Madrid, Barcelona and Valencia. It has two other branches: Demium Games that focuses on the video-gaming sector and Oarsis, oriented to startups working on VR/AR-related technology.

Purple Bull Startups was founded by Cheetah Mobile CEO Fu Sheng and former China Central Television news anchor Zhang Quanling in September 2015. It invests in early-stage tech startups. A team of seasoned investors offer the firm’s startups three months of entrepreneurship training as well as counseling services.

Purple Bull Startups was founded by Cheetah Mobile CEO Fu Sheng and former China Central Television news anchor Zhang Quanling in September 2015. It invests in early-stage tech startups. A team of seasoned investors offer the firm’s startups three months of entrepreneurship training as well as counseling services.

Backed by Lyft CEO and the Rothschilds trust, regulated equity crowdfunding platform Seedrs opens startup investing–usually exclusive to VCs and the super rich–to retail investors.

Backed by Lyft CEO and the Rothschilds trust, regulated equity crowdfunding platform Seedrs opens startup investing–usually exclusive to VCs and the super rich–to retail investors.

Founder and CEO of Ciweishixi

After working for 17 years as a senior HR executive at Fortune 500 companies such as Huawei and Emerson Electric, Li Yaping founded Ciweishixi in March 2015. She holds a master’s degree in Management as well as an EMBA from China Europe International Business School.

After working for 17 years as a senior HR executive at Fortune 500 companies such as Huawei and Emerson Electric, Li Yaping founded Ciweishixi in March 2015. She holds a master’s degree in Management as well as an EMBA from China Europe International Business School.

Founder and Chairman of the Board of Shenma

Founder and Chairman of the Board at Shenma. In 2009, Chen took over Xindazhou Electric Motorcycles. She helped increase the company’s annual sales volume from 20–30 thousand to 500 thousand motorcycles in six years. During her time at Xindazhou, Chen realized there were significant untapped opportunities in rural financial services and started Shenma.

Founder and Chairman of the Board at Shenma. In 2009, Chen took over Xindazhou Electric Motorcycles. She helped increase the company’s annual sales volume from 20–30 thousand to 500 thousand motorcycles in six years. During her time at Xindazhou, Chen realized there were significant untapped opportunities in rural financial services and started Shenma.

Ashraf Sinclair is a Malaysian-born actor and businessman. He moved and worked in Indonesia after marrying Indonesian singer Bunga Citra Lestari. He has also personally invested in crowdfunding platform Konserku in 2016 and became a venture partner at 500 Startups in 2017.

Ashraf Sinclair is a Malaysian-born actor and businessman. He moved and worked in Indonesia after marrying Indonesian singer Bunga Citra Lestari. He has also personally invested in crowdfunding platform Konserku in 2016 and became a venture partner at 500 Startups in 2017.

Co-Founder of Zhen Robotics

Co-founder of Zhen Robotics. Born in Hong Kong, he has a bachelor’s degree in Computer Science from the Chinese University of Hong Kong and a master’s degree in Innovation, Entrepreneurship & Management from Imperial College London. Prior to founding Zhen Robotics with his schoolmate Liu Zhiyong, he worked for a Fortune 500 technology company in Hong Kong.

Co-founder of Zhen Robotics. Born in Hong Kong, he has a bachelor’s degree in Computer Science from the Chinese University of Hong Kong and a master’s degree in Innovation, Entrepreneurship & Management from Imperial College London. Prior to founding Zhen Robotics with his schoolmate Liu Zhiyong, he worked for a Fortune 500 technology company in Hong Kong.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

Tetuan Valley has built a network of over 500 entrepreneurs through its six-week Madrid-based Startup School program, which was started in 2009 and is in its 25th edition. Partnering with Google, the European Commission, MIT and universities in Spain, Tetuan offers early stage startups guidance on financial and commercial strategy, while providing technology mentors to support them on product development.

Tetuan Valley has built a network of over 500 entrepreneurs through its six-week Madrid-based Startup School program, which was started in 2009 and is in its 25th edition. Partnering with Google, the European Commission, MIT and universities in Spain, Tetuan offers early stage startups guidance on financial and commercial strategy, while providing technology mentors to support them on product development.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Western Technology Investment (WTI)

Founded in 1980, Western Technology Investment invests in tech and life science startups. To date, it has invested over $6bn in 1,300 companies worldwide across diverse market segments.The Silicon Valley-based WTI currently has more than 500 companies in its global portfolio. Recent investments include US anti-aging medtech Elevio’s $15m funding in November 2020 and the $4.3m seed round in August 2020 for US fintech for teens Copper Banking.

Founded in 1980, Western Technology Investment invests in tech and life science startups. To date, it has invested over $6bn in 1,300 companies worldwide across diverse market segments.The Silicon Valley-based WTI currently has more than 500 companies in its global portfolio. Recent investments include US anti-aging medtech Elevio’s $15m funding in November 2020 and the $4.3m seed round in August 2020 for US fintech for teens Copper Banking.

CreditEase New Financial Industry Investment Fund

Credit Ease Financial Industry Investment Fund was founded in 2016 and now manages a combined total of RMB 3 billion and US$ 500 million. It has invested in more than 20 Fintech companies around the world.

Credit Ease Financial Industry Investment Fund was founded in 2016 and now manages a combined total of RMB 3 billion and US$ 500 million. It has invested in more than 20 Fintech companies around the world.

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Can Indonesia plug its tech talent gap to keep its digital economy growing?

Local institutions are stepping up to boost tech skills among students and jobseekers, as the government opens the way for more foreign talent joining startups

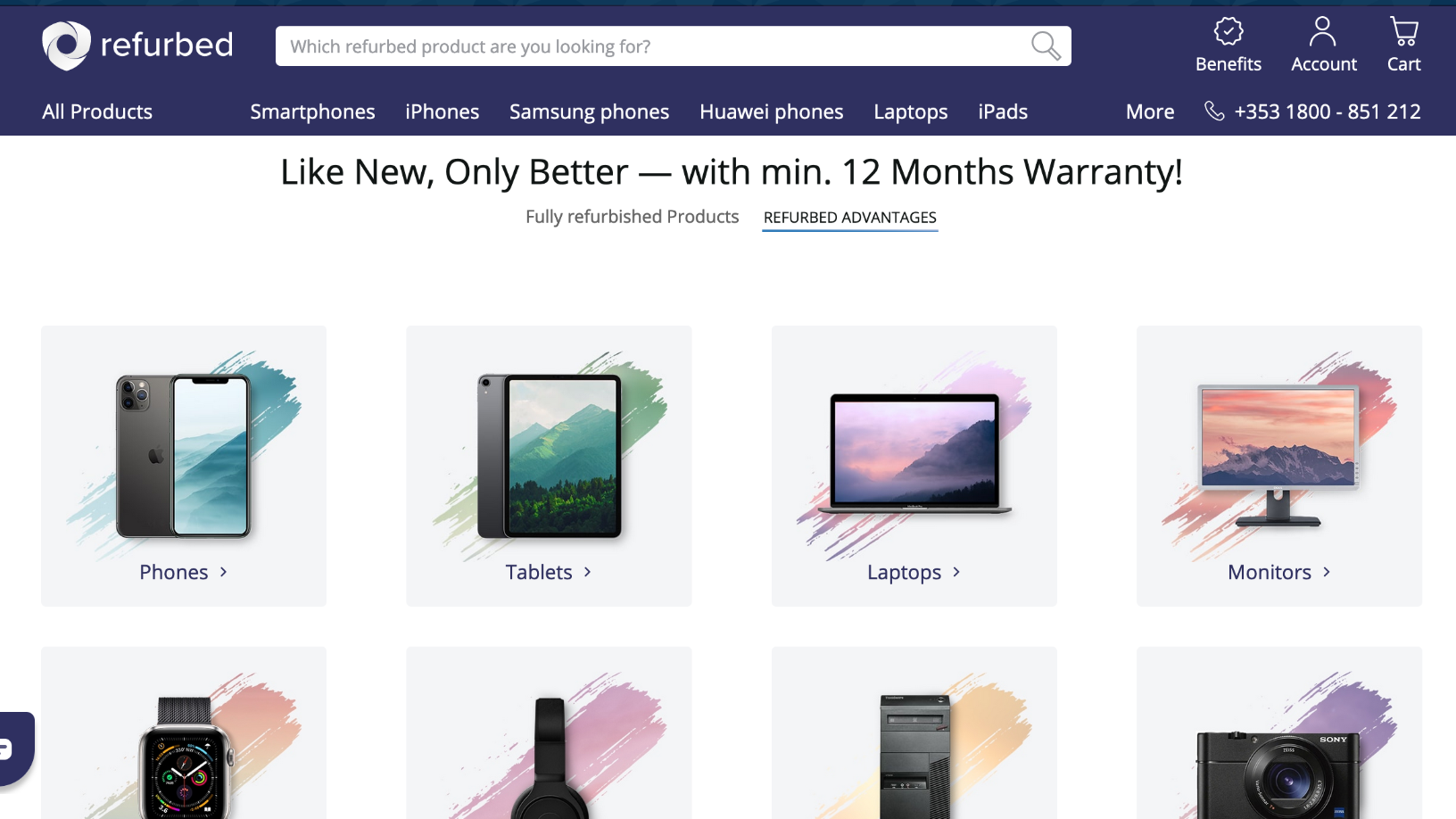

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Halal Local: Companion for the faithful

Indonesian app lets Muslims travel fuss-free, without sacrificing their religious values

In depth: The business ecosystems China’s tech giants and unicorns build

Startups could accept to join Alibaba, Tencent or other tech giants in their ecosystems and scale quickly. Or they could say no and keep their independence. But do they really have a choice?

“Good thing about my style. Some like it, some hate it but everybody recognizes it.” @sofíabenjumea

Outspoken with a hands-on management style, Sofía Benjumea is a force to reckon with at Google’s Campus Madrid

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Worktile sells an easier, more efficient approach to teamwork

Employees no longer have to switch between different apps to complete projects, thanks to this collaborative SaaS for enterprises

Logisly challenges the Indonesian on-demand freight sector with managed marketplace

In less than a year of launching, Logisly has facilitated more than a thousand shipments and raised seed funding from three investors

Venturra Capital's Raditya Pramana: Bear market "very close now"

In an interview, the Indonesian VC firm's newest partner also charts out the course for their new fund, Venturra Discovery

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Insights on tech and the Indonesian diaspora in Silicon Valley

Navigating the different diaspora communities, one tech event at a time

Sorry, we couldn’t find any matches for“500 Startups”.