Bank of China

DATABASE (995)

ARTICLES (811)

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

BOC International (China) Limited

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

Boc&Utrust Private Equity Fund Management (Guangdong) Co., Ltd.

Boc&Utrust Private Equity Fund Management (Guangdong) Co., Ltd., was co-founded by Bank of China Group Investment Ltd., a subsidiary of the Bank of China, and Guangdong Yuecai Investment Co., Ltd., which is authorized by the Guangdong government to manage state-owned capital.

Boc&Utrust Private Equity Fund Management (Guangdong) Co., Ltd., was co-founded by Bank of China Group Investment Ltd., a subsidiary of the Bank of China, and Guangdong Yuecai Investment Co., Ltd., which is authorized by the Guangdong government to manage state-owned capital.

Founder and CEO of Doctor Che

Xue has served as product manager for VIP, an e-commerce platform dedicated to flash sales in China, and for China UnionPay, China’s largest bank card payment network.

Xue has served as product manager for VIP, an e-commerce platform dedicated to flash sales in China, and for China UnionPay, China’s largest bank card payment network.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

Creadev was created in 2002 in France as the private equity arm of the Mulliez family. Creadev expanded to Shanghai in 2012, through a unit called Crehol China. It has since been renamed Creadev China.

Creadev was created in 2002 in France as the private equity arm of the Mulliez family. Creadev expanded to Shanghai in 2012, through a unit called Crehol China. It has since been renamed Creadev China.

Founder and CEO of Hero Entertainment

Ying, who invented the concept of mobile game publishing, is often referred to as the Father of Mobile Esports in China. In 1999, he dropped out of East China Normal University three months after matriculating to start his first business venture. In 2006, Ying worked at Standard Chartered Bank. In 2008, he started a mobile game distributing business, later acquired by the V1 Group. Ying became president of China Mobile Games and Entertainment Group, a subsidiary of V1, in 2013. In 2015, he founded Hero Entertainment.

Ying, who invented the concept of mobile game publishing, is often referred to as the Father of Mobile Esports in China. In 1999, he dropped out of East China Normal University three months after matriculating to start his first business venture. In 2006, Ying worked at Standard Chartered Bank. In 2008, he started a mobile game distributing business, later acquired by the V1 Group. Ying became president of China Mobile Games and Entertainment Group, a subsidiary of V1, in 2013. In 2015, he founded Hero Entertainment.

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

China new retail: A blend of the best of online and offline shopping

Players big and small are contributing to China’s new retail revolution

This startup aims to be the DocuSign of China

Having captured a third of a largely untapped domestic e-contracting market, Shangshangqian looks to gain a greater foothold at home and abroad

NANOxARCH: Pioneering awareness and use of sustainable materials in China

Founder Lei Yuxi reckons Covid-19 could usher China into a new era of sustainability, as her startup seeks to make sustainable materials more affordable

CraiditX gives banks and insurers AI tools for assessing consumer credit risk

Used by big lenders like Bank of China and Minsheng Bank, CraiditX's solutions can gauge consumer default risk even if a user has no credit history

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

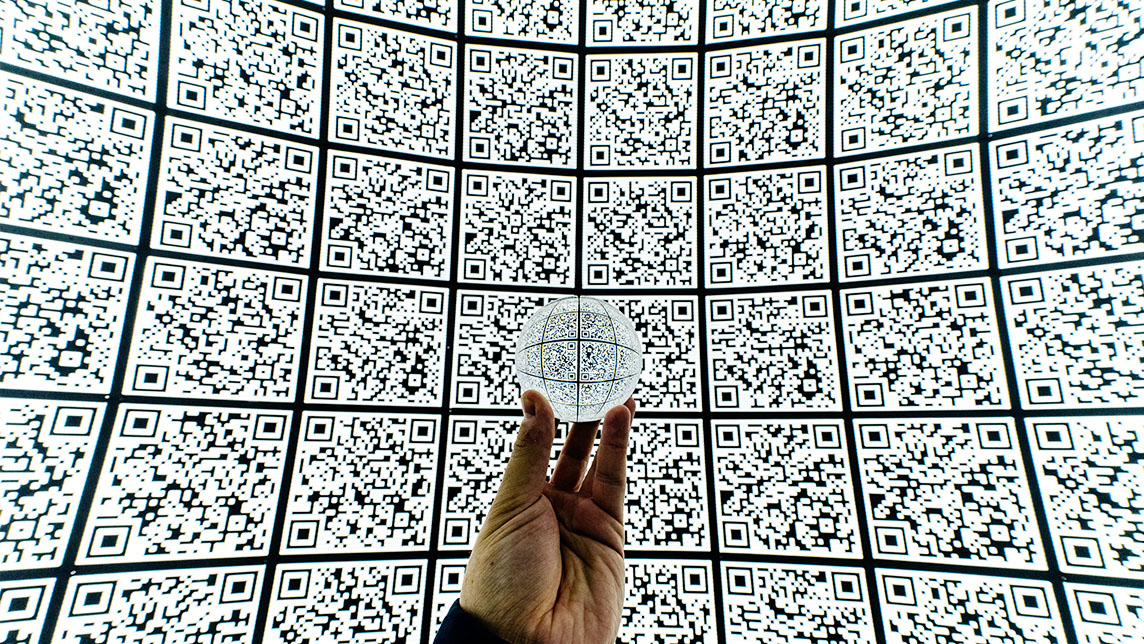

With universal QR code, Indonesia achieves e-payment harmony

The move to standardize Indonesia's QR code is expected to unify the country's cashless payments system and lift tens of thousands of small merchants into the payments mainstream

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

More than desire: When resale sneakers become objects of speculation

Sneaker resale platforms like Poizon and Nice feel the heat as China regulators panned such trading for getting out of control

Have you ever bought expensive equipment but seldom used it? Do you want to try the latest electronic gadgets at low cost? Try this online sharing and rental platform

Once the darling of investors, unmanned shelf startups are going through a hard time in China

Startups are being forced to transform their business models to survive

China bets on road-vehicle coordination for the mass adoption of autonomous driving cars by 2025

Money pours in as China pushes sector to be the next growth engine, and both self-driving startups and their investors are optimistic about their commercialization attempts

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Covid-19: A closer look at how China's businesses and consumer behavior have changed

The lockdown in China has reshaped how people work and live. Some of the changes may be short-term, but others probably have become a part of life

China's Yuanfudao now the world's most valuable edtech with $2.2bn new funding

Yuanfudao’s second tranche of its Series G funding follows the $1bn it raised in March, bringing its valuation to $15.5bn

Sorry, we couldn’t find any matches for“Bank of China”.