Amazon Web Services

-

DATABASE (577)

-

ARTICLES (469)

In an aging society, ePeizhen connects elder patients requiring basic care/chaperone services with nurses with spare time, seeking to boost their income.

In an aging society, ePeizhen connects elder patients requiring basic care/chaperone services with nurses with spare time, seeking to boost their income.

Fast like the wind, Mr Feng’s army of mobile-technology-enabled “courier-warriors” provide reliable on-demand intracity delivery for individuals and businesses; and is Hangzhou’s No. 1 player.

Fast like the wind, Mr Feng’s army of mobile-technology-enabled “courier-warriors” provide reliable on-demand intracity delivery for individuals and businesses; and is Hangzhou’s No. 1 player.

A members-only platform offering goods and services in lower-tier cities, Blackfish gained 400,000 subscribers and raised RMB 1.3bn just nine months after launch.

A members-only platform offering goods and services in lower-tier cities, Blackfish gained 400,000 subscribers and raised RMB 1.3bn just nine months after launch.

AI-powered WOOM fertility app has +1m users, helped 60,000+ women conceive while providing medical advice and a vast social network; set for rapid expansion.

AI-powered WOOM fertility app has +1m users, helped 60,000+ women conceive while providing medical advice and a vast social network; set for rapid expansion.

Award-winning proptech Mayordomo expects total revenues to reach €75m by 2024, banking on rapid adoption of Smart Point shopping and locker delivery services across Europe.

Award-winning proptech Mayordomo expects total revenues to reach €75m by 2024, banking on rapid adoption of Smart Point shopping and locker delivery services across Europe.

B2B asset reuse marketplace for local lending, exchange or sales, with the SaaS platform doubling up as company equipment register, while rewarding employee participation.

B2B asset reuse marketplace for local lending, exchange or sales, with the SaaS platform doubling up as company equipment register, while rewarding employee participation.

Founded in 2015, Xin Ding Capital makes equity, pre-IPO and overseas investments. It also provides consultation services to startups in the biomedicine, new energy vehicle, chip and semiconductor manufacturing and artificial intelligence sectors that want to get listed on the National Equities Exchange and Quotations, a Chinese over-the-counter system for trading shares of public limited companies. As of May 2018, Xin Ding Capital has invested nearly RMB 2 billion in over 30 projects.

Founded in 2015, Xin Ding Capital makes equity, pre-IPO and overseas investments. It also provides consultation services to startups in the biomedicine, new energy vehicle, chip and semiconductor manufacturing and artificial intelligence sectors that want to get listed on the National Equities Exchange and Quotations, a Chinese over-the-counter system for trading shares of public limited companies. As of May 2018, Xin Ding Capital has invested nearly RMB 2 billion in over 30 projects.

Rodolfo Lomascolo is a serial entrepreneur with a strong technical foundation in the software, e-commerce and energy sector. He has more than 25 years of experience in C-level positions and is one of the pioneers who fostered the early growth of the tech ecosystem in Spain. For over 14 years, Lomascolo was CEO of the Internet Publishing Services Certification Authority (ipsCA) that was eventually acquired by the STS Group, of which he was subsequently vice-president of International Business Development, growing the company's revenue from zero to €30m in three years. In 2015, he became co-founder and CEO of Pervasive Technologies, a company that deploys big data, machine learning and IoT for digital innovation.

Rodolfo Lomascolo is a serial entrepreneur with a strong technical foundation in the software, e-commerce and energy sector. He has more than 25 years of experience in C-level positions and is one of the pioneers who fostered the early growth of the tech ecosystem in Spain. For over 14 years, Lomascolo was CEO of the Internet Publishing Services Certification Authority (ipsCA) that was eventually acquired by the STS Group, of which he was subsequently vice-president of International Business Development, growing the company's revenue from zero to €30m in three years. In 2015, he became co-founder and CEO of Pervasive Technologies, a company that deploys big data, machine learning and IoT for digital innovation.

Established in 1958, VERSO Capital is a boutique merchant banking and financial services firm based in Luxembourg. It also has offices in Geneva, Fribourg, Vaduz, Dubai, Singapore and BVI. VERSO specializes in sectors like education, food and renewables. Since 2011, the firm has invested over $700bn in venture capital in the global startup ecosystem. Funds worth over $245m were pumped into climatech, foodtech and biotech sectors since 2017. In February 2021, it merged with Swiss alternative asset manager ALDINI Capital that was also founded in 1958 and based in Switzerland and Liechtenstein. VERSO will leverage the expertise of ALDINI in hedge funds, private equity and real estate.

Established in 1958, VERSO Capital is a boutique merchant banking and financial services firm based in Luxembourg. It also has offices in Geneva, Fribourg, Vaduz, Dubai, Singapore and BVI. VERSO specializes in sectors like education, food and renewables. Since 2011, the firm has invested over $700bn in venture capital in the global startup ecosystem. Funds worth over $245m were pumped into climatech, foodtech and biotech sectors since 2017. In February 2021, it merged with Swiss alternative asset manager ALDINI Capital that was also founded in 1958 and based in Switzerland and Liechtenstein. VERSO will leverage the expertise of ALDINI in hedge funds, private equity and real estate.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Profitable Estay has built a leading brand in online booking of short-term luxury home rentals and services for travelers; with property management, upgrading for homeowners.

Profitable Estay has built a leading brand in online booking of short-term luxury home rentals and services for travelers; with property management, upgrading for homeowners.

Backed by Lyft CEO and the Rothschilds trust, regulated equity crowdfunding platform Seedrs opens startup investing–usually exclusive to VCs and the super rich–to retail investors.

Backed by Lyft CEO and the Rothschilds trust, regulated equity crowdfunding platform Seedrs opens startup investing–usually exclusive to VCs and the super rich–to retail investors.

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

A sub-second response time in cloud computing? Yes, with QingCloud, you can

Unusually for China, this five-year old startup chose to pursue slow expansion instead of a rapid growth model – a move that's now giving it an edge over the competition

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Automated marketing platform Frizbit reaches over 1bn end-users; seeks European, LatAm expansion

Using AI and proprietary technology, Frizbit aims to help clients retain customers with personalized and automated push notification campaigns

Animal AgTech Innovation Summit 2021: Experts discuss post-pandemic priorities

The pandemic not only put digital tech in everyone’s hands, it also forced thinking about collecting meaningful data and moving it on-demand to both producers and decision makers

Spanish tech companies launch multi-project Covid-19 portal to help citizens and authorities

Startups including Glovo, CARTO and Cabify join forces with the likes of Google, Apple and IBM in the #StopCorona initiative to help Spain fight the pandemic

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Arkademi wants people "to finish the course, pass the test and get the certificate they need"

Adopting a mobile-first focus, Indonesian MOOC Arkademi sets out to meet the needs of professionals and graduates for affordable courses that have ready applicability

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

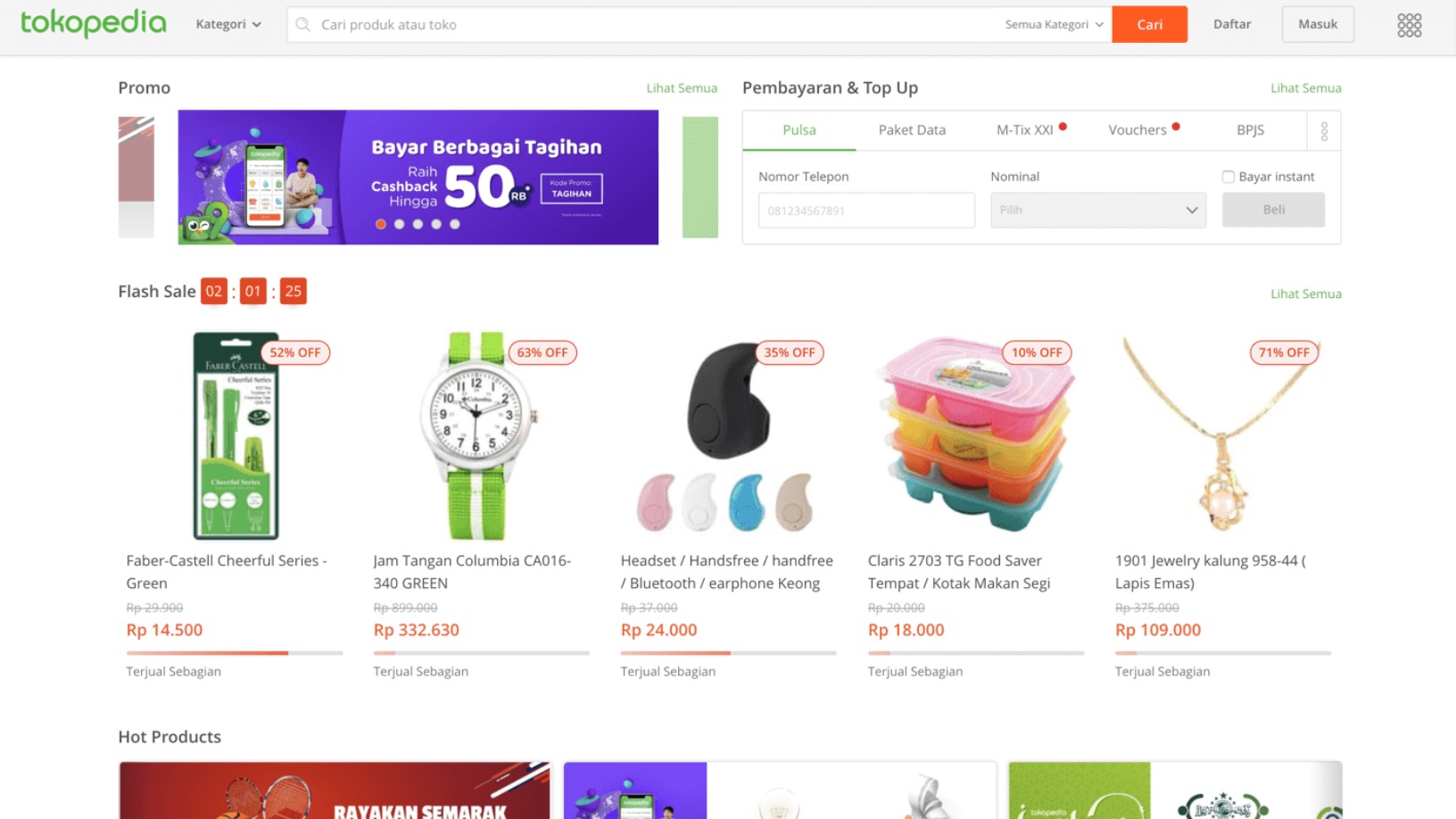

Tokopedia gets hacked, 91m customer records for sale on the dark web

Tokopedia is investigating the breach, and users should change their passwords as soon as possible

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

Last-mile delivery disrupted post-Covid: How Spanish startups can show a better way forward

As the recent jump in online retail and home deliveries looks set to stay, startups are playing a key role in reshaping the Spanish last-mile logistics scene to meet new challenges

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Data integration platform Onna accelerates growth with Covid-19 boost

Corporates use up to 80 different apps in their workflows. Slack- and Dropbox-backed Onna is a central platform integrating all that fragmented data, giving companies greater control

Sorry, we couldn’t find any matches for“Amazon Web Services”.