Bühler Group

-

DATABASE (492)

-

ARTICLES (274)

CEO and Founder of Reclamador.es

Pablo Rabanal holds a degree in Business Administration and Economics as well as one master's in Audiovisual Management and another in Internet Business.He started his career in the entertainment sector as a TV/movie producer and distributor for Esicma. He was CEO at Bwin and started a joint venture facilitating private investments in audiovisual products with British group Future Film.Since 2012, Rabanal has served as CEO and founder of Reclamador.es, a web platform that manages and automates consumer claims, which has over 25,000 clients and collected more than €40m in compensation for users to date.

Pablo Rabanal holds a degree in Business Administration and Economics as well as one master's in Audiovisual Management and another in Internet Business.He started his career in the entertainment sector as a TV/movie producer and distributor for Esicma. He was CEO at Bwin and started a joint venture facilitating private investments in audiovisual products with British group Future Film.Since 2012, Rabanal has served as CEO and founder of Reclamador.es, a web platform that manages and automates consumer claims, which has over 25,000 clients and collected more than €40m in compensation for users to date.

Founder and CEO of Fumi Technology

Wang Anquan joined the Alibaba Group in 2006. He was the technology director at Ali Financial, director of Taobao Loan Division and assistant to the MD of Ali Financial.In 2013, Wang and a colleague at Ali jointly developed the MVP of Webull to provide market intelligence. He then joined HengFeng Bank in 2014 as the president of the Department of Online Financial Asset Transaction. Wang joined Xiaomi in 2015 as the general manager of Xiaomi Finance. In 2016, he founded Fumi Technology with Webull as its main platform. Xiaomi is one of Fumi's early investors.

Wang Anquan joined the Alibaba Group in 2006. He was the technology director at Ali Financial, director of Taobao Loan Division and assistant to the MD of Ali Financial.In 2013, Wang and a colleague at Ali jointly developed the MVP of Webull to provide market intelligence. He then joined HengFeng Bank in 2014 as the president of the Department of Online Financial Asset Transaction. Wang joined Xiaomi in 2015 as the general manager of Xiaomi Finance. In 2016, he founded Fumi Technology with Webull as its main platform. Xiaomi is one of Fumi's early investors.

Sales and Marketing specialist of Atomian

With a degree from the Open University of Catalonia in marketing and social selling studies and an MBA from EAE Business school, Vives i Fàbregas is one of Atomian’s co-founders and an entrepreneur. He has experience in multinationals (Ricoh Spain and NGR Group Spain), SMEs and start-ups (DERICHEBOURG, Eladi Fenoll, Execus) in sales, marketing and corporate strategic consulting. He is also founder and CEO of LeadToWin and CEO of Plexiled Lighting, S.L. and is a specialist in digital transformation and lead generation channels and a professor at Inesdi Digital Business School.

With a degree from the Open University of Catalonia in marketing and social selling studies and an MBA from EAE Business school, Vives i Fàbregas is one of Atomian’s co-founders and an entrepreneur. He has experience in multinationals (Ricoh Spain and NGR Group Spain), SMEs and start-ups (DERICHEBOURG, Eladi Fenoll, Execus) in sales, marketing and corporate strategic consulting. He is also founder and CEO of LeadToWin and CEO of Plexiled Lighting, S.L. and is a specialist in digital transformation and lead generation channels and a professor at Inesdi Digital Business School.

Co-founder, CEO of Smile and Learn

Victor Sánchez Rodríguez is a veteran consultant, having worked at Boston Consulting Group as senior principal from 2006 to 2015. After graduating in 1996, he joined PwC as consultant and moved on to Booz Allen in 2000 as a senior associate. He completed an MBA from INSEAD in 2002. The multi-lingual Sánchez started Smile and Learn in 2013 to help his children's school to acquire more hi-tech teaching resources. He left his BCG job to become CEO of the edtech in 2015. BCG consultant Blanca Rodríguez joined as co-founder and advisor in 2014.

Victor Sánchez Rodríguez is a veteran consultant, having worked at Boston Consulting Group as senior principal from 2006 to 2015. After graduating in 1996, he joined PwC as consultant and moved on to Booz Allen in 2000 as a senior associate. He completed an MBA from INSEAD in 2002. The multi-lingual Sánchez started Smile and Learn in 2013 to help his children's school to acquire more hi-tech teaching resources. He left his BCG job to become CEO of the edtech in 2015. BCG consultant Blanca Rodríguez joined as co-founder and advisor in 2014.

CEO and Founder of Smile Formula

Sam Xu (Xu Yinglin) holds a bachelor's in Petroleum Engineering from Texas A&M University. After graduation, he joined British Petroleum in 2010 as a petroleum engineer and worked for three years in Houston before moving to energy investment from 2013 to 2017, working for KLR Group and CohnReznick Capital. He made it to the Forbes 30 Under 30 list in 2017 for his work in the energy field. In 2017, Xu enrolled in the Harvard Business School and obtained his MBA in 2019. In July 2019, he founded Smile Formula and has since served as its CEO.

Sam Xu (Xu Yinglin) holds a bachelor's in Petroleum Engineering from Texas A&M University. After graduation, he joined British Petroleum in 2010 as a petroleum engineer and worked for three years in Houston before moving to energy investment from 2013 to 2017, working for KLR Group and CohnReznick Capital. He made it to the Forbes 30 Under 30 list in 2017 for his work in the energy field. In 2017, Xu enrolled in the Harvard Business School and obtained his MBA in 2019. In July 2019, he founded Smile Formula and has since served as its CEO.

Co-founder, CTO of Rheaply

Peter Tucker is the CTO and co-founder of Chicago-based pioneering circular economy B2B asset reuse platform Rheaply, where he has worked full-time since 2016. Before that, he worked at online mortgage lender Guaranteed Rate as Senior Software Engineer for almost four years and, before that, as a software developer at Rosenthal Collins Group and Flippex. Tucker also briefly worked as a business analyst and spent five years as a software developer at University of Iowa Health Care. He holds a Bachelor’s in Management Information Systems from the University of Northern Iowa.

Peter Tucker is the CTO and co-founder of Chicago-based pioneering circular economy B2B asset reuse platform Rheaply, where he has worked full-time since 2016. Before that, he worked at online mortgage lender Guaranteed Rate as Senior Software Engineer for almost four years and, before that, as a software developer at Rosenthal Collins Group and Flippex. Tucker also briefly worked as a business analyst and spent five years as a software developer at University of Iowa Health Care. He holds a Bachelor’s in Management Information Systems from the University of Northern Iowa.

Ibersol is a Portuguese restaurant sector investor established in 1994. It holds the franchises of several of Spain and Portugal's top-selling fast-food chains including Burger King in both nations, Pans & Company in Spain and KFC in Portugal and Angola.To date, it has invested in one startup, the Portuguese healthy food service EatTasty, with undisclosed investment in the company's seed stage, phase one, that raised €1.1m. It also acquired one food sector entity, the Spanish restaurant group, Eat Out Group, for an undisclosed sum in 2016.

Ibersol is a Portuguese restaurant sector investor established in 1994. It holds the franchises of several of Spain and Portugal's top-selling fast-food chains including Burger King in both nations, Pans & Company in Spain and KFC in Portugal and Angola.To date, it has invested in one startup, the Portuguese healthy food service EatTasty, with undisclosed investment in the company's seed stage, phase one, that raised €1.1m. It also acquired one food sector entity, the Spanish restaurant group, Eat Out Group, for an undisclosed sum in 2016.

Launched in 2003, Dianping is China's most popular restaurant-reviewing and group-buying service. It merged with closest rival Meituan in October 2015, in a US$15 billion deal.

Launched in 2003, Dianping is China's most popular restaurant-reviewing and group-buying service. It merged with closest rival Meituan in October 2015, in a US$15 billion deal.

Lanjun Invest is an investment subsidiary of Zjlander Group, a conglomerate across industries such as sports, finance, media, internet, education, hospitality, airlines and agriculture.

Lanjun Invest is an investment subsidiary of Zjlander Group, a conglomerate across industries such as sports, finance, media, internet, education, hospitality, airlines and agriculture.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

JJ VC is a joint initiative by JJ.cn and a group of investors specialized in TMT investment. JJ.cn is a leading developer and operator in online board and card games.

JJ VC is a joint initiative by JJ.cn and a group of investors specialized in TMT investment. JJ.cn is a leading developer and operator in online board and card games.

Private equity and venture capital arm of Portuguese banking group Caixa Geral de Depósitos. Founded in 1991, Caixa Capital manages €500m with total potential capital of €700m for its managed funds.

Private equity and venture capital arm of Portuguese banking group Caixa Geral de Depósitos. Founded in 1991, Caixa Capital manages €500m with total potential capital of €700m for its managed funds.

Shanshui Investment (Born For Maker Fund)

Founded in 2015 by Beijing News, Beijing Culture Investment Development Group, among other funds, the Born For Maker program was renamed Shanshui Investment in April 2018 by Chairman of the Board Dai Zigeng, former publisher of Beijing News and CEO of Beijing Culture Investment Development Group. Wang Yuechun, former editor-in-chief of Beijing News, was named founder of Shanshui Investment. Born For Maker, an incubator program, holds an annual startup competition. In 2016, the program set up an investment fund.

Founded in 2015 by Beijing News, Beijing Culture Investment Development Group, among other funds, the Born For Maker program was renamed Shanshui Investment in April 2018 by Chairman of the Board Dai Zigeng, former publisher of Beijing News and CEO of Beijing Culture Investment Development Group. Wang Yuechun, former editor-in-chief of Beijing News, was named founder of Shanshui Investment. Born For Maker, an incubator program, holds an annual startup competition. In 2016, the program set up an investment fund.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

BDMI is a New York-based VC company that is part of the global media group, Bertelsmann, which backs mainly companies in the new digital media ecosystem. The company usually invests through Series A and Series B rounds ranging from US$500,000 to US$5 million with reserves for follow-ons.Companies backed by BDMI get access to a vast network of media companies in the Bertelsmann group and benefit from their extensive media expertise with a global perspective.The firm’s portfolio includes startups from North America, Europe and Israel.

BDMI is a New York-based VC company that is part of the global media group, Bertelsmann, which backs mainly companies in the new digital media ecosystem. The company usually invests through Series A and Series B rounds ranging from US$500,000 to US$5 million with reserves for follow-ons.Companies backed by BDMI get access to a vast network of media companies in the Bertelsmann group and benefit from their extensive media expertise with a global perspective.The firm’s portfolio includes startups from North America, Europe and Israel.

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

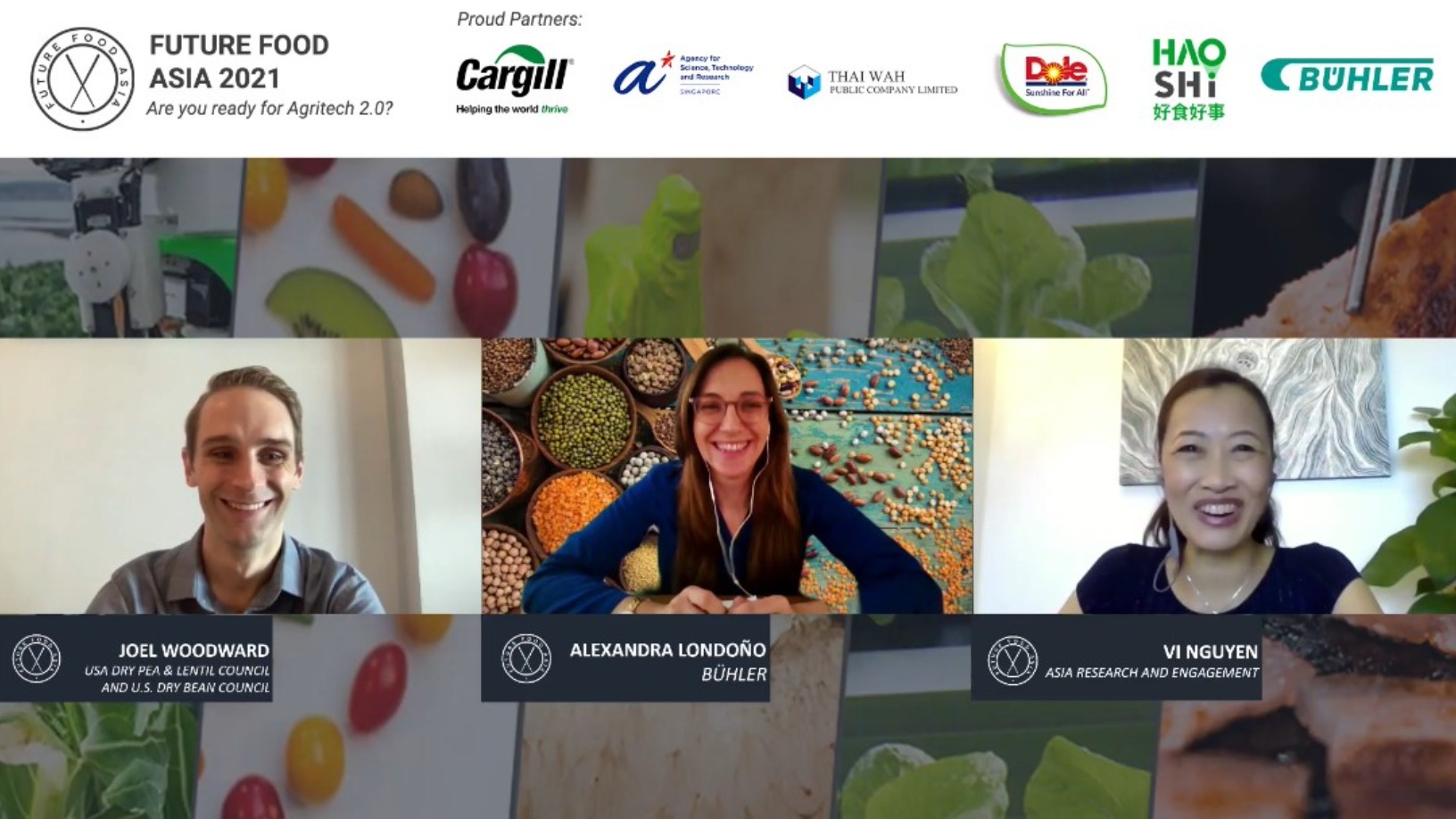

Future Food Asia 2021: Potential of pulses in the alt-protein space

Asia presents a unique opportunity for pulses as people in the region, who traditionally fractionated pulses for starch, now see protein as a useful byproduct

Bobobobo: Indonesian luxury at a click

Amid a booming local e-commerce market, this startup carves a niche for itself in upscale trending goods and experiences influenced by Indonesia’s rich traditions

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

Gojek and Tokopedia merge to form GoTo

The new entity, now Indonesia’s largest tech group, plans to go public in Indonesia and the US, targeting a $40bn valuation

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

E-wallet unicorn OVO’s future in question amid Lippo's divestment, talk of DANA merger

As even the conglomerate giant feels the pain of OVO's aggressive cash-burning, should digital payments players rethink their strategy to gain market share, beyond the usual discounts and subsidies?

TroopTravel: Growth opportunities in Big Data corporate travel analytics

International award-winner TroopTravel wants to be the ultimate choice for global travellers.

QinLin Tech gets advertisers to pay for your local security systems

Besides keeping residents safe from intruders, QinLin’s smart community business model also offers essential home services, social activities and group-buying discounts

Alodokter wants personalised healthcare on tap

The Indonesian healthcare startup recently got a US$9 million Series B funding for expansion.

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

Sorry, we couldn’t find any matches for“Bühler Group”.