Bank Indonesia

DATABASE (639)

ARTICLES (299)

Co-founder and Commissioner of IDCloudHost

Although Depi Rusnandar holds a bachelor’s in Geophysics and Seismology from Indonesia’s Institut Teknologi Bandung, he spent most of his career at Bank Syariah Mandiri (the sharia arm of Bank Mandiri). He joined the bank as an Account Officer in 2002 and became a data analyst for its commercial banking vertical in 2015. Depi obtained a master’s in Syariah banking at Indonesia Banking School in 2015 and eventually left the bank to establish IDCloudHost as a co-founder and commissioner. He also joined PT BPRS Artha Fisabilillah as a director in 2017.

Although Depi Rusnandar holds a bachelor’s in Geophysics and Seismology from Indonesia’s Institut Teknologi Bandung, he spent most of his career at Bank Syariah Mandiri (the sharia arm of Bank Mandiri). He joined the bank as an Account Officer in 2002 and became a data analyst for its commercial banking vertical in 2015. Depi obtained a master’s in Syariah banking at Indonesia Banking School in 2015 and eventually left the bank to establish IDCloudHost as a co-founder and commissioner. He also joined PT BPRS Artha Fisabilillah as a director in 2017.

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

Co-founder of Kioson

Viperi Limiardi is the commissioner of Artav, the national distributor for mobile network operator XL Axiata. Artav was an early investor in Kioson and is now a majority shareholder of the recently public-listed fintech in Indonesia. A Computer Science graduate from Universitas Trisakti, Viperi had also worked as a professional banker at Bank Indonesia for more than 15 years.

Viperi Limiardi is the commissioner of Artav, the national distributor for mobile network operator XL Axiata. Artav was an early investor in Kioson and is now a majority shareholder of the recently public-listed fintech in Indonesia. A Computer Science graduate from Universitas Trisakti, Viperi had also worked as a professional banker at Bank Indonesia for more than 15 years.

An online community to share information on salaries and workplace reviews of companies in Indonesia and Malaysia helps level the playing field for employees.

An online community to share information on salaries and workplace reviews of companies in Indonesia and Malaysia helps level the playing field for employees.

Co-founder and Commissioner of Tanamduit

Indra Suryawan is the co-founder of Star Mercato Capitale, the company behind mutual fund investment platform Tanamduit. Between 1997 and 2001, he was the department head of business and development at Bank Bali. He later joined Jatis Solutions, which specializes in developing enterprise IT applications, leaving as deputy CEO in 2010. Between 2013 and 2017, Indra was the CEO of PT Digital Artha Media, which developed Bank Mandiri's e-cash system. Indra holds a master's in Management and Finance from Prasetiya Mulya Business School, Indonesia.

Indra Suryawan is the co-founder of Star Mercato Capitale, the company behind mutual fund investment platform Tanamduit. Between 1997 and 2001, he was the department head of business and development at Bank Bali. He later joined Jatis Solutions, which specializes in developing enterprise IT applications, leaving as deputy CEO in 2010. Between 2013 and 2017, Indra was the CEO of PT Digital Artha Media, which developed Bank Mandiri's e-cash system. Indra holds a master's in Management and Finance from Prasetiya Mulya Business School, Indonesia.

Co-founder and CEO of Tanamduit

Rini Hapsari is currently the CEO of Star Mercato Capitale, the company behind mutual fund investment platform Tanamduit. Her career spans IT and banking, working at Bank Bali and Lippo Bank between 1999 and 2004. From 2005 to 2010, she worked at enterprise IT firm Jatis Solutions, becoming the head of the division in charge of Jatis' Avantrade wealth management software. She was also vice president at Bakrie Telecom between 2012 and 2015. Rini graduated from the University of Indonesia with a bachelor's degree in Anthropology.

Rini Hapsari is currently the CEO of Star Mercato Capitale, the company behind mutual fund investment platform Tanamduit. Her career spans IT and banking, working at Bank Bali and Lippo Bank between 1999 and 2004. From 2005 to 2010, she worked at enterprise IT firm Jatis Solutions, becoming the head of the division in charge of Jatis' Avantrade wealth management software. She was also vice president at Bakrie Telecom between 2012 and 2015. Rini graduated from the University of Indonesia with a bachelor's degree in Anthropology.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

Jerry Ng was the CEO of Indonesian financial institution Bank Tabungan Pensiunan Nasional (BTPN) for a decade until BTPN's merger with Sumitomo Mitsui Indonesia. Ng participated in the seed round of smart retail kiosk startup Warung Pintar in 2017 and again in early 2019 for its Series B funding.

Jerry Ng was the CEO of Indonesian financial institution Bank Tabungan Pensiunan Nasional (BTPN) for a decade until BTPN's merger with Sumitomo Mitsui Indonesia. Ng participated in the seed round of smart retail kiosk startup Warung Pintar in 2017 and again in early 2019 for its Series B funding.

Co-founder and CEO of Eragano

Stephanie Jesselyn is a former Business Intelligence Specialist at Zalora Indonesia, part of the German company Rocket Internet Gmbh. She had also worked as a management associate at DBS Bank in Jakarta for over a year, in addition to her earlier role as an investment analyst at Satuan Kekayaan Dana ITB in Bandung.Stephanie co-founded Eragano and became the CEO in July 2016.She has a bachelor’s in Industrial Engineering from the Institut Teknologi Bandung, Indonesia.

Stephanie Jesselyn is a former Business Intelligence Specialist at Zalora Indonesia, part of the German company Rocket Internet Gmbh. She had also worked as a management associate at DBS Bank in Jakarta for over a year, in addition to her earlier role as an investment analyst at Satuan Kekayaan Dana ITB in Bandung.Stephanie co-founded Eragano and became the CEO in July 2016.She has a bachelor’s in Industrial Engineering from the Institut Teknologi Bandung, Indonesia.

Co-founder and CEO of Qlue

Rama Raditya graduated with a master’s in Management Information Systems in 2005 from Strayer University, USA. He returned to Indonesia and joined PwC as an IT auditor for a year. He then worked at Bank Danamon as an IT auditor and advisor before moving on to Ernst & Young. In 2013, he founded TerralogiQ, which later launched Qlue as part of Jakarta’s Smart City initiative. Rama became the CEO of PT Qlue Performa Indonesia when Qlue was incorporated as a standalone company.

Rama Raditya graduated with a master’s in Management Information Systems in 2005 from Strayer University, USA. He returned to Indonesia and joined PwC as an IT auditor for a year. He then worked at Bank Danamon as an IT auditor and advisor before moving on to Ernst & Young. In 2013, he founded TerralogiQ, which later launched Qlue as part of Jakarta’s Smart City initiative. Rama became the CEO of PT Qlue Performa Indonesia when Qlue was incorporated as a standalone company.

Co-founder and Technology & Innovation Director of Tanamduit

Ferry Aprilianto has over 17 years of experience as an IT engineer. From 2000 to 2005, he was a project manager at enterprise IT firm Jatis Solutions, where he worked on mutual fund distribution systems for major Indonesian banks. In 2005, he became an independent IT consultant, working for companies in Indonesia and the Philippines. In 2013, he joined the company that developed Bank Mandiri's e-cash system, Digital Artha Media, as an IT architect. Ferry graduated from the University of Indonesia with a bachelor's in Electrical and Electronic Engineering.

Ferry Aprilianto has over 17 years of experience as an IT engineer. From 2000 to 2005, he was a project manager at enterprise IT firm Jatis Solutions, where he worked on mutual fund distribution systems for major Indonesian banks. In 2005, he became an independent IT consultant, working for companies in Indonesia and the Philippines. In 2013, he joined the company that developed Bank Mandiri's e-cash system, Digital Artha Media, as an IT architect. Ferry graduated from the University of Indonesia with a bachelor's in Electrical and Electronic Engineering.

Indonesia’s fashion industry is concentrated in large cities in Java. For those living elsewhere, Sale Stock’s low prices and free shipping are especially attractive.

Indonesia’s fashion industry is concentrated in large cities in Java. For those living elsewhere, Sale Stock’s low prices and free shipping are especially attractive.

Co-founder, Director and COO of Travelio

Christie Amanda has Australian diplomas in hospitality and business from the Alexander Education Group and a bachelor’s in Management and Marketing from Curtin University. After graduating in 2007, she worked at Australian retailer Coles and at the Commonwealth Bank before returning to Indonesia. She worked at PT Indosurya Finance before becoming the COO of Code-O Solutions, a software development startup that she co-founded with Hendry Rusli in 2012.

Christie Amanda has Australian diplomas in hospitality and business from the Alexander Education Group and a bachelor’s in Management and Marketing from Curtin University. After graduating in 2007, she worked at Australian retailer Coles and at the Commonwealth Bank before returning to Indonesia. She worked at PT Indosurya Finance before becoming the COO of Code-O Solutions, a software development startup that she co-founded with Hendry Rusli in 2012.

Indonesia’s most popular OTA, Traveloka is an easy-to-use source of cheap regional flights and accommodation for the fast-rising Indonesian and Southeast Asian middle class.

Indonesia’s most popular OTA, Traveloka is an easy-to-use source of cheap regional flights and accommodation for the fast-rising Indonesian and Southeast Asian middle class.

By translating intimidating financial jargon into plain language, this product comparison fintech helps improve access to financial products for Indonesians, many of them financially illiterate.

By translating intimidating financial jargon into plain language, this product comparison fintech helps improve access to financial products for Indonesians, many of them financially illiterate.

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

With universal QR code, Indonesia achieves e-payment harmony

The move to standardize Indonesia's QR code is expected to unify the country's cashless payments system and lift tens of thousands of small merchants into the payments mainstream

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

Indonesian state enterprises launch e-wallet LinkAja, competing with Go-Pay and OVO

Even with a wider range of services and extensive state backing, LinkAja faces a tough battle

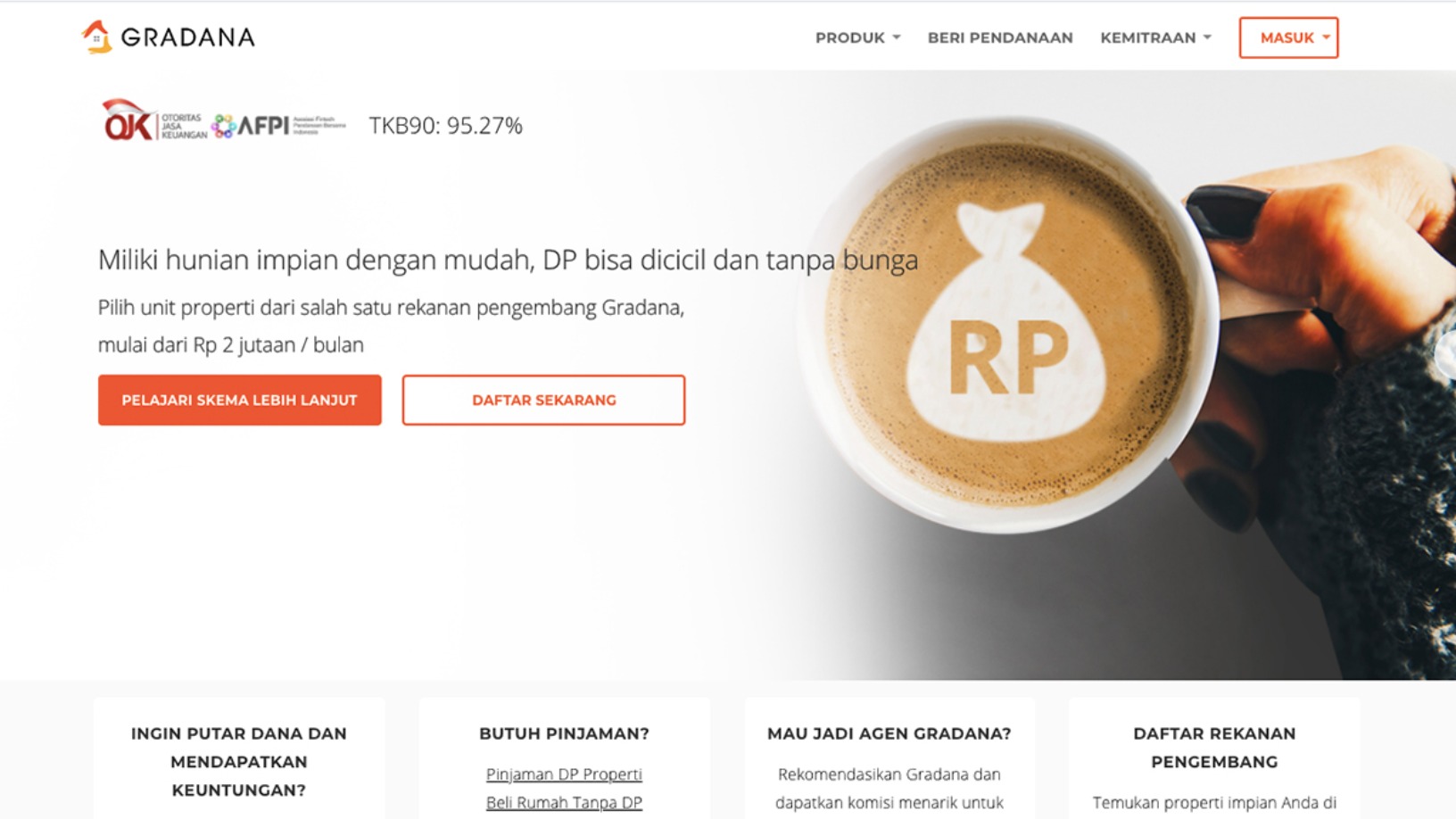

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

ZendMoney: Putting cash back into the pockets of Indonesian migrant workers

ZendMoney's unique remittance concept has already helped 90,000 migrant workers send money back home

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Payfazz aims to be Indonesia's first on-demand financial services company

Handling transactions averaging over IDR 1tn monthly, Payfazz hopes to bring the benefits of banking to all Indonesians

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Sorry, we couldn’t find any matches for“Bank Indonesia”.