Animal AgTech Innovation Summit

-

DATABASE (176)

-

ARTICLES (335)

A Boston-based VC founded in 1984 with an impressive investment history, currently totaling US$9.5 billion. With offices in Boston, Menlo Park, California and London, Summit Partners has invested in more than 460 companies in technology, healthcare, life sciences and other high-growth industries, including as lead investor in 77 companies. It has seen 192 exits to date. Recent major investments include as lead investor in Red Points' Series C round and in Markforged's Series D round.The company also provides services, such as, recruitment of senior executives and board members and Peak Performance Groups to help companies’ identify and execute growth initiatives and operational efficiency.

A Boston-based VC founded in 1984 with an impressive investment history, currently totaling US$9.5 billion. With offices in Boston, Menlo Park, California and London, Summit Partners has invested in more than 460 companies in technology, healthcare, life sciences and other high-growth industries, including as lead investor in 77 companies. It has seen 192 exits to date. Recent major investments include as lead investor in Red Points' Series C round and in Markforged's Series D round.The company also provides services, such as, recruitment of senior executives and board members and Peak Performance Groups to help companies’ identify and execute growth initiatives and operational efficiency.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Founded in 2018, Trinity Innovation Fund is a fund management firm that mainly invests in pharmaceutical innovations. TIF currently manages two PE funds and its limited partners include renowned pharmaceuticals and institutional investors. It also has offices managing funds overseas, for example, Trinity Innovation Bioventure Singapore Pte Ltd.

Founded in 2018, Trinity Innovation Fund is a fund management firm that mainly invests in pharmaceutical innovations. TIF currently manages two PE funds and its limited partners include renowned pharmaceuticals and institutional investors. It also has offices managing funds overseas, for example, Trinity Innovation Bioventure Singapore Pte Ltd.

CEO and co-founder of agroSingularity

In 2019, Juanfra Abad Navarro became the CEO and co-founder of agroSingularity, a Murcia-based startup producing natural powder ingredients from wasted agricultural by-products.The graphic and product designer has led multiple international innovation projects at the Catholic University of Murcia and at the European Business Factory. He also co-founded and headed Innovarligero for over nine years, facilitating innovative agile processes for agrifood SMEs. Navarro was selected as one of 10 brilliant Murcian entrepreneurs to join the executive training programs of the Advanced Leadership Foundation (ALF). Through AFL, he had the opportunity to meet former US President Barack Obama during the Summit of Technological Innovation and Circular Economy held in Madrid in 2018.

In 2019, Juanfra Abad Navarro became the CEO and co-founder of agroSingularity, a Murcia-based startup producing natural powder ingredients from wasted agricultural by-products.The graphic and product designer has led multiple international innovation projects at the Catholic University of Murcia and at the European Business Factory. He also co-founded and headed Innovarligero for over nine years, facilitating innovative agile processes for agrifood SMEs. Navarro was selected as one of 10 brilliant Murcian entrepreneurs to join the executive training programs of the Advanced Leadership Foundation (ALF). Through AFL, he had the opportunity to meet former US President Barack Obama during the Summit of Technological Innovation and Circular Economy held in Madrid in 2018.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Xora Innovation is a subsidiary of the Singapore sovereign investment fund, Temasek. It was established as an early-stage deeptech investment platform that identifies startups connected with the Singapore science and technology ecosystem (although the startup can be based anywhere in the world). Xora plans to invest as a lead or co-lead in seed or Series A rounds, with later-stage investments being handled through Temasek. As of July 2021, Xora has invested in two companies based in Singapore: Allozymes, which provides enzyme engineering services, and Nuevocor, which is developing gene therapy for certain heart diseases.

Xora Innovation is a subsidiary of the Singapore sovereign investment fund, Temasek. It was established as an early-stage deeptech investment platform that identifies startups connected with the Singapore science and technology ecosystem (although the startup can be based anywhere in the world). Xora plans to invest as a lead or co-lead in seed or Series A rounds, with later-stage investments being handled through Temasek. As of July 2021, Xora has invested in two companies based in Singapore: Allozymes, which provides enzyme engineering services, and Nuevocor, which is developing gene therapy for certain heart diseases.

With a specific focus on clean energy, Innogy Innovation Hub was established in 2014 and currently has 53 startups in its portfolio spanning from Austria to Bangladesh. Recent investments include HypeLabs' US$3m seed round and the €4m Series A round of augmented and mixed reality solutions provider Holo-Light.

With a specific focus on clean energy, Innogy Innovation Hub was established in 2014 and currently has 53 startups in its portfolio spanning from Austria to Bangladesh. Recent investments include HypeLabs' US$3m seed round and the €4m Series A round of augmented and mixed reality solutions provider Holo-Light.

Innovation Nest is an early-stage venture capitalist firm based in Krakow, Poland. Founded in 2010, the VC has invested in more than 50 startups, with a special focus on European B2B SaaS companies. The firm was the lead investor in eight of the startups' funding rounds.The VC usually participates in seed rounds, with the most recent being a US$1-million investment in Poland's fraud detection company Netone and another seed investment in Portuguese facility management platform Infraspeak. The VC has also joined a Series A round for ICT SaaS company CallPage and Series B funding in sensor company Estimote.

Innovation Nest is an early-stage venture capitalist firm based in Krakow, Poland. Founded in 2010, the VC has invested in more than 50 startups, with a special focus on European B2B SaaS companies. The firm was the lead investor in eight of the startups' funding rounds.The VC usually participates in seed rounds, with the most recent being a US$1-million investment in Poland's fraud detection company Netone and another seed investment in Portuguese facility management platform Infraspeak. The VC has also joined a Series A round for ICT SaaS company CallPage and Series B funding in sensor company Estimote.

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

KDDI Open Innovation Fund is a joint corporate VC operated by Japanese telecommunications firm KDDI and investment firm Global Brain. It forms one part of KDDI's venture programs, the other being a Japan-only accelerator program, KDDI Infinity Labo. With the support of other companies in the group, such as au Financial Holdings and Soracom, KDDI is able to provide extensive and relevant support to its portfolio companies.

KDDI Open Innovation Fund is a joint corporate VC operated by Japanese telecommunications firm KDDI and investment firm Global Brain. It forms one part of KDDI's venture programs, the other being a Japan-only accelerator program, KDDI Infinity Labo. With the support of other companies in the group, such as au Financial Holdings and Soracom, KDDI is able to provide extensive and relevant support to its portfolio companies.

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund is a VC fund set up by China International Marine Containers (CIMC) and Shenzhen Readysun Investment Group on June 14, 2017. The fund focuses on fast-growing high-end equipment manufacturing and new technology sectors, such as intelligent logistics, industrial automation and robots, industrial internet, green new materials.

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund is a VC fund set up by China International Marine Containers (CIMC) and Shenzhen Readysun Investment Group on June 14, 2017. The fund focuses on fast-growing high-end equipment manufacturing and new technology sectors, such as intelligent logistics, industrial automation and robots, industrial internet, green new materials.

Founder and Board Chairman of Leepet (formerly Weibaquan)

Li Yuan started his own internet community and chatroom business as early as 1997, after graduating from high school. The animal lover went on to help his uncle manage his playground business for pets. Hence Li began his career in the pet business.

Li Yuan started his own internet community and chatroom business as early as 1997, after graduating from high school. The animal lover went on to help his uncle manage his playground business for pets. Hence Li began his career in the pet business.

Capital V is a French rural-based investor that only invests in solutions that facilitate sustained behavioral change and eliminate the consumption of animal products. Its investments range from €10,000 to €1m and currently has 20 startups in its portfolio, mainly plant-based meat makers.In 2020, it announced its participation in Pitch & Plant 2020, the global investment competition by Vevolution for plant-based and animal-free startups, offering £100,000 to finalists. Among its recent investments are participation in the extended 2020 seed round of THIS, a UK-based plant-based meat startup that has raised over £6m to date and, in August 2020, in vegan confectionary manufacturer, Livia’s that has raised over £1m so far.

Capital V is a French rural-based investor that only invests in solutions that facilitate sustained behavioral change and eliminate the consumption of animal products. Its investments range from €10,000 to €1m and currently has 20 startups in its portfolio, mainly plant-based meat makers.In 2020, it announced its participation in Pitch & Plant 2020, the global investment competition by Vevolution for plant-based and animal-free startups, offering £100,000 to finalists. Among its recent investments are participation in the extended 2020 seed round of THIS, a UK-based plant-based meat startup that has raised over £6m to date and, in August 2020, in vegan confectionary manufacturer, Livia’s that has raised over £1m so far.

Co-founder and CEO of Bioo / Arkyne Technologies

Pablo Manuel Vidarte Gordillo is the co-founder and CEO of Arkyne Technologies. Graduating in 2018, the Multimedia Engineering student at Universidad Ramón Llull (La Salle University BCN) in Barcelona was named as one of the most promising young people in Forbes 30u30 Europe in 2017. Vidarte is an energetic serial entrepreneur and has won several awards for his endeavors. Besides co-founding Bioo and Geoo, he also founded AI and video game software Aioo. He was also a speaker at the 2017 South Summit.

Pablo Manuel Vidarte Gordillo is the co-founder and CEO of Arkyne Technologies. Graduating in 2018, the Multimedia Engineering student at Universidad Ramón Llull (La Salle University BCN) in Barcelona was named as one of the most promising young people in Forbes 30u30 Europe in 2017. Vidarte is an energetic serial entrepreneur and has won several awards for his endeavors. Besides co-founding Bioo and Geoo, he also founded AI and video game software Aioo. He was also a speaker at the 2017 South Summit.

CEO and Co-founder of Bdeo

Julio Pernía Aznar is a Spanish telecommunication engineer. He started his career as a programmer in CERN and later consulted for big companies like Altran, Telefonica and AENA in a European Commission project. In 2006, he founded his first company, Noaris, specialized in SaaS and cloud computing for insurance companies. He was managing director of Noaris until 2017 when he co-founded Bdeo, a video intelligence platform for underwriting and claims process. Bdeo won the "Most Innovative Product" award in the Insurtech and Fintech categories at the South Summit in Madrid in 2018.

Julio Pernía Aznar is a Spanish telecommunication engineer. He started his career as a programmer in CERN and later consulted for big companies like Altran, Telefonica and AENA in a European Commission project. In 2006, he founded his first company, Noaris, specialized in SaaS and cloud computing for insurance companies. He was managing director of Noaris until 2017 when he co-founded Bdeo, a video intelligence platform for underwriting and claims process. Bdeo won the "Most Innovative Product" award in the Insurtech and Fintech categories at the South Summit in Madrid in 2018.

eFishery poised to benefit from Indonesia's growing aquaculture sector

eFishery's IoT automatic feeding system is delivering efficiencies and boosting output for small fish farmers, driving strong growth for the aquaculture startup.

3D printing foodtech Natural Machines joins Euronext's pre-IPO training program

With its 3D printed vegan candies and snowflake pizzas, Natural Machines already has more than 300 companies using its Foodini food printer, which it’s upgrading with laser tech for simultaneous cooking too

AddVolt: Taking the diesel out of cold-chain transport to make it cleaner, more efficient

The Porto-based startup is winning over the refrigerated goods transportation industry in Europe with the world's first renewable energy plug-in electrical system for the sector

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Didimo: Creator of "digital humans" secures €6.2m in seed funding

Portuguese startup Didimo aims to humanize online interactions with its disruptive 3D technology

iLoF: Accelerating access to personalized medicine, from a drop of blood

Backed by Microsoft’s venture fund M12, Mayfield and Melinda Gates’s Pivotal Ventures, iLoF focuses on painless screening to facilitate disease detection, forecasting and drug development, from Alzheimer’s to Covid-19

Ecojoko: Using AI, real-time data to save electricity

The French startup’s energy-saving assistant and mobile app show how much electricity is being used and how much can be saved for every household appliance

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

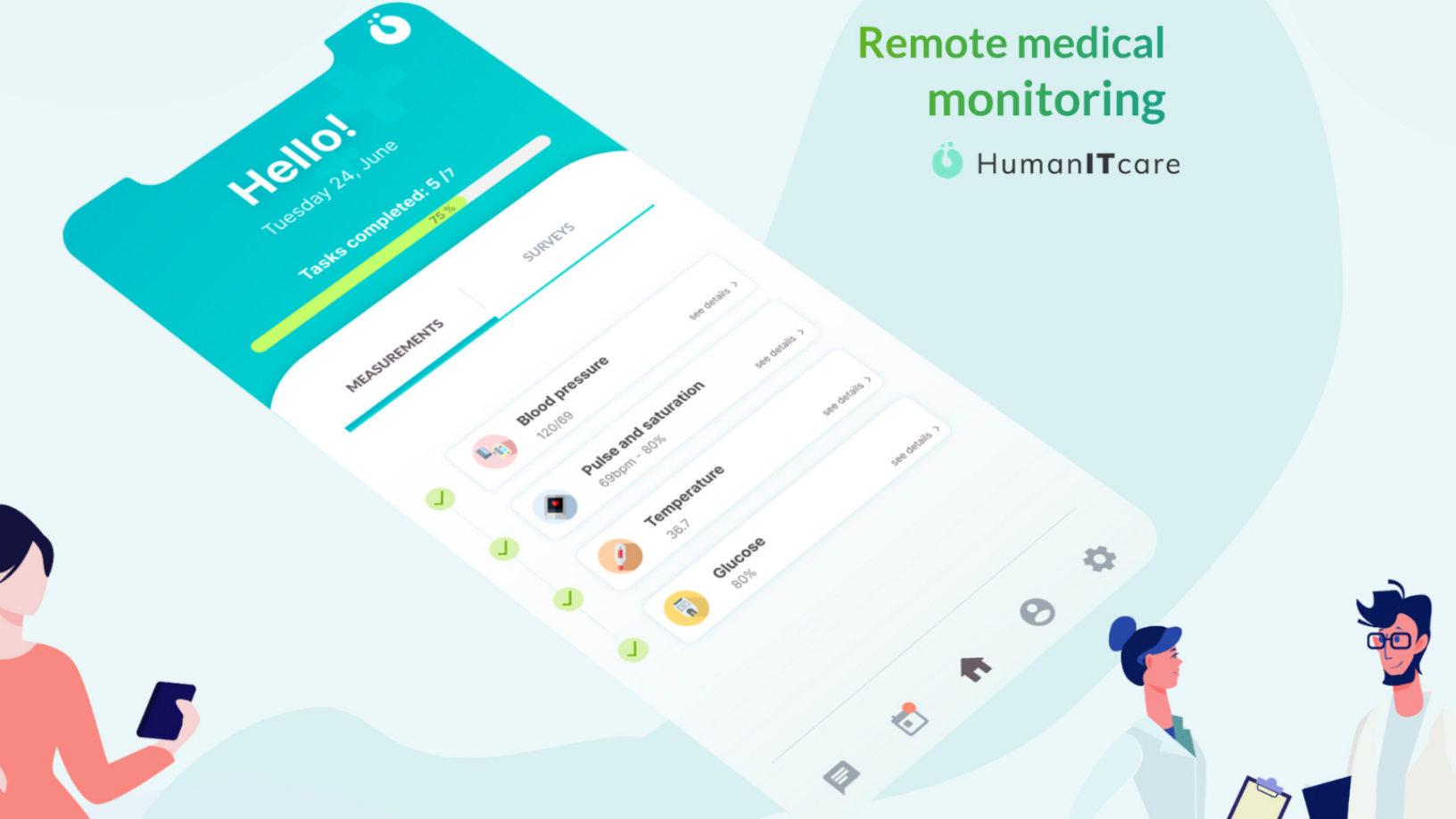

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

Agricool: Growing fresh strawberries in shipping containers

Paris-based Agricool grows fresh produce in urban aeroponics farms within shipping containers for sale at downtown supermarkets, aims to supply more large cities by 2030

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Glovo’s 2018 rollercoaster ride

The year saw the delivery giant dealing with labor unions, diversification and international expansion

SWORD Health nabs Portugal's second biggest Series A round within one year

SWORD Health's AI-based physiotherapy solution has just clinched $9m from Khosla Ventures and Founders Fund, ringing in a total of $17m in Series A funding

Napbox: Sleeping capsule mania takes off in Spain

Napbox's on-demand and intelligent cabins give privacy and connectivity in public spaces and offices

Bettair's air pollution monitoring system for cities promises over 90% accuracy

Combining smart sensors, AI and machine learning, Barcelona-based Bettair has developed a unique, affordable PaaS to accurately measure pollution levels in urban areas

Sorry, we couldn’t find any matches for“Animal AgTech Innovation Summit”.