Amazon Web Services

-

DATABASE (577)

-

ARTICLES (469)

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

Volkswagen Group China is a division of German automobile manufacturer Volkswagen Group. Volkswagen Group China produces, sells and services cars, engines and transmission systems, as well as other parts and components. It runs more than 2,000 authorized dealerships and has 360,000 dealers on staff. Volkswagen Group China and its joint-venture companies plan to invest €15 billion by 2020 in developing autonomous and new energy vehicles.

Volkswagen Group China is a division of German automobile manufacturer Volkswagen Group. Volkswagen Group China produces, sells and services cars, engines and transmission systems, as well as other parts and components. It runs more than 2,000 authorized dealerships and has 360,000 dealers on staff. Volkswagen Group China and its joint-venture companies plan to invest €15 billion by 2020 in developing autonomous and new energy vehicles.

Josep Rius is Global Product Manager Digital Services at ABB and a private investor. He has a degree in Industrial Engineering. He also holds an MBA from ESADE Business School and has more than 20 years international experience in sales in multinational companies and high-tech digital transformation and industrial startups (HP, Asea Brown Boveri, Abrast, Logitek, Parkare, IMAGO light in motion and Nexiona). He co-founded Skinlight in 2002.

Josep Rius is Global Product Manager Digital Services at ABB and a private investor. He has a degree in Industrial Engineering. He also holds an MBA from ESADE Business School and has more than 20 years international experience in sales in multinational companies and high-tech digital transformation and industrial startups (HP, Asea Brown Boveri, Abrast, Logitek, Parkare, IMAGO light in motion and Nexiona). He co-founded Skinlight in 2002.

Co-founded by Alibaba founder Jack Ma and Target Media founder David Yu in 2010, YF Capital focuses on the internet, technology, healthcare, media & entertainment, financial services, logistics and consumer sectors. Its Chinese name “Yunfeng” combines the first names of Jack Ma (Ma Yun) and David Yu (Yu Feng). Headquartered in Shanghai, it also has offices in Beijing, Hong Kong, Hangzhou and other Chinese cities; and manages both USD- and RMB-denominated and funds.

Co-founded by Alibaba founder Jack Ma and Target Media founder David Yu in 2010, YF Capital focuses on the internet, technology, healthcare, media & entertainment, financial services, logistics and consumer sectors. Its Chinese name “Yunfeng” combines the first names of Jack Ma (Ma Yun) and David Yu (Yu Feng). Headquartered in Shanghai, it also has offices in Beijing, Hong Kong, Hangzhou and other Chinese cities; and manages both USD- and RMB-denominated and funds.

Goldman Sachs Asset Management

Established in 1988, Goldman Sachs Asset Management (GSAM) initially specialized in fixed income separate account management for pension funds and institutions. Today, it has grown into one of the world's leading investment managers. As the primary investment arm of Goldman Sachs, it provides investment and advisory services to institutions, financial advisors and individuals through its 33 offices worldwide. As of March 2021, it has overseen over $2tn in assets across the world.

Established in 1988, Goldman Sachs Asset Management (GSAM) initially specialized in fixed income separate account management for pension funds and institutions. Today, it has grown into one of the world's leading investment managers. As the primary investment arm of Goldman Sachs, it provides investment and advisory services to institutions, financial advisors and individuals through its 33 offices worldwide. As of March 2021, it has overseen over $2tn in assets across the world.

Founder and CEO of Ayibang

Former staff of Sogou, Yahoo and Qihoo 360, in browser development.Graduate of Huazhong University of Science and Technology (class of 2007), with master’s in computer studies. Founded Ayibang, China’s most popular home services app (by user activity), in 2013.

Former staff of Sogou, Yahoo and Qihoo 360, in browser development.Graduate of Huazhong University of Science and Technology (class of 2007), with master’s in computer studies. Founded Ayibang, China’s most popular home services app (by user activity), in 2013.

Founded in 2006, AdMaster is a Chinese digital marketing monitoring company. The company offers media auditing, optimization consulting, audience analysis, public opinion monitoring, among other services. Its online ad measurement technology tracks over 5bn impressions every day on computers, smartphones, tablets and smart TVs. AdMaster owns the largest server cluster in the Chinese advertising industry. The company's clients include well-known foreign and domestic brands such as P&G, Coca Cola, Robust and Wahaha.

Founded in 2006, AdMaster is a Chinese digital marketing monitoring company. The company offers media auditing, optimization consulting, audience analysis, public opinion monitoring, among other services. Its online ad measurement technology tracks over 5bn impressions every day on computers, smartphones, tablets and smart TVs. AdMaster owns the largest server cluster in the Chinese advertising industry. The company's clients include well-known foreign and domestic brands such as P&G, Coca Cola, Robust and Wahaha.

Albert Domingo is a Spanish entrepreneur and investor. He is the founder and CEO NexTReT, which was established in 1992 to provide IT systems and infrastructure services. Domingo is also an active business angel, backing startups as a partner investor in Barcelona-based venture builder Itnig's network, which has seen two exits, Gym For Less and Playfulbet. He studied computer engineering and also management development at the IESE Business School in Barcelona.

Albert Domingo is a Spanish entrepreneur and investor. He is the founder and CEO NexTReT, which was established in 1992 to provide IT systems and infrastructure services. Domingo is also an active business angel, backing startups as a partner investor in Barcelona-based venture builder Itnig's network, which has seen two exits, Gym For Less and Playfulbet. He studied computer engineering and also management development at the IESE Business School in Barcelona.

Grand China Capital is a Beijing-based venture capital firm. It invests mainly in media, entertainment, sports, tourism, and smart manufacturing sectors. It provides businesses with services such as financial investment, strategic consulting and data-based marketing. Grand China Capital co-launched a RMB 2 billion fund with Japan's SBI Group (previously known as Softbank Investment Co., Ltd) in September 2018 to drive tech development in the Asia Pacific region.

Grand China Capital is a Beijing-based venture capital firm. It invests mainly in media, entertainment, sports, tourism, and smart manufacturing sectors. It provides businesses with services such as financial investment, strategic consulting and data-based marketing. Grand China Capital co-launched a RMB 2 billion fund with Japan's SBI Group (previously known as Softbank Investment Co., Ltd) in September 2018 to drive tech development in the Asia Pacific region.

Founded in October 1995, CITIC Securities is China's first securities company listed in Shanghai and the Hong Kong. CITIC is its major shareholder, with 15.47% stake in it. The company provides services from securities trading, brokerage, asset management to investment banking. In 2013, CITIC Securities acquired CLSA to extend its international businesses. With branches in 13 countries and regions, it now has over 40,000 business clients and more than 10.3m individual customers home and abroad.

Founded in October 1995, CITIC Securities is China's first securities company listed in Shanghai and the Hong Kong. CITIC is its major shareholder, with 15.47% stake in it. The company provides services from securities trading, brokerage, asset management to investment banking. In 2013, CITIC Securities acquired CLSA to extend its international businesses. With branches in 13 countries and regions, it now has over 40,000 business clients and more than 10.3m individual customers home and abroad.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

Founded in 2014 by internet/high-tech veteran and serial entrepreneur Huang Mingming, FutureCap focuses on early-stage investment of internet and high-tech startups. Differing from other early-stage investors, FutureCap conducts a more conservative investment strategy. With less than 20 investments a year, which are mostly from automotive, corporate services and hardware industries, FutureCap tries to avoid fintech and online-to-offline startups, citing the lack of business model in some and cash burning involved.

Founded in 2014 by internet/high-tech veteran and serial entrepreneur Huang Mingming, FutureCap focuses on early-stage investment of internet and high-tech startups. Differing from other early-stage investors, FutureCap conducts a more conservative investment strategy. With less than 20 investments a year, which are mostly from automotive, corporate services and hardware industries, FutureCap tries to avoid fintech and online-to-offline startups, citing the lack of business model in some and cash burning involved.

Ex-Alibaba executive who is now a key figure in the Zhejiang province internet technology startup scene. In 1999, Li Zhiguo (Frank Li) moved alone to Hangzhou and became the 46th employee of Alibaba. In 2004, he left Alibaba and founded the highly popular life services platform Koubei (later acquired by Alibaba). He is also an active investor, having co-founded early-stage VC fund Ameba Capital in 2011. Li’s investments in Chinese startups include Mogujie, Kuaidadi and Zhaocai.

Ex-Alibaba executive who is now a key figure in the Zhejiang province internet technology startup scene. In 1999, Li Zhiguo (Frank Li) moved alone to Hangzhou and became the 46th employee of Alibaba. In 2004, he left Alibaba and founded the highly popular life services platform Koubei (later acquired by Alibaba). He is also an active investor, having co-founded early-stage VC fund Ameba Capital in 2011. Li’s investments in Chinese startups include Mogujie, Kuaidadi and Zhaocai.

Fosun RZ Capital (Fosun Kinzon Capital)

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Challengers Capital was founded in 2014. Its founding partners are angel investors Xie Xianlin and Tang Binsen. It manages three RMB funds with around RMB 2 billion in management.Challengers Capital focuses on areas like consumption upgrade, entertainment, gaming, enterprise services and fintech.

Challengers Capital was founded in 2014. Its founding partners are angel investors Xie Xianlin and Tang Binsen. It manages three RMB funds with around RMB 2 billion in management.Challengers Capital focuses on areas like consumption upgrade, entertainment, gaming, enterprise services and fintech.

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

A sub-second response time in cloud computing? Yes, with QingCloud, you can

Unusually for China, this five-year old startup chose to pursue slow expansion instead of a rapid growth model – a move that's now giving it an edge over the competition

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Automated marketing platform Frizbit reaches over 1bn end-users; seeks European, LatAm expansion

Using AI and proprietary technology, Frizbit aims to help clients retain customers with personalized and automated push notification campaigns

Animal AgTech Innovation Summit 2021: Experts discuss post-pandemic priorities

The pandemic not only put digital tech in everyone’s hands, it also forced thinking about collecting meaningful data and moving it on-demand to both producers and decision makers

Spanish tech companies launch multi-project Covid-19 portal to help citizens and authorities

Startups including Glovo, CARTO and Cabify join forces with the likes of Google, Apple and IBM in the #StopCorona initiative to help Spain fight the pandemic

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Arkademi wants people "to finish the course, pass the test and get the certificate they need"

Adopting a mobile-first focus, Indonesian MOOC Arkademi sets out to meet the needs of professionals and graduates for affordable courses that have ready applicability

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

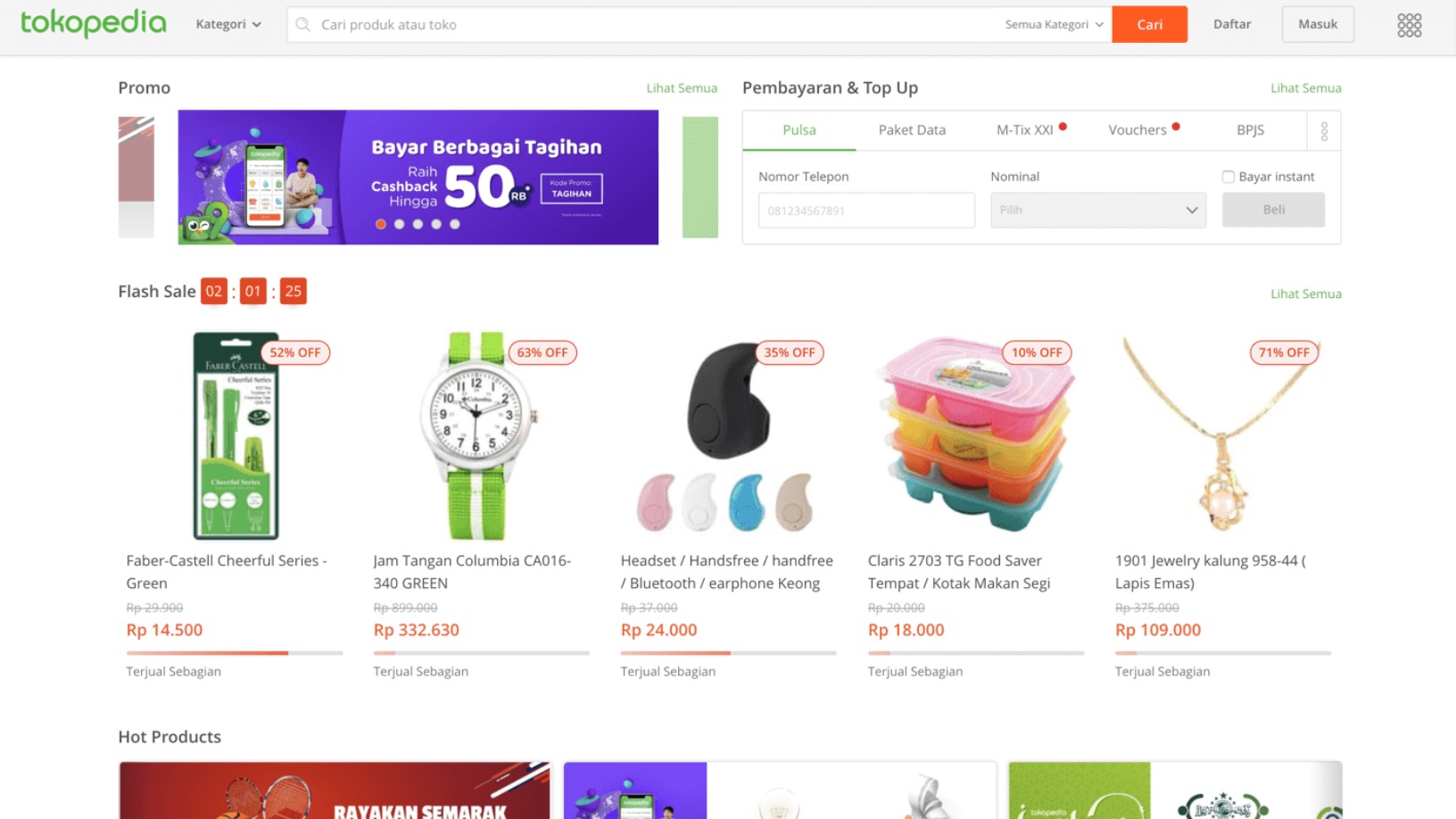

Tokopedia gets hacked, 91m customer records for sale on the dark web

Tokopedia is investigating the breach, and users should change their passwords as soon as possible

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

Last-mile delivery disrupted post-Covid: How Spanish startups can show a better way forward

As the recent jump in online retail and home deliveries looks set to stay, startups are playing a key role in reshaping the Spanish last-mile logistics scene to meet new challenges

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Data integration platform Onna accelerates growth with Covid-19 boost

Corporates use up to 80 different apps in their workflows. Slack- and Dropbox-backed Onna is a central platform integrating all that fragmented data, giving companies greater control

Sorry, we couldn’t find any matches for“Amazon Web Services”.