Bühler Group

DATABASE (492)

ARTICLES (274)

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

UTour Group was set up in 2005 providing outbound tourism and related services, including offshore finance, immigration services, overseas study services etc.

UTour Group was set up in 2005 providing outbound tourism and related services, including offshore finance, immigration services, overseas study services etc.

Beijing Hualian Group Investment

Beijing-based Hualian Group is one of China’s leading retailers, owning and operating hypermarkets, supermarkets, department stores and shopping malls. Founded in 1996, Beijing Hualian Group now has 121 supermarkets across 33 main cities. It is the only Chinese member of International Association of Department Stores.

Beijing-based Hualian Group is one of China’s leading retailers, owning and operating hypermarkets, supermarkets, department stores and shopping malls. Founded in 1996, Beijing Hualian Group now has 121 supermarkets across 33 main cities. It is the only Chinese member of International Association of Department Stores.

China Minsheng Investment Group

China Minsheng Investment Group (CMIG) is the largest privately owned investment group in China, with RMB 50 billion in registered capital. It was initiated by the All-China Federation of Industry and Commerce, and its Global Advisory Council includes the former prime ministers of France, Italy and Pakistan, and various other global experts and Nobel Prize winners.

China Minsheng Investment Group (CMIG) is the largest privately owned investment group in China, with RMB 50 billion in registered capital. It was initiated by the All-China Federation of Industry and Commerce, and its Global Advisory Council includes the former prime ministers of France, Italy and Pakistan, and various other global experts and Nobel Prize winners.

Mitsubishi UFJ Financial Group

Japan's largest financial institution, the Mitsubishi UFJ Financial Group (MUFG) runs the country's flagship MUFG Bank. As part of the Mitsubishi Group, MUFG also has subsidiaries specializing in finance, securities and investments. Its investment in Indonesia's fast-growing Gojek is part of MUFG's expansion plans to enter the financial services market in Southeast-Asia.

Japan's largest financial institution, the Mitsubishi UFJ Financial Group (MUFG) runs the country's flagship MUFG Bank. As part of the Mitsubishi Group, MUFG also has subsidiaries specializing in finance, securities and investments. Its investment in Indonesia's fast-growing Gojek is part of MUFG's expansion plans to enter the financial services market in Southeast-Asia.

Established in 2002, the Edge Group focuses on real estate investment and venture capital holdings. Headed by José Luis Pinto Basto, its investment strategy is based on the “triple bottom line” philosophy: reaching the optimal balance between economic, social and environmental sustainability.

Established in 2002, the Edge Group focuses on real estate investment and venture capital holdings. Headed by José Luis Pinto Basto, its investment strategy is based on the “triple bottom line” philosophy: reaching the optimal balance between economic, social and environmental sustainability.

Founded in 2012, Heyi Group was established via the merger of China’s two leading internet video channels, Youku and Tudou. The group promotes the creation of original video content through IP licensing, native content production and collaborating with users to generate content. In August 2015, it announced a plan to invest RMB 10 billion in content projects. It was acquired by Alibaba Group in 2016.

Founded in 2012, Heyi Group was established via the merger of China’s two leading internet video channels, Youku and Tudou. The group promotes the creation of original video content through IP licensing, native content production and collaborating with users to generate content. In August 2015, it announced a plan to invest RMB 10 billion in content projects. It was acquired by Alibaba Group in 2016.

STI Financial Group is a Hong Kong-based investment firm. It specializes in hedge fund and private equity investments, managing the assets of clients through various investment instruments and structured products. The company also runs services to help clients set up trust funds for their heirs or family members.

STI Financial Group is a Hong Kong-based investment firm. It specializes in hedge fund and private equity investments, managing the assets of clients through various investment instruments and structured products. The company also runs services to help clients set up trust funds for their heirs or family members.

Axon Partners Group is an international investment, corporate development, alternative asset management and consulting firm. It was formed in 2012 as the result of bringing together two companies founded by Francisco Velázquez six years earlier: Axon Capital, a Spanish venture capital firm and SVP Advisors, a boutique consulting outfit that specialized in media and telecommunications. Axon Partners Group manages five funds across Southern Europe, Latin America and India and is in the midst of launching a multi-sectoral pan-European fund.

Axon Partners Group is an international investment, corporate development, alternative asset management and consulting firm. It was formed in 2012 as the result of bringing together two companies founded by Francisco Velázquez six years earlier: Axon Capital, a Spanish venture capital firm and SVP Advisors, a boutique consulting outfit that specialized in media and telecommunications. Axon Partners Group manages five funds across Southern Europe, Latin America and India and is in the midst of launching a multi-sectoral pan-European fund.

Founded in 2018, Linden Asset Group currently has offices in Nanjing, Shenzhen and Singapore. With both US dollar- and RMB-denominated funds under management, it is focused on the fields of biotechnology, medtech and smart technology in the Asia Pacific region. Linden Asset prefers growth-stage startups that are cutting-edge in their respective areas and plans for overseas expansion.

Founded in 2018, Linden Asset Group currently has offices in Nanjing, Shenzhen and Singapore. With both US dollar- and RMB-denominated funds under management, it is focused on the fields of biotechnology, medtech and smart technology in the Asia Pacific region. Linden Asset prefers growth-stage startups that are cutting-edge in their respective areas and plans for overseas expansion.

With offices in Beijing and Hong Kong, Primavera Capital Group focuses on private equity investment and helps businesses with corporate restructuring and non-performing assets handling. It was founded in 2010 by Fred Hu (Hu Zuliu), who worked at Goldman Sachs from 1997–2010 and served as the bank’s chairman for Greater China from 2008–2010.

With offices in Beijing and Hong Kong, Primavera Capital Group focuses on private equity investment and helps businesses with corporate restructuring and non-performing assets handling. It was founded in 2010 by Fred Hu (Hu Zuliu), who worked at Goldman Sachs from 1997–2010 and served as the bank’s chairman for Greater China from 2008–2010.

China’s second largest e-commerce platform after Alibaba, Pinduoduo gained 300 million users through social e-commerce in just three years.

China’s second largest e-commerce platform after Alibaba, Pinduoduo gained 300 million users through social e-commerce in just three years.

Established by the Shenzhen Government in 1999, Shenzhen Capital Group invests mainly in small- and medium-sized enterprises as well as high-tech startups in the fields of information technology, internet, biomedicine, new energy, high-end equipment manufacturing, etc. As of June 2018, it had invested RMB 37.6 billion in 889 projects and startups, 140 of which have been listed on 16 stock exchanges around the world.

Established by the Shenzhen Government in 1999, Shenzhen Capital Group invests mainly in small- and medium-sized enterprises as well as high-tech startups in the fields of information technology, internet, biomedicine, new energy, high-end equipment manufacturing, etc. As of June 2018, it had invested RMB 37.6 billion in 889 projects and startups, 140 of which have been listed on 16 stock exchanges around the world.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

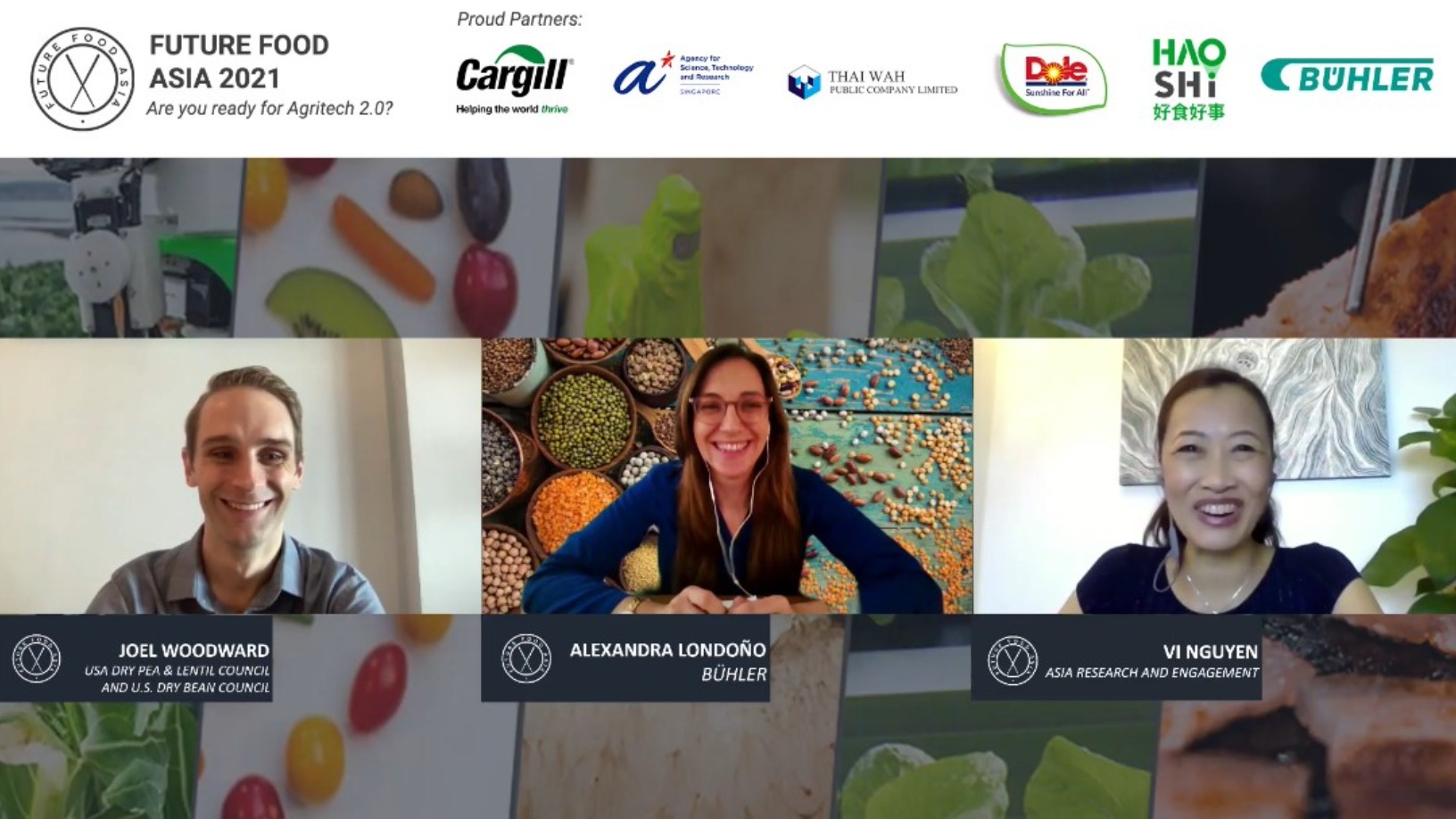

Future Food Asia 2021: Potential of pulses in the alt-protein space

Asia presents a unique opportunity for pulses as people in the region, who traditionally fractionated pulses for starch, now see protein as a useful byproduct

Bobobobo: Indonesian luxury at a click

Amid a booming local e-commerce market, this startup carves a niche for itself in upscale trending goods and experiences influenced by Indonesia’s rich traditions

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

Gojek and Tokopedia merge to form GoTo

The new entity, now Indonesia’s largest tech group, plans to go public in Indonesia and the US, targeting a $40bn valuation

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

E-wallet unicorn OVO’s future in question amid Lippo's divestment, talk of DANA merger

As even the conglomerate giant feels the pain of OVO's aggressive cash-burning, should digital payments players rethink their strategy to gain market share, beyond the usual discounts and subsidies?

TroopTravel: Growth opportunities in Big Data corporate travel analytics

International award-winner TroopTravel wants to be the ultimate choice for global travellers.

QinLin Tech gets advertisers to pay for your local security systems

Besides keeping residents safe from intruders, QinLin’s smart community business model also offers essential home services, social activities and group-buying discounts

Alodokter wants personalised healthcare on tap

The Indonesian healthcare startup recently got a US$9 million Series B funding for expansion.

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

Sorry, we couldn’t find any matches for“Bühler Group”.