Active Venture Partners

-

DATABASE (655)

-

ARTICLES (472)

The IESE BAN was formed in 2003 by a group of angel investors and entrepreneurs bringing together both alumni and non-alumni of the IESE Business School. It creates and manages deal flow for investors while establishing synergies and collaboration among the network's members. It counts on more than 250 active investors financing technology startups in Madrid and Barcelona. To-date, IESE BAN has invested more than €50m in over 220 startups. It is also part of ACCIÓ’s Network of Private Investors, which fosters technology innovation and startups’ growth in Catalonia.

The IESE BAN was formed in 2003 by a group of angel investors and entrepreneurs bringing together both alumni and non-alumni of the IESE Business School. It creates and manages deal flow for investors while establishing synergies and collaboration among the network's members. It counts on more than 250 active investors financing technology startups in Madrid and Barcelona. To-date, IESE BAN has invested more than €50m in over 220 startups. It is also part of ACCIÓ’s Network of Private Investors, which fosters technology innovation and startups’ growth in Catalonia.

Chris Bouwer is a Barcelona-based angel investor, active in the Spanish tech ecosystem and known for backing startups including Delivery Hero, Fanly and Airhelp. More recently, he was the lead investor in a funding round by Polaroo, a mobile app that manages and automates household payments, as well as investing in Cobee, a compensation and benefits management SaaS. He’s currently Board Advisor in Cellulant, a financial service provider providing digital payments in Africa. Bouwer has a background in sales, with his last key position as VP of Sales (2007–2015) in Adyen, a Dutch PSP services fintech he co-founded.

Chris Bouwer is a Barcelona-based angel investor, active in the Spanish tech ecosystem and known for backing startups including Delivery Hero, Fanly and Airhelp. More recently, he was the lead investor in a funding round by Polaroo, a mobile app that manages and automates household payments, as well as investing in Cobee, a compensation and benefits management SaaS. He’s currently Board Advisor in Cellulant, a financial service provider providing digital payments in Africa. Bouwer has a background in sales, with his last key position as VP of Sales (2007–2015) in Adyen, a Dutch PSP services fintech he co-founded.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

COO and co-founder of Xendit

Tessa Wijaya joined Indonesian fintech Xendit as co-founder and COO in 2016, a year after the payment gateway startup graduated from the Y Combinator program and launched its platform in Indonesia.Wijaya obtained a master’s in philosophy from the University of Sydney in 2006 after graduating from Syracuse University’s Maxwell School of Citizenship and Public Affairs in 2003. She returned to Indonesia and worked as a corporate development officer for over three years. In 2010, she became an analyst at Principia Management Group and Fairways Investment Group, both being Southeast Asia-focused investment firms. In 2013, Wijaya went on to work as an associate at Singapore-based investment firm Mizuho Asia Partners for over three years before joining Xendit back in Jakarta.

Tessa Wijaya joined Indonesian fintech Xendit as co-founder and COO in 2016, a year after the payment gateway startup graduated from the Y Combinator program and launched its platform in Indonesia.Wijaya obtained a master’s in philosophy from the University of Sydney in 2006 after graduating from Syracuse University’s Maxwell School of Citizenship and Public Affairs in 2003. She returned to Indonesia and worked as a corporate development officer for over three years. In 2010, she became an analyst at Principia Management Group and Fairways Investment Group, both being Southeast Asia-focused investment firms. In 2013, Wijaya went on to work as an associate at Singapore-based investment firm Mizuho Asia Partners for over three years before joining Xendit back in Jakarta.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

Citizen journalism is hot, but where’s the money? Panda iMedia helps talented “we media” creators to market and monetize their content, even investing in them.

Citizen journalism is hot, but where’s the money? Panda iMedia helps talented “we media” creators to market and monetize their content, even investing in them.

Supported by major insurers and backed by Indonesia’s largest unicorns, PasarPolis targets the underserved market for affordable personal insurance coverage.

Supported by major insurers and backed by Indonesia’s largest unicorns, PasarPolis targets the underserved market for affordable personal insurance coverage.

MIWA expands eco-friendly smart vending services in Europe and the US, convenient pre-order and e-payment app for merchants and consumers to get real-time product information.

MIWA expands eco-friendly smart vending services in Europe and the US, convenient pre-order and e-payment app for merchants and consumers to get real-time product information.

Co-Founder of Qraved

Cambridge and Stanford graduate Adrian Li was born in London to parents from Hong Kong and Malaysia. He holds a bachelor’s degree in Economics from Cambridge University and an MBA from Stanford University. He is currently a board member of dating startup Paktor, media company MBDC, female online community Female Daily Network, technology development company Imaginato and food social network startup Qraved. He is also the founding and managing partner of venture capital firm Convergence Ventures.

Cambridge and Stanford graduate Adrian Li was born in London to parents from Hong Kong and Malaysia. He holds a bachelor’s degree in Economics from Cambridge University and an MBA from Stanford University. He is currently a board member of dating startup Paktor, media company MBDC, female online community Female Daily Network, technology development company Imaginato and food social network startup Qraved. He is also the founding and managing partner of venture capital firm Convergence Ventures.

Co-founder, CEO and CFO of Growpal

Ahmad Rizqy Akbar is the CEO and CFO of Growpal, an investment crowdfunding platform for aquaculture and fishery projects. A graduate of Aquaculture studies from Indonesia’s Universitas Brawijaya, he has run his own fish and shrimp farm and had worked at Pertamina Dana Ventura, a venture capital fund owned by national oil and gas firm Pertamina. In 2017, he joined fellow Brawijaya graduate Paundra Noorbaskoro to establish Growpal.

Ahmad Rizqy Akbar is the CEO and CFO of Growpal, an investment crowdfunding platform for aquaculture and fishery projects. A graduate of Aquaculture studies from Indonesia’s Universitas Brawijaya, he has run his own fish and shrimp farm and had worked at Pertamina Dana Ventura, a venture capital fund owned by national oil and gas firm Pertamina. In 2017, he joined fellow Brawijaya graduate Paundra Noorbaskoro to establish Growpal.

Co-founder of Warung Pintar

Harya Putra is the co-founder of MUVE, a community of Muslim travelers, which he established while still in university. After graduating in 2016, he joined East Ventures' coworking space, EV Hive, as an expansion and partnership executive. In 2017, Harya co-founded the East Venture-supported retail startup Warung Pintar, where he is currently its COO. He holds a bachelor's degree in Information Systems and Technology from Institut Teknologi Bandung, Indonesia.

Harya Putra is the co-founder of MUVE, a community of Muslim travelers, which he established while still in university. After graduating in 2016, he joined East Ventures' coworking space, EV Hive, as an expansion and partnership executive. In 2017, Harya co-founded the East Venture-supported retail startup Warung Pintar, where he is currently its COO. He holds a bachelor's degree in Information Systems and Technology from Institut Teknologi Bandung, Indonesia.

Co-founder and Chief Business Officer of Datanest

Thibaud Plaquet hails from France, where he earned his master's degree in Electronics and Computer Science from Polytech'Paris UPMC. He previously worked as an apprentice tech support at Philips and later became an apprentice system engineer and channel account manager at Sony. In 2016, he moved to Indonesia and met Manggala Ratulangie when the two were hired to head a joint venture. After the project wound down, they established data science startup Datanest in 2017.

Thibaud Plaquet hails from France, where he earned his master's degree in Electronics and Computer Science from Polytech'Paris UPMC. He previously worked as an apprentice tech support at Philips and later became an apprentice system engineer and channel account manager at Sony. In 2016, he moved to Indonesia and met Manggala Ratulangie when the two were hired to head a joint venture. After the project wound down, they established data science startup Datanest in 2017.

This startup helps college students get job ready by providing them with internship opportunities and career-planning services.

This startup helps college students get job ready by providing them with internship opportunities and career-planning services.

Pioneering insurtech leverages AI to tailor offers to SMEs and the self-employed, with monthly payments and no commission.

Pioneering insurtech leverages AI to tailor offers to SMEs and the self-employed, with monthly payments and no commission.

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Warung Pintar: Creating a little place of happiness with smart kiosks

CEO Agung Bezharie Hadinegoro on how Warung Pintar is tapping IoT and other digital tech to unleash the economic potential of Indonesia's traditional street vendors

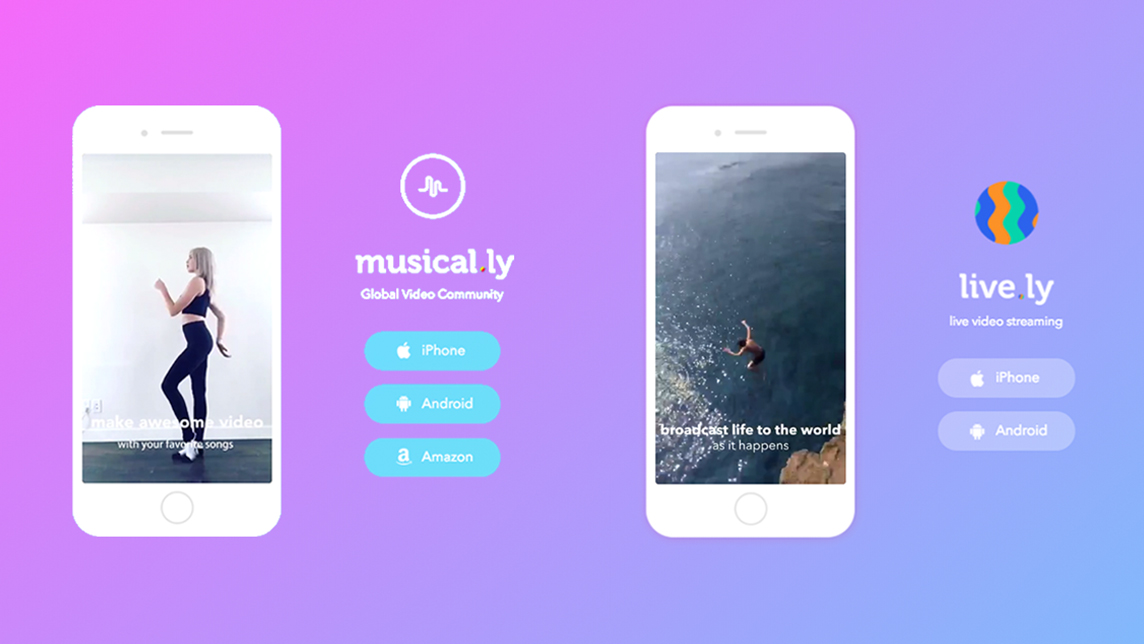

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

How Glovo became one of Spain’s hottest startups

The Barcelona-based on-demand delivery app by a 23-year-old aerospace engineer now spans 14 countries with 7,000 couriers

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Pintek: Fintech offers wide variety of loans to improve Indonesians' access to education

Pintek is expanding into Islamic finance with new Sharia-compliant loans for students at Islamic schools and universities

Venturra Capital's Raditya Pramana interview (Part II): "We need to prioritize progress"

In part two of an interview, Indonesian VC Raditya Pramana discusses foreign investment in the local ecosystem, the qualities of startups that attract him and more

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Chinese startups feel the chill of capital winter as VC activities slow

The goods news is investors still have plenty of money. They just become more cautious when making investment decisions

Sorry, we couldn’t find any matches for“Active Venture Partners”.