Asistencia COVID-19

-

DATABASE (19)

-

ARTICLES (272)

Pioneering SaaS with AI-refined content keeps healthcare workers up-to-date on the latest treatments, including clinical simulations with tests and research personalized to users.

Pioneering SaaS with AI-refined content keeps healthcare workers up-to-date on the latest treatments, including clinical simulations with tests and research personalized to users.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Established in 2007, Exago is an innovation management software and service provider for companies in 19 countries across four continents. Its clients include Shell, Carrefour and Barclays. Exago has offices in Lisbon, London, and São Paulo, Brazil.

Established in 2007, Exago is an innovation management software and service provider for companies in 19 countries across four continents. Its clients include Shell, Carrefour and Barclays. Exago has offices in Lisbon, London, and São Paulo, Brazil.

Co-founder and COO of Halodoc

Doddy Lukito has over 19 years of experience in both corporate management and technology roles. After earning a master's in Computer Engineering from Carnegie Mellon University, USA, he worked at New York based software company TenFold between 1999 and 2003. Doddy later returned to Indonesia, joining software consulting firm infinITechnology and International Investment Communication Network. He also had a brief lecturing stint at Universitas Bina Nusantara. Doddy had previously co-founded Bistip, a peer-to-peer courier service startup, after which he joined pharmaceutical conglomerate Mensa Group through doctors-only social media LinkDokter, which was later the basis for healthcare platform Halodoc.

Doddy Lukito has over 19 years of experience in both corporate management and technology roles. After earning a master's in Computer Engineering from Carnegie Mellon University, USA, he worked at New York based software company TenFold between 1999 and 2003. Doddy later returned to Indonesia, joining software consulting firm infinITechnology and International Investment Communication Network. He also had a brief lecturing stint at Universitas Bina Nusantara. Doddy had previously co-founded Bistip, a peer-to-peer courier service startup, after which he joined pharmaceutical conglomerate Mensa Group through doctors-only social media LinkDokter, which was later the basis for healthcare platform Halodoc.

Founder and CEO of Laku6

At the age of 19, Alvin Yap started his first business while studying at Ngee Ann Polytechnic in Singapore. The retail venture for customized phone screen covers was dissolved after one year in 2005. The young business student had also worked at McDonald's, becoming a crew leader within the first year in 2001.During his national service as a platoon sergeant in 2008, Alvin and friends often joined and won several business enterprise competitions. Alvin went on to set up mobile games portal TheMobileGamer that lasted for over six years until April 2015. Laku6 was established a month later.

At the age of 19, Alvin Yap started his first business while studying at Ngee Ann Polytechnic in Singapore. The retail venture for customized phone screen covers was dissolved after one year in 2005. The young business student had also worked at McDonald's, becoming a crew leader within the first year in 2001.During his national service as a platoon sergeant in 2008, Alvin and friends often joined and won several business enterprise competitions. Alvin went on to set up mobile games portal TheMobileGamer that lasted for over six years until April 2015. Laku6 was established a month later.

Furnished workplaces providing flexibility for post-Covid hybrid working arrangements, purpose-designed for early-stage startups requiring short-term rental and investment-free commitments.

Furnished workplaces providing flexibility for post-Covid hybrid working arrangements, purpose-designed for early-stage startups requiring short-term rental and investment-free commitments.

Elaia' focusses on digital and deeptech companies in their seed and growth phases. The firm’s portfolio includes 19 exited companies like Criteo and over 60 investments with a total of €350 million under management.The firm was founded in Paris in 2002 by a group of four professionals in the technology sector, private equity and operations with a cumulative experience of 75 years in investment and financing.

Elaia' focusses on digital and deeptech companies in their seed and growth phases. The firm’s portfolio includes 19 exited companies like Criteo and over 60 investments with a total of €350 million under management.The firm was founded in Paris in 2002 by a group of four professionals in the technology sector, private equity and operations with a cumulative experience of 75 years in investment and financing.

Lighthouse Capital is a boutique investment bank established in 2014. The firm has helped to raise finance for over 75 companies, completing more than 120 private funding deals worth over $11bn in total. Its portfolio of companies is valued at over $100bn, including 19 with unicorn status.Lighthouse Capital also manages four PE funds, worth $250bn, targeted at companies in the growth and later stages in emerging sectors.

Lighthouse Capital is a boutique investment bank established in 2014. The firm has helped to raise finance for over 75 companies, completing more than 120 private funding deals worth over $11bn in total. Its portfolio of companies is valued at over $100bn, including 19 with unicorn status.Lighthouse Capital also manages four PE funds, worth $250bn, targeted at companies in the growth and later stages in emerging sectors.

Established in 2017, Educapital invests in edtech, HR and training tech startups. The French VC has stakes in 19 companies, mostly based in Europe, including participation in the €5m Series B funding of French Supermood, a contractor’s workplace engagement tool.In the edtech space, Educapital has recently joined a R$1.7m seed investment round for Brazilian edtech Blox and a €10m Series B round for Preply, a Ukrainian edtech specializing in online language learning.

Established in 2017, Educapital invests in edtech, HR and training tech startups. The French VC has stakes in 19 companies, mostly based in Europe, including participation in the €5m Series B funding of French Supermood, a contractor’s workplace engagement tool.In the edtech space, Educapital has recently joined a R$1.7m seed investment round for Brazilian edtech Blox and a €10m Series B round for Preply, a Ukrainian edtech specializing in online language learning.

Adrian Suherman has over 19 years of management experience, including senior executive roles. He was the vice president of Indonesian telco Telkomsel and was also the CEO of aCommerce. Adrian was previously a software engineer for Sun Microsystems and had also worked at Sherikon Inc, Oracle, AT Kearney and LivingSocial.He is currently the CEO of Lippo Group’s digital branch and fintech firm OVO, as well as a commissioner of Lippo Group’s e-tailer MatahariMall.

Adrian Suherman has over 19 years of management experience, including senior executive roles. He was the vice president of Indonesian telco Telkomsel and was also the CEO of aCommerce. Adrian was previously a software engineer for Sun Microsystems and had also worked at Sherikon Inc, Oracle, AT Kearney and LivingSocial.He is currently the CEO of Lippo Group’s digital branch and fintech firm OVO, as well as a commissioner of Lippo Group’s e-tailer MatahariMall.

American private equity firm Warburg Pincus was established in 1966 and has since invested more than $55bn in more than 750 companies in more than 40 countries around the world. So far, the company has raised 19 private equity funds with over $90bn in assets under management. Its investment portfolio can be divided geographically into Asia, Europe, and the Americas. Its Asian portfolio includes tech companies, real estate, healthcare and more verticals, with many Chinese companies featured on the list.

American private equity firm Warburg Pincus was established in 1966 and has since invested more than $55bn in more than 750 companies in more than 40 countries around the world. So far, the company has raised 19 private equity funds with over $90bn in assets under management. Its investment portfolio can be divided geographically into Asia, Europe, and the Americas. Its Asian portfolio includes tech companies, real estate, healthcare and more verticals, with many Chinese companies featured on the list.

CFO and co-founder of Modulous Tech

Sarah Hordern is a co-founder, CFO and Group Development Leader at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where she has worked since 2019. She is simultaneously a non-executive director at Oxford University Hospitals NHS Foundation Trust and at lenders Newbury Building Society. She was previously executive advisor at the Cambridge Code 2018-19, the first digital tool that measures subconscious drivers of behavior, and spent two years as COO at residential management company Meyrick Estate Management. From 1999 to 2014, she was a joint managing director in the area of property and finance at Newbury Racecourse, one of the UK’s largest horse-racing establishments, where she was responsible for the design and commercial negotiations for a new community of 1,500 homes. Prior to this, Hordern spent five years at PwC in corporate tax management. She holds a Bachelor’s degree from Oxford University in Politics, Philosophy and Economics.

Sarah Hordern is a co-founder, CFO and Group Development Leader at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where she has worked since 2019. She is simultaneously a non-executive director at Oxford University Hospitals NHS Foundation Trust and at lenders Newbury Building Society. She was previously executive advisor at the Cambridge Code 2018-19, the first digital tool that measures subconscious drivers of behavior, and spent two years as COO at residential management company Meyrick Estate Management. From 1999 to 2014, she was a joint managing director in the area of property and finance at Newbury Racecourse, one of the UK’s largest horse-racing establishments, where she was responsible for the design and commercial negotiations for a new community of 1,500 homes. Prior to this, Hordern spent five years at PwC in corporate tax management. She holds a Bachelor’s degree from Oxford University in Politics, Philosophy and Economics.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

- 1

- 2

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

Spanish startups and investors rethink strategies as Covid-19 hits funding, valuations

Investors and startups in Spain say most funding has stalled, and share their strategies and advice for coping with the downturn

MENA and Du’Anyam: How two Indonesian social enterprises are tackling Covid-19 challenges

The call to help women in rural communities has become more urgent as social enterprises struggle to survive the current crisis

Infervision: AI-screening platform helps doctors detect Covid-19 infection within 10 seconds

Chinese medtech lets doctors analyze chest CT scans to diagnose Covid-19 with 98% accuracy; first used in Wuhan, Infervision's system has also been deployed in Japan, Italy and the US

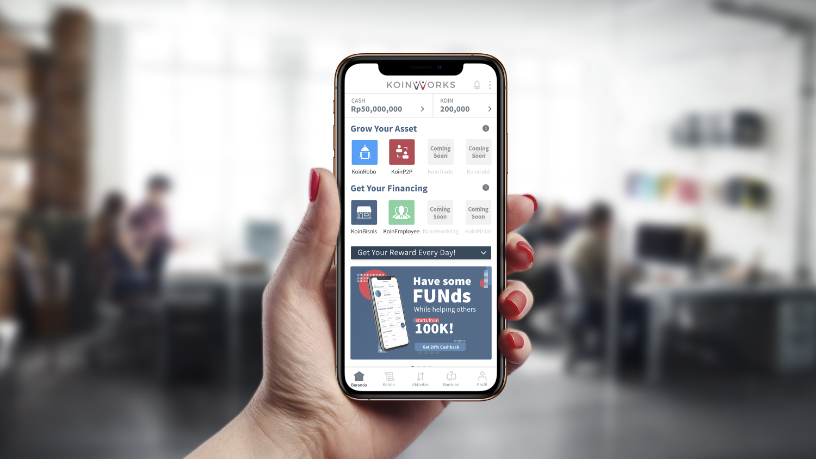

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

Fintech startup Xendit launches aid program for Indonesian businesses amid Covid-19 crisis

Xendit is helping more SMEs go online by waiving transaction fees for its digital payments solution for the first month

Amid Covid-19, contactless smart mailbox startup Mayordomo eyes €75m revenue by 2024

Mayordomo's Smart Point app-locker system helps consumers get the best deals online while minimizing CO2 emissions from multiple vendors’ last-mile deliveries

IOMED: Delivering structured, extractable patient big data and helping Spain's Covid-19 response

The medtech cuts the time spent on finding candidates for medical research by 90% and last month secured €2m in seed funding to take its software overseas

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

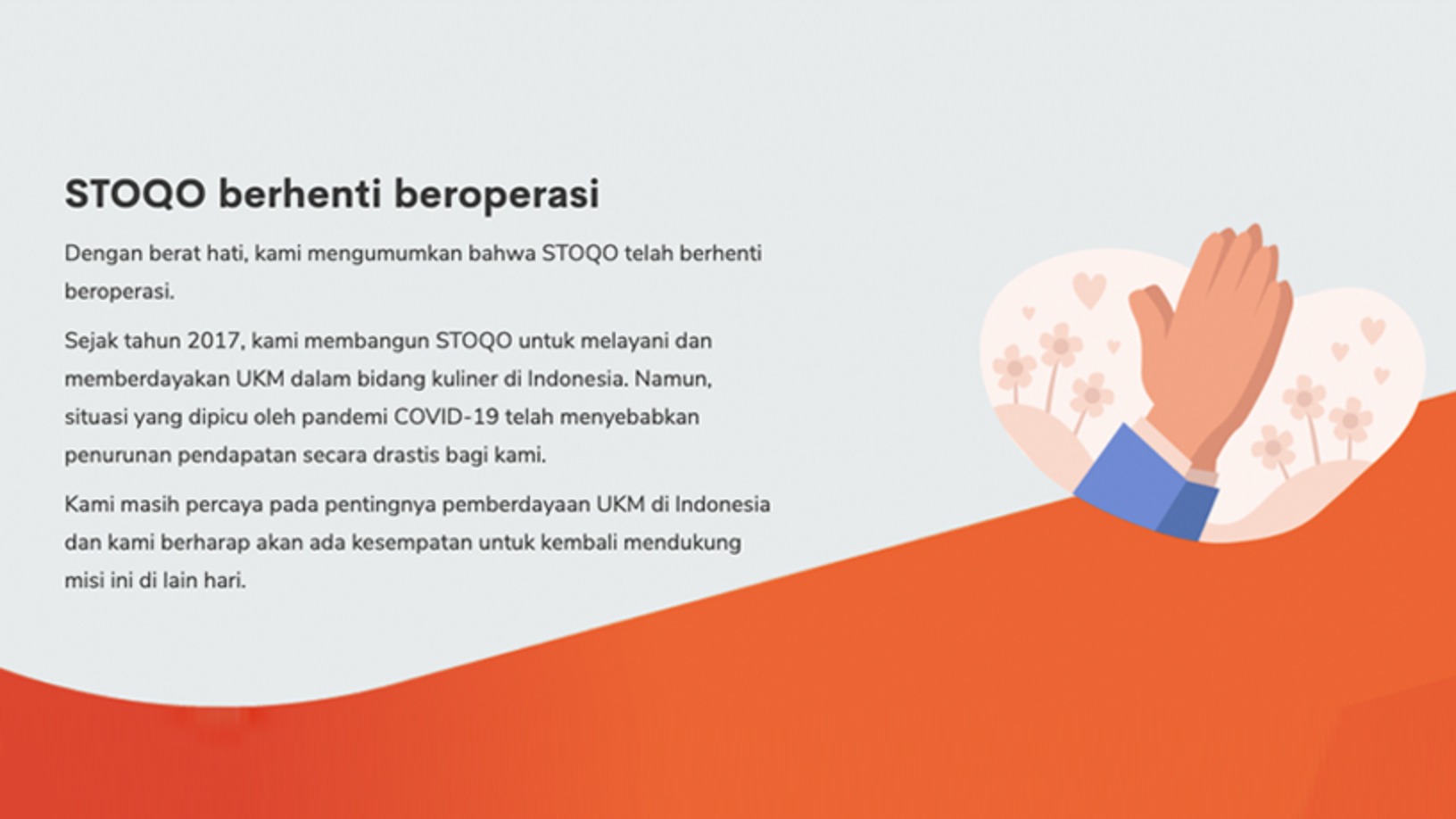

F&B supplier STOQO collapses, a casualty of Covid-19 restaurant closures in Indonesia

A once promising startup, STOQO's woes reflect the challenges faced by the local F&B industry, which is finding new ways to stay afloat

Covid-19: A closer look at how China's businesses and consumer behavior have changed

The lockdown in China has reshaped how people work and live. Some of the changes may be short-term, but others probably have become a part of life

Spanish tech companies launch multi-project Covid-19 portal to help citizens and authorities

Startups including Glovo, CARTO and Cabify join forces with the likes of Google, Apple and IBM in the #StopCorona initiative to help Spain fight the pandemic

Pony.ai repurposes its robotaxi fleet for last-mile delivery amid the Covid-19 pandemic

Pony.ai is seeking more ways to commercialize its versatile autonomous driving technology, transforming mobility and logistics

Future Food Asia: Covid-19 sparked dramatic shifts in agriculture in China and India

Key Chinese players from e-commerce giant Pinduoduo and and agritech VC Omnivore share their insights at last week’s agrifood conference by ID Capital

Fish trading startup Aruna thrives despite Covid-19 with a pivot to domestic sales

Having brought forward its domestic expansion by one year, Aruna wants to use its recent funding to further boost market expansion, develop the tech for product traceability and an intelligent supply chain

Sorry, we couldn’t find any matches for“Asistencia COVID-19”.