A*Star

-

DATABASE (997)

-

ARTICLES (811)

A leader in autonomous vehicle tech, Veniam's Wi-Fi meshes support smart city connected vehicle networks and move terabytes of data between vehicles and the Cloud.

A leader in autonomous vehicle tech, Veniam's Wi-Fi meshes support smart city connected vehicle networks and move terabytes of data between vehicles and the Cloud.

Factorial cuts time-consuming HR administration for over 60,000 SMEs in almost 100 countries allowing departments to focus on employee productivity and complex labor laws.

Factorial cuts time-consuming HR administration for over 60,000 SMEs in almost 100 countries allowing departments to focus on employee productivity and complex labor laws.

AI- and NLP-powered software accelerating clinical research by structuring relevant patient big data and facilitating clinical data searches, with dramatic improvements of up to 90%.

AI- and NLP-powered software accelerating clinical research by structuring relevant patient big data and facilitating clinical data searches, with dramatic improvements of up to 90%.

Myanmar’s first circular economy waste management and recycling marketplace is banking on blockchain and analytics to become a key player in Southeast Asia.

Myanmar’s first circular economy waste management and recycling marketplace is banking on blockchain and analytics to become a key player in Southeast Asia.

Natural Machines is launching the world’s first commercial 3D food printing and laser beam cooking machine for affordable, personalized meals, endorsed by Michelin-starred restaurants.

Natural Machines is launching the world’s first commercial 3D food printing and laser beam cooking machine for affordable, personalized meals, endorsed by Michelin-starred restaurants.

Computer vision-based SaaS platform auto reads, selects and converts relevant text, symbols and codes into big data to help digitize industries and supply chains.

Computer vision-based SaaS platform auto reads, selects and converts relevant text, symbols and codes into big data to help digitize industries and supply chains.

The only diamond producer to be certified carbon-neutral, this unicorn makes high-carat, high-value lab-grown diamonds at scale that are jewelry-grade, ethical, environmentally sustainable and conflict-free.

The only diamond producer to be certified carbon-neutral, this unicorn makes high-carat, high-value lab-grown diamonds at scale that are jewelry-grade, ethical, environmentally sustainable and conflict-free.

Founded in 2008 and headquartered in Xiamen, Fujian Province, Meitu is a public company traded at HK Stock Exchange.Its products include photo-editing and sharing software Meitu Xiuxiu(MeituPic), short video app Meipai, apps focusing on oversea users AirBrush and BeautyPlus, etc. (https://corp.meitu.com/news/news/110.html) It reported having a MAU of 3320 million adding up all its apps in 2018. (https://wallstreetcn.com/articles/3497467)It used to have a smartphone line but has announced to shut down the line. Meitu let Xiaomi handle its development and sale and it got a commission.

Founded in 2008 and headquartered in Xiamen, Fujian Province, Meitu is a public company traded at HK Stock Exchange.Its products include photo-editing and sharing software Meitu Xiuxiu(MeituPic), short video app Meipai, apps focusing on oversea users AirBrush and BeautyPlus, etc. (https://corp.meitu.com/news/news/110.html) It reported having a MAU of 3320 million adding up all its apps in 2018. (https://wallstreetcn.com/articles/3497467)It used to have a smartphone line but has announced to shut down the line. Meitu let Xiaomi handle its development and sale and it got a commission.

Established in 2003, Indonusa Dwitama is a holding company that manages and develops a range of investment portfolios in Indonesia, including mining, financial services and information technology. In the mining industry, it has a portfolio of andesite and bauxite mines, and it also invested in an oil and gas mining company. As a tech investor, it is a relatively early investor in Tokopedia when it joined in 2016. It has also invested in VOSPAY, a digital payment intermediary, and cross-border money transfer company Wallex.

Established in 2003, Indonusa Dwitama is a holding company that manages and develops a range of investment portfolios in Indonesia, including mining, financial services and information technology. In the mining industry, it has a portfolio of andesite and bauxite mines, and it also invested in an oil and gas mining company. As a tech investor, it is a relatively early investor in Tokopedia when it joined in 2016. It has also invested in VOSPAY, a digital payment intermediary, and cross-border money transfer company Wallex.

Yamaha Motor Ventures & Laboratory Silicon Valley

The investment arm of Yamaha Motor Group (Japan) was founded in 2015 and is headquartered in Palo Alto, California. It focuses on industrial automation and transportation technology, and on smart and automated solutions in particular. Recent investments include automated strawberry picker Advanced Farm Technologies' US$7.5m Series A round and drone and robotics startup Exyn Technology's US$16m Series A round.

The investment arm of Yamaha Motor Group (Japan) was founded in 2015 and is headquartered in Palo Alto, California. It focuses on industrial automation and transportation technology, and on smart and automated solutions in particular. Recent investments include automated strawberry picker Advanced Farm Technologies' US$7.5m Series A round and drone and robotics startup Exyn Technology's US$16m Series A round.

Founded in 2018, Kale United is a Stockholm-based ethical investor with an overriding interest in plant-based technologies. It raises funds from crowd campaigns and currently has a portfolio of 30 companies, mostly Swedish alternative meat startups. It had crowdfunded €1.34m by April 2020 for its portfolio of companies from three separate campaigns. It also has a portfolio of plant-based public shares and features a team of vegan expert investors and business leaders. Its founder, Måns Ullerstam, owns a third of the company. He is also CEO of local vegetarian food producer startup Astrid och Aporna.

Founded in 2018, Kale United is a Stockholm-based ethical investor with an overriding interest in plant-based technologies. It raises funds from crowd campaigns and currently has a portfolio of 30 companies, mostly Swedish alternative meat startups. It had crowdfunded €1.34m by April 2020 for its portfolio of companies from three separate campaigns. It also has a portfolio of plant-based public shares and features a team of vegan expert investors and business leaders. Its founder, Måns Ullerstam, owns a third of the company. He is also CEO of local vegetarian food producer startup Astrid och Aporna.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

Charles Songhurst is a founding partner of hedge fund Katana Capital and also runs the Songhurst Group, which holds assets in a variety of private companies, besides being a prolific angel investor having invested in more than 500 companies to date across sectors and geographies. His most recent investments have included in the 2021 seed rounds of home-based eye medtech Quadrant Eye and in the $2m funding of Canadian small business logistics startup Tyltgo. Songhurst is a former general manager and former head of corporate strategy at Microsoft. He has a bachelor's in philosophy, politics and economics from Oxford University.

Charles Songhurst is a founding partner of hedge fund Katana Capital and also runs the Songhurst Group, which holds assets in a variety of private companies, besides being a prolific angel investor having invested in more than 500 companies to date across sectors and geographies. His most recent investments have included in the 2021 seed rounds of home-based eye medtech Quadrant Eye and in the $2m funding of Canadian small business logistics startup Tyltgo. Songhurst is a former general manager and former head of corporate strategy at Microsoft. He has a bachelor's in philosophy, politics and economics from Oxford University.

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

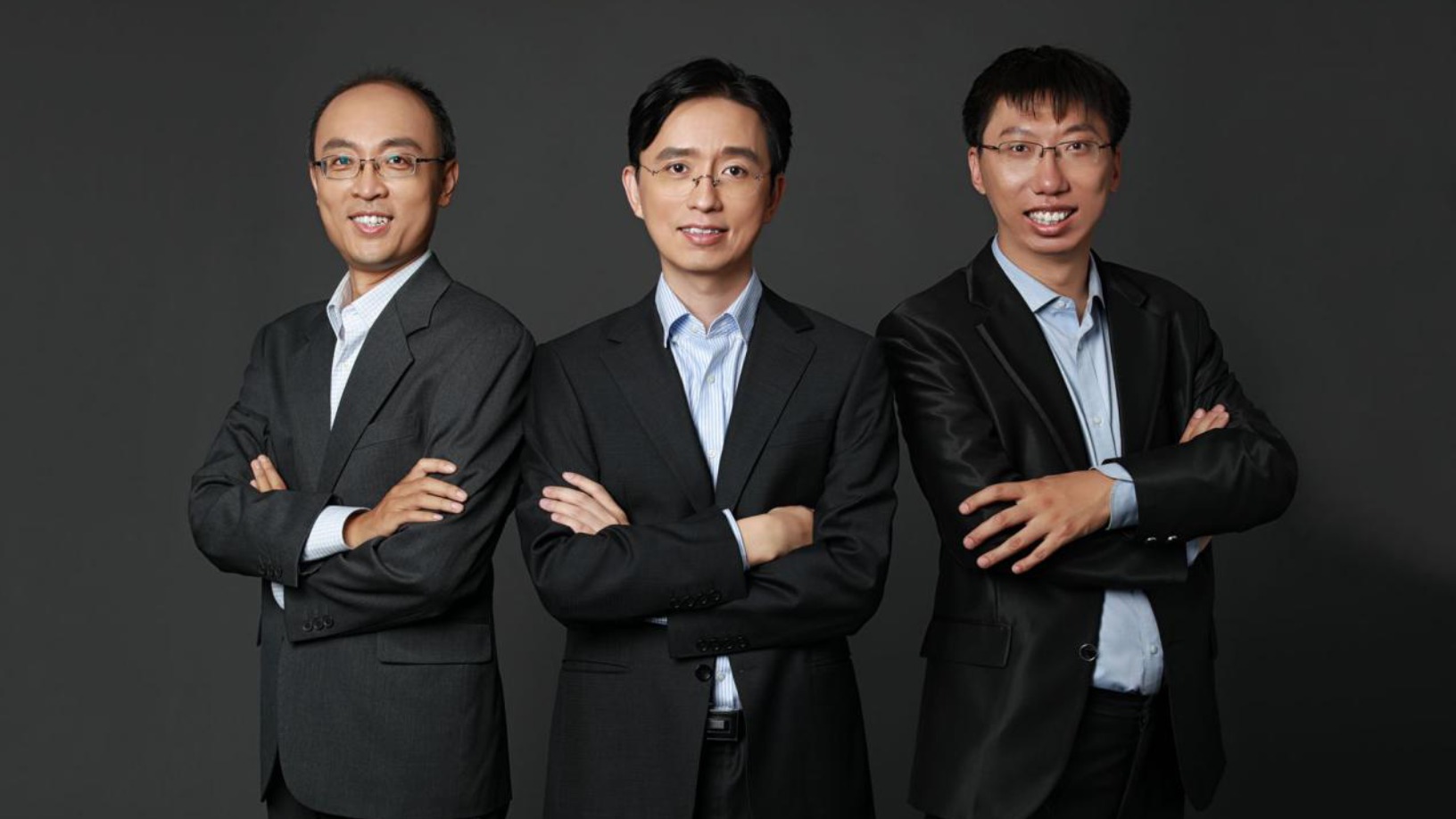

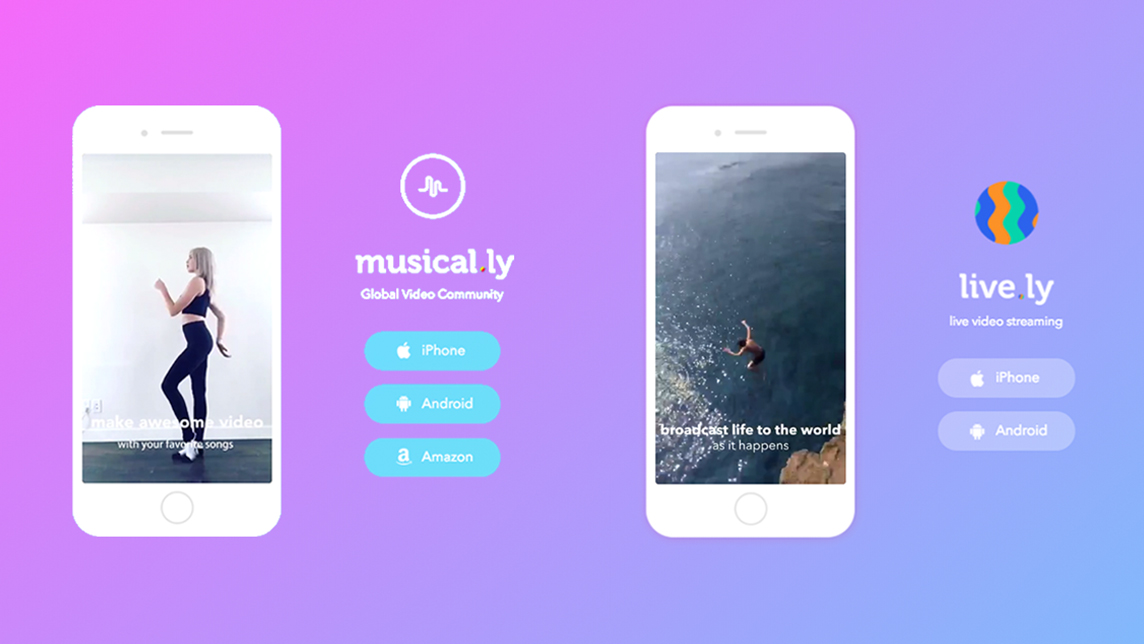

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

Sorry, we couldn’t find any matches for“A*Star”.