Bühler Group

DATABASE (492)

ARTICLES (274)

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

Co-founded by Lending Club's Soul Htite, Dianrong is one of China's largest P2P lending platforms, offering lower borrowing costs, higher returns, at relatively low risk.

Co-founded by Lending Club's Soul Htite, Dianrong is one of China's largest P2P lending platforms, offering lower borrowing costs, higher returns, at relatively low risk.

The latest bright idea from Aldi Haryopratomo’s social enterprise success Ruma, the Mapan app gives a unique twist to an Indonesian group-buying culture.

The latest bright idea from Aldi Haryopratomo’s social enterprise success Ruma, the Mapan app gives a unique twist to an Indonesian group-buying culture.

Based in Singapore, Clermont Group is a venture capital group that was founded by New Zealand-born billionaire Richard F. Chandler. The company styles itself as a "business house" with a philosophy that entrepreneurship and managing capital are noble callings. To this end, Clermont invests in businesses that are geared towards fulfilling customer needs and those that generate employment. As a group, Clermont owns shares in Vietnamese healthcare group Hoan My, Philippines based clinic network The Medical City and the Small Business FinCredit company in India.

Based in Singapore, Clermont Group is a venture capital group that was founded by New Zealand-born billionaire Richard F. Chandler. The company styles itself as a "business house" with a philosophy that entrepreneurship and managing capital are noble callings. To this end, Clermont invests in businesses that are geared towards fulfilling customer needs and those that generate employment. As a group, Clermont owns shares in Vietnamese healthcare group Hoan My, Philippines based clinic network The Medical City and the Small Business FinCredit company in India.

Founded in 2003, Hina Group is an investment bank that provides financial consulting services. It has helped more than 180 companies close their funding and perform M&As. The total value of these transactions is US$56 billion. Hina Group oversaw Alibaba’s acquisition of Ele.me and the merger Qunar.com and Ctrip. Hina Group manages over RMB 10 billion. It has invested in unicorns such as Hujiang.com and Youbao.

Founded in 2003, Hina Group is an investment bank that provides financial consulting services. It has helped more than 180 companies close their funding and perform M&As. The total value of these transactions is US$56 billion. Hina Group oversaw Alibaba’s acquisition of Ele.me and the merger Qunar.com and Ctrip. Hina Group manages over RMB 10 billion. It has invested in unicorns such as Hujiang.com and Youbao.

Renhe Group was founded in Jiangxi Province by Yang Wenlong in 2001. The group, including its flagship listed Renhe Pharmacy, earned total sales revenue of RMB 11.23bn in 2018 with a year-on-year profit growth of 25%. The group comprises 20 subsidiaries dealing in cosmetics, household chemicals, pharmaceutical, medical supplies and equipment.

Renhe Group was founded in Jiangxi Province by Yang Wenlong in 2001. The group, including its flagship listed Renhe Pharmacy, earned total sales revenue of RMB 11.23bn in 2018 with a year-on-year profit growth of 25%. The group comprises 20 subsidiaries dealing in cosmetics, household chemicals, pharmaceutical, medical supplies and equipment.

CP Group is a multinational company founded by Chia Ek Chor and Chia Siew Whooy in Bangkok in 1921. Also known as Charoen Pokphand Group, the conglomerate does business in retail, telecommunications, real estate and finance. It has over 350,000 employees working for 400 subsidiaries in more than 100 countries and regions. In the past 30 years, CP Group has invested over RMB 12 billion in China.

CP Group is a multinational company founded by Chia Ek Chor and Chia Siew Whooy in Bangkok in 1921. Also known as Charoen Pokphand Group, the conglomerate does business in retail, telecommunications, real estate and finance. It has over 350,000 employees working for 400 subsidiaries in more than 100 countries and regions. In the past 30 years, CP Group has invested over RMB 12 billion in China.

American financial services company Capital Group was established in 1931. As one of the world’s oldest investment management firms, it has over $2tn assets under management. Major known investments include arms and aerospace firm BAE Systems and British American Tobacco. In 1992, Capital Group established Capital Group Private Markets, which specializes in alternative private equity and venture capital investments. This organization has invested in companies like ride-hailing firms Gojek and Didi Chuxing, Philippines media conglomerate ABS-CBN, and more.

American financial services company Capital Group was established in 1931. As one of the world’s oldest investment management firms, it has over $2tn assets under management. Major known investments include arms and aerospace firm BAE Systems and British American Tobacco. In 1992, Capital Group established Capital Group Private Markets, which specializes in alternative private equity and venture capital investments. This organization has invested in companies like ride-hailing firms Gojek and Didi Chuxing, Philippines media conglomerate ABS-CBN, and more.

Founded in 1990, Macrolink Group is now a large-scale modernized group with businesses in real estate, mining, petroleum, chemical, investment, finance and other industries. It has 90+ wholly owned subsidiaries, holding subsidiaries and sharing subsidiaries, operating in 20+ provinces in China and 40+ countries overseas.

Founded in 1990, Macrolink Group is now a large-scale modernized group with businesses in real estate, mining, petroleum, chemical, investment, finance and other industries. It has 90+ wholly owned subsidiaries, holding subsidiaries and sharing subsidiaries, operating in 20+ provinces in China and 40+ countries overseas.

Founded in 1972 by Sudono Salim, aka Liem Sioe Liong, the Salim Group is now headed by his son Anthoni Salim. The Salim Group is one of Indonesia's biggest diversified conglomerates, with business interests in real estate, banking, automotive, telecommunications and F&B. Flagship brands include Bank BCA, Bogasari (wheat flour manufacturer) and Indofood, one of the world's largest producer of instant noodles. The Salim Group is a partner of NUS Enterprise, the startup incubator wing of the National University of Singapore.

Founded in 1972 by Sudono Salim, aka Liem Sioe Liong, the Salim Group is now headed by his son Anthoni Salim. The Salim Group is one of Indonesia's biggest diversified conglomerates, with business interests in real estate, banking, automotive, telecommunications and F&B. Flagship brands include Bank BCA, Bogasari (wheat flour manufacturer) and Indofood, one of the world's largest producer of instant noodles. The Salim Group is a partner of NUS Enterprise, the startup incubator wing of the National University of Singapore.

With almost 20 years’ experience, ChinaEquity Group is one of the first Chinese investment firms. It was founded by Wang Chaoyong, a former child prodigy and one of the first Chinese people to study abroad and work on Wall Street as a banker. ChinaEquity Group invests in TMT, high-end consumption, internet, etc.

With almost 20 years’ experience, ChinaEquity Group is one of the first Chinese investment firms. It was founded by Wang Chaoyong, a former child prodigy and one of the first Chinese people to study abroad and work on Wall Street as a banker. ChinaEquity Group invests in TMT, high-end consumption, internet, etc.

Triputra Group is an Indonesian conglomerate with businesses in agriculture, manufacturing, trading and mining. It also runs a pension fund and a charitable foundation. The conglomerate was founded in 1998 by Theodore Permadi Rachmat, the former CEO of the Astra Group. It is a recent entrant in the startup investing scene; in 2018, it invested in retail startup Warung Pintar and fishery automation company eFishery.

Triputra Group is an Indonesian conglomerate with businesses in agriculture, manufacturing, trading and mining. It also runs a pension fund and a charitable foundation. The conglomerate was founded in 1998 by Theodore Permadi Rachmat, the former CEO of the Astra Group. It is a recent entrant in the startup investing scene; in 2018, it invested in retail startup Warung Pintar and fishery automation company eFishery.

Tongbanjie Group is a P2P financial platform founded in 2012. It funded Shenma as a strategic investor in 2018.

Tongbanjie Group is a P2P financial platform founded in 2012. It funded Shenma as a strategic investor in 2018.

Founded in 2003, Northstar Group is a private equity firm managing over US$2 billion in equity capital. The firm focuses on investments in Indonesia and the rest of Southeast Asia. Its investment portfolio includes many different companies, from banks to manufacturing firms. It launched NSI Ventures in 2014, which focuses on early-stage investing in Southeast Asia and has invested in noted startups like Go-Jek and Moka. Northstar Group invested in Go-Jek as well.

Founded in 2003, Northstar Group is a private equity firm managing over US$2 billion in equity capital. The firm focuses on investments in Indonesia and the rest of Southeast Asia. Its investment portfolio includes many different companies, from banks to manufacturing firms. It launched NSI Ventures in 2014, which focuses on early-stage investing in Southeast Asia and has invested in noted startups like Go-Jek and Moka. Northstar Group invested in Go-Jek as well.

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

Infinited Fiber: Producing biofibers for fashion to move toward circular economy

Supported by H&M, Adidas and textile manufacturers, Infinited Fiber is helping the world’s second most polluting industry go greener by turning industrial waste into regenerated biomaterials

Start with the little things: 5 Indonesian social impact startups

From providing student loans to empowering marginalized groups and farmers, these Indonesian startups are revitalizing local communities

Prosa.ai and Indonesian ministry fight fake news with "anti-hoax" chatbot

Launched a week before the elections, this Telegram-based chatbot provides alternative references to read before you share

Glovo’s 2018 rollercoaster ride

The year saw the delivery giant dealing with labor unions, diversification and international expansion

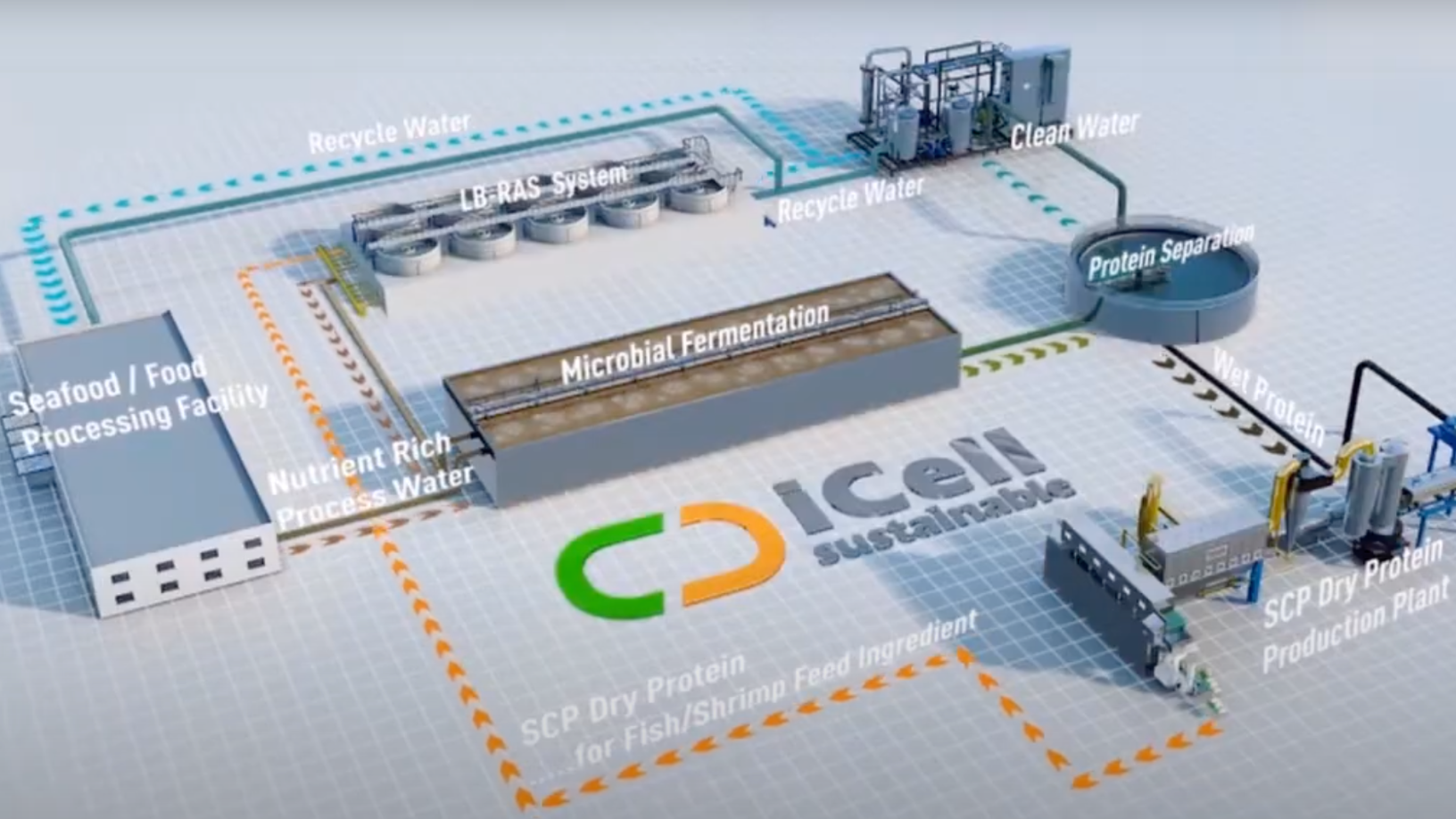

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Yu Minhong: Rags-to-riches education guru

When the New Oriental founder was working in the rice paddies as a teenager, it never occurred to him that he would become the richest teacher in China one day

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

DORM: New-generation housing for Indonesia’s tech-savvy, community-driven students

Combining online features with offline services, DORM goes way beyond what the market typically offers in student accommodation

Clear Plate: Anti-food waste AI that rewards the diners who finish their food

Taking little steps to make a big difference in fighting food waste, Clear Plate engages with digital natives to spread the message

In Spain, women are busy launching startups

Official data show women-led startups are on the rise in Spain. We take you to some of the biggest names in the game

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

Sorry, we couldn’t find any matches for“Bühler Group”.