Active Venture Partners

-

DATABASE (655)

-

ARTICLES (472)

Co-founder of Karsa

Alihan Tjohjono, also known as Ming, is a veteran businessman with experience in agribusiness. After earning his bachelor’s in Business Administration at the University of Wisconsin-Madison, USA, he worked in Singapore for the Sumitomo Trust and Banking Corporation. He returned to Indonesia in 2001 to assume the role of executive director of cosmetics manufacturer Astoria. In 2008, he became the CEO of Prima Agri Tech, an agrochemicals manufacturer. His latest venture, Karsa, is a social platform for farmers and agricultural stakeholders.

Alihan Tjohjono, also known as Ming, is a veteran businessman with experience in agribusiness. After earning his bachelor’s in Business Administration at the University of Wisconsin-Madison, USA, he worked in Singapore for the Sumitomo Trust and Banking Corporation. He returned to Indonesia in 2001 to assume the role of executive director of cosmetics manufacturer Astoria. In 2008, he became the CEO of Prima Agri Tech, an agrochemicals manufacturer. His latest venture, Karsa, is a social platform for farmers and agricultural stakeholders.

Founder and CEO of Hero Entertainment

Ying, who invented the concept of mobile game publishing, is often referred to as the Father of Mobile Esports in China. In 1999, he dropped out of East China Normal University three months after matriculating to start his first business venture. In 2006, Ying worked at Standard Chartered Bank. In 2008, he started a mobile game distributing business, later acquired by the V1 Group. Ying became president of China Mobile Games and Entertainment Group, a subsidiary of V1, in 2013. In 2015, he founded Hero Entertainment.

Ying, who invented the concept of mobile game publishing, is often referred to as the Father of Mobile Esports in China. In 1999, he dropped out of East China Normal University three months after matriculating to start his first business venture. In 2006, Ying worked at Standard Chartered Bank. In 2008, he started a mobile game distributing business, later acquired by the V1 Group. Ying became president of China Mobile Games and Entertainment Group, a subsidiary of V1, in 2013. In 2015, he founded Hero Entertainment.

Co-founder and CRO of Factorial

Bernat Farrero is a co-founder and Head of Corporate Affairs and Corporate Revenue Officer at Spanish human resource startup Factorial. He is also the Founder and CEO of Itnig, a venture builder based in Barcelona, the founder and chairman of Quipu, an account management platform and Camaloon, which offers online designing and printing of commercial products. Trained as a computer science engineer, Farrero is also an experienced entrepreneur and investor, involved in the successful exits of Playfulbet, which was acquired by Exoclick and GymForLess, which was acquired by Sodexo.

Bernat Farrero is a co-founder and Head of Corporate Affairs and Corporate Revenue Officer at Spanish human resource startup Factorial. He is also the Founder and CEO of Itnig, a venture builder based in Barcelona, the founder and chairman of Quipu, an account management platform and Camaloon, which offers online designing and printing of commercial products. Trained as a computer science engineer, Farrero is also an experienced entrepreneur and investor, involved in the successful exits of Playfulbet, which was acquired by Exoclick and GymForLess, which was acquired by Sodexo.

Co-founder of Magalarva

Karaeng Adjie graduated from Universitas Indonesia with a degree in Chemical and Process Engineering in 2014. He co-founded a garment company in 2011 that was acquired in 2016. He was also an operations director at a property development company in Makassar. He is also the CEO and co-founder of an oil trading company Sabbia. In 2015, he joined the environment-focused property developer PT Magale Sayana Indonesia as co-founder and president commissioner. He was previously the chief strategy officer of Magale’s latest venture Magalarva.

Karaeng Adjie graduated from Universitas Indonesia with a degree in Chemical and Process Engineering in 2014. He co-founded a garment company in 2011 that was acquired in 2016. He was also an operations director at a property development company in Makassar. He is also the CEO and co-founder of an oil trading company Sabbia. In 2015, he joined the environment-focused property developer PT Magale Sayana Indonesia as co-founder and president commissioner. He was previously the chief strategy officer of Magale’s latest venture Magalarva.

Co-founder and CEO of Portofolio

Mahar Indra spent more than 10 years as a representative of a brokerage company before setting out to be an entrepreneur. His first venture, launched in 2011, was Sirtanio, which sells locally grown organic rice. He exited the company in 2015 to focus on the derivatives trading academy he established in 2011. In 2018, continuing on his mission to help rookie investors trade safely and avoid scams, he established Portofolio, a platform where aspiring currency traders can learn from experienced traders and even copy their trades.

Mahar Indra spent more than 10 years as a representative of a brokerage company before setting out to be an entrepreneur. His first venture, launched in 2011, was Sirtanio, which sells locally grown organic rice. He exited the company in 2015 to focus on the derivatives trading academy he established in 2011. In 2018, continuing on his mission to help rookie investors trade safely and avoid scams, he established Portofolio, a platform where aspiring currency traders can learn from experienced traders and even copy their trades.

CTO and Co-founder of Fourier Intelligence

With a degree in Mechanics from Shanghai Jiao Tong University, Xu Zhenhua has over 10 years of experience in robotics R&D. He previously worked as a senior R&D engineer at FANUC Robotics and the Pan Asia Technical Automotive Center, a joint venture between General Motors and SAIC Motor. Xu and Alex Gu co-founded Jinghe Robot in 2012 and Fourier Intelligence in 2015. Xu served as CTO at Fourier Intelligence from 2015 to 2018, at which time he left to found new exoskeleton startup ULS Robotics.

With a degree in Mechanics from Shanghai Jiao Tong University, Xu Zhenhua has over 10 years of experience in robotics R&D. He previously worked as a senior R&D engineer at FANUC Robotics and the Pan Asia Technical Automotive Center, a joint venture between General Motors and SAIC Motor. Xu and Alex Gu co-founded Jinghe Robot in 2012 and Fourier Intelligence in 2015. Xu served as CTO at Fourier Intelligence from 2015 to 2018, at which time he left to found new exoskeleton startup ULS Robotics.

Co-founder and VP of Operations of Xurya

Philip Effendy is the VP of operations at solar power startup Xurya. Prior to establishing the company with Gusmantara Himawan and Edwin Widjonarko, he was an investment associate at early-stage venture capital firm East Ventures, where he handled deal sourcing and portfolio management tasks. He also had a one year stint in the global operations of Disney ABC Television after completing his education in the USA.Effendy graduated from the University of Southern California with a bachelor in Business Administration, specializing in Management and Operations.

Philip Effendy is the VP of operations at solar power startup Xurya. Prior to establishing the company with Gusmantara Himawan and Edwin Widjonarko, he was an investment associate at early-stage venture capital firm East Ventures, where he handled deal sourcing and portfolio management tasks. He also had a one year stint in the global operations of Disney ABC Television after completing his education in the USA.Effendy graduated from the University of Southern California with a bachelor in Business Administration, specializing in Management and Operations.

Civeta is a Madrid-based VC fund founded in 2013 by a small group of Spanish angel investors. It has backed 39 startups in blockchain, education, marketplace and platform.In 2014, the company experienced intense investment activity and was ranked among the most active VC firms in Spain. Since 2016, it has hosted the Civeta Fintech Meetings in Madrid, to which key industry players are invited to discuss and analyze fintech trends and business opportunities. Civeta also offers consultancy services on business model development, branding, UX, social media, data analysis, and legal support.

Civeta is a Madrid-based VC fund founded in 2013 by a small group of Spanish angel investors. It has backed 39 startups in blockchain, education, marketplace and platform.In 2014, the company experienced intense investment activity and was ranked among the most active VC firms in Spain. Since 2016, it has hosted the Civeta Fintech Meetings in Madrid, to which key industry players are invited to discuss and analyze fintech trends and business opportunities. Civeta also offers consultancy services on business model development, branding, UX, social media, data analysis, and legal support.

Infortisa is a Valencia-based IT company considered to be one of Spain's top tech companies. Infortisa is leader in computer distribution, with over 30 years' experience offering technological solutions in the B2B sector. Since 2016, it has been active in Juan Roig’s Marina de Empresa (EDEM) Smart Money program in Valencia and is committed to investing in highly innovative startups with the aim of accelerating and promoting Spanish innovation and entrepreneurship, and to becoming a reference investor in the national tech ecosystem.In 2017, it had invested more than €90m in capital.

Infortisa is a Valencia-based IT company considered to be one of Spain's top tech companies. Infortisa is leader in computer distribution, with over 30 years' experience offering technological solutions in the B2B sector. Since 2016, it has been active in Juan Roig’s Marina de Empresa (EDEM) Smart Money program in Valencia and is committed to investing in highly innovative startups with the aim of accelerating and promoting Spanish innovation and entrepreneurship, and to becoming a reference investor in the national tech ecosystem.In 2017, it had invested more than €90m in capital.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Founded in Colorado in 2006, Techstars is a prolific investor and accelerator. More than 2,300 companies have entered its portfolio, with a combined market cap of $32bn. It generally invests at the pre-seed and seed stages across sectors and geographies and has provided over $11.4bn in investment, with 86% of companies still active or acquired.Every year, it selects over 500 startups to join its three-month accelerators, held globally, investing $120,000 in each startup and providing access to the Techstars network for life. Its most recent investments include in the undisclosed January 2021 pre-seed rounds of Latvian logistics monitoring platform Kedeon and US product development software Bild.

Founded in Colorado in 2006, Techstars is a prolific investor and accelerator. More than 2,300 companies have entered its portfolio, with a combined market cap of $32bn. It generally invests at the pre-seed and seed stages across sectors and geographies and has provided over $11.4bn in investment, with 86% of companies still active or acquired.Every year, it selects over 500 startups to join its three-month accelerators, held globally, investing $120,000 in each startup and providing access to the Techstars network for life. Its most recent investments include in the undisclosed January 2021 pre-seed rounds of Latvian logistics monitoring platform Kedeon and US product development software Bild.

Microsoft is a US-based technology company that focuses on software products and services. Its Windows operating system is one of the most widely used in the world, and it is also a leader in the video games industry thanks to its Xbox video game platform. In the corporate world, it is best known for its Azure cloud computing services. It is one of the most valuable companies in the world alongside rival Apple, social media network Facebook, and internet giant Google. Microsoft is an active investor in the technology industry. It invests through its main business entity, as well as through subsidiaries such as M12, formerly known as Microsoft Ventures.

Microsoft is a US-based technology company that focuses on software products and services. Its Windows operating system is one of the most widely used in the world, and it is also a leader in the video games industry thanks to its Xbox video game platform. In the corporate world, it is best known for its Azure cloud computing services. It is one of the most valuable companies in the world alongside rival Apple, social media network Facebook, and internet giant Google. Microsoft is an active investor in the technology industry. It invests through its main business entity, as well as through subsidiaries such as M12, formerly known as Microsoft Ventures.

Karnataka Information and Biotechnology Venture Fund (KITVEN)

Founded in 1999, KITVEN is a state investor in startups in the Indian state of Karnataka. Major investment sectors include biotech, animation, visual effects, electronics, manufacturing, gaming and comics. Based in Bengaluru, the office is run by Karnataka Asset Management Company Private Limited.KITVEN has invested in more than 50 startups. In 2019, the VC invested in String Bio’s Series A round and joined the $2.2m seed round of smart lock startup Open App. Backed by state and central government financial institutions, the VC manages five funds: KITVEN Fund, KITVEN Fund 2, KITVEN Fund 3 Biotech, KITVEN Fund 4 and Karnataka Semiconductor Venture Capital Fund (KARSEMVEN Fund).

Founded in 1999, KITVEN is a state investor in startups in the Indian state of Karnataka. Major investment sectors include biotech, animation, visual effects, electronics, manufacturing, gaming and comics. Based in Bengaluru, the office is run by Karnataka Asset Management Company Private Limited.KITVEN has invested in more than 50 startups. In 2019, the VC invested in String Bio’s Series A round and joined the $2.2m seed round of smart lock startup Open App. Backed by state and central government financial institutions, the VC manages five funds: KITVEN Fund, KITVEN Fund 2, KITVEN Fund 3 Biotech, KITVEN Fund 4 and Karnataka Semiconductor Venture Capital Fund (KARSEMVEN Fund).

Freesfund was founded in 2015 by Li Feng and Lin Zhonghua, both former partners at International Data Group. In 2016, Freesfund managed RMB 3.6 billion.

Freesfund was founded in 2015 by Li Feng and Lin Zhonghua, both former partners at International Data Group. In 2016, Freesfund managed RMB 3.6 billion.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Warung Pintar: Creating a little place of happiness with smart kiosks

CEO Agung Bezharie Hadinegoro on how Warung Pintar is tapping IoT and other digital tech to unleash the economic potential of Indonesia's traditional street vendors

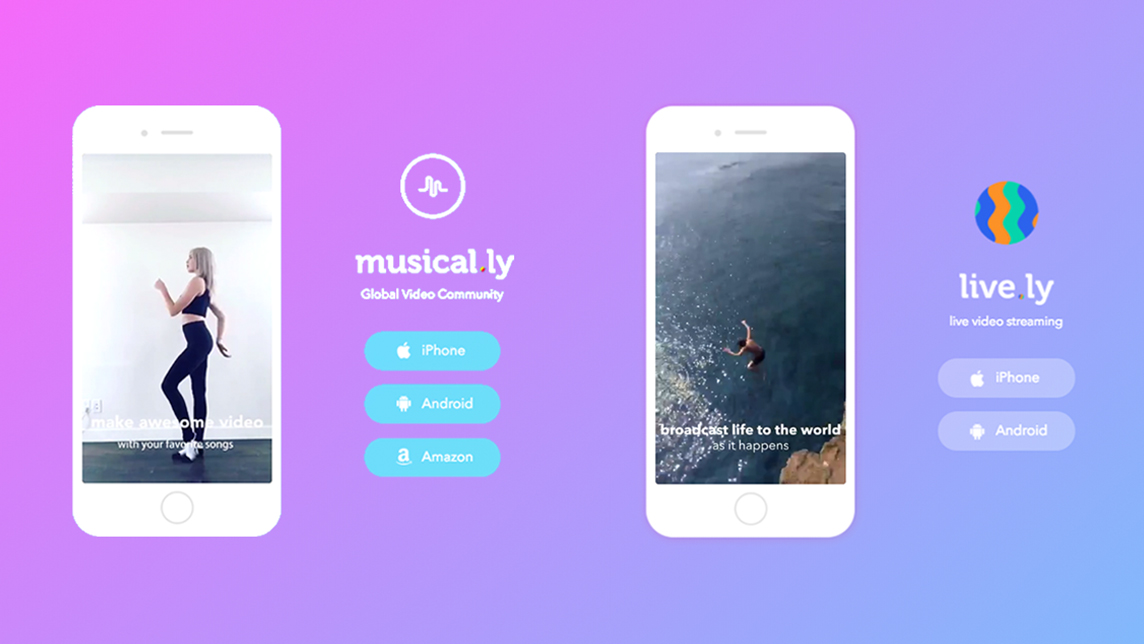

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

How Glovo became one of Spain’s hottest startups

The Barcelona-based on-demand delivery app by a 23-year-old aerospace engineer now spans 14 countries with 7,000 couriers

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Pintek: Fintech offers wide variety of loans to improve Indonesians' access to education

Pintek is expanding into Islamic finance with new Sharia-compliant loans for students at Islamic schools and universities

Venturra Capital's Raditya Pramana interview (Part II): "We need to prioritize progress"

In part two of an interview, Indonesian VC Raditya Pramana discusses foreign investment in the local ecosystem, the qualities of startups that attract him and more

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Chinese startups feel the chill of capital winter as VC activities slow

The goods news is investors still have plenty of money. They just become more cautious when making investment decisions

Sorry, we couldn’t find any matches for“Active Venture Partners”.