Active Venture Partners

-

DATABASE (655)

-

ARTICLES (472)

A government-backed firm, Portugal Ventures is the country's most active VC. It invests exclusively in Portugal-based or initiated startups. There are currently over 100 companies in its portfolio, predominantly from the engineering, tourism, manufacturing and life sciences sectors. Established in 2012, Portugal Ventures focuses on MVP-ready projects and invests from €300,000 to €1.5m in the projects it selects for funding. The firm has managed eight exits to date. It most recently invested in the €1m seed round of conversational games developer Doppio Games and in the €2m seed round of remote access security company Fyde.

A government-backed firm, Portugal Ventures is the country's most active VC. It invests exclusively in Portugal-based or initiated startups. There are currently over 100 companies in its portfolio, predominantly from the engineering, tourism, manufacturing and life sciences sectors. Established in 2012, Portugal Ventures focuses on MVP-ready projects and invests from €300,000 to €1.5m in the projects it selects for funding. The firm has managed eight exits to date. It most recently invested in the €1m seed round of conversational games developer Doppio Games and in the €2m seed round of remote access security company Fyde.

Founder and CEO of UrbanIndo

Silicon Valley highflier Arip Tirta left a top job in 2011 to develop a big data and analytics property platform in Indonesia. He was based in Palo Alto, California for more than seven years and was a director of Investment Analysis and Strategy at a leading venture debt provider Hercules Technology Growth Capital.Armed with a bachelor’s in Mathematics of Computation from UCLA in 2002 and a master’s in Scientific Computing and Computational Mathematics from Stanford University in 2004, Arip found it frustrating to find a property in Indonesia, so he started UrbanIndo.

Silicon Valley highflier Arip Tirta left a top job in 2011 to develop a big data and analytics property platform in Indonesia. He was based in Palo Alto, California for more than seven years and was a director of Investment Analysis and Strategy at a leading venture debt provider Hercules Technology Growth Capital.Armed with a bachelor’s in Mathematics of Computation from UCLA in 2002 and a master’s in Scientific Computing and Computational Mathematics from Stanford University in 2004, Arip found it frustrating to find a property in Indonesia, so he started UrbanIndo.

Ex Co-founder and MD of Valuklik

Former Rocket Internet man Liviu Nedef is a digital marketing veteran. Liviu attained an MBA in 2012 at the IE Business School of Madrid in Spain. He is now based in Singapore as the regional head of digital marketing for HOOQ, a video-on-demand service, in November 2016. HOOQ is a joint venture comprising Singtel, Sony Pictures and Warner Brothers with offices in Singapore, Indonesia, Thailand and India. He had briefly joined Valuklik as co-founder and managing director, before moving to Ensogo as its regional Head of Marketing for Southeast Asia and Hong Kong until October 2016.

Former Rocket Internet man Liviu Nedef is a digital marketing veteran. Liviu attained an MBA in 2012 at the IE Business School of Madrid in Spain. He is now based in Singapore as the regional head of digital marketing for HOOQ, a video-on-demand service, in November 2016. HOOQ is a joint venture comprising Singtel, Sony Pictures and Warner Brothers with offices in Singapore, Indonesia, Thailand and India. He had briefly joined Valuklik as co-founder and managing director, before moving to Ensogo as its regional Head of Marketing for Southeast Asia and Hong Kong until October 2016.

Founder and CEO of Fresh Market (Shihang Shengxian)

With the innovative C2B2F (Customer to Business to Farm) business model he came up with, Fresh Market survived the winter for venture capital funding in China in 2016, and is today the leading fresh food e-commerce platform in East China.Zhang Hongliang (b. 1975) embarked on his journey as a serial entrepreneur after five years in the financial management sector and six years in the automobile industry. The persistent Suzhou native founded Fresh Market (Shihang Shengxian) in 2011 at aged 36, after several tries in three years.

With the innovative C2B2F (Customer to Business to Farm) business model he came up with, Fresh Market survived the winter for venture capital funding in China in 2016, and is today the leading fresh food e-commerce platform in East China.Zhang Hongliang (b. 1975) embarked on his journey as a serial entrepreneur after five years in the financial management sector and six years in the automobile industry. The persistent Suzhou native founded Fresh Market (Shihang Shengxian) in 2011 at aged 36, after several tries in three years.

Co-founder and CEO of GOI

Yaiza Canosa Ferrío (b. 1993) is a native from O Birloque, A Coruña. The Universidad de A Coruña Business graduate has been working while studying since the age of 16. She co-founded business consultancy Glue Concept SL in 2014 while completing an MBA at EUDE Business School in Madrid. She became a partner of Glue’s co-working venture GlueWork in 2017.Canosa has also ventured into app-based businesses like local restaurants guide WithMenu and last-mile courier company GOI Travel SL. She was named by Forbes 30 under 30 as one of Europe’s most promising young entrepreneurs.

Yaiza Canosa Ferrío (b. 1993) is a native from O Birloque, A Coruña. The Universidad de A Coruña Business graduate has been working while studying since the age of 16. She co-founded business consultancy Glue Concept SL in 2014 while completing an MBA at EUDE Business School in Madrid. She became a partner of Glue’s co-working venture GlueWork in 2017.Canosa has also ventured into app-based businesses like local restaurants guide WithMenu and last-mile courier company GOI Travel SL. She was named by Forbes 30 under 30 as one of Europe’s most promising young entrepreneurs.

Co-founder and Chairman of Tiantian Xuenong

Yan became interested in agriculture while working as a venture capitalist at Pingan Trust, the trust unit of Ping An Insurance, from 2010 to 2014. He invested in dozens of agricultural projects on behalf of his clients. Yan resigned from Pingan Trust in 2014 and founded DFS168.com, an e-commerce platform for agricultural materials. In 2017, he co-founded Tiantian Xuenong with Zhao Guang, a friend from university, and became the company's chairman. Yan received his bachelor's degree in Electronics from Sun Yat-sen University in 2006 and his MBA from Hong Kong Baptist University in 2010.

Yan became interested in agriculture while working as a venture capitalist at Pingan Trust, the trust unit of Ping An Insurance, from 2010 to 2014. He invested in dozens of agricultural projects on behalf of his clients. Yan resigned from Pingan Trust in 2014 and founded DFS168.com, an e-commerce platform for agricultural materials. In 2017, he co-founded Tiantian Xuenong with Zhao Guang, a friend from university, and became the company's chairman. Yan received his bachelor's degree in Electronics from Sun Yat-sen University in 2006 and his MBA from Hong Kong Baptist University in 2010.

CEO and Founder of Reclamador.es

Pablo Rabanal holds a degree in Business Administration and Economics as well as one master's in Audiovisual Management and another in Internet Business.He started his career in the entertainment sector as a TV/movie producer and distributor for Esicma. He was CEO at Bwin and started a joint venture facilitating private investments in audiovisual products with British group Future Film.Since 2012, Rabanal has served as CEO and founder of Reclamador.es, a web platform that manages and automates consumer claims, which has over 25,000 clients and collected more than €40m in compensation for users to date.

Pablo Rabanal holds a degree in Business Administration and Economics as well as one master's in Audiovisual Management and another in Internet Business.He started his career in the entertainment sector as a TV/movie producer and distributor for Esicma. He was CEO at Bwin and started a joint venture facilitating private investments in audiovisual products with British group Future Film.Since 2012, Rabanal has served as CEO and founder of Reclamador.es, a web platform that manages and automates consumer claims, which has over 25,000 clients and collected more than €40m in compensation for users to date.

TuSimple aims to become profitable by revving up mass production of self-driving trucks and launching world’s first freight version of Waymo One by 2024.

TuSimple aims to become profitable by revving up mass production of self-driving trucks and launching world’s first freight version of Waymo One by 2024.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Founder and CEO of Insan Medika

Born in 1989, Try Wibowo has joined entrepreneurship coaching programs since his second year at Madiun Public High School. Eager to follow in the footsteps of the successful, local entrepreneurs; Try decided to start his first business venture in 2008 after leaving high school. The success of his Assistant Nurse Vocational Training Center motivated him to consider setting up an online nursing services agency to provide employment for the local graduates, nurses and other healthcare workers. The young entrepreneur, from Ngawi Regency in East Java, invested IDR 50 million to launch Insan Medika in 2013. He became the CEO of the newly incorporated PT Insan Medika Persada in December 2015.

Born in 1989, Try Wibowo has joined entrepreneurship coaching programs since his second year at Madiun Public High School. Eager to follow in the footsteps of the successful, local entrepreneurs; Try decided to start his first business venture in 2008 after leaving high school. The success of his Assistant Nurse Vocational Training Center motivated him to consider setting up an online nursing services agency to provide employment for the local graduates, nurses and other healthcare workers. The young entrepreneur, from Ngawi Regency in East Java, invested IDR 50 million to launch Insan Medika in 2013. He became the CEO of the newly incorporated PT Insan Medika Persada in December 2015.

Co-founder and CEO of Astronaut Technologies

After six years of building innovative products and new businesses in Singapore and India, Nigel Hembrow has made Indonesia his home and headquarters for Astronaut Technologies, his latest venture in HR tech. Hailing from Australia, Queensland civil engineer Nigel started out in project management and engineering design for construction company Mace. After an MBA from the University of Melbourne in 2009, he worked at The Great Little Water Company and Amida Recruitment. Nigel is also currently a director at Rayjon Group, a family-owned property investment and development conglomerate that was co-founded by managing director John Hembrow in 1976.

After six years of building innovative products and new businesses in Singapore and India, Nigel Hembrow has made Indonesia his home and headquarters for Astronaut Technologies, his latest venture in HR tech. Hailing from Australia, Queensland civil engineer Nigel started out in project management and engineering design for construction company Mace. After an MBA from the University of Melbourne in 2009, he worked at The Great Little Water Company and Amida Recruitment. Nigel is also currently a director at Rayjon Group, a family-owned property investment and development conglomerate that was co-founded by managing director John Hembrow in 1976.

Founder and CEO of ParkBox

Founder and CEO of ParkBox. Huang graduated from Zhejiang University with a bachelor’s in Engineering and Industrial Design. In 2016, she received her master’s in Management from the Stanford University Graduate School of Business. She worked at P&G for almost four years and then at Philips for five years. ParkBox is her first entrepreneurial venture.

Founder and CEO of ParkBox. Huang graduated from Zhejiang University with a bachelor’s in Engineering and Industrial Design. In 2016, she received her master’s in Management from the Stanford University Graduate School of Business. She worked at P&G for almost four years and then at Philips for five years. ParkBox is her first entrepreneurial venture.

Co-founder and co-CEO of Shotl

Osvald Martret is the chairman of Drivania Chauffeurs co-founded by the Martret brothers in 2001, now transformed into Drivania International with operations in Europe and the US. In 2001, the Martrets also established mobility venture builder Camina Lab in New York.Martret graduated in Nautical Science at Barcelona Polytechnic University and has a master's in International Transport from Pontificia de Comillas University in Madrid. He worked as a transport manager at MAXAM that transports dangerous substances and was operations manager at shipping agency Transcoma. In 2016, he became co-CEO of Shotl, another Martret transportation startup in Barcelona.

Osvald Martret is the chairman of Drivania Chauffeurs co-founded by the Martret brothers in 2001, now transformed into Drivania International with operations in Europe and the US. In 2001, the Martrets also established mobility venture builder Camina Lab in New York.Martret graduated in Nautical Science at Barcelona Polytechnic University and has a master's in International Transport from Pontificia de Comillas University in Madrid. He worked as a transport manager at MAXAM that transports dangerous substances and was operations manager at shipping agency Transcoma. In 2016, he became co-CEO of Shotl, another Martret transportation startup in Barcelona.

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Warung Pintar: Creating a little place of happiness with smart kiosks

CEO Agung Bezharie Hadinegoro on how Warung Pintar is tapping IoT and other digital tech to unleash the economic potential of Indonesia's traditional street vendors

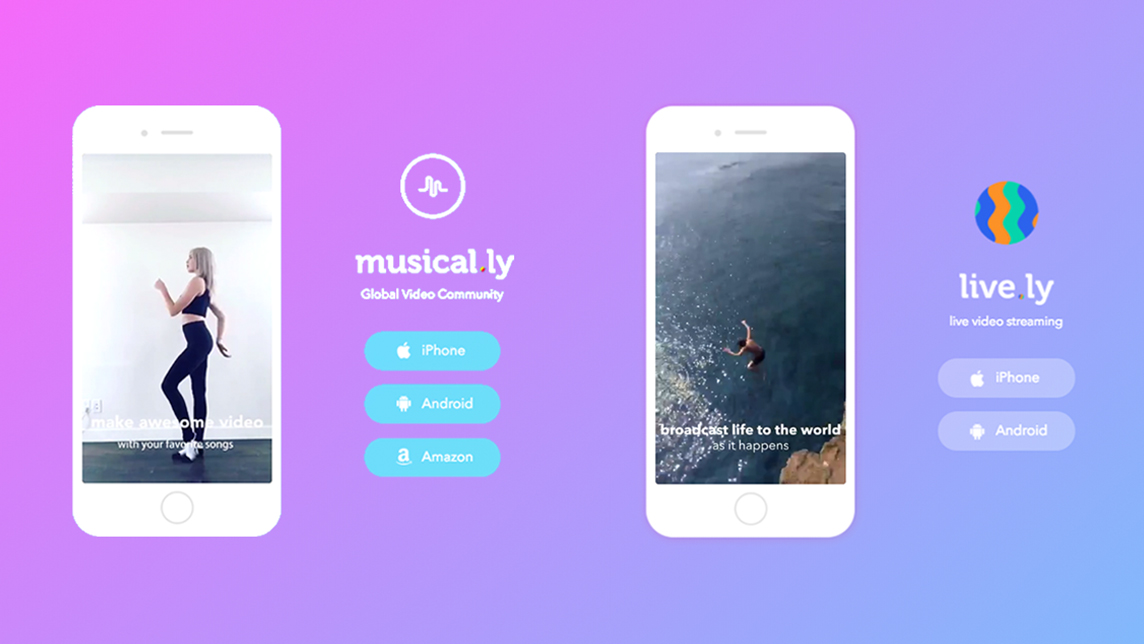

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

How Glovo became one of Spain’s hottest startups

The Barcelona-based on-demand delivery app by a 23-year-old aerospace engineer now spans 14 countries with 7,000 couriers

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Pintek: Fintech offers wide variety of loans to improve Indonesians' access to education

Pintek is expanding into Islamic finance with new Sharia-compliant loans for students at Islamic schools and universities

Venturra Capital's Raditya Pramana interview (Part II): "We need to prioritize progress"

In part two of an interview, Indonesian VC Raditya Pramana discusses foreign investment in the local ecosystem, the qualities of startups that attract him and more

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Chinese startups feel the chill of capital winter as VC activities slow

The goods news is investors still have plenty of money. They just become more cautious when making investment decisions

Sorry, we couldn’t find any matches for“Active Venture Partners”.