Barcelona Tech City

-

DATABASE (570)

-

ARTICLES (536)

CEO and Founder of Didimo

Argentinian-born Verónica Costa Orvalho is a veteran in animation technology. In 2016, she became the CEO and founder of Didimo that was inspired by an earlier venture Face In Motion, established in 2007 to focus on cinematic quality and animation production of faces. Orvalho won the award for the AI and virtual reality category at a Women Startup Challenge event held in New York in 2017. Orvalho has a long academic track record in related fields, beginning with a first degree in Software Engineering from the University of Belgrano in Buenos Aires. She moved to Barcelona and obtained a master's degree in Videogame Design and Development at University Pompeu Fabra where she continued to work on creating a facial animation system “For CG Films”. She later completed her PhD at the Polytechnic University of Catalonia with her thesis: Fast and Reusable Facial Rigging and Animation to develop an application that could speed up the traditional “slowing rigging” process. She has worked at Ericsson as a systems analyst and was a producer at the Argentinian film company Patagonik Film Group that helped to produce the Oscar-winning movie El hijo de la novia. She worked for four years as the founder of Panorama Consulting, a consultancy focusing on developing systems for the medical, logistics and entertainment industries. Since 2003, she has lectured in different institutions, including Porto University's Porto Interactive Center as its specialist in facial animation since 2008.

Argentinian-born Verónica Costa Orvalho is a veteran in animation technology. In 2016, she became the CEO and founder of Didimo that was inspired by an earlier venture Face In Motion, established in 2007 to focus on cinematic quality and animation production of faces. Orvalho won the award for the AI and virtual reality category at a Women Startup Challenge event held in New York in 2017. Orvalho has a long academic track record in related fields, beginning with a first degree in Software Engineering from the University of Belgrano in Buenos Aires. She moved to Barcelona and obtained a master's degree in Videogame Design and Development at University Pompeu Fabra where she continued to work on creating a facial animation system “For CG Films”. She later completed her PhD at the Polytechnic University of Catalonia with her thesis: Fast and Reusable Facial Rigging and Animation to develop an application that could speed up the traditional “slowing rigging” process. She has worked at Ericsson as a systems analyst and was a producer at the Argentinian film company Patagonik Film Group that helped to produce the Oscar-winning movie El hijo de la novia. She worked for four years as the founder of Panorama Consulting, a consultancy focusing on developing systems for the medical, logistics and entertainment industries. Since 2003, she has lectured in different institutions, including Porto University's Porto Interactive Center as its specialist in facial animation since 2008.

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Bojiang Capital was founded in Shanghai in September 2005. The investment management group has branches in Hong Kong, Beijing, Zhejiang and Shenzhen. It also has offices in Silicon Valley and Los Angeles in the US.Bojiang mainly invests in the primary equity market and focuses on high-tech young companies in the technology, media and telecoms (TMT) industry, big data, artificial intelligence, corporate services, fintech, new materials and culture.

Bojiang Capital was founded in Shanghai in September 2005. The investment management group has branches in Hong Kong, Beijing, Zhejiang and Shenzhen. It also has offices in Silicon Valley and Los Angeles in the US.Bojiang mainly invests in the primary equity market and focuses on high-tech young companies in the technology, media and telecoms (TMT) industry, big data, artificial intelligence, corporate services, fintech, new materials and culture.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

In January 2006, Chen Hua (Tony Chen) co-founded Kuxun.cn, a Chinese travel and hotel search engine that was acquired by TripAdvisor in 2009. Chen exited Kuxun in late 2008 and joined Alibaba in early 2009, working on the application of search engine technology. He resigned in February 2011 and started a mobile tech enterprise. In May 2012, he released Changba, an app offering users a portable solo KTV booth that attracted over 1m users in just one week after its release.

In January 2006, Chen Hua (Tony Chen) co-founded Kuxun.cn, a Chinese travel and hotel search engine that was acquired by TripAdvisor in 2009. Chen exited Kuxun in late 2008 and joined Alibaba in early 2009, working on the application of search engine technology. He resigned in February 2011 and started a mobile tech enterprise. In May 2012, he released Changba, an app offering users a portable solo KTV booth that attracted over 1m users in just one week after its release.

Founded in 2005, Fortune Link focuses on private equity investment. Its founder, Kan Zhidong was also the founder of Shenzhen Capital Group, one of the first few venture capitalists in China. As at March 2018, it had set up a number of funds and managed over 20 investment teams.With over RMB 30bn worth of assets under its management, Fortune Link mainly invests in sectors including TMT, environmental protection, advanced material, healthcare, high tech industries, culture and media.

Founded in 2005, Fortune Link focuses on private equity investment. Its founder, Kan Zhidong was also the founder of Shenzhen Capital Group, one of the first few venture capitalists in China. As at March 2018, it had set up a number of funds and managed over 20 investment teams.With over RMB 30bn worth of assets under its management, Fortune Link mainly invests in sectors including TMT, environmental protection, advanced material, healthcare, high tech industries, culture and media.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

IDC Ventures is the VC arm of Grupo IDC, a Latin American investment bank. The fund was created in 2019 by corporate executives, entrepreneurs and investors from Latin America, focused on pre-Series A to Series B rounds. Headquartered in Madrid with offices in Copenhagen and Guatemala, the company acts as an international VC working with tech companies to accelerate expansion across LatAm markets. Sectors of interest include fintech, on-demand transportation, digital tools for small and large retailers, and commercialization platforms for robotics.

IDC Ventures is the VC arm of Grupo IDC, a Latin American investment bank. The fund was created in 2019 by corporate executives, entrepreneurs and investors from Latin America, focused on pre-Series A to Series B rounds. Headquartered in Madrid with offices in Copenhagen and Guatemala, the company acts as an international VC working with tech companies to accelerate expansion across LatAm markets. Sectors of interest include fintech, on-demand transportation, digital tools for small and large retailers, and commercialization platforms for robotics.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Founded in Boston in 2015, Material Impact is a science-based investment fund backing products that make an impact on real-world problems. It currently has 10 companies in its portfolio, from seed to Series C investments. Its most recent investments have been in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2020 $12m Series A round of US electronics protective substance producer actnano.

Founded in Boston in 2015, Material Impact is a science-based investment fund backing products that make an impact on real-world problems. It currently has 10 companies in its portfolio, from seed to Series C investments. Its most recent investments have been in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2020 $12m Series A round of US electronics protective substance producer actnano.

Established in 2003, Indonusa Dwitama is a holding company that manages and develops a range of investment portfolios in Indonesia, including mining, financial services and information technology. In the mining industry, it has a portfolio of andesite and bauxite mines, and it also invested in an oil and gas mining company. As a tech investor, it is a relatively early investor in Tokopedia when it joined in 2016. It has also invested in VOSPAY, a digital payment intermediary, and cross-border money transfer company Wallex.

Established in 2003, Indonusa Dwitama is a holding company that manages and develops a range of investment portfolios in Indonesia, including mining, financial services and information technology. In the mining industry, it has a portfolio of andesite and bauxite mines, and it also invested in an oil and gas mining company. As a tech investor, it is a relatively early investor in Tokopedia when it joined in 2016. It has also invested in VOSPAY, a digital payment intermediary, and cross-border money transfer company Wallex.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

Zhongguancun Longmen Investment

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

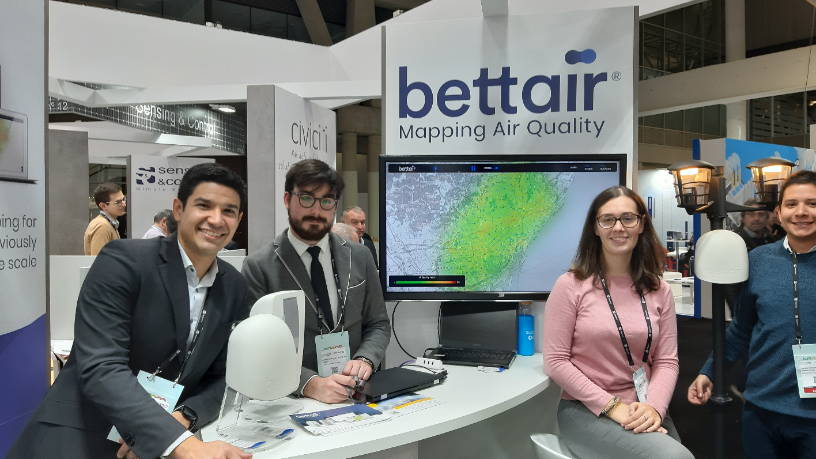

Bettair's air pollution monitoring system for cities promises over 90% accuracy

Combining smart sensors, AI and machine learning, Barcelona-based Bettair has developed a unique, affordable PaaS to accurately measure pollution levels in urban areas

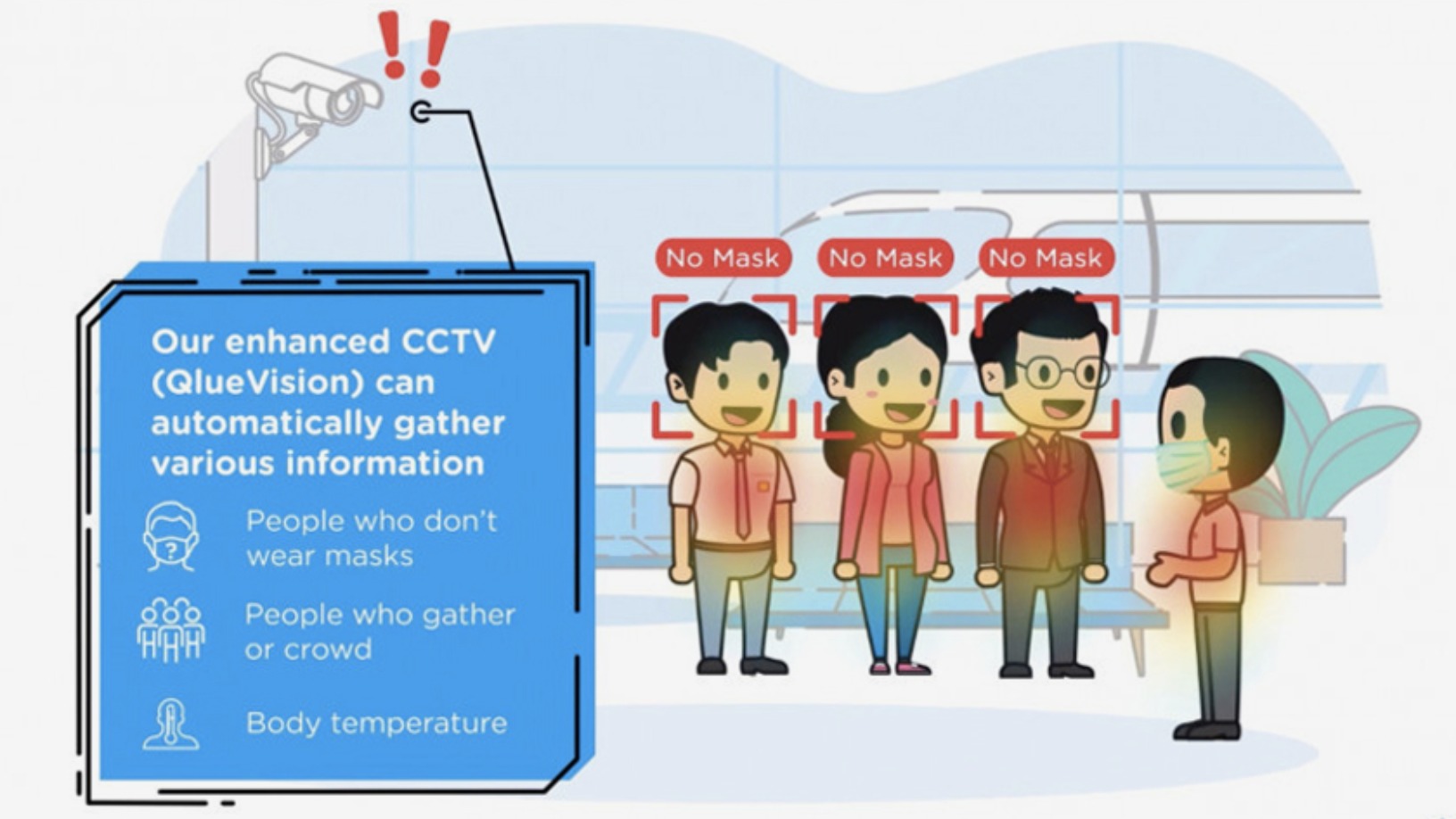

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Vadecity: Stop bicycle theft with an intelligent bike-parking system

The Barcelona-based startup wants more people to bike by offering flexible, affordable parking with its Vadebike solution

Automated marketing platform Frizbit reaches over 1bn end-users; seeks European, LatAm expansion

Using AI and proprietary technology, Frizbit aims to help clients retain customers with personalized and automated push notification campaigns

Cecilia Tham: the power of shifting paradigms

The embodiment of unconventional thinking and creativity, this female entrepreneur from Hong Kong has been pioneering social transformation within Barcelona's startup ecosystem since 2011

Iomob: Universal mobility app to help people find best route from A to B

Rapid growth in MaaS will boost revenue to over €1m by 2020 for Spanish transport app Iomob

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

Napbox: Sleeping capsule mania takes off in Spain

Napbox's on-demand and intelligent cabins give privacy and connectivity in public spaces and offices

Eliport: Friendly neighborhood robots for cheaper last-mile deliveries

The Spanish logistics robot maker has a solution to improve last-mile delivery, with community-based smart robots, parcel hubs and postboxes. CompassList spoke to its co-founders at the recent 4YFN conference in Barcelona

Qlue on international expansion, privacy concerns in smart cities

Qlue's CEO Rama Raditya and CCO Maya Arvini on protecting individual privacy when handling citizens' data in smart cities, the lack of clarity in regulation of use of facial recognition technology in Indonesia

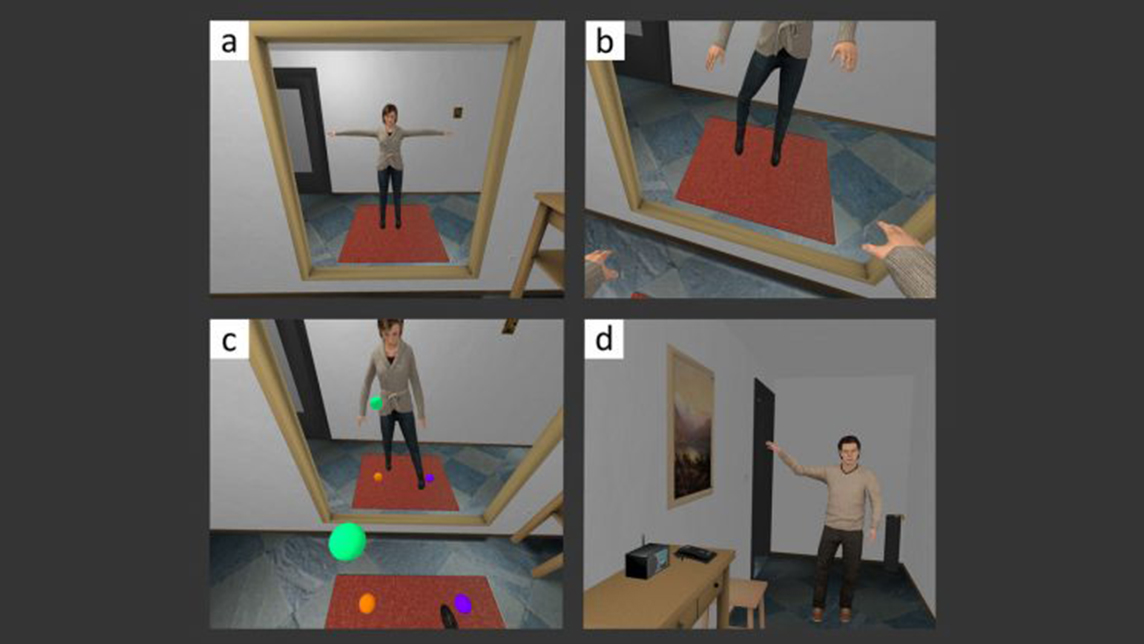

Virtual Bodyworks: VR psychotherapy to reduce crime and health issues

Applications created by the Barcelona-based startup could be used to track and influence human behavior

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Spain's gig and sharing economy startups flourish, despite barrage of restrictions

Startups like Glovo and Spotahome topped fundings raised in 2018 despite local regulatory risks, as Spanish tech firms conquer overseas markets

Sorry, we couldn’t find any matches for“Barcelona Tech City”.