Atlantic Smart Ports Blue Acceleration Network

-

DATABASE (313)

-

ARTICLES (385)

Founded by Ray Hu and Alex Yin in 2014, Blue Lake Capital has about US$200 million under management, focusing on early-stage investment in vertical industry such as O2O, social media, smart hardware, mobile internet and education.

Founded by Ray Hu and Alex Yin in 2014, Blue Lake Capital has about US$200 million under management, focusing on early-stage investment in vertical industry such as O2O, social media, smart hardware, mobile internet and education.

American health insurance provider Blue Cross Blue Shield is based in Chantilly, Virginia. It is a subsidiary of Anthem Health Plans of Virginia Inc. The company publishes a BCBS health index, based on data collected from 40m members, that can be used by clinicians and other healthcare bodies for research and improvement of services. BCBS members have access to medical assistance, doctors and hospitals in many countries around the world.

American health insurance provider Blue Cross Blue Shield is based in Chantilly, Virginia. It is a subsidiary of Anthem Health Plans of Virginia Inc. The company publishes a BCBS health index, based on data collected from 40m members, that can be used by clinicians and other healthcare bodies for research and improvement of services. BCBS members have access to medical assistance, doctors and hospitals in many countries around the world.

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

Founded in Berlin in 2016, Atlantic Food Labs’ mission is to support startups with the potential to feed 10bn people by 2050. It has supported 20 companies to date and its most recent investments include in the German healthy last-minute delivery service Gorillas’ $290m Series B round and in the €5.9m seed round of B2B German retail connection service Magaloop in March 2021.

Founded in Berlin in 2016, Atlantic Food Labs’ mission is to support startups with the potential to feed 10bn people by 2050. It has supported 20 companies to date and its most recent investments include in the German healthy last-minute delivery service Gorillas’ $290m Series B round and in the €5.9m seed round of B2B German retail connection service Magaloop in March 2021.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

Smart Delivery Routes is a last-mile delivery startup based in Andalucia and founded in 2017. Its only declared investment has been in Valencian accessibility hardware and app for the deaf, Visualfy, to which it has contributed €520,000 in a 2021 seed funding round. It is also Visualfy’s distribution partner for the Andalucian region.

Smart Delivery Routes is a last-mile delivery startup based in Andalucia and founded in 2017. Its only declared investment has been in Valencian accessibility hardware and app for the deaf, Visualfy, to which it has contributed €520,000 in a 2021 seed funding round. It is also Visualfy’s distribution partner for the Andalucian region.

KapanLagi Network (KLN) is a media company that was co-founded in 2003 by Steve Christian and Eka Wiharto. Originally launched as KapanLagi.com, it was later expanded with the additions of specialist platforms such as the news portal Merdeka.com and football website Bola.net. KLN later merged with the Fimela Network of lifestyle websites in 2014, transforming the group into one of Indonesia’s major online content and media services player. KLN is 52% owned by Singapore’s MediaCorp, with well-known clients like Bank Mandiri, Telkomsel, Allianz and Nestle.

KapanLagi Network (KLN) is a media company that was co-founded in 2003 by Steve Christian and Eka Wiharto. Originally launched as KapanLagi.com, it was later expanded with the additions of specialist platforms such as the news portal Merdeka.com and football website Bola.net. KLN later merged with the Fimela Network of lifestyle websites in 2014, transforming the group into one of Indonesia’s major online content and media services player. KLN is 52% owned by Singapore’s MediaCorp, with well-known clients like Bank Mandiri, Telkomsel, Allianz and Nestle.

Warung Pintar brings traditional roadside retailing into the digital age with its smart kiosks, lifting incomes and improving business knowledge of traditional stall owners.

Warung Pintar brings traditional roadside retailing into the digital age with its smart kiosks, lifting incomes and improving business knowledge of traditional stall owners.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Omidyar Network is a private equity fund and venture capital firm. Founded in 2004 by eBay co-founder Pierre Omidyar, it focuses on “impact investing” in diverse startups that are able to cater to the needs of even the poorest consumers worldwide. Omidyar provides investment funds and nonprofit grants, as well as management support services including talent recruitment.

Omidyar Network is a private equity fund and venture capital firm. Founded in 2004 by eBay co-founder Pierre Omidyar, it focuses on “impact investing” in diverse startups that are able to cater to the needs of even the poorest consumers worldwide. Omidyar provides investment funds and nonprofit grants, as well as management support services including talent recruitment.

Angel Investment Network Indonesia (ANGIN)

ANGIN (Angel Investment Network Indonesia) is the first and largest network of angel investors in Indonesia. The funding and mentoring network comprises high net-worth individuals from diverse industry sectors, including venture capitalists, senior executives and celebrities. ANGIN also manages its own impact investment fund and a fund for women’s empowerment and entrepreneurship.

ANGIN (Angel Investment Network Indonesia) is the first and largest network of angel investors in Indonesia. The funding and mentoring network comprises high net-worth individuals from diverse industry sectors, including venture capitalists, senior executives and celebrities. ANGIN also manages its own impact investment fund and a fund for women’s empowerment and entrepreneurship.

Part of the Telefonica group, Wayra started its investment in Latin American countries and Spain in 2011. It offers mentoring and acceleration programs across 24 countries, leveraging on a global network of over 350 million customers.Wayra bridges the gap between tech entrepreneurs and networks of governments, corporations and partners where Telefónica has a presence.To date, the firm has invested more than €40 million and built 11 acceleration hubs that provide startup entrepreneurs mentoring and support from corporate leaders, investors and serial entrepreneurs.

Part of the Telefonica group, Wayra started its investment in Latin American countries and Spain in 2011. It offers mentoring and acceleration programs across 24 countries, leveraging on a global network of over 350 million customers.Wayra bridges the gap between tech entrepreneurs and networks of governments, corporations and partners where Telefónica has a presence.To date, the firm has invested more than €40 million and built 11 acceleration hubs that provide startup entrepreneurs mentoring and support from corporate leaders, investors and serial entrepreneurs.

Founded in 2003, Bezos Expeditions is a family investment office based in Mercer Island in the US. The firm was originally set up to manage the personal investments of Amazon founder, Jeff Bezos.The Bezos fund owns the Washington Post, Blue Origin space projects and the Bezos family foundation. The fund has also backed early tech startups like Twitter, Airbnb and Uber. Today, Bezos Expeditions also supports non-profit projects. In 2013, it helped to recover parts of two engines from the Atlantic Ocean that were later identified as belonging to Apollo 11, the first space mission that successfully landed humans on the moon in 1969. The crew of the ship Seabed Worker spent three weeks at sea pulling up pieces of the Apollo F1 engines.

Founded in 2003, Bezos Expeditions is a family investment office based in Mercer Island in the US. The firm was originally set up to manage the personal investments of Amazon founder, Jeff Bezos.The Bezos fund owns the Washington Post, Blue Origin space projects and the Bezos family foundation. The fund has also backed early tech startups like Twitter, Airbnb and Uber. Today, Bezos Expeditions also supports non-profit projects. In 2013, it helped to recover parts of two engines from the Atlantic Ocean that were later identified as belonging to Apollo 11, the first space mission that successfully landed humans on the moon in 1969. The crew of the ship Seabed Worker spent three weeks at sea pulling up pieces of the Apollo F1 engines.

Like Sweden's Ikea, Smart Bees designs stylish furniture to maximize living spaces for families in big cities.

Like Sweden's Ikea, Smart Bees designs stylish furniture to maximize living spaces for families in big cities.

Director and Founder of Mayordomo

UK-born serial entrepreneur Edward Hamilton founded his first tech startup, Lavalocker, in Barcelona in 2013 to provide on-demand laundry and dry-cleaning services. He later built on the smart-locker technology to establish Mayordomo that launched Smart Point in 2016, a digital vending system with smart lockers to offer personal shopping, delivery and pickups for over 200 categories of goods and services. Hamilton graduated in Business Administration from Berkeley, University of California in 2000. He worked for almost four years at WP Carey & Co in New York specializing in investments and acquisitions. In March 2006, he moved to London to work as a real estate equity investment manager at Barclay’s Capital. In 2010, he went to Spain to work as a Green Bean business coach for SMEs based in Barcelona. His latest venture is Droppo, which he co-founded in 2019. Based in Barcelona, Droppo is a zero-emission electric last-mile logistics transport network.

UK-born serial entrepreneur Edward Hamilton founded his first tech startup, Lavalocker, in Barcelona in 2013 to provide on-demand laundry and dry-cleaning services. He later built on the smart-locker technology to establish Mayordomo that launched Smart Point in 2016, a digital vending system with smart lockers to offer personal shopping, delivery and pickups for over 200 categories of goods and services. Hamilton graduated in Business Administration from Berkeley, University of California in 2000. He worked for almost four years at WP Carey & Co in New York specializing in investments and acquisitions. In March 2006, he moved to London to work as a real estate equity investment manager at Barclay’s Capital. In 2010, he went to Spain to work as a Green Bean business coach for SMEs based in Barcelona. His latest venture is Droppo, which he co-founded in 2019. Based in Barcelona, Droppo is a zero-emission electric last-mile logistics transport network.

China bets on road-vehicle coordination for the mass adoption of autonomous driving cars by 2025

Money pours in as China pushes sector to be the next growth engine, and both self-driving startups and their investors are optimistic about their commercialization attempts

HomeRun: IoT devices for home-alone pets

Founded by a pet owner who worried about leaving his dog alone at home, HomeRun is chalking up big sales in China's billion-dollar pet care market

Supercharging and battery swap in race to cut EV charging times in China

Supercharging can slash EV charging times but has technological challenges. Hence battery swapping is on the rise in China, with state support

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

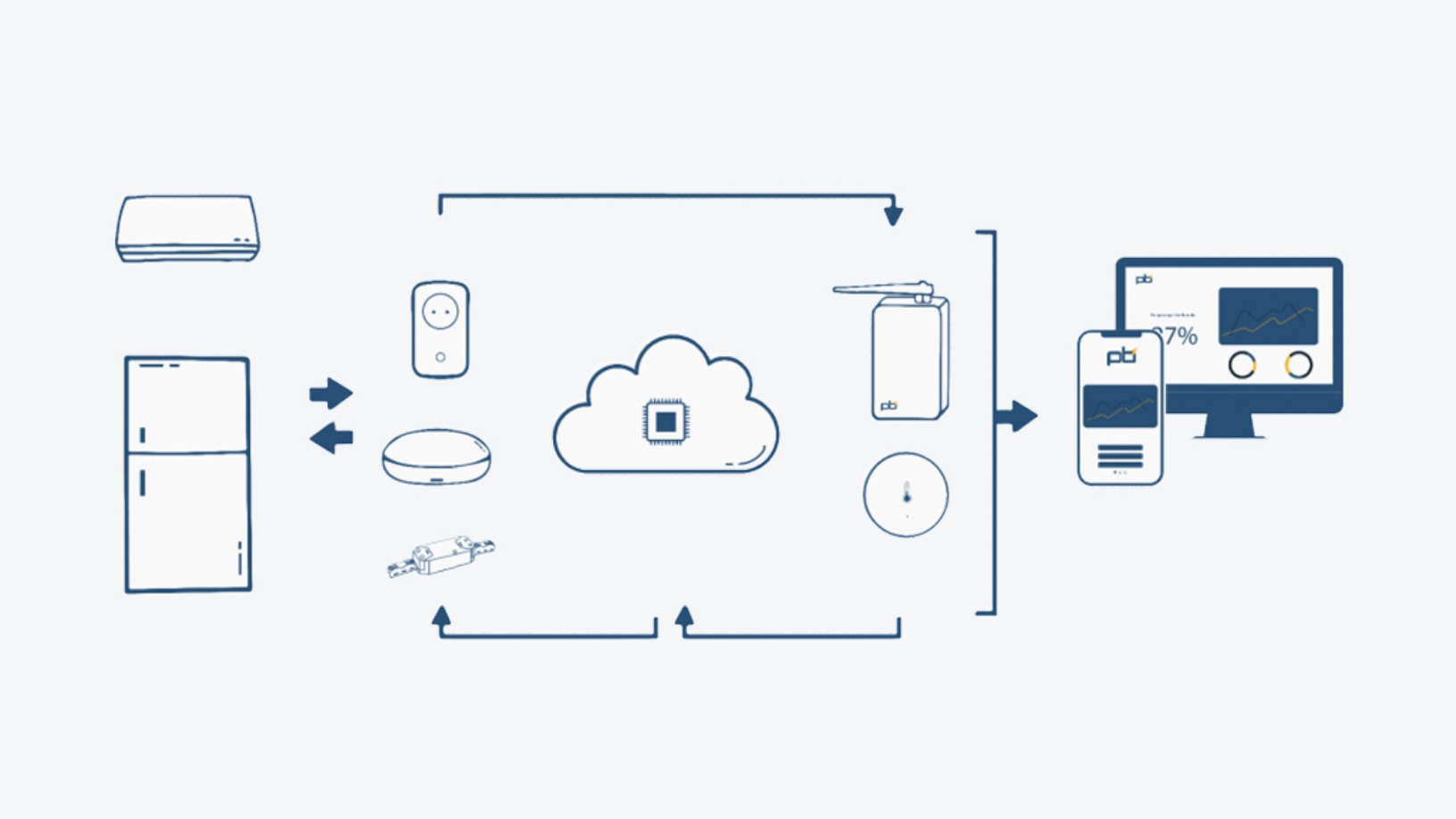

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

Tonic App: Just the tonic for overburdened doctors

CEO Daniela Seixas and COO Gonçalo Vilaça discussed Tonic App, their free solution for streamlining administrative tasks in the medical sector

Bewe: From LatAm to the US, scaling fitness and wellness business globally post-Covid

Serial entrepreneur Diego Ballesteros’s latest venture Bewe seeks to disrupt the lucrative US wellness and fitness market with more competitive pricing

Vadecity: Stop bicycle theft with an intelligent bike-parking system

The Barcelona-based startup wants more people to bike by offering flexible, affordable parking with its Vadebike solution

Visualfy: Tech for autonomy for the hearing-impaired, at home and in public

Visualfy’s app-plus-hardware solution helps the deaf lead fully independent lives

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Early Charm Ventures: Taking research from the labs to the real world

Instead of investing money, the venture studio gets hands-on, co-running companies with top scientists and their cutting-edge research

NoMorePass: Free app for safe, easy password retrieval across platforms

NoMorePass is a password storage solution that employs military-grade encryption to guard against hackers and data leaks, rendering cloud-based password managers obsolete

GeoDB: Empowering consumers through monetizing their digital data

Consumers and businesses, and not just tech giants, should tap the value of big data too, says blockchain-based data trading platform GeoDB, which has raised £5.5m since 2018

China new retail: A blend of the best of online and offline shopping

Players big and small are contributing to China’s new retail revolution

Triporate: Producing business travel itineraries and bookings 10x faster than human agents

Triporate helps corporates save time and money with its automated travel bookings from analyzing staff emails; it raised €1.3m recently

Sorry, we couldn’t find any matches for“Atlantic Smart Ports Blue Acceleration Network”.