Bank of China

-

DATABASE (995)

-

ARTICLES (811)

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

BOC International (China) Limited

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

Boc&Utrust Private Equity Fund Management (Guangdong) Co., Ltd.

Boc&Utrust Private Equity Fund Management (Guangdong) Co., Ltd., was co-founded by Bank of China Group Investment Ltd., a subsidiary of the Bank of China, and Guangdong Yuecai Investment Co., Ltd., which is authorized by the Guangdong government to manage state-owned capital.

Boc&Utrust Private Equity Fund Management (Guangdong) Co., Ltd., was co-founded by Bank of China Group Investment Ltd., a subsidiary of the Bank of China, and Guangdong Yuecai Investment Co., Ltd., which is authorized by the Guangdong government to manage state-owned capital.

Founder and CEO of Doctor Che

Xue has served as product manager for VIP, an e-commerce platform dedicated to flash sales in China, and for China UnionPay, China’s largest bank card payment network.

Xue has served as product manager for VIP, an e-commerce platform dedicated to flash sales in China, and for China UnionPay, China’s largest bank card payment network.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

Creadev was created in 2002 in France as the private equity arm of the Mulliez family. Creadev expanded to Shanghai in 2012, through a unit called Crehol China. It has since been renamed Creadev China.

Creadev was created in 2002 in France as the private equity arm of the Mulliez family. Creadev expanded to Shanghai in 2012, through a unit called Crehol China. It has since been renamed Creadev China.

Founder and CEO of Hero Entertainment

Ying, who invented the concept of mobile game publishing, is often referred to as the Father of Mobile Esports in China. In 1999, he dropped out of East China Normal University three months after matriculating to start his first business venture. In 2006, Ying worked at Standard Chartered Bank. In 2008, he started a mobile game distributing business, later acquired by the V1 Group. Ying became president of China Mobile Games and Entertainment Group, a subsidiary of V1, in 2013. In 2015, he founded Hero Entertainment.

Ying, who invented the concept of mobile game publishing, is often referred to as the Father of Mobile Esports in China. In 1999, he dropped out of East China Normal University three months after matriculating to start his first business venture. In 2006, Ying worked at Standard Chartered Bank. In 2008, he started a mobile game distributing business, later acquired by the V1 Group. Ying became president of China Mobile Games and Entertainment Group, a subsidiary of V1, in 2013. In 2015, he founded Hero Entertainment.

VitiBot: Using robotics to make winemaking more sustainable

Combining a passion for robotics with his family’s history in winemaking, VitiBot CEO and co-founder Cedric Bache saw an opportunity to help winemakers meet the dual challenges of modernization and sustainable development

Education for all: Interview with DANAdidik CEO Dipo Satria

The student loan startup is narrowing its focus to funding students planning on healthcare careers, and it also hopes to attract more financing from impact investors

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

Amid IPO talk, Meicai continues to push for growth in bid to become China's Sysco

Covid-19 helped speed up expansion to the B2C market for Meicai, China’s most valuable agrifood tech unicorn founded by a farmer’s son

4D ShoeTech: Digital design platform helps shoemakers to slash production time by over 60%

Armed with new funding, 4D ShoeTech is scaling its Ideation platform to offer digital modelling services to cover other popular products like suitcases

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon

Keep: Social fitness app bags $80m Series E as Covid-19 lockdown fuels demand for virtual gyms

Keep becomes China’s first sports tech unicorn as number of fitness app users in the country almost doubled to 89m amid home confinement and gym closures

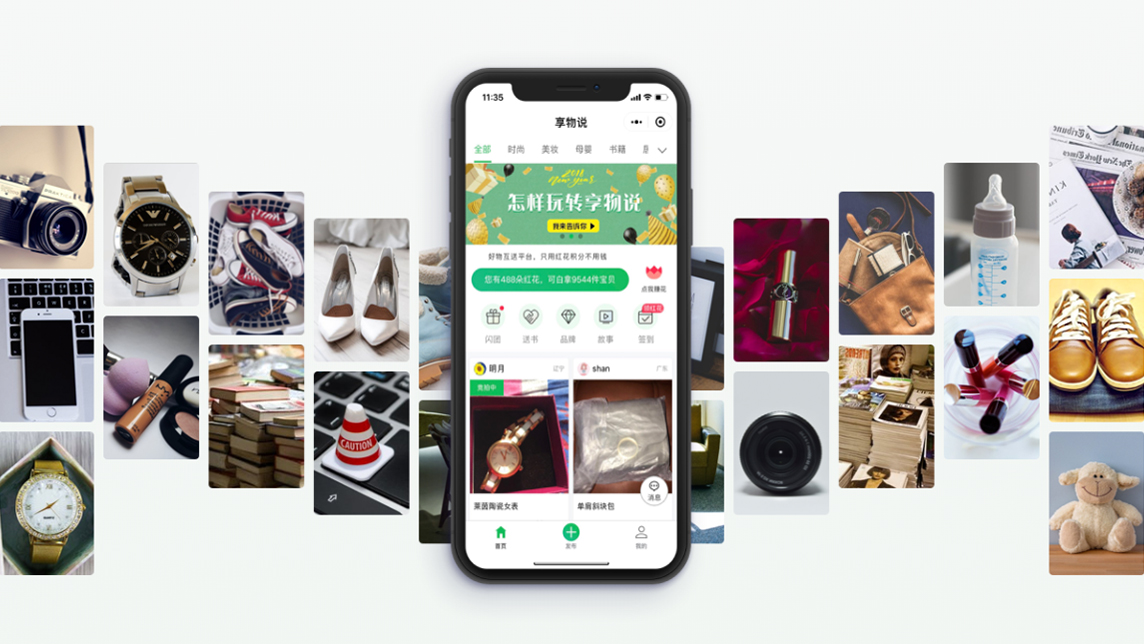

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

CoRTP: Building sustainable supply chains with returnable packaging

The Shanghai-based startup’s award-winning returnable transit packaging reduced carbon emissions in 2020 by 250,000 tons, and the figure is estimated to reach 8m by 2030

In-store robots and online doctors serve customers 24/7 at Dingdang Medicine Express

Dingdang also offers cheaper medicines and 28-minute home delivery, thanks to its innovative logistics and partnership models

How Xiaomi founder Lei Jun became a billionaire by pursuing passion, not fortune

From young man deconstructing and rebuilding smartphones at Kingsoft to top of the smartphone world as founder and chair of Xiaomi, Lei has always let his interests lead the way

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Foot Analytics: Turning pedestrian footfall into data for smart cities and retail

Applying sensors and proprietary algorithms to digitalize spaces, Foot Analytics gathers data and insights on customer behavior in retail spaces, stadia and airports

South Summit wants to go global, as it launches Brazilian chapter

CEO Marta del Castillo on South Summit’s LatAm, Asia expansion plans; its net-zero pledge; her new role as co-head to further drive growth and more

Sorry, we couldn’t find any matches for“Bank of China”.