Ant Financial

-

DATABASE (197)

-

ARTICLES (237)

Co-founder and CTO of Feedloop

Software engineer Ronaldi Kurniawan was the only Android developer at YesBoss, an Indonesian virtual assistant startup. The Computer Science graduate from Universitas Bina Nusantara went on to work at financial product comparison website Cermati after YesBoss became inactive in 2016. YesBoss was later transformed into Kata.ai.Ronaldi had also worked at Thailand-based IT consultancy firm TN Corporation before returning to Indonesia to join Go-Jek. In May 2019, he left Go-Jek to team up again with Kata.ai co-founder Ahmad Rizqi Meydiarso to establish brand campaign builder startup Feedloop.

Software engineer Ronaldi Kurniawan was the only Android developer at YesBoss, an Indonesian virtual assistant startup. The Computer Science graduate from Universitas Bina Nusantara went on to work at financial product comparison website Cermati after YesBoss became inactive in 2016. YesBoss was later transformed into Kata.ai.Ronaldi had also worked at Thailand-based IT consultancy firm TN Corporation before returning to Indonesia to join Go-Jek. In May 2019, he left Go-Jek to team up again with Kata.ai co-founder Ahmad Rizqi Meydiarso to establish brand campaign builder startup Feedloop.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Boyu Capital is a China-focused investment firm with offices in Beijing and Hong Kong. It manages tens of billions of US dollars and is one of the largest private equity investment firm in China, and mainly invests in sectors of consumer and retail, financial services, healthcare, media and technology.Boyu Capital was founded in 2011 by the late Ma Xuezheng (died in September 2019), former senior vice-president and financial director of Lenovo Group and managing director and partner of TPG, and Zhang Zixin (Louis Cheung), former general manager of Ping An Insurance. Boyu Capital's first chairman of the board was Jiang Zhicheng (Alvin Jiang), the grandson of former Chinese president Jiang Zemin.

Boyu Capital is a China-focused investment firm with offices in Beijing and Hong Kong. It manages tens of billions of US dollars and is one of the largest private equity investment firm in China, and mainly invests in sectors of consumer and retail, financial services, healthcare, media and technology.Boyu Capital was founded in 2011 by the late Ma Xuezheng (died in September 2019), former senior vice-president and financial director of Lenovo Group and managing director and partner of TPG, and Zhang Zixin (Louis Cheung), former general manager of Ping An Insurance. Boyu Capital's first chairman of the board was Jiang Zhicheng (Alvin Jiang), the grandson of former Chinese president Jiang Zemin.

Beijing Easyhome Investment Holdings Group Co., Ltd. was established in 1999. Its main business is home furnishing. Easyhome also works in intelligent logistics, financial services, overseas e-commerce and digital intelligence. In 2017, Easyhome earned sales revenue of more than RMB 60 billion.

Beijing Easyhome Investment Holdings Group Co., Ltd. was established in 1999. Its main business is home furnishing. Easyhome also works in intelligent logistics, financial services, overseas e-commerce and digital intelligence. In 2017, Easyhome earned sales revenue of more than RMB 60 billion.

Shanghai Guohe Capital was set up in 2009 by Shanghai International Group, a state-owned financial institution. It is China’s first private fund management company to obtain the qualification of private equity fund manager. The firm currently runs multiple funds with assets worth over RMB 10bn.

Shanghai Guohe Capital was set up in 2009 by Shanghai International Group, a state-owned financial institution. It is China’s first private fund management company to obtain the qualification of private equity fund manager. The firm currently runs multiple funds with assets worth over RMB 10bn.

Toutoushidao Capital (Datou Capital)

Toutoushidao Capital was co-founded in 2015 by Cao Guoxiong, partner of Matrix Partners China, and Wu Xiaobo, a well-known financial writer. Mainly targeting the culture and entertainment sectors, it had planned to invest RMB 2bn–RMB 3bn in the next three years.

Toutoushidao Capital was co-founded in 2015 by Cao Guoxiong, partner of Matrix Partners China, and Wu Xiaobo, a well-known financial writer. Mainly targeting the culture and entertainment sectors, it had planned to invest RMB 2bn–RMB 3bn in the next three years.

Established in January 2015, Riverhead Capital Investment Management Co., Ltd. is among the first batch of insurance private equity fund pilot units approved by the China Insurance Regulatory Commission. With assets under management of RMB 17 billion, it mainly invests in medical, pharmaceutical, Internet, innovative financial services and other fields.

Established in January 2015, Riverhead Capital Investment Management Co., Ltd. is among the first batch of insurance private equity fund pilot units approved by the China Insurance Regulatory Commission. With assets under management of RMB 17 billion, it mainly invests in medical, pharmaceutical, Internet, innovative financial services and other fields.

Mitsubishi Corporation is the general trading company of the Japanese conglomerate Mitsubishi Group. The corporation covers diverse industries, ranging from general business and financial services to metals and energy. Its largest business unit is the energy group, which trades and invests in oil and gas projects around the world.

Mitsubishi Corporation is the general trading company of the Japanese conglomerate Mitsubishi Group. The corporation covers diverse industries, ranging from general business and financial services to metals and energy. Its largest business unit is the energy group, which trades and invests in oil and gas projects around the world.

Guotai Junan International is China’s first securities company with IPO-listing on the Hong Kong Stock Exchange. Based in Hong Kong, it provides wealth management, brokerage, corporate finance, loans and financing, asset management and financial products. Its parent company Guotai Junan Securities Company Limited is its controlling shareholder.

Guotai Junan International is China’s first securities company with IPO-listing on the Hong Kong Stock Exchange. Based in Hong Kong, it provides wealth management, brokerage, corporate finance, loans and financing, asset management and financial products. Its parent company Guotai Junan Securities Company Limited is its controlling shareholder.

Co-founder and CEO of Berrybenka

Serial entrepreneur Jason Lamuda has a bachelor’s in Chemical Engineering from Purdue University, USA. He obtained a master’s in 2008 in Financial Engineering from Columbia University. Married to another Berrybenka co-founder, Jason is currently the CEO and driving force of Berrybenka.Jason worked at McKinsey in Jakarta for two years before quitting to pursue his dream of becoming an entrepreneur in 2010. Jason and a university friend Ferry Tenka co-founded Disdus, which later became known as Groupon Indonesia. Both of them also co-founded Bilna which was merged with another e-commerce company to become Orami that also caters to women.

Serial entrepreneur Jason Lamuda has a bachelor’s in Chemical Engineering from Purdue University, USA. He obtained a master’s in 2008 in Financial Engineering from Columbia University. Married to another Berrybenka co-founder, Jason is currently the CEO and driving force of Berrybenka.Jason worked at McKinsey in Jakarta for two years before quitting to pursue his dream of becoming an entrepreneur in 2010. Jason and a university friend Ferry Tenka co-founded Disdus, which later became known as Groupon Indonesia. Both of them also co-founded Bilna which was merged with another e-commerce company to become Orami that also caters to women.

Founder and Former CEO of CekAja

International relations graduate, John Patrick Ellis worked in East Indonesia for two years with ViA-Volunteers Asia in 2005. He has picked up some Manggarai dialect along the way and also speaks Indonesian. In 2011, John created Harpoon Mobile, a maptech software that was later sold to a North American online marketing company in 2013. He went on to co-found C88 Financial Technologies Pte Ltd in Singapore that acquired CekAja and Otobro in Indonesia. John became the Group CEO of C88. The group’s other co-founder and chairman Karl Knoflach is based in the Philippines.

International relations graduate, John Patrick Ellis worked in East Indonesia for two years with ViA-Volunteers Asia in 2005. He has picked up some Manggarai dialect along the way and also speaks Indonesian. In 2011, John created Harpoon Mobile, a maptech software that was later sold to a North American online marketing company in 2013. He went on to co-found C88 Financial Technologies Pte Ltd in Singapore that acquired CekAja and Otobro in Indonesia. John became the Group CEO of C88. The group’s other co-founder and chairman Karl Knoflach is based in the Philippines.

COO and Co-founder of GeoDB

Sacha Gordillo is a business management and finance graduate from Comillas Pontifical University (ICADE), with over 10 years of experience in financial trading, specializing in fixed income. Since 2006, he has worked as a trader at TransMarket Group LLC, OSTC Ltd and SM Investments. He is now the CIO and head trader at POW Partners that he co-founded in 2016 in Madrid.The cryptocurrency ecosystem has always fascinated the veteran trader. In 2018, Gordillo joined GeoDB as co-founder and COO. He is one of the key figures in the conceptualization of GeoDB, a global decentralized data marketplace based in Madrid.

Sacha Gordillo is a business management and finance graduate from Comillas Pontifical University (ICADE), with over 10 years of experience in financial trading, specializing in fixed income. Since 2006, he has worked as a trader at TransMarket Group LLC, OSTC Ltd and SM Investments. He is now the CIO and head trader at POW Partners that he co-founded in 2016 in Madrid.The cryptocurrency ecosystem has always fascinated the veteran trader. In 2018, Gordillo joined GeoDB as co-founder and COO. He is one of the key figures in the conceptualization of GeoDB, a global decentralized data marketplace based in Madrid.

Co-founder and CEO of Halofina

Adjie Wicaksana graduated from the Bandung Institute of Technology (ITB) with a degree in Industrial Engineering. He also holds a master's in Social Entrepreneurship from the University of Southern California. Wicaksana is active in the Social Organization Center for Innovation and Community Development, the Indonesian Youth Student Association in the United States (Permias) Los Angeles and the Global Shapers Community - World Economic Forum. He is also a facilitator, specializing in business financial management, for BEKRAF's (Indonesia's Creative Economy Agency) Creative SME Finance Class Training Series. Wicaksana started Halofina with Eko Pratomo in 2017.

Adjie Wicaksana graduated from the Bandung Institute of Technology (ITB) with a degree in Industrial Engineering. He also holds a master's in Social Entrepreneurship from the University of Southern California. Wicaksana is active in the Social Organization Center for Innovation and Community Development, the Indonesian Youth Student Association in the United States (Permias) Los Angeles and the Global Shapers Community - World Economic Forum. He is also a facilitator, specializing in business financial management, for BEKRAF's (Indonesia's Creative Economy Agency) Creative SME Finance Class Training Series. Wicaksana started Halofina with Eko Pratomo in 2017.

COO and Co-founder of Impress

Diliara Lupenko is the COO and co-founder of Impress, an invisible aligners company regarded as one of the fastest-growing telemedicine startups in Europe. Prior to Impress, Lupenko served for over eight years as COO and CFO of Aquaton, a bathroom furniture plant and a subsidiary of the ROCA Group. She also worked in the Transaction Service Group in KPMG, managing financial due diligence of over 100 targets, pre-sale preparation of vendors, and restructuring, amongst other tasks. Impress is not Lupenko’s first entrepreneurial experience. In 2013 she co-founded Style Me Up the first Russian marketplace for designers of jewelry and accessories.

Diliara Lupenko is the COO and co-founder of Impress, an invisible aligners company regarded as one of the fastest-growing telemedicine startups in Europe. Prior to Impress, Lupenko served for over eight years as COO and CFO of Aquaton, a bathroom furniture plant and a subsidiary of the ROCA Group. She also worked in the Transaction Service Group in KPMG, managing financial due diligence of over 100 targets, pre-sale preparation of vendors, and restructuring, amongst other tasks. Impress is not Lupenko’s first entrepreneurial experience. In 2013 she co-founded Style Me Up the first Russian marketplace for designers of jewelry and accessories.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

China’s online mutual aid market: A new battleground for tech giants and startups

Startups spotted the opportunity and tech giants too have entered a market seen tripling by 2025. But profitability is still in doubt amid regulatory uncertainty

Have you ever bought expensive equipment but seldom used it? Do you want to try the latest electronic gadgets at low cost? Try this online sharing and rental platform

Alipay opens its platform to speed up digitalization of Chinese service providers amid Covid-19

As Alipay continues to battle WeChat for super-app supremacy, it's created a stronghold in China’s services industry, where 80% of businesses still operate under brick-and-mortar models

An AI future as seen through Chinese retail

Retail provides a good contemporary case study for how an AI future might look in China

Once the darling of investors, unmanned shelf startups are going through a hard time in China

Startups are being forced to transform their business models to survive

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

Already helping over 1,000 corporates like Alibaba and JD.com manage and lower their carbon emissions, Carbonstop is ready to do more when China’s carbon trading starts next year

E-wallet unicorn OVO’s future in question amid Lippo's divestment, talk of DANA merger

As even the conglomerate giant feels the pain of OVO's aggressive cash-burning, should digital payments players rethink their strategy to gain market share, beyond the usual discounts and subsidies?

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

Waterdrop: Using crowdfunding and social media to disrupt health insurance

Insurtech startup Waterdrop helps families in China who cannot afford medical treatment to raise money via online mutual aid and crowdfunding, while selling insurance plans too

2gether: The world's first crypto-collaborative financial platform

Banking on the opportunities afforded by blockchain, 2gether is owned by its customers who get commission-free financial services in euros and cryptocurrency

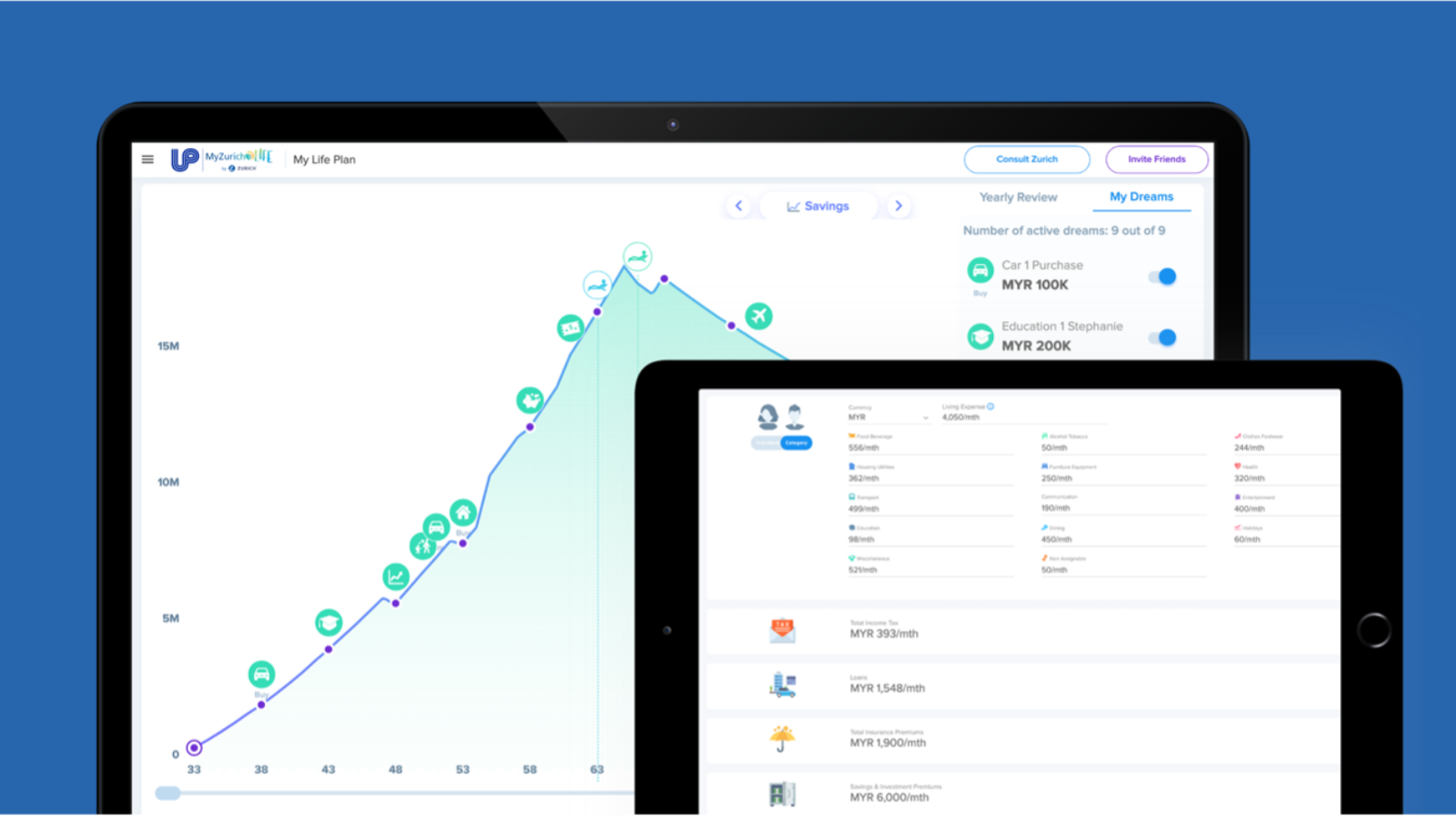

BetterTradeOff: Taking the pain out of financial planning

The Singapore-based startup’s user numbers rose sharply during Covid-19. It wants to raise $11.5m by year-end, is planning a launch in Australia and is eyeing the US market

Gigacover: Providing a financial safety net for gig workers

Gigacover is eyeing multi-billion-dollar opportunities in income and healthcare protection and financial services for the 150m self-employed workers in Southeast Asia, about half of whom are underbanked

In depth: The business ecosystems China’s tech giants and unicorns build

Startups could accept to join Alibaba, Tencent or other tech giants in their ecosystems and scale quickly. Or they could say no and keep their independence. But do they really have a choice?

Sorry, we couldn’t find any matches for“Ant Financial”.