Bühler Group

-

DATABASE (492)

-

ARTICLES (274)

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

Co-founded by Lending Club's Soul Htite, Dianrong is one of China's largest P2P lending platforms, offering lower borrowing costs, higher returns, at relatively low risk.

Co-founded by Lending Club's Soul Htite, Dianrong is one of China's largest P2P lending platforms, offering lower borrowing costs, higher returns, at relatively low risk.

The latest bright idea from Aldi Haryopratomo’s social enterprise success Ruma, the Mapan app gives a unique twist to an Indonesian group-buying culture.

The latest bright idea from Aldi Haryopratomo’s social enterprise success Ruma, the Mapan app gives a unique twist to an Indonesian group-buying culture.

Based in Singapore, Clermont Group is a venture capital group that was founded by New Zealand-born billionaire Richard F. Chandler. The company styles itself as a "business house" with a philosophy that entrepreneurship and managing capital are noble callings. To this end, Clermont invests in businesses that are geared towards fulfilling customer needs and those that generate employment. As a group, Clermont owns shares in Vietnamese healthcare group Hoan My, Philippines based clinic network The Medical City and the Small Business FinCredit company in India.

Based in Singapore, Clermont Group is a venture capital group that was founded by New Zealand-born billionaire Richard F. Chandler. The company styles itself as a "business house" with a philosophy that entrepreneurship and managing capital are noble callings. To this end, Clermont invests in businesses that are geared towards fulfilling customer needs and those that generate employment. As a group, Clermont owns shares in Vietnamese healthcare group Hoan My, Philippines based clinic network The Medical City and the Small Business FinCredit company in India.

Founded in 2003, Hina Group is an investment bank that provides financial consulting services. It has helped more than 180 companies close their funding and perform M&As. The total value of these transactions is US$56 billion. Hina Group oversaw Alibaba’s acquisition of Ele.me and the merger Qunar.com and Ctrip. Hina Group manages over RMB 10 billion. It has invested in unicorns such as Hujiang.com and Youbao.

Founded in 2003, Hina Group is an investment bank that provides financial consulting services. It has helped more than 180 companies close their funding and perform M&As. The total value of these transactions is US$56 billion. Hina Group oversaw Alibaba’s acquisition of Ele.me and the merger Qunar.com and Ctrip. Hina Group manages over RMB 10 billion. It has invested in unicorns such as Hujiang.com and Youbao.

Renhe Group was founded in Jiangxi Province by Yang Wenlong in 2001. The group, including its flagship listed Renhe Pharmacy, earned total sales revenue of RMB 11.23bn in 2018 with a year-on-year profit growth of 25%. The group comprises 20 subsidiaries dealing in cosmetics, household chemicals, pharmaceutical, medical supplies and equipment.

Renhe Group was founded in Jiangxi Province by Yang Wenlong in 2001. The group, including its flagship listed Renhe Pharmacy, earned total sales revenue of RMB 11.23bn in 2018 with a year-on-year profit growth of 25%. The group comprises 20 subsidiaries dealing in cosmetics, household chemicals, pharmaceutical, medical supplies and equipment.

CP Group is a multinational company founded by Chia Ek Chor and Chia Siew Whooy in Bangkok in 1921. Also known as Charoen Pokphand Group, the conglomerate does business in retail, telecommunications, real estate and finance. It has over 350,000 employees working for 400 subsidiaries in more than 100 countries and regions. In the past 30 years, CP Group has invested over RMB 12 billion in China.

CP Group is a multinational company founded by Chia Ek Chor and Chia Siew Whooy in Bangkok in 1921. Also known as Charoen Pokphand Group, the conglomerate does business in retail, telecommunications, real estate and finance. It has over 350,000 employees working for 400 subsidiaries in more than 100 countries and regions. In the past 30 years, CP Group has invested over RMB 12 billion in China.

American financial services company Capital Group was established in 1931. As one of the world’s oldest investment management firms, it has over $2tn assets under management. Major known investments include arms and aerospace firm BAE Systems and British American Tobacco. In 1992, Capital Group established Capital Group Private Markets, which specializes in alternative private equity and venture capital investments. This organization has invested in companies like ride-hailing firms Gojek and Didi Chuxing, Philippines media conglomerate ABS-CBN, and more.

American financial services company Capital Group was established in 1931. As one of the world’s oldest investment management firms, it has over $2tn assets under management. Major known investments include arms and aerospace firm BAE Systems and British American Tobacco. In 1992, Capital Group established Capital Group Private Markets, which specializes in alternative private equity and venture capital investments. This organization has invested in companies like ride-hailing firms Gojek and Didi Chuxing, Philippines media conglomerate ABS-CBN, and more.

Founded in 1990, Macrolink Group is now a large-scale modernized group with businesses in real estate, mining, petroleum, chemical, investment, finance and other industries. It has 90+ wholly owned subsidiaries, holding subsidiaries and sharing subsidiaries, operating in 20+ provinces in China and 40+ countries overseas.

Founded in 1990, Macrolink Group is now a large-scale modernized group with businesses in real estate, mining, petroleum, chemical, investment, finance and other industries. It has 90+ wholly owned subsidiaries, holding subsidiaries and sharing subsidiaries, operating in 20+ provinces in China and 40+ countries overseas.

Founded in 1972 by Sudono Salim, aka Liem Sioe Liong, the Salim Group is now headed by his son Anthoni Salim. The Salim Group is one of Indonesia's biggest diversified conglomerates, with business interests in real estate, banking, automotive, telecommunications and F&B. Flagship brands include Bank BCA, Bogasari (wheat flour manufacturer) and Indofood, one of the world's largest producer of instant noodles. The Salim Group is a partner of NUS Enterprise, the startup incubator wing of the National University of Singapore.

Founded in 1972 by Sudono Salim, aka Liem Sioe Liong, the Salim Group is now headed by his son Anthoni Salim. The Salim Group is one of Indonesia's biggest diversified conglomerates, with business interests in real estate, banking, automotive, telecommunications and F&B. Flagship brands include Bank BCA, Bogasari (wheat flour manufacturer) and Indofood, one of the world's largest producer of instant noodles. The Salim Group is a partner of NUS Enterprise, the startup incubator wing of the National University of Singapore.

With almost 20 years’ experience, ChinaEquity Group is one of the first Chinese investment firms. It was founded by Wang Chaoyong, a former child prodigy and one of the first Chinese people to study abroad and work on Wall Street as a banker. ChinaEquity Group invests in TMT, high-end consumption, internet, etc.

With almost 20 years’ experience, ChinaEquity Group is one of the first Chinese investment firms. It was founded by Wang Chaoyong, a former child prodigy and one of the first Chinese people to study abroad and work on Wall Street as a banker. ChinaEquity Group invests in TMT, high-end consumption, internet, etc.

Triputra Group is an Indonesian conglomerate with businesses in agriculture, manufacturing, trading and mining. It also runs a pension fund and a charitable foundation. The conglomerate was founded in 1998 by Theodore Permadi Rachmat, the former CEO of the Astra Group. It is a recent entrant in the startup investing scene; in 2018, it invested in retail startup Warung Pintar and fishery automation company eFishery.

Triputra Group is an Indonesian conglomerate with businesses in agriculture, manufacturing, trading and mining. It also runs a pension fund and a charitable foundation. The conglomerate was founded in 1998 by Theodore Permadi Rachmat, the former CEO of the Astra Group. It is a recent entrant in the startup investing scene; in 2018, it invested in retail startup Warung Pintar and fishery automation company eFishery.

Tongbanjie Group is a P2P financial platform founded in 2012. It funded Shenma as a strategic investor in 2018.

Tongbanjie Group is a P2P financial platform founded in 2012. It funded Shenma as a strategic investor in 2018.

Founded in 2003, Northstar Group is a private equity firm managing over US$2 billion in equity capital. The firm focuses on investments in Indonesia and the rest of Southeast Asia. Its investment portfolio includes many different companies, from banks to manufacturing firms. It launched NSI Ventures in 2014, which focuses on early-stage investing in Southeast Asia and has invested in noted startups like Go-Jek and Moka. Northstar Group invested in Go-Jek as well.

Founded in 2003, Northstar Group is a private equity firm managing over US$2 billion in equity capital. The firm focuses on investments in Indonesia and the rest of Southeast Asia. Its investment portfolio includes many different companies, from banks to manufacturing firms. It launched NSI Ventures in 2014, which focuses on early-stage investing in Southeast Asia and has invested in noted startups like Go-Jek and Moka. Northstar Group invested in Go-Jek as well.

Councilbox: Lawtech that helps cut corporate meeting costs by up to 80%

The startup behind legally validated meeting software is one of the first market movers, targeting some 3m companies in Spain

Indonesian startup Traval goes virtual to stay afloat during pandemic

The startup is also trying to set itself apart from mainstream tourism with tours like Zero Waste Journey where travelers do not bring plastic items and even plant trees

Ento: Making cookies and burger patties from crickets

From whole-roasted crickets and granola bars to sausages and meatballs, Ento aims to tap the growing market for insect-based alternative proteins, targeting enthusiasts and early adopters

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

The rising Indonesian edtech star wants to help high-school dropouts earn their diploma and learn the relevant skills to find a job – with an innovative solution lauded at this year’s MIT Solve Challenge

Ajaib targets millennials with easy-to-use investment app

Y Combinator alumnus Ajaib recently acquired a local brokerage to add stock trading to its products

Marta Esteve: Talent, intuition and resolve – a winning formula for entrepreneurship

She founded her first two internet startups during the dot-com era. Today, Marta Esteve is considered one of the most influential and successful women entrepreneurs in the Spanish startup ecosystem

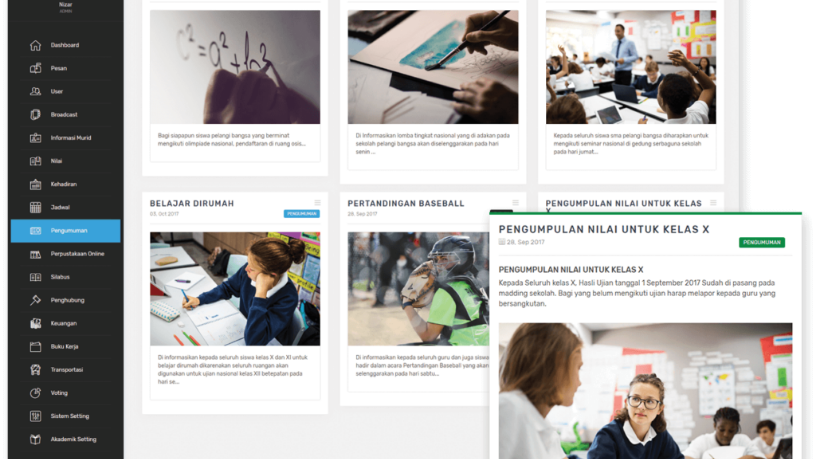

Simak: An integrated edtech platform for Indonesian schools, parents, teachers and students

By connecting all players via its communication and information app, Simak hopes to modernize the Indonesian education system and make it more efficient

Edpuzzle waives fees for video learning platform during coronavirus pandemic

Spanish edtech startup Edpuzzle lets teachers create engaging remote-learning tools from easily accessible online videos

The edtech startup formerly named Squiline hopes greater fluency in English can boost Indonesia's creative and tourism sectors

Neurafarm: Putting an AI plant doctor in farmers' hands

This startup is riding on Indonesia’s urban farming trend with its planting kit and an AI-powered app that identifies plant diseases from photos of unhealthy leaves

Indonesian edtechs attract funding even as students head back to school

With services that complement and support conventional schools at a fraction of offline tuition cost, edtech companies are likely to continue growing

Bukalapak to raise IDR 21tn in Indonesia's biggest IPO yet

Although trailing rivals Tokopedia and Shopee in market share, Bukalapak cut its losses last year and will be Indonesia’s first unicorn to go public

China's WeDoctor offers free coronavirus consultations globally in English and Chinese

WeDoctor lets anyone in the world send queries to doctors who fought to save lives in China's most affected Covid-19 districts, and now helping people overseas to stay safe during the pandemic

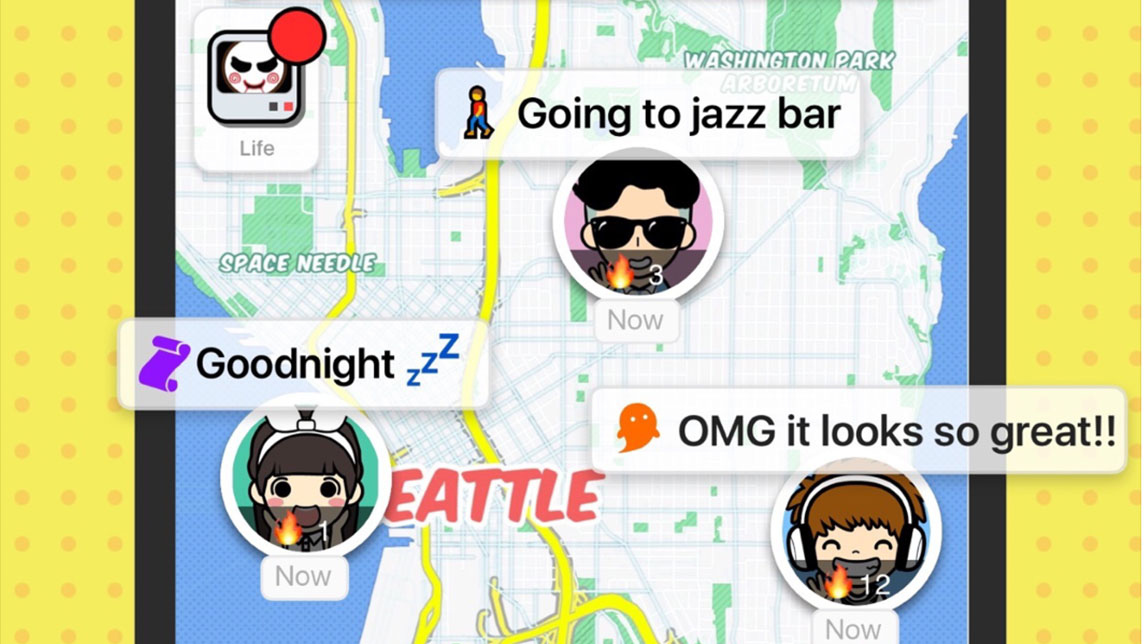

"Spot" your friends, live chat and share music with this social mapping app

Spot, a new challenger to China's WeChat, is using pop-up song lyrics to entice youths to live chat and play games

Sorry, we couldn’t find any matches for“Bühler Group”.