A*Star

-

DATABASE (997)

-

ARTICLES (811)

Angel investor Grace Tahir, daughter of Indonesian banker and real estate tycoon, has a passion for tech startups. Besides her self-made billionaire father, business is also in her blood from her mother’s Riady conglomerate family. Married to Ronald Kumalaputra, she finally realised her dream of becoming a techpreneur in her own right. In 2012, she founded an app BibbyCam that failed less than two years later. Building on her experience in healthcare, as the Tahir empire owns hospitals in Indonesia, she created an online health portal, www.doktor.id offering free health consultations.

Angel investor Grace Tahir, daughter of Indonesian banker and real estate tycoon, has a passion for tech startups. Besides her self-made billionaire father, business is also in her blood from her mother’s Riady conglomerate family. Married to Ronald Kumalaputra, she finally realised her dream of becoming a techpreneur in her own right. In 2012, she founded an app BibbyCam that failed less than two years later. Building on her experience in healthcare, as the Tahir empire owns hospitals in Indonesia, she created an online health portal, www.doktor.id offering free health consultations.

Based in Porto, Nuno Miller joined Sonae as head of digital channels in 2015 and eventually became the chief digital and information officer at Sonae S&F in March 2018. He was CIO at Farfetch for three years until 2014 when he was named as European CIO of the year by CIONET and INSEAD.Graduating as an IT engineer in 1994, Miller initially worked as a systems engineer at DTTI for four years before joining Deloitte's as a business unit manager. He completed an executive MBA at EUDEM in 2002 and became the CIO and director of Organtex.

Based in Porto, Nuno Miller joined Sonae as head of digital channels in 2015 and eventually became the chief digital and information officer at Sonae S&F in March 2018. He was CIO at Farfetch for three years until 2014 when he was named as European CIO of the year by CIONET and INSEAD.Graduating as an IT engineer in 1994, Miller initially worked as a systems engineer at DTTI for four years before joining Deloitte's as a business unit manager. He completed an executive MBA at EUDEM in 2002 and became the CIO and director of Organtex.

Billed as the world’s first online venture capital platform, launched in 2012 in San Francisco, FundersClub is a marketplace that allows accredited investors to become equity holders in managed venture funds, which then fund pre-screened private companies. It has invested in more than 340 companies to date, valued at more than US$7.6 billion and has seen 35 exits. The platform has invested more than US$115 million to date across sectors and technologies in companies from 21 different countries. Recent investments include in SendBird's Series B, that raised US$52 million, and Zentail's Series A that raised US$5 million.

Billed as the world’s first online venture capital platform, launched in 2012 in San Francisco, FundersClub is a marketplace that allows accredited investors to become equity holders in managed venture funds, which then fund pre-screened private companies. It has invested in more than 340 companies to date, valued at more than US$7.6 billion and has seen 35 exits. The platform has invested more than US$115 million to date across sectors and technologies in companies from 21 different countries. Recent investments include in SendBird's Series B, that raised US$52 million, and Zentail's Series A that raised US$5 million.

Bynd Venture Capital (formerly Busy Angels)

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Kibo Ventures is a Madrid-based venture capital firm founded in 2011 by Alquilino Peña, Jose Maria Amusategui and Javier Torremocha with €114 million under management. The firm is supported by a network of 31 international co-investors who offer access to foreign markets, especially to the US and Latin America, as well as digital-savvy operating partners who provide guidance on technology matters. As of July 2018, Kibo had invested in 44 companies, five of which it has successfully exited, including Blink Booking (acquired by Groupon in 2013), Ducksboard (acquired by New Relic in 2014) and Trip4real (acquired by AirBnB in 2016).

Kibo Ventures is a Madrid-based venture capital firm founded in 2011 by Alquilino Peña, Jose Maria Amusategui and Javier Torremocha with €114 million under management. The firm is supported by a network of 31 international co-investors who offer access to foreign markets, especially to the US and Latin America, as well as digital-savvy operating partners who provide guidance on technology matters. As of July 2018, Kibo had invested in 44 companies, five of which it has successfully exited, including Blink Booking (acquired by Groupon in 2013), Ducksboard (acquired by New Relic in 2014) and Trip4real (acquired by AirBnB in 2016).

Established in August 2017, Insignia Ventures Partners is a newly-founded VC by former Sequoia Capital partner Yinglan Tan, a Stanford and Carnegie Mellon alumnus who joined Sequoia in 2012. He had also worked for 3i, Taiwanese AI startup Appier and has been with Indonesia’s Tokopedia since 2014.Starting with maiden funds worth US$120 million, Insignia has invested US$1 million in Indonesia’s B2B platform for the F&B sector Stoqo. Its lead round of US$3.5 million, for co-working spaces EV Hive in September 2017, was joined by Intudo Ventures, Pandu Sjahrir and other prominent angel investors.

Established in August 2017, Insignia Ventures Partners is a newly-founded VC by former Sequoia Capital partner Yinglan Tan, a Stanford and Carnegie Mellon alumnus who joined Sequoia in 2012. He had also worked for 3i, Taiwanese AI startup Appier and has been with Indonesia’s Tokopedia since 2014.Starting with maiden funds worth US$120 million, Insignia has invested US$1 million in Indonesia’s B2B platform for the F&B sector Stoqo. Its lead round of US$3.5 million, for co-working spaces EV Hive in September 2017, was joined by Intudo Ventures, Pandu Sjahrir and other prominent angel investors.

Co-founded by Robin Li and six others in 2000, Baidu, Inc., is a search engine provider with 80% of the Chinese market. Its business consists of three parts: search services, transaction services and iQiyi video services. Search services are targeted at internet users; pay-for-placement services, for example, are triggered by search queries. Transaction services include Baidu Nuomi, Baidu Maps, Baidu Connect, Baidu Wallet, etc. iQiyi is an online video platform with a content library that includes licensed and self-produced films and shows. In 2017, Baidu invested mainly in the fields of AI, transportation and enterprise services.

Co-founded by Robin Li and six others in 2000, Baidu, Inc., is a search engine provider with 80% of the Chinese market. Its business consists of three parts: search services, transaction services and iQiyi video services. Search services are targeted at internet users; pay-for-placement services, for example, are triggered by search queries. Transaction services include Baidu Nuomi, Baidu Maps, Baidu Connect, Baidu Wallet, etc. iQiyi is an online video platform with a content library that includes licensed and self-produced films and shows. In 2017, Baidu invested mainly in the fields of AI, transportation and enterprise services.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

Toro Ventures is a VC fund based in Monterrey, Mexico, with offices in San Francisco. Led by entrepreneurs Elsa Treviño and Tuto Assad, the fund helps tech startups raise seed capital as well as build a network of family offices and business angels interested in investment opportunities in the Latin American tech ecosystem.Toro Ventures also supports big companies looking to innovate by connecting them with startups from relevant industry verticals. In December 2018, it made its biggest investment to date: €2 million in Spain's BEWE. Established in December 2016, the company has invested in nine startups, to date.

Toro Ventures is a VC fund based in Monterrey, Mexico, with offices in San Francisco. Led by entrepreneurs Elsa Treviño and Tuto Assad, the fund helps tech startups raise seed capital as well as build a network of family offices and business angels interested in investment opportunities in the Latin American tech ecosystem.Toro Ventures also supports big companies looking to innovate by connecting them with startups from relevant industry verticals. In December 2018, it made its biggest investment to date: €2 million in Spain's BEWE. Established in December 2016, the company has invested in nine startups, to date.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

Alfonso Villanueva is a well known angel investor based in San Jose, California. He is currently also the Global Head of Strategy of Corporate Ventures and the CEO Office at Paypal, where he has worked since 2015. He has been an angel investor in various European, US, Asian and Latin American startups since 2008, investing in 13 companies to date. His last investment was in Spanish real estate developer Peranakan, where he invested €650,000 in debt financing. He has also invested in the Series A round of Spanish space transportation services company Zero 2 Infinity.

Alfonso Villanueva is a well known angel investor based in San Jose, California. He is currently also the Global Head of Strategy of Corporate Ventures and the CEO Office at Paypal, where he has worked since 2015. He has been an angel investor in various European, US, Asian and Latin American startups since 2008, investing in 13 companies to date. His last investment was in Spanish real estate developer Peranakan, where he invested €650,000 in debt financing. He has also invested in the Series A round of Spanish space transportation services company Zero 2 Infinity.

Next Chance Invest SL is part of the family firm Next Chance Group that was founded in 2010 by Nicolás Luca de Tena, a well-known Spanish entrepreneur and angel investor. Based in Madrid, the firm invested in the city's Spanish food delivery company La Nevera Roja in 2013. The "Red Fridge", acquired by Rocket Internet for €80m in 2016, was later sold on to Just Eat a year later. Next Chance normally invests between €500,000 and €2m on the scaling tech startups with annual turnover of over €2m.

Next Chance Invest SL is part of the family firm Next Chance Group that was founded in 2010 by Nicolás Luca de Tena, a well-known Spanish entrepreneur and angel investor. Based in Madrid, the firm invested in the city's Spanish food delivery company La Nevera Roja in 2013. The "Red Fridge", acquired by Rocket Internet for €80m in 2016, was later sold on to Just Eat a year later. Next Chance normally invests between €500,000 and €2m on the scaling tech startups with annual turnover of over €2m.

LEVO Capital is a US venture capital firm that focuses on seed investment for utility-based tech companies. Founded by real estate entrepreneur Weston Marcum, the VC has exited digital wallet fintech Evenly that was sold to Square.Based in his birthplace Louisville in Kentucky, Marcum built a successful real estate investment and management company Atlas Properties that later became the Atlas group of companies. The Furman University business graduate began investing in SMEs and tech startups through Levo Capital in 2011. Many of Levo's ventures, including downtown cafes, are also tenants in buildings owned by Marcum's Atlas group.

LEVO Capital is a US venture capital firm that focuses on seed investment for utility-based tech companies. Founded by real estate entrepreneur Weston Marcum, the VC has exited digital wallet fintech Evenly that was sold to Square.Based in his birthplace Louisville in Kentucky, Marcum built a successful real estate investment and management company Atlas Properties that later became the Atlas group of companies. The Furman University business graduate began investing in SMEs and tech startups through Levo Capital in 2011. Many of Levo's ventures, including downtown cafes, are also tenants in buildings owned by Marcum's Atlas group.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

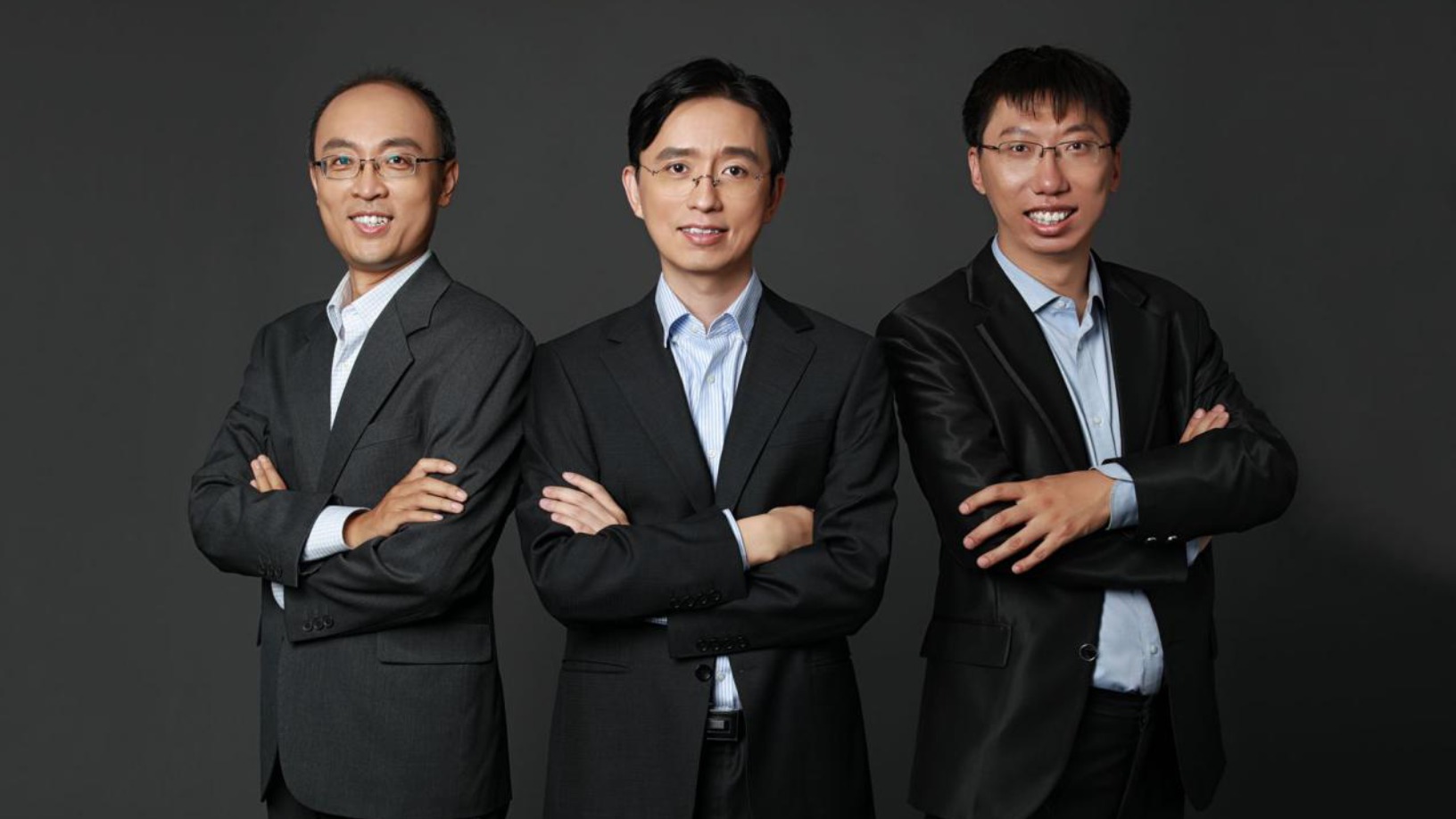

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

Sorry, we couldn’t find any matches for“A*Star”.