Bank Indonesia

DATABASE (639)

ARTICLES (299)

Ajaib’s online wealth management tool brings personalized mutual fund investing to the masses, potentially mobilizing billions of investable assets across Southeast Asia.

Ajaib’s online wealth management tool brings personalized mutual fund investing to the masses, potentially mobilizing billions of investable assets across Southeast Asia.

Xendit, an all-purpose payment gateway and management platform for SMEs and startups in Southeast Asia, becomes a unicorn after expansion into the Philippines.

Xendit, an all-purpose payment gateway and management platform for SMEs and startups in Southeast Asia, becomes a unicorn after expansion into the Philippines.

Furnishing happiness and championing local craftsmanship, Fabelio partners with Indonesian designers and furniture producers to give IKEA a run for their money.

Furnishing happiness and championing local craftsmanship, Fabelio partners with Indonesian designers and furniture producers to give IKEA a run for their money.

The world’s first online Islamic fashion retailer, HijUp brings innovation to a fashion world that has long overlooked the huge potential of the Muslim market.

The world’s first online Islamic fashion retailer, HijUp brings innovation to a fashion world that has long overlooked the huge potential of the Muslim market.

Indonesian agritech pioneer Crowde has battled competition to stay ahead by pivoting from crowdfunding farming projects to channeling institutional lenders’ funds into agricultural loans.

Indonesian agritech pioneer Crowde has battled competition to stay ahead by pivoting from crowdfunding farming projects to channeling institutional lenders’ funds into agricultural loans.

CEO and co-founder of Xendit

Moses Lo comes from an entrepreneurial family, his father acquired a failing business in Australia and turned it into a successful company. The family business inspired Lo to start his own fashion business in Australia after graduating in finance and commerce at the University of New South Wales in 2010.Lo initially gained work experience as an analyst in 2008 as part of his undergraduate finance and commerce programs in Australia. In 2011, he became an associate at the Boston Consulting Group in Australia. After two years, he was promoted to senior associate but left BCG in 2013 to focus on his menswear ventures until 2014.Lo decided to get first-hand tech startup experience in the Silicon Valley, working at Amazon while completing an MBA program at the University of California, Berkeley. In 2015, he decided to established a P2P payments platform Xendit in Indonesia. The platform has since pivoted into a payment gateway service and became a unicorn in 2021, with Lo as CEO based in California and Jakarta. He was also featured in Forbes’ 30 Under 30 list for Asian figures in finance and venture capital in 2016.

Moses Lo comes from an entrepreneurial family, his father acquired a failing business in Australia and turned it into a successful company. The family business inspired Lo to start his own fashion business in Australia after graduating in finance and commerce at the University of New South Wales in 2010.Lo initially gained work experience as an analyst in 2008 as part of his undergraduate finance and commerce programs in Australia. In 2011, he became an associate at the Boston Consulting Group in Australia. After two years, he was promoted to senior associate but left BCG in 2013 to focus on his menswear ventures until 2014.Lo decided to get first-hand tech startup experience in the Silicon Valley, working at Amazon while completing an MBA program at the University of California, Berkeley. In 2015, he decided to established a P2P payments platform Xendit in Indonesia. The platform has since pivoted into a payment gateway service and became a unicorn in 2021, with Lo as CEO based in California and Jakarta. He was also featured in Forbes’ 30 Under 30 list for Asian figures in finance and venture capital in 2016.

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

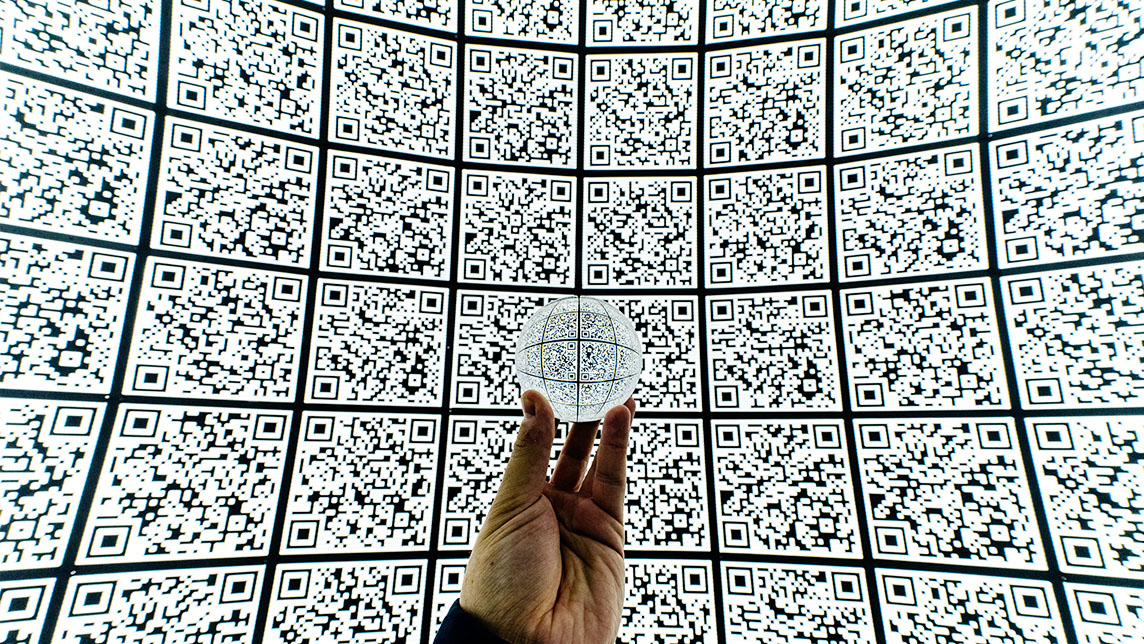

With universal QR code, Indonesia achieves e-payment harmony

The move to standardize Indonesia's QR code is expected to unify the country's cashless payments system and lift tens of thousands of small merchants into the payments mainstream

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

Indonesian state enterprises launch e-wallet LinkAja, competing with Go-Pay and OVO

Even with a wider range of services and extensive state backing, LinkAja faces a tough battle

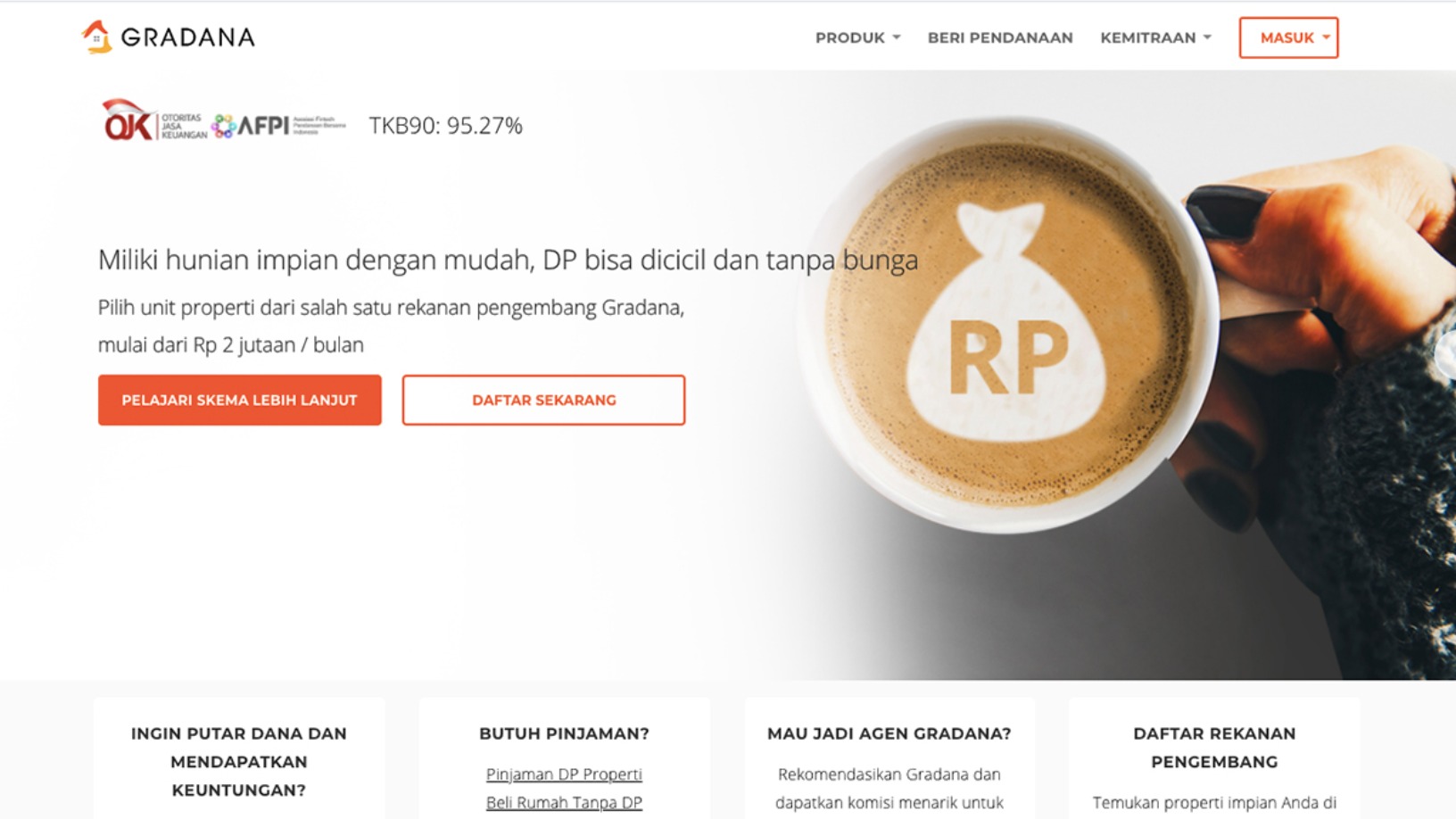

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

ZendMoney: Putting cash back into the pockets of Indonesian migrant workers

ZendMoney's unique remittance concept has already helped 90,000 migrant workers send money back home

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

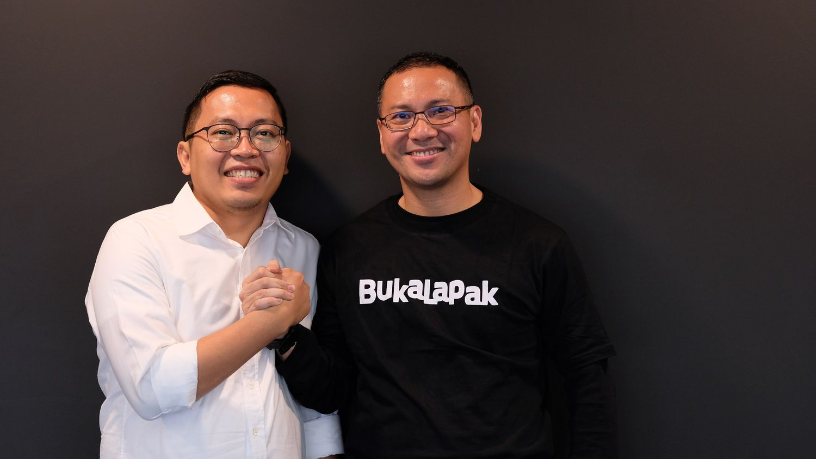

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Payfazz aims to be Indonesia's first on-demand financial services company

Handling transactions averaging over IDR 1tn monthly, Payfazz hopes to bring the benefits of banking to all Indonesians

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Sorry, we couldn’t find any matches for“Bank Indonesia”.