Awadah Group

-

DATABASE (492)

-

ARTICLES (273)

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

US-French private equity company L Catterton is based in Greenwich, USA, with 17 offices around the world and over $28bn of equity capital. It mostly invests in the consumer industry as well as real estate and technology startups.Founded in 1989 and currently led by co-CEOs Michael Chu and Scott Dahnke, in 2016, L Catterton partnered with the LVMH Group and Groupe Arnault combining Catterton's operations with LVMH and Groupe Arnault's real estate and private equity operations across Europe Asia, and North America. The partnership formed the largest global consumer-focused private equity firm yet the 31st largest private equity firm in the world. L Catterton holds majority stakes in companies like Birkenstock, Crystal Jade, Bliss, John Hardy amongst others; it also invests in technology startups in their growth and hyper-growth phases. Most notable investments include Aleph Farms, ClassPass, and more recently the plant-based products manufacturer NotCo. Its latest growth fund, L Catterton Growth IV, targets an investment range of $10m–$75m in North America and Europe.

US-French private equity company L Catterton is based in Greenwich, USA, with 17 offices around the world and over $28bn of equity capital. It mostly invests in the consumer industry as well as real estate and technology startups.Founded in 1989 and currently led by co-CEOs Michael Chu and Scott Dahnke, in 2016, L Catterton partnered with the LVMH Group and Groupe Arnault combining Catterton's operations with LVMH and Groupe Arnault's real estate and private equity operations across Europe Asia, and North America. The partnership formed the largest global consumer-focused private equity firm yet the 31st largest private equity firm in the world. L Catterton holds majority stakes in companies like Birkenstock, Crystal Jade, Bliss, John Hardy amongst others; it also invests in technology startups in their growth and hyper-growth phases. Most notable investments include Aleph Farms, ClassPass, and more recently the plant-based products manufacturer NotCo. Its latest growth fund, L Catterton Growth IV, targets an investment range of $10m–$75m in North America and Europe.

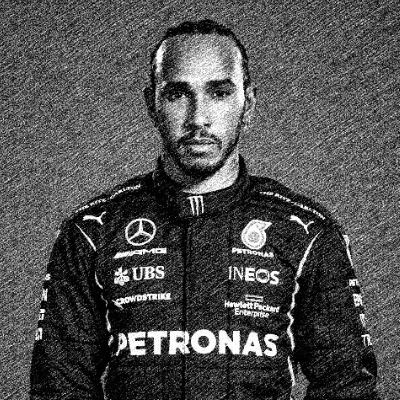

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

Lugard Road Capital/ Luxor Capital

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

H&M Foundation is a non-profit foundation established in 2013. It is privately funded by the Stefan Persson family, the founders and major shareholders of the H&M Group, who have donated SEK 1.5 billion to it to date. The foundation aims to help accelerate progress towards the UN Sustainable Development Goals 2030, by developing, funding and sharing solutions to address the world’s most urgent issues. It has a particular focus on promoting a planet-positive fashion industry and on building inclusive societies.Tackling mostly challenges associated with the fast fashion industry and its supply chain, H&M Foundation advocates for more sustainable practices across the fashion value chain and more inclusive business practices. The foundation is also actively involved in providing emergency relief for natural disasters or pandemics. It also aims to encourage innovation that promotes social change and sustainability. To this end, it provides startups support in accelerating and scale new technologies. It also runs the Global Change Award. Dubbed the Nobel Prize of fashion, this aims to recognise disruptive innovations that have the potential to make fashion more sustainable, and transform the way garments are designed, produced, shipped, bought, used and recycled.

H&M Foundation is a non-profit foundation established in 2013. It is privately funded by the Stefan Persson family, the founders and major shareholders of the H&M Group, who have donated SEK 1.5 billion to it to date. The foundation aims to help accelerate progress towards the UN Sustainable Development Goals 2030, by developing, funding and sharing solutions to address the world’s most urgent issues. It has a particular focus on promoting a planet-positive fashion industry and on building inclusive societies.Tackling mostly challenges associated with the fast fashion industry and its supply chain, H&M Foundation advocates for more sustainable practices across the fashion value chain and more inclusive business practices. The foundation is also actively involved in providing emergency relief for natural disasters or pandemics. It also aims to encourage innovation that promotes social change and sustainability. To this end, it provides startups support in accelerating and scale new technologies. It also runs the Global Change Award. Dubbed the Nobel Prize of fashion, this aims to recognise disruptive innovations that have the potential to make fashion more sustainable, and transform the way garments are designed, produced, shipped, bought, used and recycled.

Born in 1968, Jerry Yang is a Taiwanese-American billionaire computer programmer. After co-creating the Yahoo internet navigational guide in 1994, he co-founded the company Yahoo! Inc in 1995 with David Filo while both were studying at Stanford University. Yang did not complete his PhD in electrical engineering to become an entrepreneur “selling internet advertising”.Yang was Yahoo! CEO for almost two years until 2009, rejecting Microsoft’s takeover offer of $47.5bn in 2008. He eventually left the board in 2012 when he resigned due to strategic disagreements such as whether to sell all or part of the company. In 2016, Yahoo! completed the sale of its core operating business to Verizon for $5bn. Yang was also a board member of the Alibaba Group from 2006 to 2012. Yang met Jack Ma in 1997 when Ma was working as a government-employed tour guide. The former English teacher gave him a tour of the Great Wall of China. Ma went on to found Alibaba a few months after meeting Yang.After leaving Yahoo!, Yang founded AME Cloud Ventures to invest in multiple tech startups. As of November 2020, Yang’s net worth was valued at $2.3bn. In 2017, he and his wife pledged $25m to the Asian Art Museum in San Francisco, the largest gift in the museum's history.

Born in 1968, Jerry Yang is a Taiwanese-American billionaire computer programmer. After co-creating the Yahoo internet navigational guide in 1994, he co-founded the company Yahoo! Inc in 1995 with David Filo while both were studying at Stanford University. Yang did not complete his PhD in electrical engineering to become an entrepreneur “selling internet advertising”.Yang was Yahoo! CEO for almost two years until 2009, rejecting Microsoft’s takeover offer of $47.5bn in 2008. He eventually left the board in 2012 when he resigned due to strategic disagreements such as whether to sell all or part of the company. In 2016, Yahoo! completed the sale of its core operating business to Verizon for $5bn. Yang was also a board member of the Alibaba Group from 2006 to 2012. Yang met Jack Ma in 1997 when Ma was working as a government-employed tour guide. The former English teacher gave him a tour of the Great Wall of China. Ma went on to found Alibaba a few months after meeting Yang.After leaving Yahoo!, Yang founded AME Cloud Ventures to invest in multiple tech startups. As of November 2020, Yang’s net worth was valued at $2.3bn. In 2017, he and his wife pledged $25m to the Asian Art Museum in San Francisco, the largest gift in the museum's history.

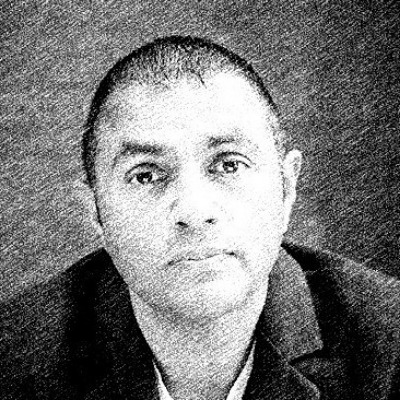

Waheed Ali became a Labour life peer and Baron of Norbury at aged 33, the youngest to join the House of Lords in 1998. He is also one of the few openly gay Muslim politicians in the world and a gay rights activist. Waheed Ali left school and started work in financial research at the age of 16 to support his mother and siblings. He moved on to a media career by co-founding an independent television company Planet 24 with Bob Geldof during the 1990s, pioneering TV reality shows like Survivor. Planet 24 was sold to ITV franchisee Carlton Communications in 1999 for £15m. He also backed Elizabeth Murdoch’s TV production company Shine that was sold to her father, Rupert Murdoch’s media group, 21st Century Fox. Of Guyana and Trinidad descent, the well-known British media tycoon is also a businessman and investor. In 2011, he lost millions by investing in loss-making Chorion that owned the Agatha Christie literary rights. He formed a television production company Silvergate Media to acquire the rights to several Chorion TV series like Beatrix Potter. As an investor, he became the chairman of online fashion marketplace ASOS for 12 years until 2012. He later founded the “ASOS of India,” Koovs that was listed in London in 2014. Most recently, he joined the Series B funding round of London-based zero-food-waste app OLIO in September 2021.

Waheed Ali became a Labour life peer and Baron of Norbury at aged 33, the youngest to join the House of Lords in 1998. He is also one of the few openly gay Muslim politicians in the world and a gay rights activist. Waheed Ali left school and started work in financial research at the age of 16 to support his mother and siblings. He moved on to a media career by co-founding an independent television company Planet 24 with Bob Geldof during the 1990s, pioneering TV reality shows like Survivor. Planet 24 was sold to ITV franchisee Carlton Communications in 1999 for £15m. He also backed Elizabeth Murdoch’s TV production company Shine that was sold to her father, Rupert Murdoch’s media group, 21st Century Fox. Of Guyana and Trinidad descent, the well-known British media tycoon is also a businessman and investor. In 2011, he lost millions by investing in loss-making Chorion that owned the Agatha Christie literary rights. He formed a television production company Silvergate Media to acquire the rights to several Chorion TV series like Beatrix Potter. As an investor, he became the chairman of online fashion marketplace ASOS for 12 years until 2012. He later founded the “ASOS of India,” Koovs that was listed in London in 2014. Most recently, he joined the Series B funding round of London-based zero-food-waste app OLIO in September 2021.

The edtech startup formerly named Squiline hopes greater fluency in English can boost Indonesia's creative and tourism sectors

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Bobobobo: Indonesian luxury at a click

Amid a booming local e-commerce market, this startup carves a niche for itself in upscale trending goods and experiences influenced by Indonesia’s rich traditions

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

Gojek and Tokopedia merge to form GoTo

The new entity, now Indonesia’s largest tech group, plans to go public in Indonesia and the US, targeting a $40bn valuation

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

E-wallet unicorn OVO’s future in question amid Lippo's divestment, talk of DANA merger

As even the conglomerate giant feels the pain of OVO's aggressive cash-burning, should digital payments players rethink their strategy to gain market share, beyond the usual discounts and subsidies?

TroopTravel: Growth opportunities in Big Data corporate travel analytics

International award-winner TroopTravel wants to be the ultimate choice for global travellers.

QinLin Tech gets advertisers to pay for your local security systems

Besides keeping residents safe from intruders, QinLin’s smart community business model also offers essential home services, social activities and group-buying discounts

Alodokter wants personalised healthcare on tap

The Indonesian healthcare startup recently got a US$9 million Series B funding for expansion.

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

Future Food Asia 2021: Impact assessments – getting the metrics right

Common impact measures are useful but each situation requires specific, sometimes subjective considerations. The priority is to gauge if the impact has led to positive changes

Sorry, we couldn’t find any matches for“Awadah Group”.