A*Star

-

DATABASE (997)

-

ARTICLES (811)

DFS168.com is a B2C e-commerce platform for agricultural materials. DFS168.com sells to major agricultural provinces in China such as Jiangxi, Heibei and Anhui. Upon noticing Chinese farmers' lack of agricultural expertise and technical knowledge, the team at DFS168.com came up with the idea of building an agricultural education platform. However, the company decided not to launch the business itself, worried farmers might misinterpret the platform as simply a means to sell more products. Instead, founder Yan Zitong co-founded Tiantian Xuenong, an independent company, with Zhao Guang, and DFS168.com assumed the role of angel investor.

DFS168.com is a B2C e-commerce platform for agricultural materials. DFS168.com sells to major agricultural provinces in China such as Jiangxi, Heibei and Anhui. Upon noticing Chinese farmers' lack of agricultural expertise and technical knowledge, the team at DFS168.com came up with the idea of building an agricultural education platform. However, the company decided not to launch the business itself, worried farmers might misinterpret the platform as simply a means to sell more products. Instead, founder Yan Zitong co-founded Tiantian Xuenong, an independent company, with Zhao Guang, and DFS168.com assumed the role of angel investor.

Marin Holding Limited is a Cyprus-based holding company, headquartered in Limassol. Its subsidiary Marin Ship Management focuses on the maritime logistic sector. Founded in February 2007 as a member of Germany's NSC Group in Hamburg, Marin's core activity is to provide crew management services to NSC and other clients. Marin Ship Management has worked with over 50 vessels including Containers, MPC, Con-Bulkers, Bulk carriers, Car carriers, Oil and Chemical tankers worldwide. Managing Director Martina Meinders-Michael has 20 years of experience in the shipping sector.

Marin Holding Limited is a Cyprus-based holding company, headquartered in Limassol. Its subsidiary Marin Ship Management focuses on the maritime logistic sector. Founded in February 2007 as a member of Germany's NSC Group in Hamburg, Marin's core activity is to provide crew management services to NSC and other clients. Marin Ship Management has worked with over 50 vessels including Containers, MPC, Con-Bulkers, Bulk carriers, Car carriers, Oil and Chemical tankers worldwide. Managing Director Martina Meinders-Michael has 20 years of experience in the shipping sector.

David Boronat is an internet enthusiast, with over 20 years of professional experience in the market. He is a mentor and advisor to tech startups in Spain and Latin America. He is passionate about digital strategies, UX and web analytics. Based in Mexico and the US, Boronat is currently managing two of his own businesses. In 2000, he became the CEO and founder of Multiplica, an international performance consultancy agency. In 2005, he founded Metriplica, a partner agency of Google Analytics, IBM, ComScore and Omniture. Metriplica offers digital measurement and data mining services.

David Boronat is an internet enthusiast, with over 20 years of professional experience in the market. He is a mentor and advisor to tech startups in Spain and Latin America. He is passionate about digital strategies, UX and web analytics. Based in Mexico and the US, Boronat is currently managing two of his own businesses. In 2000, he became the CEO and founder of Multiplica, an international performance consultancy agency. In 2005, he founded Metriplica, a partner agency of Google Analytics, IBM, ComScore and Omniture. Metriplica offers digital measurement and data mining services.

China Merchants Venture, a subsidiary of China Merchants Group, was founded in November 2015. It is headquartered in Shenzhen and has opened offices in Beijing, Hong Kong, Israel and Silicon Valley. The company invests in finance, real estate, logistics, transportation, healthcare, AI, among other industries. Of the RMB 5 bn capital under its management, RMB 2bn is earmarked for a fund of funds (FOF) and the other RMB 3 bn for direct investment. As of April 2019, the FOF has invested in 28 early and growth stage funds, and directly invested in over 50 startups.

China Merchants Venture, a subsidiary of China Merchants Group, was founded in November 2015. It is headquartered in Shenzhen and has opened offices in Beijing, Hong Kong, Israel and Silicon Valley. The company invests in finance, real estate, logistics, transportation, healthcare, AI, among other industries. Of the RMB 5 bn capital under its management, RMB 2bn is earmarked for a fund of funds (FOF) and the other RMB 3 bn for direct investment. As of April 2019, the FOF has invested in 28 early and growth stage funds, and directly invested in over 50 startups.

An entrepreneur and investor in new technologies and digital business, Manuel Serrano has extensive experience in the field of digital transformation and startups' mentoring.He is the managing director and founder of FHIOS Smart Knowledge, a company that specializes in consultancy services for digital innovation, where he has worked since 2012. Serrano is also a committee member of FC Barcelona, the city's famous soccer club, and an investor in fast-growing Spanish startups like Red Points, Wysee and CITIBOX. He has also managed and founded several IT companies in the Barcelona area.

An entrepreneur and investor in new technologies and digital business, Manuel Serrano has extensive experience in the field of digital transformation and startups' mentoring.He is the managing director and founder of FHIOS Smart Knowledge, a company that specializes in consultancy services for digital innovation, where he has worked since 2012. Serrano is also a committee member of FC Barcelona, the city's famous soccer club, and an investor in fast-growing Spanish startups like Red Points, Wysee and CITIBOX. He has also managed and founded several IT companies in the Barcelona area.

42CAP is a German VC fund established in 2016 for seed and early-stage investments in European startups. Alex Meyer and Thomas Wilke, both founders of eCircle, one of Europe’s largest SaaS companies that was sold to Teradata in 2012, are co-founders and partners of 42CAP. They have taken advantage of 42CAP’s success to invest in international AI-powered startups. To date, the company has made 21 investments, most recently in the Series A rounds of streaming analytics integration software company Crosser, in customer data and engagement platform CrossEngage and in the Series B round of marketing platform Adversity.

42CAP is a German VC fund established in 2016 for seed and early-stage investments in European startups. Alex Meyer and Thomas Wilke, both founders of eCircle, one of Europe’s largest SaaS companies that was sold to Teradata in 2012, are co-founders and partners of 42CAP. They have taken advantage of 42CAP’s success to invest in international AI-powered startups. To date, the company has made 21 investments, most recently in the Series A rounds of streaming analytics integration software company Crosser, in customer data and engagement platform CrossEngage and in the Series B round of marketing platform Adversity.

Angels Capital is an investment vehicle created by Juan Roig as part of the Marina of Companies network in Valencia. Its mission is to grow startups within the Lanzadera accelerator, as well as external projects that facilitate the creation of a strong entrepreneurial ecosystem in Valencia. Angels Capital has 13 current investment projects, seven of which it is lead investor in and, since 2014, it has invested €15.5 million in capital. Recent investments include a €1 million venture round for cloud-based workflow platform SheetGo, and €360,000 in seed funding for bank aggregation system Afterbanks.

Angels Capital is an investment vehicle created by Juan Roig as part of the Marina of Companies network in Valencia. Its mission is to grow startups within the Lanzadera accelerator, as well as external projects that facilitate the creation of a strong entrepreneurial ecosystem in Valencia. Angels Capital has 13 current investment projects, seven of which it is lead investor in and, since 2014, it has invested €15.5 million in capital. Recent investments include a €1 million venture round for cloud-based workflow platform SheetGo, and €360,000 in seed funding for bank aggregation system Afterbanks.

Part of the Telefonica group, Wayra started its investment in Latin American countries and Spain in 2011. It offers mentoring and acceleration programs across 24 countries, leveraging on a global network of over 350 million customers.Wayra bridges the gap between tech entrepreneurs and networks of governments, corporations and partners where Telefónica has a presence.To date, the firm has invested more than €40 million and built 11 acceleration hubs that provide startup entrepreneurs mentoring and support from corporate leaders, investors and serial entrepreneurs.

Part of the Telefonica group, Wayra started its investment in Latin American countries and Spain in 2011. It offers mentoring and acceleration programs across 24 countries, leveraging on a global network of over 350 million customers.Wayra bridges the gap between tech entrepreneurs and networks of governments, corporations and partners where Telefónica has a presence.To date, the firm has invested more than €40 million and built 11 acceleration hubs that provide startup entrepreneurs mentoring and support from corporate leaders, investors and serial entrepreneurs.

An active and well-known angel investor in Spain and the US, Iñaki Berenguer was also co-founder and CEO at Klink (acquired by Thinkingphones) and Pixable (acquired by SingTel). He previously worked for MNCs like Hewlett Packard, STMicroelectronics, Pentium group of Intel and NEC Laboratories America. He spent two years as a management consultant at McKinsey & Company and as a manager in the Corporate Strategy Group of Microsoft.Originally from Valencia, but now based in New York, Berenguer is currently co-founder and CEO of Coverwallet.

An active and well-known angel investor in Spain and the US, Iñaki Berenguer was also co-founder and CEO at Klink (acquired by Thinkingphones) and Pixable (acquired by SingTel). He previously worked for MNCs like Hewlett Packard, STMicroelectronics, Pentium group of Intel and NEC Laboratories America. He spent two years as a management consultant at McKinsey & Company and as a manager in the Corporate Strategy Group of Microsoft.Originally from Valencia, but now based in New York, Berenguer is currently co-founder and CEO of Coverwallet.

Yago Arbeloa is a serial entrepreneur with over 20 years of experience founding internet and advertising companies in Spain.Arbeloa is president of MIOGROUP, a marketing and advertising group with yearly turnover of more than €50m. He is also president of the Internet Investors and Entrepreneurs Association. Through Viriditas Ventures, his investment vehicle, Arbeloa has backed tech startups such as We are Knitters, Rentuos, Baluwo, iContainers and Reclamador.es.

Yago Arbeloa is a serial entrepreneur with over 20 years of experience founding internet and advertising companies in Spain.Arbeloa is president of MIOGROUP, a marketing and advertising group with yearly turnover of more than €50m. He is also president of the Internet Investors and Entrepreneurs Association. Through Viriditas Ventures, his investment vehicle, Arbeloa has backed tech startups such as We are Knitters, Rentuos, Baluwo, iContainers and Reclamador.es.

Jeroen Merchiers is a Belgian executive based in Barcelona. He has led Airbnb EMEA expansion over the past six years and he is currently Managing Director for Airbnb in Europe, the Middle East and Africa. A commercial engineer and executive MBA from the IESE Business School, Merchiers has over 10 years' experience in management consulting for international manufacturing and supply chain companies. He was COO at Groupalia He’s also an active angel investor. Standouts in his startup portfolio include: 21Buttons, Mr. Jeff and Trip4Real (sold to Airbnb).

Jeroen Merchiers is a Belgian executive based in Barcelona. He has led Airbnb EMEA expansion over the past six years and he is currently Managing Director for Airbnb in Europe, the Middle East and Africa. A commercial engineer and executive MBA from the IESE Business School, Merchiers has over 10 years' experience in management consulting for international manufacturing and supply chain companies. He was COO at Groupalia He’s also an active angel investor. Standouts in his startup portfolio include: 21Buttons, Mr. Jeff and Trip4Real (sold to Airbnb).

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

Everbright New Economy USD Fund

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Founded in 1969, Hong Kong-based Sun Hung Kai & Co is an investment company listed in the Hong Kong Stock Exchange. Its founder, Fung King-hey, is also the co-founder of Sun Hung Kai Properties. It invests mainly in finance, fintech, health insurance, media and technology sectors. The company has about HKD 43bn in assets and is the main shareholder of UA Finance and Everbright Sun Hung Kai.

Founded in 1969, Hong Kong-based Sun Hung Kai & Co is an investment company listed in the Hong Kong Stock Exchange. Its founder, Fung King-hey, is also the co-founder of Sun Hung Kai Properties. It invests mainly in finance, fintech, health insurance, media and technology sectors. The company has about HKD 43bn in assets and is the main shareholder of UA Finance and Everbright Sun Hung Kai.

Alberto Knapp Bjeren has more than 20 years of experience in the tech startup ecosystem in Spain and internationally. He is the CEO of London-based digital tech PR agency Wunderman Thompson. He also founded the agency’s Madrid-based digital consultancy The Cocktail that has offices in London, New York, Mexico City and Bogota.Knapp is also a partner and advisor at Seaya Ventures, a Spanish VC with investments in startups like Cabify and Glovo. As an angel investor, he has participated in the pre-seed and seed rounds of Spain’s femtech WOOM and other undisclosed startups.

Alberto Knapp Bjeren has more than 20 years of experience in the tech startup ecosystem in Spain and internationally. He is the CEO of London-based digital tech PR agency Wunderman Thompson. He also founded the agency’s Madrid-based digital consultancy The Cocktail that has offices in London, New York, Mexico City and Bogota.Knapp is also a partner and advisor at Seaya Ventures, a Spanish VC with investments in startups like Cabify and Glovo. As an angel investor, he has participated in the pre-seed and seed rounds of Spain’s femtech WOOM and other undisclosed startups.

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

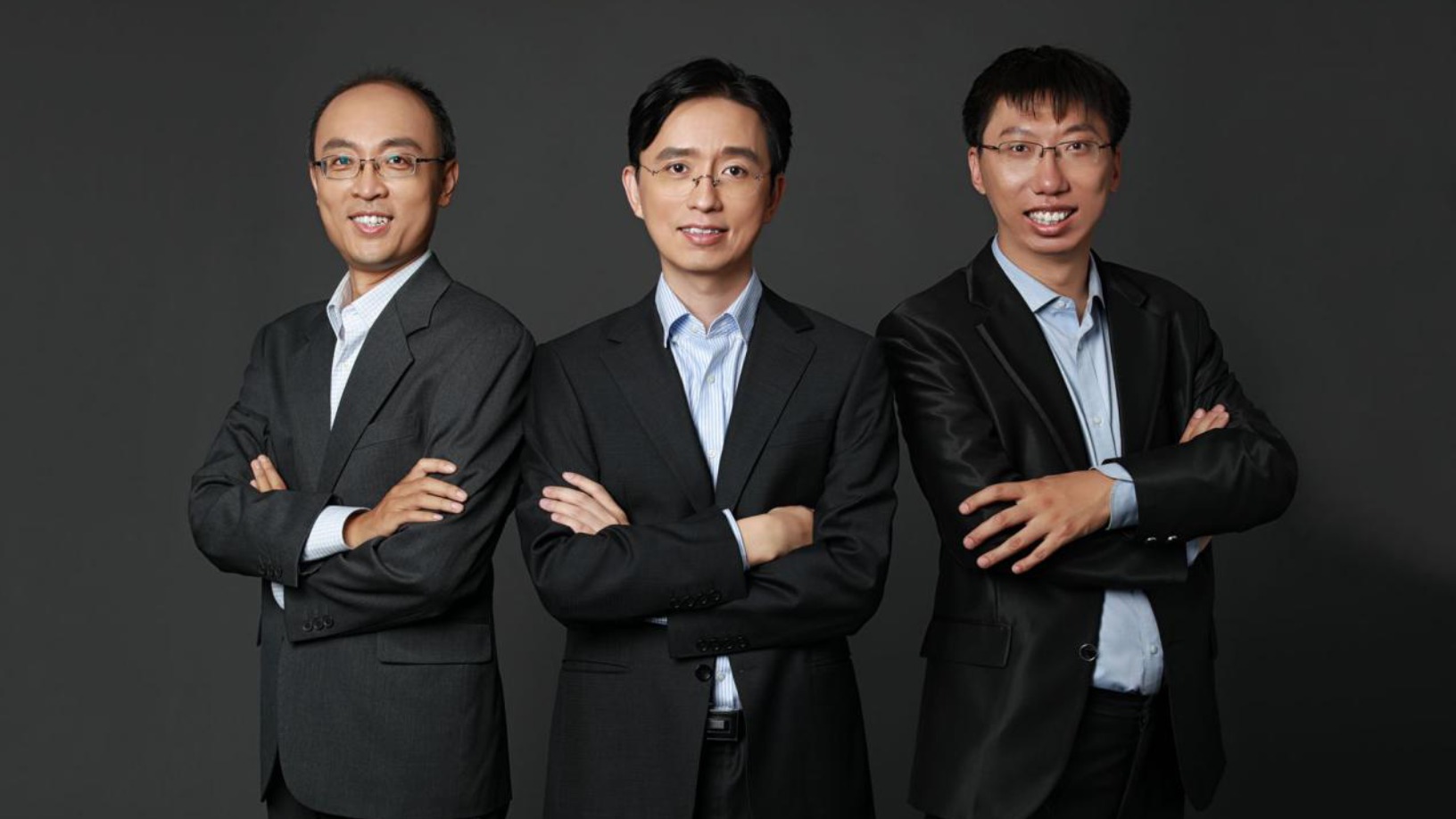

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

Sorry, we couldn’t find any matches for“A*Star”.