Akola Venture Builder

-

DATABASE (443)

-

ARTICLES (211)

Sunway Ventures is the venture capital arm of the Sunway Group, a Malaysian conglomerate. The parent company has business interests ranging from property development and management to hospitality and education. In July 2018, it launched Sun SEA Capital in collaboration with Singapore-based KK Capital, focusing on Series A and Series B-tier startups in Southeast Asia.

Sunway Ventures is the venture capital arm of the Sunway Group, a Malaysian conglomerate. The parent company has business interests ranging from property development and management to hospitality and education. In July 2018, it launched Sun SEA Capital in collaboration with Singapore-based KK Capital, focusing on Series A and Series B-tier startups in Southeast Asia.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Founded in 2015, the Porto-based Betwixt Ventures is no longer active. The venture capital fund manager and advisory firm specialized in early-stage investments in Portuguese tech startups. It invested in startups vetted by other business angels, or co-invested with other VC partners and private investors. The focus of the investments was to fill in the funding gap between seed and Series A rounds.

Founded in 2015, the Porto-based Betwixt Ventures is no longer active. The venture capital fund manager and advisory firm specialized in early-stage investments in Portuguese tech startups. It invested in startups vetted by other business angels, or co-invested with other VC partners and private investors. The focus of the investments was to fill in the funding gap between seed and Series A rounds.

Founded in 2011 by Cyril Ebersweiler, partner of the venture capital firm SOSV, HAX has grown into the world’s first and largest hardware accelerator. It currently operates in Shenzhen and San Francisco. Funded by SOSV, HAX selects teams with hardware prototypes and turns them into functional, sustainable companies. In this way, HAX has brought 65 products to the market in the last three years.

Founded in 2011 by Cyril Ebersweiler, partner of the venture capital firm SOSV, HAX has grown into the world’s first and largest hardware accelerator. It currently operates in Shenzhen and San Francisco. Funded by SOSV, HAX selects teams with hardware prototypes and turns them into functional, sustainable companies. In this way, HAX has brought 65 products to the market in the last three years.

KDDI Open Innovation Fund is a joint corporate VC operated by Japanese telecommunications firm KDDI and investment firm Global Brain. It forms one part of KDDI's venture programs, the other being a Japan-only accelerator program, KDDI Infinity Labo. With the support of other companies in the group, such as au Financial Holdings and Soracom, KDDI is able to provide extensive and relevant support to its portfolio companies.

KDDI Open Innovation Fund is a joint corporate VC operated by Japanese telecommunications firm KDDI and investment firm Global Brain. It forms one part of KDDI's venture programs, the other being a Japan-only accelerator program, KDDI Infinity Labo. With the support of other companies in the group, such as au Financial Holdings and Soracom, KDDI is able to provide extensive and relevant support to its portfolio companies.

GoHub Ventures is the Valencia-based corporate venture capital arm of Global Omnium, a company specialised in water management. The firm invests in the seed and scale-up phases with a ticket size between €500,000 - €3m.The comnpany has so far invested €11m until 2020 and is mostly backing deep tech startups working in AI, big data, 3D, IoT and robotics and cybersecurity sectors.

GoHub Ventures is the Valencia-based corporate venture capital arm of Global Omnium, a company specialised in water management. The firm invests in the seed and scale-up phases with a ticket size between €500,000 - €3m.The comnpany has so far invested €11m until 2020 and is mostly backing deep tech startups working in AI, big data, 3D, IoT and robotics and cybersecurity sectors.

Since its acquisition by US-based internet giant IAC in 2003, Expedia Inc has quickly transformed into a worldwide travel group with stakes in SilverRail, Hotels.com, Trivago, HomeAway, Orbitz, Travelocity, Mobiata travel apps and long-term China partner eLong.Expedia.com was originally launched in 1996 as Microsoft’s pioneering online travel booking venture to help consumers to search for the best travel deals and book tickets at the best prices.

Since its acquisition by US-based internet giant IAC in 2003, Expedia Inc has quickly transformed into a worldwide travel group with stakes in SilverRail, Hotels.com, Trivago, HomeAway, Orbitz, Travelocity, Mobiata travel apps and long-term China partner eLong.Expedia.com was originally launched in 1996 as Microsoft’s pioneering online travel booking venture to help consumers to search for the best travel deals and book tickets at the best prices.

Best known for being the first to invest in social networking hit Momo, seed and early-stage venture capital firm Purplesky Capital, also known as Buttonwood Capital, was founded in 2011. Founded in 2011 by Zheng Gang (Scott Zheng), a successful serial entrepreneur. Brett Krause, former president of JPMorgan Chase China, is its managing partner. PurpleSky focuses on early-stage investments in China digital media and mobile internet companies.

Best known for being the first to invest in social networking hit Momo, seed and early-stage venture capital firm Purplesky Capital, also known as Buttonwood Capital, was founded in 2011. Founded in 2011 by Zheng Gang (Scott Zheng), a successful serial entrepreneur. Brett Krause, former president of JPMorgan Chase China, is its managing partner. PurpleSky focuses on early-stage investments in China digital media and mobile internet companies.

Lightspeed China Partners is a venture capital firm focusing on early-stage investments in China internet firms. In the past 20 years, Lightspeed China has invested in more than 60 companies in China; more than 70% of the investments were in seed or Series A rounds, where Lightspeed China was the lead investor in over 90% of the financings. In 2016, Lightspeed China launched its first RMB fund of 500 million.

Lightspeed China Partners is a venture capital firm focusing on early-stage investments in China internet firms. In the past 20 years, Lightspeed China has invested in more than 60 companies in China; more than 70% of the investments were in seed or Series A rounds, where Lightspeed China was the lead investor in over 90% of the financings. In 2016, Lightspeed China launched its first RMB fund of 500 million.

Founded in 2015, Mandiri Capital Indonesia (MCI) is the venture capital arm of Bank Mandiri, Indonesia’s largest bank. With the full weight of the Mandiri assets, network and knowhow at its disposal, MCI positions itself as a gateway for fintech firms looking to tap into Indonesia’s vast market potential. It also hosts Mandiri Digital Incubator and StartupBerbagi (Startups Share) to help SMEs go digital by connecting them to startups that can provide free services.

Founded in 2015, Mandiri Capital Indonesia (MCI) is the venture capital arm of Bank Mandiri, Indonesia’s largest bank. With the full weight of the Mandiri assets, network and knowhow at its disposal, MCI positions itself as a gateway for fintech firms looking to tap into Indonesia’s vast market potential. It also hosts Mandiri Digital Incubator and StartupBerbagi (Startups Share) to help SMEs go digital by connecting them to startups that can provide free services.

One of the world’s oldest venture capital firms, Greylock Partner was founded in 1965 in Cambridge, Massachusetts by Bill Elfers and Dan Gregory, and later Charlie Waite. It has offices in Silicon Valley, San Francisco and Wellesley and over US$3.5 billion under management. Focused on early-stage startups, Greylock has backed more than 120 profitable M&As and more than 170 IPOs, including Facebook, LinkedIn and Workday.

One of the world’s oldest venture capital firms, Greylock Partner was founded in 1965 in Cambridge, Massachusetts by Bill Elfers and Dan Gregory, and later Charlie Waite. It has offices in Silicon Valley, San Francisco and Wellesley and over US$3.5 billion under management. Focused on early-stage startups, Greylock has backed more than 120 profitable M&As and more than 170 IPOs, including Facebook, LinkedIn and Workday.

Utrust (Guangdong Yuecai Venture Capital Co., Ltd.) was founded in 1995. It is a wholly owned subsidiary of Guangdong Yuecai Investment Co., Ltd., which is authorized by the Guangdong government to manage state-owned capital. With the support of the government of Guangdong province, Utrust invests in many Guangdong-based companies. By the end of December 2017, Utrust had managed capital of over RMB 4.3 billion with assets exceeding RMB 900 million.

Utrust (Guangdong Yuecai Venture Capital Co., Ltd.) was founded in 1995. It is a wholly owned subsidiary of Guangdong Yuecai Investment Co., Ltd., which is authorized by the Guangdong government to manage state-owned capital. With the support of the government of Guangdong province, Utrust invests in many Guangdong-based companies. By the end of December 2017, Utrust had managed capital of over RMB 4.3 billion with assets exceeding RMB 900 million.

Stella Maris Partners is a venture capital fund based in San Pedro Garza García, Mexico with a focus on the education, healthcare and financial services sectors. It invests in Mexican and foreign startups looking to expand to Mexico and Latin America. The firm was founded by Armando Badillo in 2012 and has four other managing partners, Angel Alvarez Cadaveico, Guillermo Zambrano Martinez, Jesus O. Lanza Losa and Marcelo Antonio Benitez Akbo.

Stella Maris Partners is a venture capital fund based in San Pedro Garza García, Mexico with a focus on the education, healthcare and financial services sectors. It invests in Mexican and foreign startups looking to expand to Mexico and Latin America. The firm was founded by Armando Badillo in 2012 and has four other managing partners, Angel Alvarez Cadaveico, Guillermo Zambrano Martinez, Jesus O. Lanza Losa and Marcelo Antonio Benitez Akbo.

Volkswagen Group China is a division of German automobile manufacturer Volkswagen Group. Volkswagen Group China produces, sells and services cars, engines and transmission systems, as well as other parts and components. It runs more than 2,000 authorized dealerships and has 360,000 dealers on staff. Volkswagen Group China and its joint-venture companies plan to invest €15 billion by 2020 in developing autonomous and new energy vehicles.

Volkswagen Group China is a division of German automobile manufacturer Volkswagen Group. Volkswagen Group China produces, sells and services cars, engines and transmission systems, as well as other parts and components. It runs more than 2,000 authorized dealerships and has 360,000 dealers on staff. Volkswagen Group China and its joint-venture companies plan to invest €15 billion by 2020 in developing autonomous and new energy vehicles.

The 10100 Fund (pronounced "ten one-hundred") was established by former Uber CEO Travis Kalanick as a vehicle for both his for-profit investments and non-profit projects. The fund focuses on China and India and has been described as a "home to [Kalanick's] passions, investments, ideas and big bets". 10100 had earlier invested in Kalanick's venture to develop kitchens for on-demand food delivery, CloudKitchens (now known as City Storage Systems).

The 10100 Fund (pronounced "ten one-hundred") was established by former Uber CEO Travis Kalanick as a vehicle for both his for-profit investments and non-profit projects. The fund focuses on China and India and has been described as a "home to [Kalanick's] passions, investments, ideas and big bets". 10100 had earlier invested in Kalanick's venture to develop kitchens for on-demand food delivery, CloudKitchens (now known as City Storage Systems).

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

Nuuk, the cooler box poised to disrupt cold chain logistics

Barcelona-based startup Groenlandia Tech has developed a smart cooler box to track and monitor biological samples, providing an extra layer of security and control during transport

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

Koinpack tackles Indonesia's sachet waste problem with refillable bottles

Partnering with FMCG companies, Koinpack is making small amounts of household consumables available to lower-income groups without using traditional sachet packaging

EXCLUSIVE: Mexico’s Trendier invests in Chicfy as part of €1 million deal

Spain's most popular secondhand fashion marketplace and media darling gets lifeline as it struggles financially to stay afloat

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

The death of Wazypark: A tale of too much money, and no business model

It was an investors’ and media darling. But the story of Wazypark got bitter in 2017, when management disputes and ballooning losses culminated in the startup’s final days

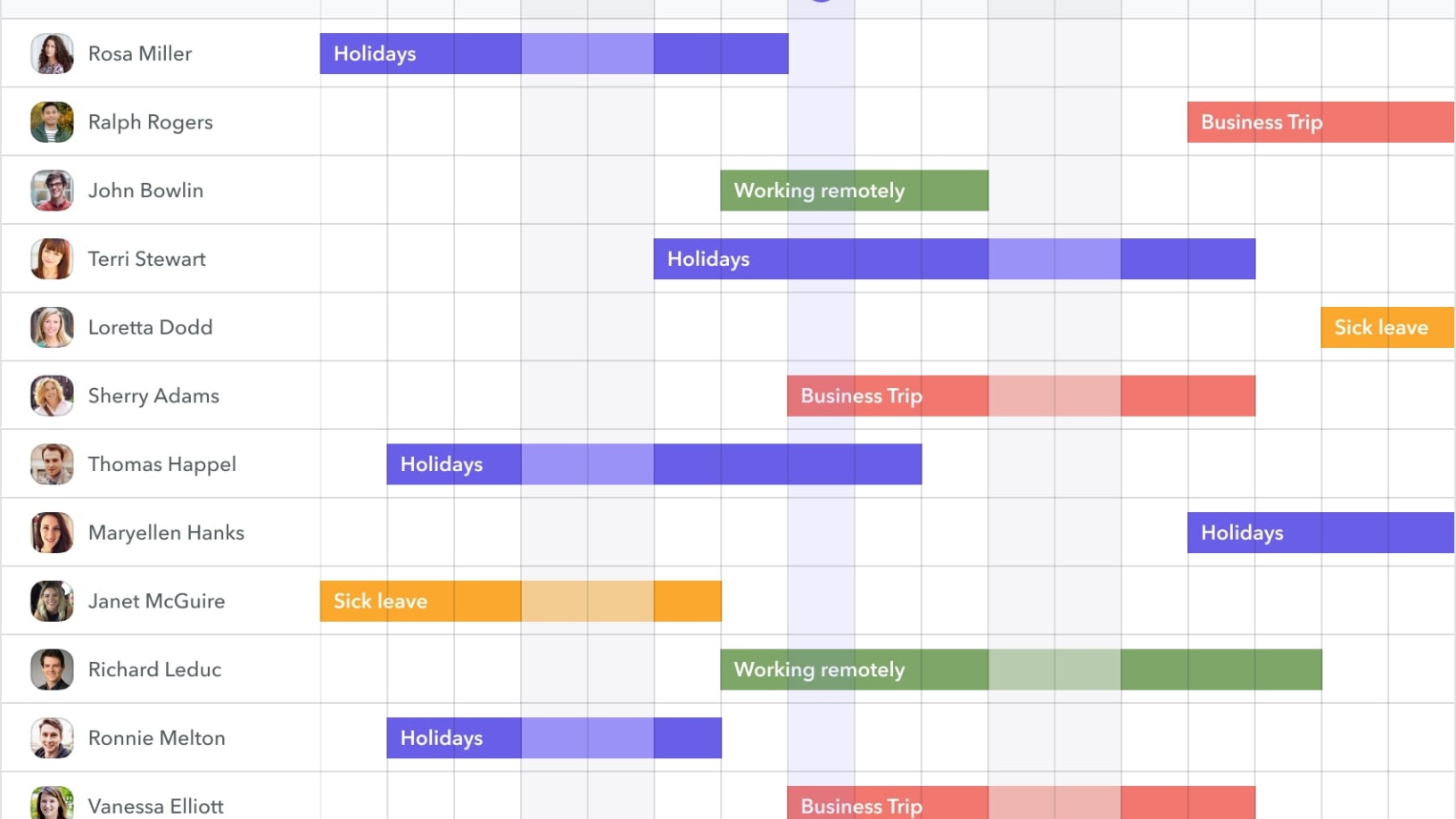

Catapa: Putting AI into HR to help SMEs put their best people forward

Powered by AI and offering affordable subscription rates, Catapa is aiming to lift Indonesian SMEs – especially startups – into the HR mainstream

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Ento: Making cookies and burger patties from crickets

From whole-roasted crickets and granola bars to sausages and meatballs, Ento aims to tap the growing market for insect-based alternative proteins, targeting enthusiasts and early adopters

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

Calling Factorial “the Zendesk of HR," Silicon Valley heavyweight CRV led the round, in its first-ever investment in Spain

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Sorry, we couldn’t find any matches for“Akola Venture Builder”.