Alpha JWC Ventures

-

DATABASE (307)

-

ARTICLES (218)

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

Alberto Knapp Bjeren has more than 20 years of experience in the tech startup ecosystem in Spain and internationally. He is the CEO of London-based digital tech PR agency Wunderman Thompson. He also founded the agency’s Madrid-based digital consultancy The Cocktail that has offices in London, New York, Mexico City and Bogota.Knapp is also a partner and advisor at Seaya Ventures, a Spanish VC with investments in startups like Cabify and Glovo. As an angel investor, he has participated in the pre-seed and seed rounds of Spain’s femtech WOOM and other undisclosed startups.

Alberto Knapp Bjeren has more than 20 years of experience in the tech startup ecosystem in Spain and internationally. He is the CEO of London-based digital tech PR agency Wunderman Thompson. He also founded the agency’s Madrid-based digital consultancy The Cocktail that has offices in London, New York, Mexico City and Bogota.Knapp is also a partner and advisor at Seaya Ventures, a Spanish VC with investments in startups like Cabify and Glovo. As an angel investor, he has participated in the pre-seed and seed rounds of Spain’s femtech WOOM and other undisclosed startups.

Ontario Teachers' Pension Plan

Founded by the Ontario government and Ontario Teachers' Federation in 1990, Ontario Teachers' Pension Plan is Canada's largest single-profession pension plan. Headquartered in Toronto, Ontario Teachers' also has investment offices in London, Singapore and Hong Kong. With C$204.7bn worth of assets under its management, Ontario Teachers' is responsible for the pensions of 329,000 working and retired teachers in Ontario. Its diverse global portfolio of assets generates a total-fund net return of 9.5% annually. A new investment department, Teachers’ Innovation Platform, was set up in 2019 to invest in late-stage ventures that deliver disruptive technologies.

Founded by the Ontario government and Ontario Teachers' Federation in 1990, Ontario Teachers' Pension Plan is Canada's largest single-profession pension plan. Headquartered in Toronto, Ontario Teachers' also has investment offices in London, Singapore and Hong Kong. With C$204.7bn worth of assets under its management, Ontario Teachers' is responsible for the pensions of 329,000 working and retired teachers in Ontario. Its diverse global portfolio of assets generates a total-fund net return of 9.5% annually. A new investment department, Teachers’ Innovation Platform, was set up in 2019 to invest in late-stage ventures that deliver disruptive technologies.

Francesc Riverola is a business angel and the chairman of FXStreet. He launched FXStreet in 2000 while working as an e-Research Manager at PwC and at the IESE e-Business Center. He was CEO of the worldwide forex reference portal until 2012.He is also an investor at Lanta Digital Ventures, a Barcelona-based VC for early-stage startups in Spain and Europe. Born in Palo Alto in California USA, he moved to Barcelona as a child. He has an Economics degree from the University of Barcelona and a PDD in management development for company directors run by IESE Business School.

Francesc Riverola is a business angel and the chairman of FXStreet. He launched FXStreet in 2000 while working as an e-Research Manager at PwC and at the IESE e-Business Center. He was CEO of the worldwide forex reference portal until 2012.He is also an investor at Lanta Digital Ventures, a Barcelona-based VC for early-stage startups in Spain and Europe. Born in Palo Alto in California USA, he moved to Barcelona as a child. He has an Economics degree from the University of Barcelona and a PDD in management development for company directors run by IESE Business School.

Well-known for co-founding JobsCentral in Singapore, Lim Der Shing has been an angel investor since 2009. JobsCentral was acquired by CareerBuilder USA in 2011 and Der Shing became its Asia-Pacific MD. He left the new role after six months in 2014 to become a full-time investor and partner at Singapore-based VC Jungle Ventures. The electrical and electronic engineer graduated in 1999 with a Summa cum Laude from the University of Michigan, USA. As a scholar, he returned to work at Sembcorp before co-founding JobsCentral’s predecessor JobsFactory in 2000 with co-founder and wife Huang Shao-Ning.

Well-known for co-founding JobsCentral in Singapore, Lim Der Shing has been an angel investor since 2009. JobsCentral was acquired by CareerBuilder USA in 2011 and Der Shing became its Asia-Pacific MD. He left the new role after six months in 2014 to become a full-time investor and partner at Singapore-based VC Jungle Ventures. The electrical and electronic engineer graduated in 1999 with a Summa cum Laude from the University of Michigan, USA. As a scholar, he returned to work at Sembcorp before co-founding JobsCentral’s predecessor JobsFactory in 2000 with co-founder and wife Huang Shao-Ning.

Born in 1979, Cheng is an entrepreneur from Hong Kong. He is the third-generation heir of the Cheng Yu-tung family, which founded the New World and Chow Tai Fook empire. With a BA from Harvard University, Cheng joined the family business in 2015, serving as executive vice chairman at New World Development. In 2008, he invented the concept of “museum-retail” - incorporating art into shopping - by founding the K11 luxury shopping mall brand. In 2017, Cheng and veteran investor Clive Ng cofounded C Ventures, which funds technology-driven businesses from the art, media and fashion sectors.

Born in 1979, Cheng is an entrepreneur from Hong Kong. He is the third-generation heir of the Cheng Yu-tung family, which founded the New World and Chow Tai Fook empire. With a BA from Harvard University, Cheng joined the family business in 2015, serving as executive vice chairman at New World Development. In 2008, he invented the concept of “museum-retail” - incorporating art into shopping - by founding the K11 luxury shopping mall brand. In 2017, Cheng and veteran investor Clive Ng cofounded C Ventures, which funds technology-driven businesses from the art, media and fashion sectors.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

Alfonso Villanueva is a well known angel investor based in San Jose, California. He is currently also the Global Head of Strategy of Corporate Ventures and the CEO Office at Paypal, where he has worked since 2015. He has been an angel investor in various European, US, Asian and Latin American startups since 2008, investing in 13 companies to date. His last investment was in Spanish real estate developer Peranakan, where he invested €650,000 in debt financing. He has also invested in the Series A round of Spanish space transportation services company Zero 2 Infinity.

Alfonso Villanueva is a well known angel investor based in San Jose, California. He is currently also the Global Head of Strategy of Corporate Ventures and the CEO Office at Paypal, where he has worked since 2015. He has been an angel investor in various European, US, Asian and Latin American startups since 2008, investing in 13 companies to date. His last investment was in Spanish real estate developer Peranakan, where he invested €650,000 in debt financing. He has also invested in the Series A round of Spanish space transportation services company Zero 2 Infinity.

LEVO Capital is a US venture capital firm that focuses on seed investment for utility-based tech companies. Founded by real estate entrepreneur Weston Marcum, the VC has exited digital wallet fintech Evenly that was sold to Square.Based in his birthplace Louisville in Kentucky, Marcum built a successful real estate investment and management company Atlas Properties that later became the Atlas group of companies. The Furman University business graduate began investing in SMEs and tech startups through Levo Capital in 2011. Many of Levo's ventures, including downtown cafes, are also tenants in buildings owned by Marcum's Atlas group.

LEVO Capital is a US venture capital firm that focuses on seed investment for utility-based tech companies. Founded by real estate entrepreneur Weston Marcum, the VC has exited digital wallet fintech Evenly that was sold to Square.Based in his birthplace Louisville in Kentucky, Marcum built a successful real estate investment and management company Atlas Properties that later became the Atlas group of companies. The Furman University business graduate began investing in SMEs and tech startups through Levo Capital in 2011. Many of Levo's ventures, including downtown cafes, are also tenants in buildings owned by Marcum's Atlas group.

Beatriz González is Spain’s first and only female head of a venture capital firm. In 2013, she founded Seaya Ventures and became the MD of one of Spain’s top 10 VC funds. The VC also has interests in South America. Its portfolio includes 17 mid to large startups like Cabify, Glovo and Wallbox. The VC focuses on the internet, digital and media sectors, backing startups with investments of €5–10 million each. González is also a board member for numerous startups including Cabify and Glovo. As an angel investor, she has invested in the pre-seed and seed rounds of Spanish femtech WOOM.

Beatriz González is Spain’s first and only female head of a venture capital firm. In 2013, she founded Seaya Ventures and became the MD of one of Spain’s top 10 VC funds. The VC also has interests in South America. Its portfolio includes 17 mid to large startups like Cabify, Glovo and Wallbox. The VC focuses on the internet, digital and media sectors, backing startups with investments of €5–10 million each. González is also a board member for numerous startups including Cabify and Glovo. As an angel investor, she has invested in the pre-seed and seed rounds of Spanish femtech WOOM.

Formerly known as Google Ventures and established in 2009, GV is the VC arm of Alphabet, Inc. and stresses that it invests in the “best companies, not strategic investment for Google”. GV is headquartered in Mountain View, California, with offices in San Francisco, Boston, New York, and London and it currently has over US$3.5 billion under management. It has invested in more than 600 companies across different sectors and stages, with more than 160 as lead investor and has seen 120 exits. Its recent investments include in Lemonade and KeepTruckin's Series D rounds and in Harness' Series B.

Formerly known as Google Ventures and established in 2009, GV is the VC arm of Alphabet, Inc. and stresses that it invests in the “best companies, not strategic investment for Google”. GV is headquartered in Mountain View, California, with offices in San Francisco, Boston, New York, and London and it currently has over US$3.5 billion under management. It has invested in more than 600 companies across different sectors and stages, with more than 160 as lead investor and has seen 120 exits. Its recent investments include in Lemonade and KeepTruckin's Series D rounds and in Harness' Series B.

Domínguez has been CFO at Fundeen since June 2018 and senior manager of Globant Ventures since September. He holds a degree in IT Engineering from the Polytechnic University of Valencia (UPV), a Doctorate in Financial Economics from the Autonomous University of Madrid and an EMBA from IE Business School. He began his career as a financial consultant and project director in Cuenca's public administration, later assuming other managerial posts and working in IT at department store chain El Corte Inglés. From 2015 to 2018, he specialized in risk management at PwC Spain and Accenture.

Domínguez has been CFO at Fundeen since June 2018 and senior manager of Globant Ventures since September. He holds a degree in IT Engineering from the Polytechnic University of Valencia (UPV), a Doctorate in Financial Economics from the Autonomous University of Madrid and an EMBA from IE Business School. He began his career as a financial consultant and project director in Cuenca's public administration, later assuming other managerial posts and working in IT at department store chain El Corte Inglés. From 2015 to 2018, he specialized in risk management at PwC Spain and Accenture.

Microsoft is a US-based technology company that focuses on software products and services. Its Windows operating system is one of the most widely used in the world, and it is also a leader in the video games industry thanks to its Xbox video game platform. In the corporate world, it is best known for its Azure cloud computing services. It is one of the most valuable companies in the world alongside rival Apple, social media network Facebook, and internet giant Google. Microsoft is an active investor in the technology industry. It invests through its main business entity, as well as through subsidiaries such as M12, formerly known as Microsoft Ventures.

Microsoft is a US-based technology company that focuses on software products and services. Its Windows operating system is one of the most widely used in the world, and it is also a leader in the video games industry thanks to its Xbox video game platform. In the corporate world, it is best known for its Azure cloud computing services. It is one of the most valuable companies in the world alongside rival Apple, social media network Facebook, and internet giant Google. Microsoft is an active investor in the technology industry. It invests through its main business entity, as well as through subsidiaries such as M12, formerly known as Microsoft Ventures.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Sinar Mas Digital Ventures (SMDV)

Part of the Sinar Mas Group, one of Indonesia's largest conglomerates.

Part of the Sinar Mas Group, one of Indonesia's largest conglomerates.

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

F&B supplier STOQO collapses, a casualty of Covid-19 restaurant closures in Indonesia

A once promising startup, STOQO's woes reflect the challenges faced by the local F&B industry, which is finding new ways to stay afloat

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

Indonesian edtechs attract funding even as students head back to school

With services that complement and support conventional schools at a fraction of offline tuition cost, edtech companies are likely to continue growing

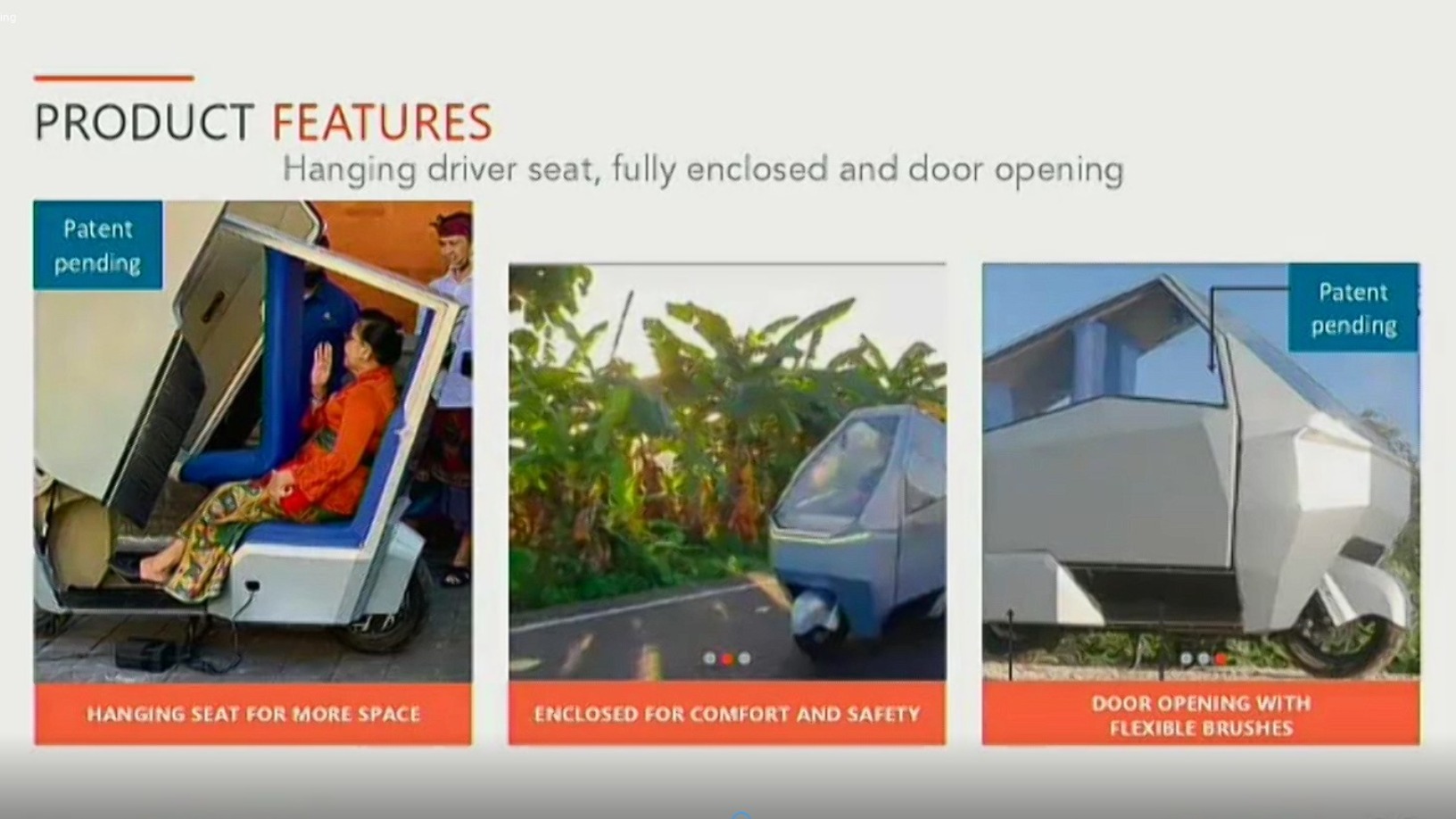

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Kopi Kenangan serves up an addictive blend of rapid expansion and profitability

Its recent $109m Series B infusion boosts the Indonesian startup's confidence for sustainability and regional expansion despite the current Covid-19 slowdown

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Ajaib targets millennials with easy-to-use investment app

Y Combinator alumnus Ajaib recently acquired a local brokerage to add stock trading to its products

Indonesia's Rata offers customized aligners for quicker teeth straightening

Founded by two dentists, Alpha JWC Ventures-backed Rata seeks to offer an affordable alternative to conventional braces by tapping AI in orthodontics

Evermos is Indonesia's version of social commerce – and it's Sharia-compliant, too

Evermos targets the resale market, encouraging students and housewives to earn extra income by promoting products on their social media and WhatsApp networks

No dine-in, no problem: Hangry’s cloud kitchens thrive amid Covid-19

Learning from global F&B franchises has helped Hangry expand rapidly, maintain quality and set expansion goals despite the pandemic

Agritech from Myanmar to Indonesia and beyond: Interview with Jefry Pratama, UMG Idealab

UMG, the Myanmar-based conglomerate, looks to Indonesia for investment and inspiration, with agritech and drones among its focuses

Cecilia Tham: the power of shifting paradigms

The embodiment of unconventional thinking and creativity, this female entrepreneur from Hong Kong has been pioneering social transformation within Barcelona's startup ecosystem since 2011

Tokopedia gets hacked, 91m customer records for sale on the dark web

Tokopedia is investigating the breach, and users should change their passwords as soon as possible

Sorry, we couldn’t find any matches for“Alpha JWC Ventures”.