Amazon Web Services

-

DATABASE (577)

-

ARTICLES (469)

Founded in 2007 by two US-educated and -trained returnees, David Zhang (Zhang Pin) and Shao Bo (Shao Yibo), Matrix Partners China has managed more than RMB 15.5 billion in capital and invested in over 320 companies, including Cheetah Mobile, Didi, Kuaidi, Ele.me, Koudai Shopping and Momo. Zhang has described the 100-strong firm’s investment style as “aggressive”, backing about 80 companies a year. An affiliate of Matrix Partners in the US, the firm focuses on internet & mobile internet, financial services, healthcare and SaaS companies in China.

Founded in 2007 by two US-educated and -trained returnees, David Zhang (Zhang Pin) and Shao Bo (Shao Yibo), Matrix Partners China has managed more than RMB 15.5 billion in capital and invested in over 320 companies, including Cheetah Mobile, Didi, Kuaidi, Ele.me, Koudai Shopping and Momo. Zhang has described the 100-strong firm’s investment style as “aggressive”, backing about 80 companies a year. An affiliate of Matrix Partners in the US, the firm focuses on internet & mobile internet, financial services, healthcare and SaaS companies in China.

SVB Financial Group has been involved in Asian markets since the early 1990s and in the Chinese market since 1999. For more than a decade, SVB has been building relationships with technology companies, entrepreneurs and venture capitalists to help clients work with businesses in Asia and sell to a variety of foreign markets. SVB established its first China subsidiary, SVB Business Partners Shanghai, in 2005 and its second, SVB Business Partners Beijing, in 2010. They provide local technology companies and venture capital investors with in-market client service support and advisory services.

SVB Financial Group has been involved in Asian markets since the early 1990s and in the Chinese market since 1999. For more than a decade, SVB has been building relationships with technology companies, entrepreneurs and venture capitalists to help clients work with businesses in Asia and sell to a variety of foreign markets. SVB established its first China subsidiary, SVB Business Partners Shanghai, in 2005 and its second, SVB Business Partners Beijing, in 2010. They provide local technology companies and venture capital investors with in-market client service support and advisory services.

B4Motion is a Spanish venture capital fund led by Sebastian Canadell and supported by a board of advisors who have varied expertise in visual media production, mobile strategy, product design and law. B4Motion is focused on mobility-related technologies, including autonomous driving systems, Internet-of-Things (IoT) applications for transport as well as on-demand logistics, car sharing, parking and valet services. B4Motion invests across all funding stages from seed through Series D and IPO in the Spanish and Latin American markets.

B4Motion is a Spanish venture capital fund led by Sebastian Canadell and supported by a board of advisors who have varied expertise in visual media production, mobile strategy, product design and law. B4Motion is focused on mobility-related technologies, including autonomous driving systems, Internet-of-Things (IoT) applications for transport as well as on-demand logistics, car sharing, parking and valet services. B4Motion invests across all funding stages from seed through Series D and IPO in the Spanish and Latin American markets.

Established in 2015, Innohub Capital offers comprehensive services for early-stage startups, including incubation, entrepreneurial training, marketing, etc. It operates incubators and manages funds that focus on seed funding in China, New Zealand and Australia. Innohub Capital has created the world's first service platform for startups operating an O2O model. Founder and Chairman Xu Hongbo is an expert in mobile internet and an evangelist of blockchain in China. Innohub Capital has invested in more than 60 companies so far.

Established in 2015, Innohub Capital offers comprehensive services for early-stage startups, including incubation, entrepreneurial training, marketing, etc. It operates incubators and manages funds that focus on seed funding in China, New Zealand and Australia. Innohub Capital has created the world's first service platform for startups operating an O2O model. Founder and Chairman Xu Hongbo is an expert in mobile internet and an evangelist of blockchain in China. Innohub Capital has invested in more than 60 companies so far.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Shanghai-based Shengyin Incubation is a wholly-owned subsidiary of Shengyin Investment, specialized in private equity investment, merger & acquisition, investment consultancy and startup incubation. It invests mainly in early-stage startups in agritech, new retail, education and enterprise services. Shengyin Incubation is also eyeing commercial opportunities brought by new technologies such as AI, blockchain and IoT. Since its establishment in 2006, Shengyin Incubation has invested in over 100 startups, of which 26 have been listed on China's stock exchanges in Shanghai and Shenzhen.

Shanghai-based Shengyin Incubation is a wholly-owned subsidiary of Shengyin Investment, specialized in private equity investment, merger & acquisition, investment consultancy and startup incubation. It invests mainly in early-stage startups in agritech, new retail, education and enterprise services. Shengyin Incubation is also eyeing commercial opportunities brought by new technologies such as AI, blockchain and IoT. Since its establishment in 2006, Shengyin Incubation has invested in over 100 startups, of which 26 have been listed on China's stock exchanges in Shanghai and Shenzhen.

Big Sur Ventures is a Spanish VC based in Madrid. It was co-founded by Jose Miguel Herrero and Manuel Matés both with extensive international experience in leading technology products and services companies and M&A. The fund invests in companies focused on SaaS, online marketplace and platforms, IT and digital media. Investments range from seed to later growth stage. The VC usually represents the first institutional capital in a company, leading or co-leading the round with capital injection of between €100,000 and €400.000 per round.

Big Sur Ventures is a Spanish VC based in Madrid. It was co-founded by Jose Miguel Herrero and Manuel Matés both with extensive international experience in leading technology products and services companies and M&A. The fund invests in companies focused on SaaS, online marketplace and platforms, IT and digital media. Investments range from seed to later growth stage. The VC usually represents the first institutional capital in a company, leading or co-leading the round with capital injection of between €100,000 and €400.000 per round.

Founded in 2006, Abacus Alpha is a German VC that has invested in water or industry service companies instead of the typical tech startups. Based in Frankenthal, Rheinland-Pfalz, it is the investment arm of German multinational, KSB Group, a pump and valve producer. Its most recent investments were the 2019 undisclosed seed funding of industrial tech company Applied Nano Services, the 2018 undisclosed seed round in desalination innovator Salinova and the 2017 undisclosed seed investment in AddVolt, pioneer of renewable energy generation technology to replace diesel engines for cold chain transport.

Founded in 2006, Abacus Alpha is a German VC that has invested in water or industry service companies instead of the typical tech startups. Based in Frankenthal, Rheinland-Pfalz, it is the investment arm of German multinational, KSB Group, a pump and valve producer. Its most recent investments were the 2019 undisclosed seed funding of industrial tech company Applied Nano Services, the 2018 undisclosed seed round in desalination innovator Salinova and the 2017 undisclosed seed investment in AddVolt, pioneer of renewable energy generation technology to replace diesel engines for cold chain transport.

Founded in 1999 by Jack Ma, Alibaba was initially an online B2B platform for small businesses in China. Today it is one of the world’s largest internet companies. Alibaba provides internet infrastructure and marketing platforms for businesses and brands globally to connect with their consumers. Its core businesses include e-commerce, cloud computing, and digital media and entertainment, as it increasingly identifies itself as a data company, rather than as an e-retailer. It is also engaged in building ecosystems of logistics and local services through its invested companies.

Founded in 1999 by Jack Ma, Alibaba was initially an online B2B platform for small businesses in China. Today it is one of the world’s largest internet companies. Alibaba provides internet infrastructure and marketing platforms for businesses and brands globally to connect with their consumers. Its core businesses include e-commerce, cloud computing, and digital media and entertainment, as it increasingly identifies itself as a data company, rather than as an e-retailer. It is also engaged in building ecosystems of logistics and local services through its invested companies.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Founded in Hong Kong in 2018, Lake Bleu Capital currently operates in both Hong Kong and Shanghai. With assets worth billions of US dollars under management, it mainly invests in pharmaceuticals, biotech, medical devices and healthcare services companies in Asia, especially Greater China. Its limited partners include sovereign wealth funds, university endowments, foundations, pension funds, and family offices across the world.With a long-term investment strategy, Lake Bleu Capital invests through both public and private equity with a focus on mid- to late-stage companies.

Founded in Hong Kong in 2018, Lake Bleu Capital currently operates in both Hong Kong and Shanghai. With assets worth billions of US dollars under management, it mainly invests in pharmaceuticals, biotech, medical devices and healthcare services companies in Asia, especially Greater China. Its limited partners include sovereign wealth funds, university endowments, foundations, pension funds, and family offices across the world.With a long-term investment strategy, Lake Bleu Capital invests through both public and private equity with a focus on mid- to late-stage companies.

Transparent fees, zero wait time with this app that connects users directly with hairdressers, not salons. Ratings enable informed choices, spur hairdressers to become competitive.

Transparent fees, zero wait time with this app that connects users directly with hairdressers, not salons. Ratings enable informed choices, spur hairdressers to become competitive.

By translating intimidating financial jargon into plain language, this product comparison fintech helps improve access to financial products for Indonesians, many of them financially illiterate.

By translating intimidating financial jargon into plain language, this product comparison fintech helps improve access to financial products for Indonesians, many of them financially illiterate.

On-demand automotive services with high-level maintenance capabilities (rare in the sector), cheap parts, reliable service in a market used to price opacity, irregular standards.

On-demand automotive services with high-level maintenance capabilities (rare in the sector), cheap parts, reliable service in a market used to price opacity, irregular standards.

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

A sub-second response time in cloud computing? Yes, with QingCloud, you can

Unusually for China, this five-year old startup chose to pursue slow expansion instead of a rapid growth model – a move that's now giving it an edge over the competition

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Automated marketing platform Frizbit reaches over 1bn end-users; seeks European, LatAm expansion

Using AI and proprietary technology, Frizbit aims to help clients retain customers with personalized and automated push notification campaigns

Animal AgTech Innovation Summit 2021: Experts discuss post-pandemic priorities

The pandemic not only put digital tech in everyone’s hands, it also forced thinking about collecting meaningful data and moving it on-demand to both producers and decision makers

Spanish tech companies launch multi-project Covid-19 portal to help citizens and authorities

Startups including Glovo, CARTO and Cabify join forces with the likes of Google, Apple and IBM in the #StopCorona initiative to help Spain fight the pandemic

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Arkademi wants people "to finish the course, pass the test and get the certificate they need"

Adopting a mobile-first focus, Indonesian MOOC Arkademi sets out to meet the needs of professionals and graduates for affordable courses that have ready applicability

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

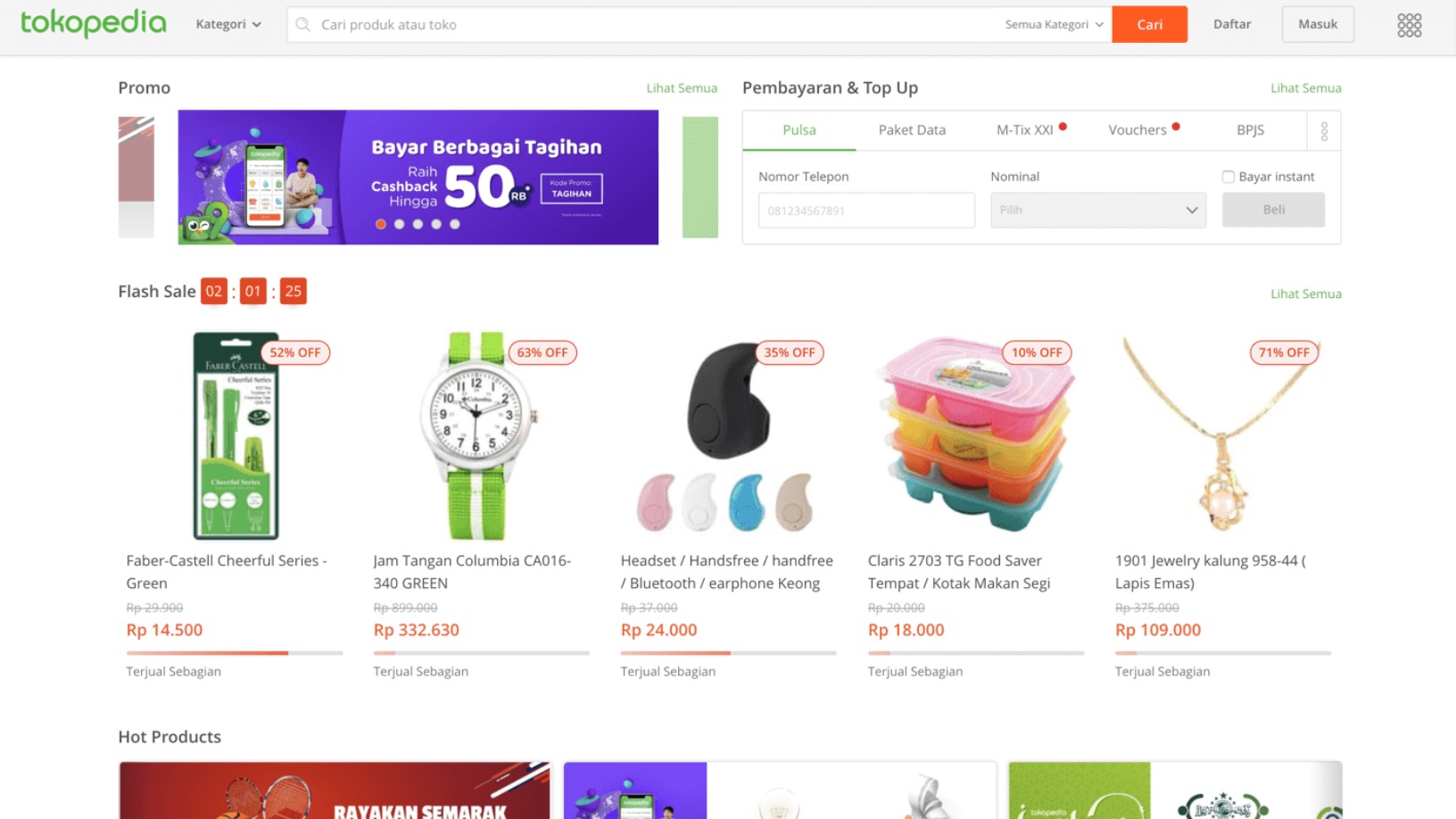

Tokopedia gets hacked, 91m customer records for sale on the dark web

Tokopedia is investigating the breach, and users should change their passwords as soon as possible

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

Last-mile delivery disrupted post-Covid: How Spanish startups can show a better way forward

As the recent jump in online retail and home deliveries looks set to stay, startups are playing a key role in reshaping the Spanish last-mile logistics scene to meet new challenges

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Data integration platform Onna accelerates growth with Covid-19 boost

Corporates use up to 80 different apps in their workflows. Slack- and Dropbox-backed Onna is a central platform integrating all that fragmented data, giving companies greater control

Sorry, we couldn’t find any matches for“Amazon Web Services”.