Asia Pacific

-

DATABASE (174)

-

ARTICLES (207)

Clime Capital is a clean energy-focused investment firm based in Singapore with a focus on early-stage companies. In June 2020, the VC launched the Southeast Asia Clean Energy Facility (SEACEF), a fund backed by philanthropic donors to support early-stage companies in commercializing clean energy solutions. The initial fund is valued at $10m. SEACEF’s first investment is in Xurya, an Indonesian startup providing solar power system leasing to commercial customers.

Clime Capital is a clean energy-focused investment firm based in Singapore with a focus on early-stage companies. In June 2020, the VC launched the Southeast Asia Clean Energy Facility (SEACEF), a fund backed by philanthropic donors to support early-stage companies in commercializing clean energy solutions. The initial fund is valued at $10m. SEACEF’s first investment is in Xurya, an Indonesian startup providing solar power system leasing to commercial customers.

BASF Venture Capital is the investment arm of the BASF Group. Founded in 2001, the VC also has offices in Ludwigshafen, San Francisco, Boston, Austin, Shanghai, Sao Paulo, Mumbai and Tel Aviv.Global investments include stakes in young, fast-growing companies involved in agritech, chemistry, new materials, sustainability, digitalization and disruptive business models. The firm also holds shares in technology funds that target enterprises in Asia, North America and South America.

BASF Venture Capital is the investment arm of the BASF Group. Founded in 2001, the VC also has offices in Ludwigshafen, San Francisco, Boston, Austin, Shanghai, Sao Paulo, Mumbai and Tel Aviv.Global investments include stakes in young, fast-growing companies involved in agritech, chemistry, new materials, sustainability, digitalization and disruptive business models. The firm also holds shares in technology funds that target enterprises in Asia, North America and South America.

As one of the original enterprises of the Japanese Mitsubishi Group, Mitsubishi Motors started its automotive business in the pre-World War era. Mitsubishi Heavy Industries produced and imported cars for local use. The automotive company became part of the Renault-Nissan-Mitsubishi alliance in 2016 after Nissan acquired a controlling stake in Mitsubishi Motors. Indonesia's Gojek is its latest investment to expand into the ride-hailing tech sector in Southeast-Asia.

As one of the original enterprises of the Japanese Mitsubishi Group, Mitsubishi Motors started its automotive business in the pre-World War era. Mitsubishi Heavy Industries produced and imported cars for local use. The automotive company became part of the Renault-Nissan-Mitsubishi alliance in 2016 after Nissan acquired a controlling stake in Mitsubishi Motors. Indonesia's Gojek is its latest investment to expand into the ride-hailing tech sector in Southeast-Asia.

Taihecap (formerly TH Capital)

Taihecap is an investment bank established in 2012. As a financial advisor, it has served over 200 startups, including 40 unicorns, to raise more than $25bn in the primary market. Taihecap's long-term clients include the social commerce platform Pinduoduo, China’s largest used-car transaction platform Guazi.com, and the online K12 education platform Zuoyebang. Since 2019, Taihecap has started its overseas expansion into markets such as Southeast Asia and India.

Taihecap is an investment bank established in 2012. As a financial advisor, it has served over 200 startups, including 40 unicorns, to raise more than $25bn in the primary market. Taihecap's long-term clients include the social commerce platform Pinduoduo, China’s largest used-car transaction platform Guazi.com, and the online K12 education platform Zuoyebang. Since 2019, Taihecap has started its overseas expansion into markets such as Southeast Asia and India.

Spiral Ventures (IMJ Investment Partners)

Founded in 2012 in Japan, IMJ Investment Partners was a Singapore-based venture capital firm focusing on startups based in Southeast Asia and Japan. It had raised US$52 million in funding as a company under IMJ Corporation, one of the biggest digital agencies in Japan. A new VC company Spiral Ventures Pte Ltd was established to takeover IMJ-IP after a successful management buyout led by IMJ-IP Managing Partner Yuji Horiguchi in 2017.

Founded in 2012 in Japan, IMJ Investment Partners was a Singapore-based venture capital firm focusing on startups based in Southeast Asia and Japan. It had raised US$52 million in funding as a company under IMJ Corporation, one of the biggest digital agencies in Japan. A new VC company Spiral Ventures Pte Ltd was established to takeover IMJ-IP after a successful management buyout led by IMJ-IP Managing Partner Yuji Horiguchi in 2017.

American private equity firm Warburg Pincus was established in 1966 and has since invested more than $55bn in more than 750 companies in more than 40 countries around the world. So far, the company has raised 19 private equity funds with over $90bn in assets under management. Its investment portfolio can be divided geographically into Asia, Europe, and the Americas. Its Asian portfolio includes tech companies, real estate, healthcare and more verticals, with many Chinese companies featured on the list.

American private equity firm Warburg Pincus was established in 1966 and has since invested more than $55bn in more than 750 companies in more than 40 countries around the world. So far, the company has raised 19 private equity funds with over $90bn in assets under management. Its investment portfolio can be divided geographically into Asia, Europe, and the Americas. Its Asian portfolio includes tech companies, real estate, healthcare and more verticals, with many Chinese companies featured on the list.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

SVB Financial Group has been involved in Asian markets since the early 1990s and in the Chinese market since 1999. For more than a decade, SVB has been building relationships with technology companies, entrepreneurs and venture capitalists to help clients work with businesses in Asia and sell to a variety of foreign markets. SVB established its first China subsidiary, SVB Business Partners Shanghai, in 2005 and its second, SVB Business Partners Beijing, in 2010. They provide local technology companies and venture capital investors with in-market client service support and advisory services.

SVB Financial Group has been involved in Asian markets since the early 1990s and in the Chinese market since 1999. For more than a decade, SVB has been building relationships with technology companies, entrepreneurs and venture capitalists to help clients work with businesses in Asia and sell to a variety of foreign markets. SVB established its first China subsidiary, SVB Business Partners Shanghai, in 2005 and its second, SVB Business Partners Beijing, in 2010. They provide local technology companies and venture capital investors with in-market client service support and advisory services.

Genesia Ventures is a Japanese VC firm founded and led by former CyberAgent Ventures executive Soichi Tajima. The company's name is a portmanteau word combining "genesis" and "Asia" and the fund focuses on seed and pre-Series A rounds. It has backed startups in new media and those implementing new technology to traditional sectors. Its portfolio includes Japanese companies Sukedachi and Linc Corporation as well as Southeast Asian startups Homedy and Bobobox.

Genesia Ventures is a Japanese VC firm founded and led by former CyberAgent Ventures executive Soichi Tajima. The company's name is a portmanteau word combining "genesis" and "Asia" and the fund focuses on seed and pre-Series A rounds. It has backed startups in new media and those implementing new technology to traditional sectors. Its portfolio includes Japanese companies Sukedachi and Linc Corporation as well as Southeast Asian startups Homedy and Bobobox.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

FSI is an independent private equity firm based in Milan. It currently manages the mid-market Fund FSI I. Before its launch in 2017, the FSI investment team had already made PE investments in the Italian mid-market for several years at Fondo Strategico Italiano.The FSI investors include some of Italy’s largest institutional investors, primary sovereign funds from the Middle East, Far East and Central Asia. The firm also has a network of asset managers, insurance companies, European banks, family offices and foundations.

FSI is an independent private equity firm based in Milan. It currently manages the mid-market Fund FSI I. Before its launch in 2017, the FSI investment team had already made PE investments in the Italian mid-market for several years at Fondo Strategico Italiano.The FSI investors include some of Italy’s largest institutional investors, primary sovereign funds from the Middle East, Far East and Central Asia. The firm also has a network of asset managers, insurance companies, European banks, family offices and foundations.

NGP Capital was founded in 2005 with Nokia and Bell Labs as its limited partners. It has investment teams in Asia (India and China), North America and Europe. It invests mainly in growth-stage companies with typical investments ranging from $8m–$12m.With more than $1.2bn under management, NGP Capital's portfolio includes Xiaomi, Deliveroo and UCweb. As of July 2019, NGP Capital had invested in more than 90 companies, including eight IPOs and 33 M&As. It focuses also on mobility and digital health sectors.

NGP Capital was founded in 2005 with Nokia and Bell Labs as its limited partners. It has investment teams in Asia (India and China), North America and Europe. It invests mainly in growth-stage companies with typical investments ranging from $8m–$12m.With more than $1.2bn under management, NGP Capital's portfolio includes Xiaomi, Deliveroo and UCweb. As of July 2019, NGP Capital had invested in more than 90 companies, including eight IPOs and 33 M&As. It focuses also on mobility and digital health sectors.

Founded in Hong Kong in 2018, Lake Bleu Capital currently operates in both Hong Kong and Shanghai. With assets worth billions of US dollars under management, it mainly invests in pharmaceuticals, biotech, medical devices and healthcare services companies in Asia, especially Greater China. Its limited partners include sovereign wealth funds, university endowments, foundations, pension funds, and family offices across the world.With a long-term investment strategy, Lake Bleu Capital invests through both public and private equity with a focus on mid- to late-stage companies.

Founded in Hong Kong in 2018, Lake Bleu Capital currently operates in both Hong Kong and Shanghai. With assets worth billions of US dollars under management, it mainly invests in pharmaceuticals, biotech, medical devices and healthcare services companies in Asia, especially Greater China. Its limited partners include sovereign wealth funds, university endowments, foundations, pension funds, and family offices across the world.With a long-term investment strategy, Lake Bleu Capital invests through both public and private equity with a focus on mid- to late-stage companies.

Pegasus Tech Ventures (Fenox Venture Capital)

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

Halal Local: Companion for the faithful

Indonesian app lets Muslims travel fuss-free, without sacrificing their religious values

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

Bound4Blue’s aeronautical tech propels first sustainable shipping vessel in the Pacific

Winning €5m fresh funding, Bound4Blue also scores with its EC-backed pilot, the first of its kind, offering new possibilities to cargo vessels seeking sustainable transportation

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Dipole Tech: Using blockchain to democratize access to renewable energy in Asia

Having established key markets in the Philippines and Thailand, China’s Dipole Tech is next gaining ground at home for its energy trading app

South Summit wants to go global, as it launches Brazilian chapter

CEO Marta del Castillo on South Summit’s LatAm, Asia expansion plans; its net-zero pledge; her new role as co-head to further drive growth and more

Founder and CEO Gao Lufeng on Ninebot's acquisition of American motorized scooter maker Segway, China’s rise in technology and innovation, and the company’s plans for the US market

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

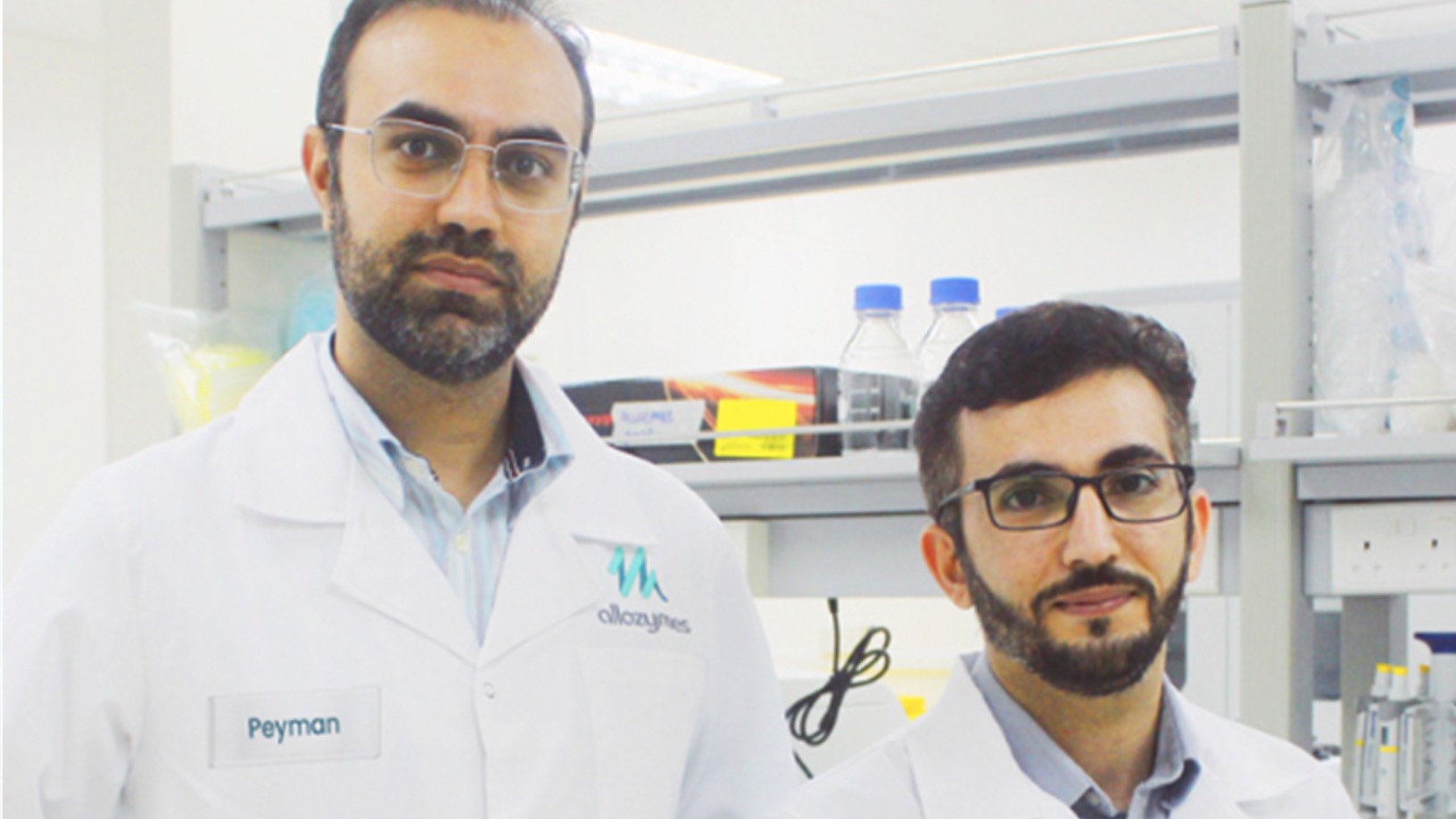

Allozymes wants to supercharge manufacturing with engineered enzymes

The Future Food Asia 2021 award winner speeds up enzyme engineering from years to months, is already attracting clients and has just raised $5m seed funding

Mindtera: Building mental resilience through bite-sized lessons

Mindtera wants to nip mental health issues in the bud by equipping working adults with skills to navigate work challenges and personal relationships, using their phones

TMiRob's medical robots lighten the load of doctors and nurses in hospitals

The robots also reach an operating room three minutes faster than human nurses – that's more time for saving lives

Sorry, we couldn’t find any matches for“Asia Pacific”.