BRI Ventures

-

DATABASE (297)

-

ARTICLES (220)

COO and co-founder of Plant on Demand

Santiago Corral Rodriguez worked at Dutch online lighting supplier Any Amp as a video manager and country manager in Spain from 2013 to 2015. He also worked at Dutch produce distributor Direct Fresh International in administration and control assistance in 2016.After completing a business administration degree at Granada University in 2012, Corral went to Finland to study International Business at SeAMK (Seinäjoki University of Applied Sciences) and graduated in 2016. He also obtained a postgrad qualification in Entrepreneurship at University of Deusto in the Basque Country, Spain.He worked at Sonar Ventures in 2017 before co-founding Plant on Demand (POD) in 2018 as COO and Customer Success Manager. POD is an e-marketplace and online management platform for small-scale food producers.

Santiago Corral Rodriguez worked at Dutch online lighting supplier Any Amp as a video manager and country manager in Spain from 2013 to 2015. He also worked at Dutch produce distributor Direct Fresh International in administration and control assistance in 2016.After completing a business administration degree at Granada University in 2012, Corral went to Finland to study International Business at SeAMK (Seinäjoki University of Applied Sciences) and graduated in 2016. He also obtained a postgrad qualification in Entrepreneurship at University of Deusto in the Basque Country, Spain.He worked at Sonar Ventures in 2017 before co-founding Plant on Demand (POD) in 2018 as COO and Customer Success Manager. POD is an e-marketplace and online management platform for small-scale food producers.

SkyDeck Berkeley is the startup accelerator initiated by the University of California, Berkeley. It was established to commercialize the university’s research arm and startup ventures of its alumni. It provides non-equity funding assistance, mentorship and networking opportunities, as well as specialist resources for not-for-profit ventures.Since 2012, SkyDeck-backed startups have raised total funding of over $1.47bn, with 17 achieving exits through acquisitions. The accelerator’s investment-arm is Berkeley SkyDeck Fund also invests about $100,000 per startup during the program. Half of the SkyDeck fund’s profits goes to UC Berkeley to support public education projects. The fund is run by Chon Tang as managing partner and Brian Bordley as principal. Contributors to the fund include private individuals, corporations and VCs like Sequoia Capital, Sierra Ventures and Canvas Ventures.

SkyDeck Berkeley is the startup accelerator initiated by the University of California, Berkeley. It was established to commercialize the university’s research arm and startup ventures of its alumni. It provides non-equity funding assistance, mentorship and networking opportunities, as well as specialist resources for not-for-profit ventures.Since 2012, SkyDeck-backed startups have raised total funding of over $1.47bn, with 17 achieving exits through acquisitions. The accelerator’s investment-arm is Berkeley SkyDeck Fund also invests about $100,000 per startup during the program. Half of the SkyDeck fund’s profits goes to UC Berkeley to support public education projects. The fund is run by Chon Tang as managing partner and Brian Bordley as principal. Contributors to the fund include private individuals, corporations and VCs like Sequoia Capital, Sierra Ventures and Canvas Ventures.

Ardent Capital is a Thai venture capital fund focusing on e-commerce and fulfilment services. It ran a subsidiary company named Ardent Ventures. In 2016, Ardent Capital merged with Wavemaker Partners. Ardent Capital maintains its portfolio, including Moxy (now Orami) and Snapcart. Ardent Ventures companies include SaleStock that is now managed by Wavemaker.

Ardent Capital is a Thai venture capital fund focusing on e-commerce and fulfilment services. It ran a subsidiary company named Ardent Ventures. In 2016, Ardent Capital merged with Wavemaker Partners. Ardent Capital maintains its portfolio, including Moxy (now Orami) and Snapcart. Ardent Ventures companies include SaleStock that is now managed by Wavemaker.

Co-founder of Smile and Learn

Blanca Rodríguez Montero won the MIT LatAm Startup competition in 2015 while completing an MBA in Entrepreneurship and Innovation at MIT's Sloan School of Management. She also worked in Boston for VCs like Rough Draft Ventures and Founder Collective while at MIT. In 2011, she started her first job at Boston Consulting Group (BCG) after graduating with in Law and Business Administration in Spain. In 2014, she joined BCG consultant Victor Sánchez Rodríguez to co-found edtech Smile and Learn. In June 2018, she moved to Paris as co-founder of Next Station, an online recruiting platform for international talent.

Blanca Rodríguez Montero won the MIT LatAm Startup competition in 2015 while completing an MBA in Entrepreneurship and Innovation at MIT's Sloan School of Management. She also worked in Boston for VCs like Rough Draft Ventures and Founder Collective while at MIT. In 2011, she started her first job at Boston Consulting Group (BCG) after graduating with in Law and Business Administration in Spain. In 2014, she joined BCG consultant Victor Sánchez Rodríguez to co-found edtech Smile and Learn. In June 2018, she moved to Paris as co-founder of Next Station, an online recruiting platform for international talent.

Wu Shichun (b. 1977) founded Plum Ventures in 2014, an internet-focused angel fund managing three RMB funds. Wu began investing in 2008 after he quit Kuxun, the leading online travel media he founded in 2006. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Wu Shichun (b. 1977) founded Plum Ventures in 2014, an internet-focused angel fund managing three RMB funds. Wu began investing in 2008 after he quit Kuxun, the leading online travel media he founded in 2006. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Andy Zain is a veteran businessman, executive and angel investor. The Monash University graduate worked in management roles in various Indonesian tech companies and also co-founded companies like Elastisitas and Numedia Global. He is well-known as a founding partner and managing director at VC Kejora Ventures. Andy is also part of ANGIN, the Indonesian network of angel investors that collaborates with Grupara Ventures.

Andy Zain is a veteran businessman, executive and angel investor. The Monash University graduate worked in management roles in various Indonesian tech companies and also co-founded companies like Elastisitas and Numedia Global. He is well-known as a founding partner and managing director at VC Kejora Ventures. Andy is also part of ANGIN, the Indonesian network of angel investors that collaborates with Grupara Ventures.

Indonesia's largest media conglomerate, Kompas Gramedia controls the country's national newspaper, Kompas, and operates the country's biggest bookstore chain, Gramedia. It also runs its own publishing house, Gramedia Pustaka Utama. With Universitas Multimedia Nusantara, Kompas Gramedia co-founded tech incubator and coworking space Skystar Ventures. The media conglomerate also backed Skystar Capital, a separate and independent investment arm from Skystar Ventures. Kompas Gramedia was founded in 1965.

Indonesia's largest media conglomerate, Kompas Gramedia controls the country's national newspaper, Kompas, and operates the country's biggest bookstore chain, Gramedia. It also runs its own publishing house, Gramedia Pustaka Utama. With Universitas Multimedia Nusantara, Kompas Gramedia co-founded tech incubator and coworking space Skystar Ventures. The media conglomerate also backed Skystar Capital, a separate and independent investment arm from Skystar Ventures. Kompas Gramedia was founded in 1965.

Cofounder and Managing Director of Hacktiv8

Ronald Ishak has been involved in tech startups since 2008 when he became Web Applications Manager, Online Trading at PT Ciptadana Capital and led a team of developers to build an online stock trading app for the Indonesian Stock Exchange. In August 2009, he became CTO at web developer company, PT Domikado, and left in January 2014 when the company was acquired. Meanwhile, in 2010, he co-founded his first (short-lived) company, which developed a photo sharing app for mobile platforms. For nine months from November 2014, he was CTO at PT Giftcard Indonesia, which distributes digital giftcards for brands. In 2016, he co-founded Hacktiv8, a training center that runs web development bootcamps and other programming courses, with Riza Fahmi and is its CEO. Ishak is also partner at RMKB Ventures, an Indonesian VC that has backed, among others, insurtech firm Qoala, “CTO-as-a-service” startup Rebel Works and Hacktiv8.

Ronald Ishak has been involved in tech startups since 2008 when he became Web Applications Manager, Online Trading at PT Ciptadana Capital and led a team of developers to build an online stock trading app for the Indonesian Stock Exchange. In August 2009, he became CTO at web developer company, PT Domikado, and left in January 2014 when the company was acquired. Meanwhile, in 2010, he co-founded his first (short-lived) company, which developed a photo sharing app for mobile platforms. For nine months from November 2014, he was CTO at PT Giftcard Indonesia, which distributes digital giftcards for brands. In 2016, he co-founded Hacktiv8, a training center that runs web development bootcamps and other programming courses, with Riza Fahmi and is its CEO. Ishak is also partner at RMKB Ventures, an Indonesian VC that has backed, among others, insurtech firm Qoala, “CTO-as-a-service” startup Rebel Works and Hacktiv8.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

NEEQ-listed NewMargin Capital is a venture capital management firm founded in 2011 by the team of NewMargin Ventures. It focuses on early-stage companies in the TMT, energy efficiency and healthcare sectors.

NEEQ-listed NewMargin Capital is a venture capital management firm founded in 2011 by the team of NewMargin Ventures. It focuses on early-stage companies in the TMT, energy efficiency and healthcare sectors.

Kejora is a stage agnostic venture capital firm that focuses in investments in Southeast Asia. Since established in 2008, Kejora has expanded to three offices in Singapore, Philippines and Indonesia. It is headquartered in Jakarta, Indonesia.

Kejora is a stage agnostic venture capital firm that focuses in investments in Southeast Asia. Since established in 2008, Kejora has expanded to three offices in Singapore, Philippines and Indonesia. It is headquartered in Jakarta, Indonesia.

The venture capital arm of semiconductor and telecom equipment giant Qualcomm is a San-Diego investor focusing on VR, robotics, IoT, cloud and digital health companies in the US, Europe, Israel, China, Korea and India.

The venture capital arm of semiconductor and telecom equipment giant Qualcomm is a San-Diego investor focusing on VR, robotics, IoT, cloud and digital health companies in the US, Europe, Israel, China, Korea and India.

Founded in 2006, the Silicon Valley-based venture capital firm was one of the earliest to focus on seed investing. It has around US$1.3 billion under management and has backed more than 700 founders.

Founded in 2006, the Silicon Valley-based venture capital firm was one of the earliest to focus on seed investing. It has around US$1.3 billion under management and has backed more than 700 founders.

The venture arm of American cloud computing company Salesforce has invested in more than 150 companies since 2009.

The venture arm of American cloud computing company Salesforce has invested in more than 150 companies since 2009.

Established in 2007, Exago is an innovation management software and service provider for companies in 19 countries across four continents. Its clients include Shell, Carrefour and Barclays. Exago has offices in Lisbon, London, and São Paulo, Brazil.

Established in 2007, Exago is an innovation management software and service provider for companies in 19 countries across four continents. Its clients include Shell, Carrefour and Barclays. Exago has offices in Lisbon, London, and São Paulo, Brazil.

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

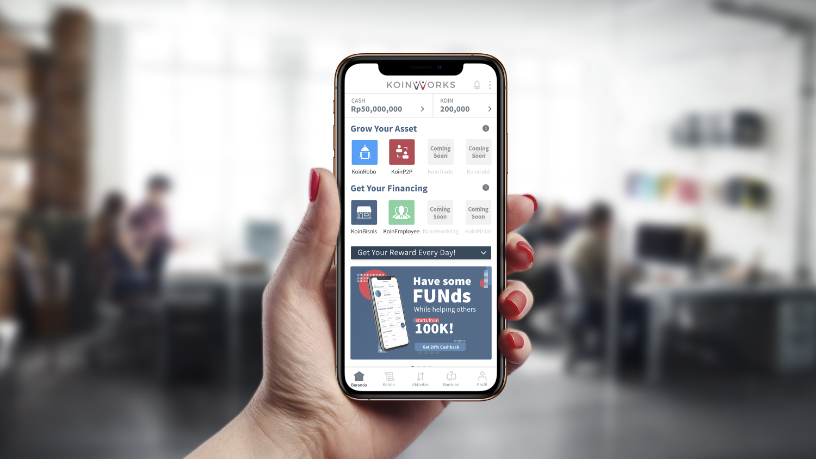

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

HighPitch 2020: Event ticketing and legal tech startups come up tops in Jakarta chapter

VC judges favored Goers’s strong pivot amid Covid and HAKITA’s outstanding pitch

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

Indonesian state enterprises launch e-wallet LinkAja, competing with Go-Pay and OVO

Even with a wider range of services and extensive state backing, LinkAja faces a tough battle

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Sorry, we couldn’t find any matches for“BRI Ventures”.