Accelerating Asia

-

DATABASE (173)

-

ARTICLES (219)

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Established in 1990, JAFCO Asia is a private equity and venture capital firm with US$650m assets under management. It has offices in Singapore, Taipei, Seoul, Beijing and Shanghai. Its parent company, JAFCO Co., Ltd., is Japan's largest venture capital firm. JAFCO Asia has invested in more than 480 companies, 110 of which have been publicly listed.

Established in 1990, JAFCO Asia is a private equity and venture capital firm with US$650m assets under management. It has offices in Singapore, Taipei, Seoul, Beijing and Shanghai. Its parent company, JAFCO Co., Ltd., is Japan's largest venture capital firm. JAFCO Asia has invested in more than 480 companies, 110 of which have been publicly listed.

Backed by Israeli-Russian billionaire Yuri Milner, Apoletto Asia is managed by Russia’s DST Global, a VC firm that funds late-stage internet startups.

Backed by Israeli-Russian billionaire Yuri Milner, Apoletto Asia is managed by Russia’s DST Global, a VC firm that funds late-stage internet startups.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

Lynx Asia is an investment advisory firm based in Singapore. Its investments cover a broad range of industries, from retail and real estate to energy and manufacturing.

Lynx Asia is an investment advisory firm based in Singapore. Its investments cover a broad range of industries, from retail and real estate to energy and manufacturing.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

Indonesia’s most popular OTA, Traveloka is an easy-to-use source of cheap regional flights and accommodation for the fast-rising Indonesian and Southeast Asian middle class.

Indonesia’s most popular OTA, Traveloka is an easy-to-use source of cheap regional flights and accommodation for the fast-rising Indonesian and Southeast Asian middle class.

Asia Africa Investment & Consulting

Founded in 2013, Asia Africa Investment & Consulting (AAIC) is a Japanese VC that invests in developing nations in Africa. Based in Singapore, the Japanese investment team are also involved in consultancy work. To date, AAIC has invested in eight companies. Investments during 2020 include two Egyptian startups: mobile teleradiology medtech Rology’s $860,000 seed funding in September and mental health medtech platform Shezlong’s Series A round in June.

Founded in 2013, Asia Africa Investment & Consulting (AAIC) is a Japanese VC that invests in developing nations in Africa. Based in Singapore, the Japanese investment team are also involved in consultancy work. To date, AAIC has invested in eight companies. Investments during 2020 include two Egyptian startups: mobile teleradiology medtech Rology’s $860,000 seed funding in September and mental health medtech platform Shezlong’s Series A round in June.

Founded in 2017, Timestamp Capital is a blockchain investment fund. With a focus on research, investment and consulting services in the blockchain field, Timestamp Capital provides all-in-one assistance to blockchain startups by helping them optimize their business models and establish a compliance framework as well as by accelerating the construction of a global community.

Founded in 2017, Timestamp Capital is a blockchain investment fund. With a focus on research, investment and consulting services in the blockchain field, Timestamp Capital provides all-in-one assistance to blockchain startups by helping them optimize their business models and establish a compliance framework as well as by accelerating the construction of a global community.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Pick up ecommerce deliveries at your convenience with PopBox Asia’s smart lockers in Indonesia and Malaysia.

Pick up ecommerce deliveries at your convenience with PopBox Asia’s smart lockers in Indonesia and Malaysia.

Sky Ocean Ventures is a £25m impact investment fund and part of the Sky Media Group. It was launched in 2018 with the goal of accelerating businesses that can tackle global plastic pollution with innovative ideas and disruptive technologies. The firm has backed 20 startups that have developed solutions that help mitigate plastic disposals in the environment, such as disposable bottles made of paper, reusable delivery boxes, sachets made from seaweed and packaging made from wood chips. Sky Ocean Ventures also partners with, among others, The National Geographic and the Imperial College in London.

Sky Ocean Ventures is a £25m impact investment fund and part of the Sky Media Group. It was launched in 2018 with the goal of accelerating businesses that can tackle global plastic pollution with innovative ideas and disruptive technologies. The firm has backed 20 startups that have developed solutions that help mitigate plastic disposals in the environment, such as disposable bottles made of paper, reusable delivery boxes, sachets made from seaweed and packaging made from wood chips. Sky Ocean Ventures also partners with, among others, The National Geographic and the Imperial College in London.

Infortisa is a Valencia-based IT company considered to be one of Spain's top tech companies. Infortisa is leader in computer distribution, with over 30 years' experience offering technological solutions in the B2B sector. Since 2016, it has been active in Juan Roig’s Marina de Empresa (EDEM) Smart Money program in Valencia and is committed to investing in highly innovative startups with the aim of accelerating and promoting Spanish innovation and entrepreneurship, and to becoming a reference investor in the national tech ecosystem.In 2017, it had invested more than €90m in capital.

Infortisa is a Valencia-based IT company considered to be one of Spain's top tech companies. Infortisa is leader in computer distribution, with over 30 years' experience offering technological solutions in the B2B sector. Since 2016, it has been active in Juan Roig’s Marina de Empresa (EDEM) Smart Money program in Valencia and is committed to investing in highly innovative startups with the aim of accelerating and promoting Spanish innovation and entrepreneurship, and to becoming a reference investor in the national tech ecosystem.In 2017, it had invested more than €90m in capital.

Co-founder of Uniplaces, CEO and co-founder of StudentFinance

Global citizen Mariano Kostelec is an Argentinian native who has lived in Asia and Europe. After earning his bachelor’s degree in Computer Science with Management from King’s College London, Kostelec moved to Asia to work at Groupon China (GaoPeng) and Wimbu China. He then moved to Portugal to launch Uniplaces with friends Miguel Amaro and Ben Grech. He is a member of the Entrepreneur Organization in Lisbon and of the Sandbox Network and has appeared on the Forbes 30 Under 30 list.

Global citizen Mariano Kostelec is an Argentinian native who has lived in Asia and Europe. After earning his bachelor’s degree in Computer Science with Management from King’s College London, Kostelec moved to Asia to work at Groupon China (GaoPeng) and Wimbu China. He then moved to Portugal to launch Uniplaces with friends Miguel Amaro and Ben Grech. He is a member of the Entrepreneur Organization in Lisbon and of the Sandbox Network and has appeared on the Forbes 30 Under 30 list.

HomeRun: IoT devices for home-alone pets

Founded by a pet owner who worried about leaving his dog alone at home, HomeRun is chalking up big sales in China's billion-dollar pet care market

Ajaib targets millennials with easy-to-use investment app

Y Combinator alumnus Ajaib recently acquired a local brokerage to add stock trading to its products

Bernardo Hernández: Celebrity investor and Google's former marketing whiz

The angel investor behind some of the most successful Spanish internet startups also has an unusual honor for techies – GQ’s Man of the Year

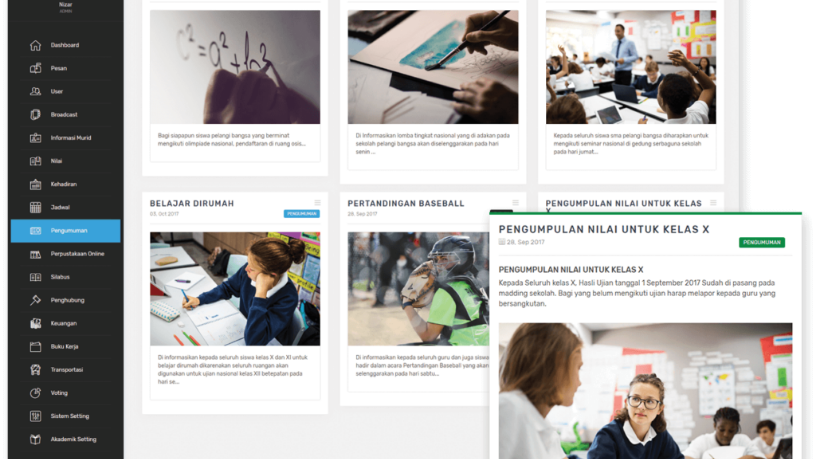

Simak: An integrated edtech platform for Indonesian schools, parents, teachers and students

By connecting all players via its communication and information app, Simak hopes to modernize the Indonesian education system and make it more efficient

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Mindtera: Building mental resilience through bite-sized lessons

Mindtera wants to nip mental health issues in the bud by equipping working adults with skills to navigate work challenges and personal relationships, using their phones

TMiRob's medical robots lighten the load of doctors and nurses in hospitals

The robots also reach an operating room three minutes faster than human nurses – that's more time for saving lives

Tutellus.io: Creating social change by tokenizing education

Tutellus.io has built an incentive-based tokenized education system to boost students’ motivation and teachers’ commitment while facilitating global access to education

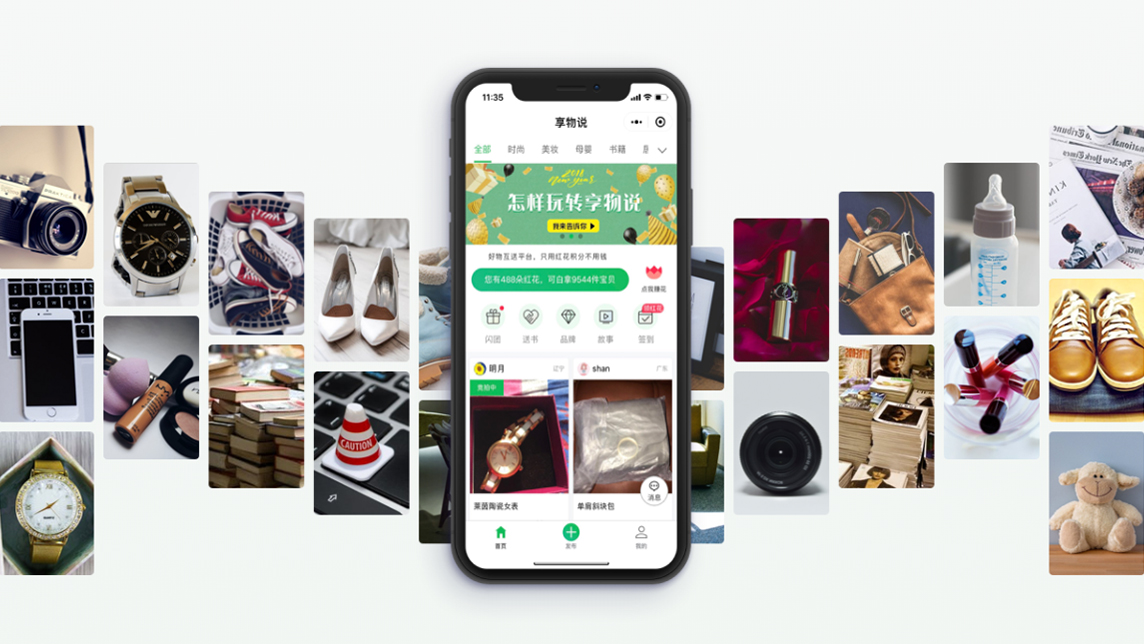

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Agate learns it's not all about the games – it's about the fun

Agate has evolved into one of the biggest game development companies in Indonesia over the past decade. We learned how it got there from Shieny Aprilia, Agate's Vice President of Enterprise Business

NoMorePass: Free app for safe, easy password retrieval across platforms

NoMorePass is a password storage solution that employs military-grade encryption to guard against hackers and data leaks, rendering cloud-based password managers obsolete

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

Mobike founder Hu Weiwei: A crazy idea that touched millions of lives

In just three years, Hu Weiwei has changed the way over 150 million people travel in the city with her company’s dockless bikes

Airhopping: Breakthrough in the OTA sector for millennials

Offering cheap and flexible multi-destination flight packages is helping the platform become the go-to reservation agent for budget travelers

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

Sorry, we couldn’t find any matches for“Accelerating Asia”.