A*Star

-

DATABASE (997)

-

ARTICLES (811)

Founded in 2010 by Martin Hartono, son of Indonesia’s richest man Robert Budi Hartono, GDP Venture is a venture capital firm focused on digital communities, and media, commerce and solution companies in the Indonesian consumer internet industry.

Founded in 2010 by Martin Hartono, son of Indonesia’s richest man Robert Budi Hartono, GDP Venture is a venture capital firm focused on digital communities, and media, commerce and solution companies in the Indonesian consumer internet industry.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Creadev was created in 2002 in France as the private equity arm of the Mulliez family. Creadev expanded to Shanghai in 2012, through a unit called Crehol China. It has since been renamed Creadev China.

Creadev was created in 2002 in France as the private equity arm of the Mulliez family. Creadev expanded to Shanghai in 2012, through a unit called Crehol China. It has since been renamed Creadev China.

Tianxing Capital is a venture capital management company that was founded in 2012. It has invested in over 500 enterprises so far. Its investment focuses are media, healthcare, energy conservation, environmental protection, high-end manufacturing, etc.

Tianxing Capital is a venture capital management company that was founded in 2012. It has invested in over 500 enterprises so far. Its investment focuses are media, healthcare, energy conservation, environmental protection, high-end manufacturing, etc.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

The venture capital arm of semiconductor and telecom equipment giant Qualcomm is a San-Diego investor focusing on VR, robotics, IoT, cloud and digital health companies in the US, Europe, Israel, China, Korea and India.

The venture capital arm of semiconductor and telecom equipment giant Qualcomm is a San-Diego investor focusing on VR, robotics, IoT, cloud and digital health companies in the US, Europe, Israel, China, Korea and India.

Bunga Citra Lestari is an Indonesian singer and actress who rose to stardom in the mid-2000s with her song “Sunny”. In 2008, she married Malaysian actor Ashraf Sinclair who is also a businessman now based in Indonesia.

Bunga Citra Lestari is an Indonesian singer and actress who rose to stardom in the mid-2000s with her song “Sunny”. In 2008, she married Malaysian actor Ashraf Sinclair who is also a businessman now based in Indonesia.

Established in 2014, WOW Aceleradora is a startup accelerator based in Porto Alegre, Brazil. It has invested over BR$8 million (US$2.1 million) through its network of 170 angel investors, specializing in tech companies.

Established in 2014, WOW Aceleradora is a startup accelerator based in Porto Alegre, Brazil. It has invested over BR$8 million (US$2.1 million) through its network of 170 angel investors, specializing in tech companies.

Korelya Capital is a Paris-based VC firm that backs startups during their growth stage, focusing on cross-border investments between Asia and Europe. The firm's investment portfolio of €200m includes unicorns like Glovo and GetYourGuide.

Korelya Capital is a Paris-based VC firm that backs startups during their growth stage, focusing on cross-border investments between Asia and Europe. The firm's investment portfolio of €200m includes unicorns like Glovo and GetYourGuide.

Engage Capital was set up by social media platform YY Inc.’s investment department. The equity fund invests primarily in TMT, entertainment and consumer products. Engage Capital manages a USD fund and an RMB fund.

Engage Capital was set up by social media platform YY Inc.’s investment department. The equity fund invests primarily in TMT, entertainment and consumer products. Engage Capital manages a USD fund and an RMB fund.

Partner of Zhenfund, Wang Qiang (b.1962) co-founded this TMT-focused seed fund with his longtime friend and partner Xu Xiaoping, in collaboration with Sequoia Capital China, in 2011. The angel investor also co-founded NYSE-listed New Oriental Education & Technology Group, where he was executive vice president in charge of teaching and training at Beijing New Oriental School, and Industry vice-president and group chairman. A leading specialist in English-language education in China, Wang has lectured at the English department of Peking University and served as senior consultant to the English channel of China National Radio. He majored in English language and literature at Peking University and holds a master's degree in computer science from the State University of New York. Wang is a lover and collector of antiquarian books.

Partner of Zhenfund, Wang Qiang (b.1962) co-founded this TMT-focused seed fund with his longtime friend and partner Xu Xiaoping, in collaboration with Sequoia Capital China, in 2011. The angel investor also co-founded NYSE-listed New Oriental Education & Technology Group, where he was executive vice president in charge of teaching and training at Beijing New Oriental School, and Industry vice-president and group chairman. A leading specialist in English-language education in China, Wang has lectured at the English department of Peking University and served as senior consultant to the English channel of China National Radio. He majored in English language and literature at Peking University and holds a master's degree in computer science from the State University of New York. Wang is a lover and collector of antiquarian books.

British Oxford-educated engineer William Reeve is a serial investor and entrepreneur who built two successful businesses Fletcher Research and LOVEFiLM.com from scratch and led them to successful exits. He is currently Chairman of online investment management platform Nutmeg.com, CEO of proptech accelerator Goodlord and Non-Executive Director of Dunhelm Soft Furnishings. He was also Co-CEO and Chairman at grocery delivery company Hubbub.co.uk and was Non-Executive Chairman at healthy snack startup Graze.com. He was Head of Operations at Paddy Power betting agency, Managing Director of Oxalyst Systems and has been a non-executive director at a host of online platforms including Secret Escapes, Zoopla! and DealChecker.co.uk.

British Oxford-educated engineer William Reeve is a serial investor and entrepreneur who built two successful businesses Fletcher Research and LOVEFiLM.com from scratch and led them to successful exits. He is currently Chairman of online investment management platform Nutmeg.com, CEO of proptech accelerator Goodlord and Non-Executive Director of Dunhelm Soft Furnishings. He was also Co-CEO and Chairman at grocery delivery company Hubbub.co.uk and was Non-Executive Chairman at healthy snack startup Graze.com. He was Head of Operations at Paddy Power betting agency, Managing Director of Oxalyst Systems and has been a non-executive director at a host of online platforms including Secret Escapes, Zoopla! and DealChecker.co.uk.

Established in 1995, Richmond Global Ventures is a global venture capital managed by Partners Peter Kellner and David Frazee.

Established in 1995, Richmond Global Ventures is a global venture capital managed by Partners Peter Kellner and David Frazee.

NewMargin Ventures is a venture capital management firm in China focused on the IT, sustainable growth technology, biomedicine and high margin manufacturing sectors. Its Chinese investors include China Foundation of Science & Technology for Development (a joint venture between the National Development and Reform Commission, the Ministry of Commerce and Chinese Academy of Sciences) and Shanghai Alliance Investment Co. (an investment firm founded by Jiang Mianheng, son of the former Chinese President Jiang Zemin); and its foreign investors include GIC, Kerry Group, K.Wah Group, SUNeVision, JAFCO, Motorola and Alcatel. NewMargin Ventures has invested more than US$1.7 billion in 160 companies, including 40 IPOs.

NewMargin Ventures is a venture capital management firm in China focused on the IT, sustainable growth technology, biomedicine and high margin manufacturing sectors. Its Chinese investors include China Foundation of Science & Technology for Development (a joint venture between the National Development and Reform Commission, the Ministry of Commerce and Chinese Academy of Sciences) and Shanghai Alliance Investment Co. (an investment firm founded by Jiang Mianheng, son of the former Chinese President Jiang Zemin); and its foreign investors include GIC, Kerry Group, K.Wah Group, SUNeVision, JAFCO, Motorola and Alcatel. NewMargin Ventures has invested more than US$1.7 billion in 160 companies, including 40 IPOs.

Charles Xue Biqun (b. 1953), alias Xue Manzi, is a popular Chinese-American billionaire venture capitalist and angel investor with over 10 million followers on Weibo. He studied foreign relations at the University of California, Berkeley. His most famous deal to date is his US$250,000 investment in Unitech in the early 1990s, which later became UTStarcom. The company went public in 2000, reaching a post-IPO value of over US$5 billion. He was also chairman of 8848.com (the earliest Chinese e-commerce network). Xue has invested in many internet startups in China, including PCPOP, Autohome, Xueqiu, CreatyChina, Community001 and 265.com (bought by Google).

Charles Xue Biqun (b. 1953), alias Xue Manzi, is a popular Chinese-American billionaire venture capitalist and angel investor with over 10 million followers on Weibo. He studied foreign relations at the University of California, Berkeley. His most famous deal to date is his US$250,000 investment in Unitech in the early 1990s, which later became UTStarcom. The company went public in 2000, reaching a post-IPO value of over US$5 billion. He was also chairman of 8848.com (the earliest Chinese e-commerce network). Xue has invested in many internet startups in China, including PCPOP, Autohome, Xueqiu, CreatyChina, Community001 and 265.com (bought by Google).

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

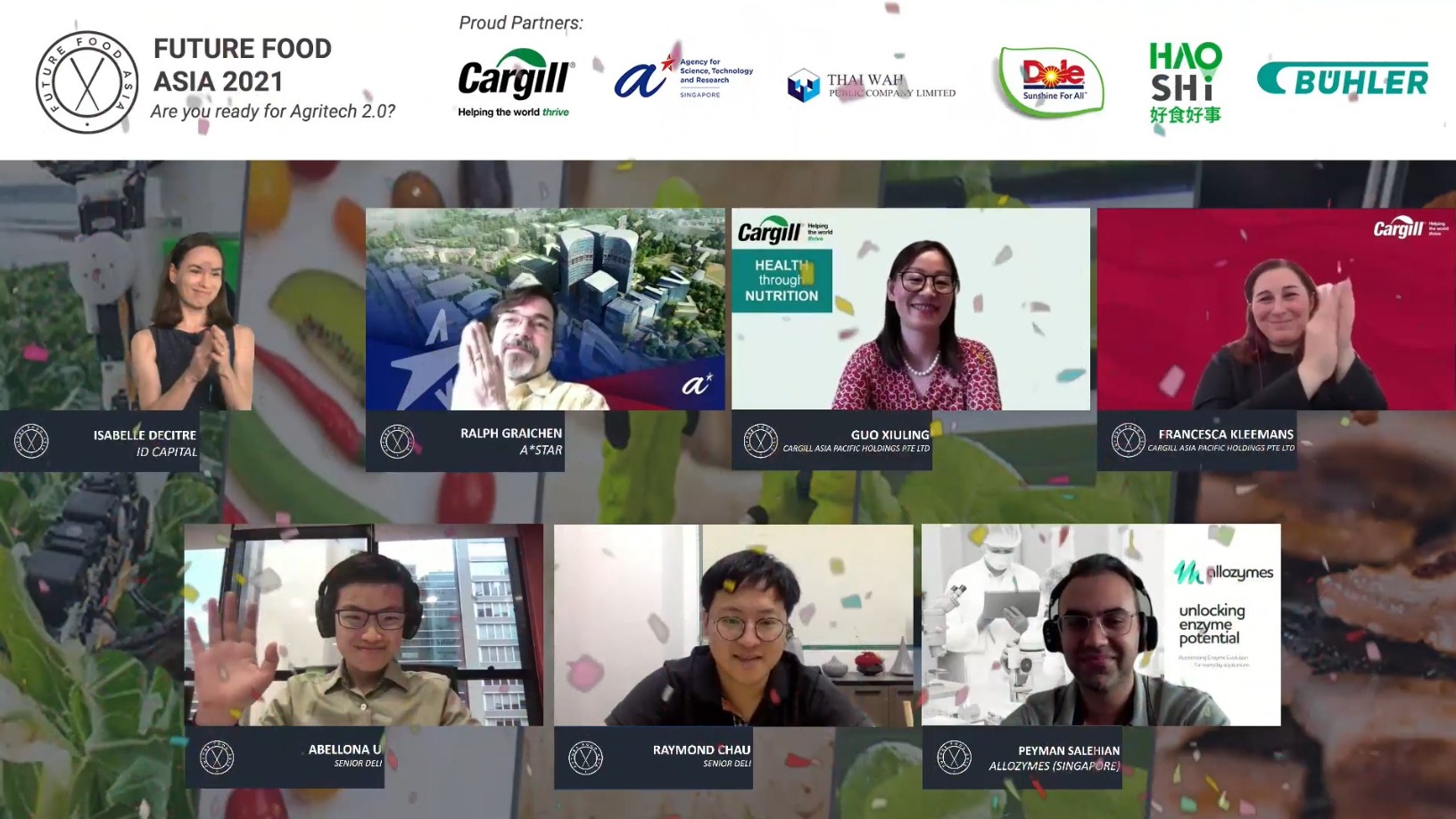

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

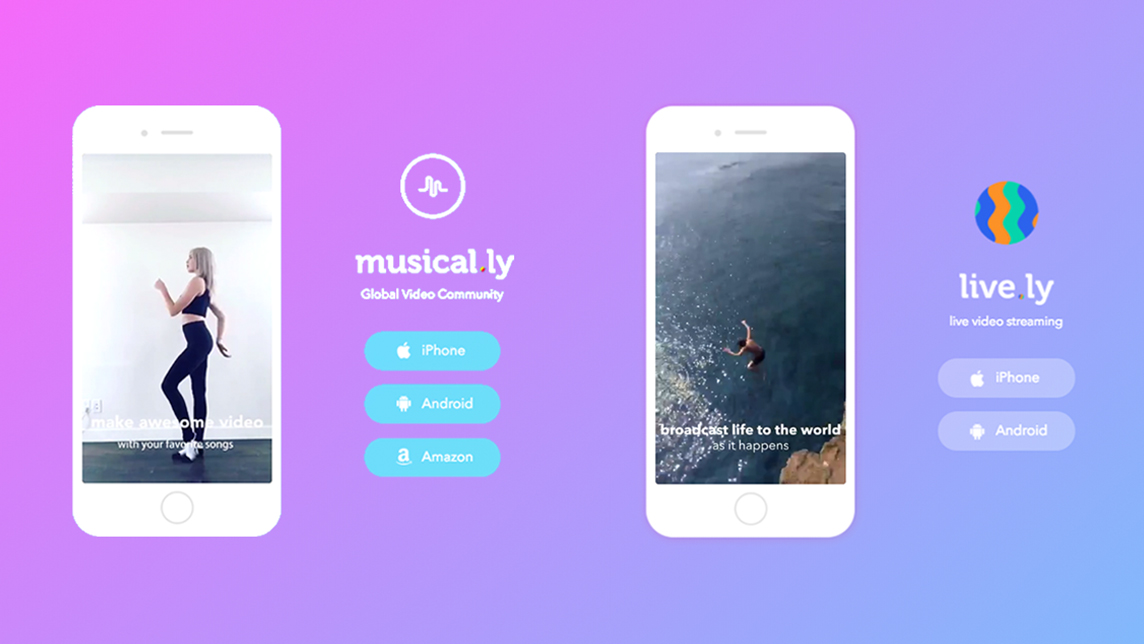

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

Sorry, we couldn’t find any matches for“A*Star”.