Barcelona Tech City

-

DATABASE (570)

-

ARTICLES (536)

Khosla Ventures is a Silicon Valley-based VC, founded in 2004 by Indian-born founder of tech pioneer Sun Microsystems Vinod Khosla. The company has no specific interest in terms of sector but heavily favors “large problems that are amenable to technology solutions” and invests in so-called high potential 'black swans´. Healthcare is a strong focus and its most recent investments include in the Portuguese home physiotherapy tech solution SWORD Health's 2021 $85m Series C and $25m Series B rounds besides its 2020 $17m Series A round which it led. Khosla has over $5bn under management and more than 70 staff, with investments in more than 700 startups, leading more than one-third. Other recent investments include in the July 2021 $75m Series C round of Indian personal health and fitness app HealthifyMe and, the same month, in the $12.5m Series A round of US commercial real estate app for tenants and property managers Jones.

Khosla Ventures is a Silicon Valley-based VC, founded in 2004 by Indian-born founder of tech pioneer Sun Microsystems Vinod Khosla. The company has no specific interest in terms of sector but heavily favors “large problems that are amenable to technology solutions” and invests in so-called high potential 'black swans´. Healthcare is a strong focus and its most recent investments include in the Portuguese home physiotherapy tech solution SWORD Health's 2021 $85m Series C and $25m Series B rounds besides its 2020 $17m Series A round which it led. Khosla has over $5bn under management and more than 70 staff, with investments in more than 700 startups, leading more than one-third. Other recent investments include in the July 2021 $75m Series C round of Indian personal health and fitness app HealthifyMe and, the same month, in the $12.5m Series A round of US commercial real estate app for tenants and property managers Jones.

Gopher Asset Management is a subsidiary of Noah Holdings, China’s first and largest independent wealth management company and only NYSE-listed wealth manager. Set up in 2010, Gopher’s assets under management reached RMB 86.7 billion in 2015, up 74.3% from 2014. Of these assets, PE/VC assets more than tripled to comprise 43.7% of total portfolio in 2015, versus 20.9% in 2014. Gopher’s investments cover nearly 1,000 high-growth companies in TMT, mobile Internet, IoT, healthcare, high-tech manufacturing and more. In 2016, it is focusing on Internet-based businesses relating to big data in healthcare, education, culture and finance.

Gopher Asset Management is a subsidiary of Noah Holdings, China’s first and largest independent wealth management company and only NYSE-listed wealth manager. Set up in 2010, Gopher’s assets under management reached RMB 86.7 billion in 2015, up 74.3% from 2014. Of these assets, PE/VC assets more than tripled to comprise 43.7% of total portfolio in 2015, versus 20.9% in 2014. Gopher’s investments cover nearly 1,000 high-growth companies in TMT, mobile Internet, IoT, healthcare, high-tech manufacturing and more. In 2016, it is focusing on Internet-based businesses relating to big data in healthcare, education, culture and finance.

As the Korean conglomerate’s gateway to deep tech startups and innovation, Samsung NEXT covers product development, investment, M&A and partnerships in a single entity to complement Samsung’s hardware business. Outside of South Korea, Samsung NEXT has offices in Berlin, Tel Aviv and in the US in New York, San Francisco, and Silicon Valley. Its portfolio currently includes 55 companies with recent investments including in Series A rounds for Tetrate, Brodmann17 and RapidDeploy, as well as Healthy.io's Series B. It has managed 13 exits to date, including LoopPay, Automated Insights and EyeVerify. The VC was established in 2013.

As the Korean conglomerate’s gateway to deep tech startups and innovation, Samsung NEXT covers product development, investment, M&A and partnerships in a single entity to complement Samsung’s hardware business. Outside of South Korea, Samsung NEXT has offices in Berlin, Tel Aviv and in the US in New York, San Francisco, and Silicon Valley. Its portfolio currently includes 55 companies with recent investments including in Series A rounds for Tetrate, Brodmann17 and RapidDeploy, as well as Healthy.io's Series B. It has managed 13 exits to date, including LoopPay, Automated Insights and EyeVerify. The VC was established in 2013.

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

Founded in 2014, Stellar Kapital is a VC and investment firm that seeks to empower new entrepreneurs and launch new tech events including a cultural and music Stellar Fest in 2018. Its first fund of US$10 million was mainly invested in real-sector companies. Armed with a second investment fund of US$25 million, Stellar Kapital is looking to invest in startups with funding ranging from US$200,000 to US$1 million. The VC also invests directly in offline companies like co-working business Freeware Spaces, Stellar Parking and Divestekno, an oil and gas company.

Founded in 2014, Stellar Kapital is a VC and investment firm that seeks to empower new entrepreneurs and launch new tech events including a cultural and music Stellar Fest in 2018. Its first fund of US$10 million was mainly invested in real-sector companies. Armed with a second investment fund of US$25 million, Stellar Kapital is looking to invest in startups with funding ranging from US$200,000 to US$1 million. The VC also invests directly in offline companies like co-working business Freeware Spaces, Stellar Parking and Divestekno, an oil and gas company.

Yale University’s Physics and Philosophy graduate Justin Kan is a tech millionaire. The American Korean became famous by broadcasting his life through a webcam on the Justin.tv website that later evolved into the global video game streaming platform Twitch. After an internship working on endless spreadsheets, Yale’s former Men of Branford Calendar model decided to become a technopreneur in 2005. He became a partner of Y Combinator in 2014 but left in 2017 to focus on Justin Kan Enterprises, Titanic’s End and Whale. He recently founded Atrium LTS and became CEO of the law services platform.

Yale University’s Physics and Philosophy graduate Justin Kan is a tech millionaire. The American Korean became famous by broadcasting his life through a webcam on the Justin.tv website that later evolved into the global video game streaming platform Twitch. After an internship working on endless spreadsheets, Yale’s former Men of Branford Calendar model decided to become a technopreneur in 2005. He became a partner of Y Combinator in 2014 but left in 2017 to focus on Justin Kan Enterprises, Titanic’s End and Whale. He recently founded Atrium LTS and became CEO of the law services platform.

Serial entrepreneur Bernardo Hernández entered the tech startup scene with his first internet venture idealista.com that has now transformed into a leading real estate platform in Spain. Since then, he has invested in well-known names in the Spanish digital market like Spain’s popular social network Tuenti, local free classified ads Wallapop and on-demand delivery app Glovo. Hernández was awarded an honorary doctorate from the Universidad Camilo José Cela from Madrid when he was the Product Management director at Google in 2010. In September 2017, he became the executive chairman at Citibox.

Serial entrepreneur Bernardo Hernández entered the tech startup scene with his first internet venture idealista.com that has now transformed into a leading real estate platform in Spain. Since then, he has invested in well-known names in the Spanish digital market like Spain’s popular social network Tuenti, local free classified ads Wallapop and on-demand delivery app Glovo. Hernández was awarded an honorary doctorate from the Universidad Camilo José Cela from Madrid when he was the Product Management director at Google in 2010. In September 2017, he became the executive chairman at Citibox.

Vincent Rosso, the co-founder of Consentio and BlaBlaCar Spain is also the chairman of GOI Travel SL. The industrial engineer has a wide range of work experience including working as an aerospace and telecom software engineer at Dassault Data Services after obtaining his master’s in 1994. He also worked as sales manager at IT firms Interwoven and Kabira Technology.He decided to become a tech investor and co-founder in 2009 with BlaBlaCar. Since then, Rosso supported more startups and eventually established SeedPod Capital in 2015 to manage all his investments.

Vincent Rosso, the co-founder of Consentio and BlaBlaCar Spain is also the chairman of GOI Travel SL. The industrial engineer has a wide range of work experience including working as an aerospace and telecom software engineer at Dassault Data Services after obtaining his master’s in 1994. He also worked as sales manager at IT firms Interwoven and Kabira Technology.He decided to become a tech investor and co-founder in 2009 with BlaBlaCar. Since then, Rosso supported more startups and eventually established SeedPod Capital in 2015 to manage all his investments.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

Justin Mateen is the co-founder and former CMO of dating app Tinder. The well-known American internet entrepreneur is also an adviser to Home Chef, Rich Uncles, LLC, Jobr, Hutch, Cargomatic and Common. He was named in Forbes 30 under 30 in 2014. His career as an entrepreneur started with Site Canvas and Cover Canvas, after he graduated from USC Marshall School of Business. The early stage investor supports innovative tech and real estate companies.

Justin Mateen is the co-founder and former CMO of dating app Tinder. The well-known American internet entrepreneur is also an adviser to Home Chef, Rich Uncles, LLC, Jobr, Hutch, Cargomatic and Common. He was named in Forbes 30 under 30 in 2014. His career as an entrepreneur started with Site Canvas and Cover Canvas, after he graduated from USC Marshall School of Business. The early stage investor supports innovative tech and real estate companies.

David Boronat is an internet enthusiast, with over 20 years of professional experience in the market. He is a mentor and advisor to tech startups in Spain and Latin America. He is passionate about digital strategies, UX and web analytics. Based in Mexico and the US, Boronat is currently managing two of his own businesses. In 2000, he became the CEO and founder of Multiplica, an international performance consultancy agency. In 2005, he founded Metriplica, a partner agency of Google Analytics, IBM, ComScore and Omniture. Metriplica offers digital measurement and data mining services.

David Boronat is an internet enthusiast, with over 20 years of professional experience in the market. He is a mentor and advisor to tech startups in Spain and Latin America. He is passionate about digital strategies, UX and web analytics. Based in Mexico and the US, Boronat is currently managing two of his own businesses. In 2000, he became the CEO and founder of Multiplica, an international performance consultancy agency. In 2005, he founded Metriplica, a partner agency of Google Analytics, IBM, ComScore and Omniture. Metriplica offers digital measurement and data mining services.

Part of the Telefonica group, Wayra started its investment in Latin American countries and Spain in 2011. It offers mentoring and acceleration programs across 24 countries, leveraging on a global network of over 350 million customers.Wayra bridges the gap between tech entrepreneurs and networks of governments, corporations and partners where Telefónica has a presence.To date, the firm has invested more than €40 million and built 11 acceleration hubs that provide startup entrepreneurs mentoring and support from corporate leaders, investors and serial entrepreneurs.

Part of the Telefonica group, Wayra started its investment in Latin American countries and Spain in 2011. It offers mentoring and acceleration programs across 24 countries, leveraging on a global network of over 350 million customers.Wayra bridges the gap between tech entrepreneurs and networks of governments, corporations and partners where Telefónica has a presence.To date, the firm has invested more than €40 million and built 11 acceleration hubs that provide startup entrepreneurs mentoring and support from corporate leaders, investors and serial entrepreneurs.

Yago Arbeloa is a serial entrepreneur with over 20 years of experience founding internet and advertising companies in Spain.Arbeloa is president of MIOGROUP, a marketing and advertising group with yearly turnover of more than €50m. He is also president of the Internet Investors and Entrepreneurs Association. Through Viriditas Ventures, his investment vehicle, Arbeloa has backed tech startups such as We are Knitters, Rentuos, Baluwo, iContainers and Reclamador.es.

Yago Arbeloa is a serial entrepreneur with over 20 years of experience founding internet and advertising companies in Spain.Arbeloa is president of MIOGROUP, a marketing and advertising group with yearly turnover of more than €50m. He is also president of the Internet Investors and Entrepreneurs Association. Through Viriditas Ventures, his investment vehicle, Arbeloa has backed tech startups such as We are Knitters, Rentuos, Baluwo, iContainers and Reclamador.es.

Greycroft is a New York-based VC, established in 2006, that currently has 113 companies in its portfolio. It has interests in multiple sectors but a preference for A.I. and Big Data technologies underpinning them. It has managed 35 exits to date including Farfetch and Huffington Post. Its recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$22m Series A round of Kheiron, a breast cancer-detecting health tech.

Greycroft is a New York-based VC, established in 2006, that currently has 113 companies in its portfolio. It has interests in multiple sectors but a preference for A.I. and Big Data technologies underpinning them. It has managed 35 exits to date including Farfetch and Huffington Post. Its recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$22m Series A round of Kheiron, a breast cancer-detecting health tech.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

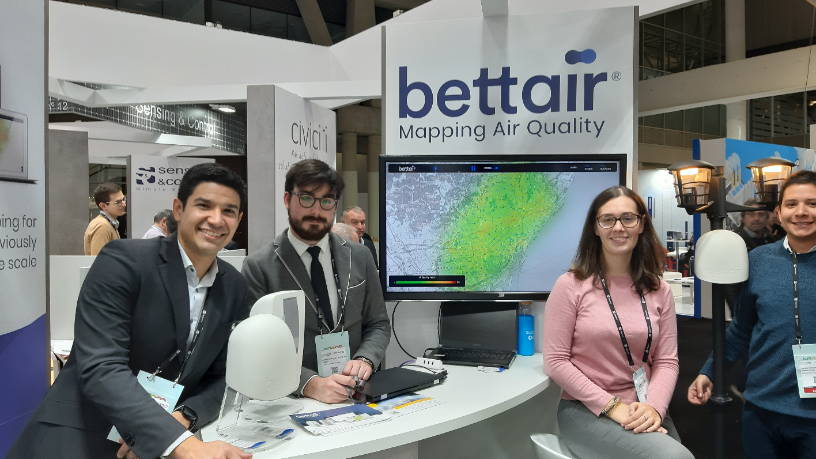

Bettair's air pollution monitoring system for cities promises over 90% accuracy

Combining smart sensors, AI and machine learning, Barcelona-based Bettair has developed a unique, affordable PaaS to accurately measure pollution levels in urban areas

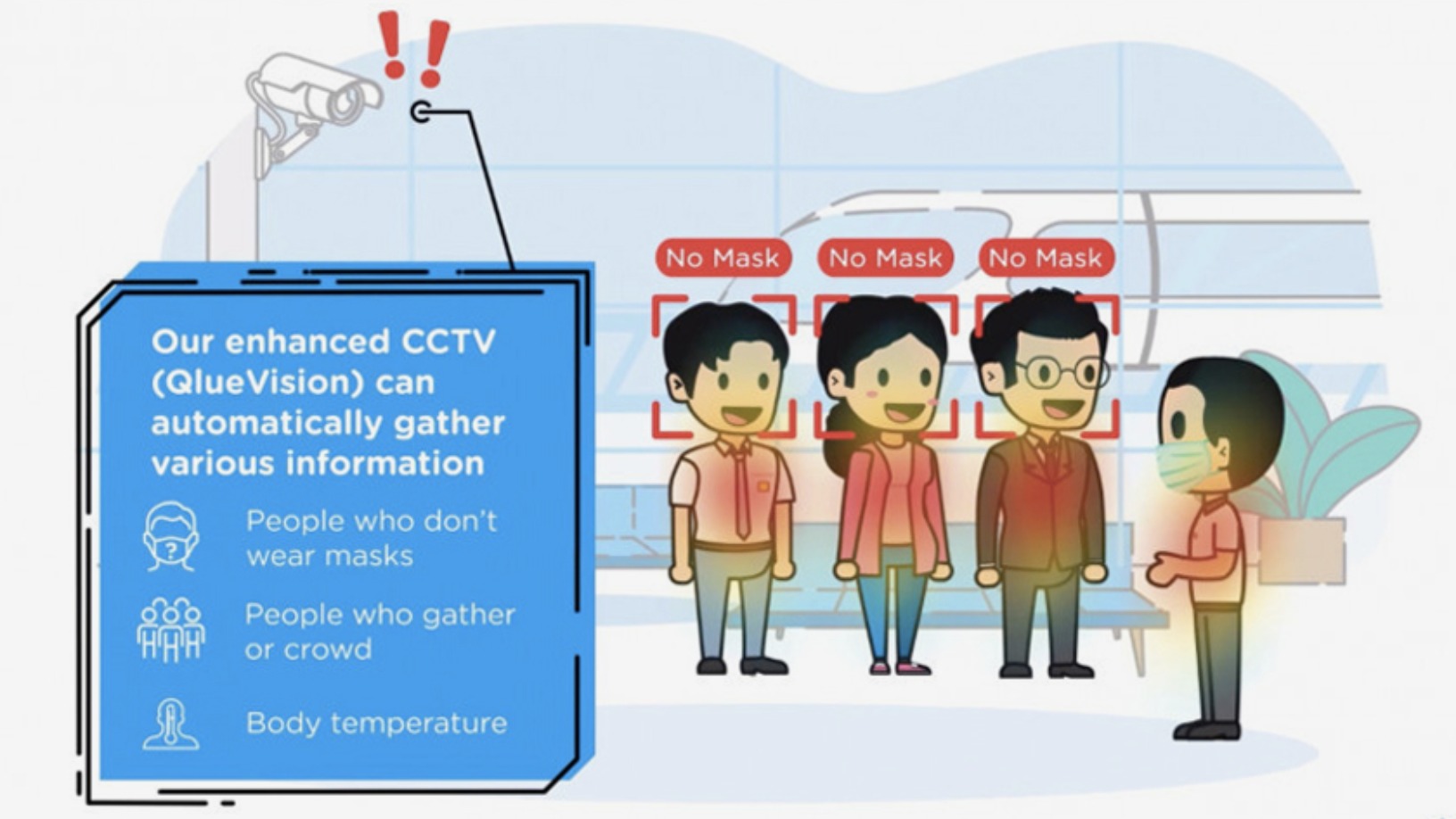

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Vadecity: Stop bicycle theft with an intelligent bike-parking system

The Barcelona-based startup wants more people to bike by offering flexible, affordable parking with its Vadebike solution

Automated marketing platform Frizbit reaches over 1bn end-users; seeks European, LatAm expansion

Using AI and proprietary technology, Frizbit aims to help clients retain customers with personalized and automated push notification campaigns

Cecilia Tham: the power of shifting paradigms

The embodiment of unconventional thinking and creativity, this female entrepreneur from Hong Kong has been pioneering social transformation within Barcelona's startup ecosystem since 2011

Iomob: Universal mobility app to help people find best route from A to B

Rapid growth in MaaS will boost revenue to over €1m by 2020 for Spanish transport app Iomob

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

Napbox: Sleeping capsule mania takes off in Spain

Napbox's on-demand and intelligent cabins give privacy and connectivity in public spaces and offices

Eliport: Friendly neighborhood robots for cheaper last-mile deliveries

The Spanish logistics robot maker has a solution to improve last-mile delivery, with community-based smart robots, parcel hubs and postboxes. CompassList spoke to its co-founders at the recent 4YFN conference in Barcelona

Qlue on international expansion, privacy concerns in smart cities

Qlue's CEO Rama Raditya and CCO Maya Arvini on protecting individual privacy when handling citizens' data in smart cities, the lack of clarity in regulation of use of facial recognition technology in Indonesia

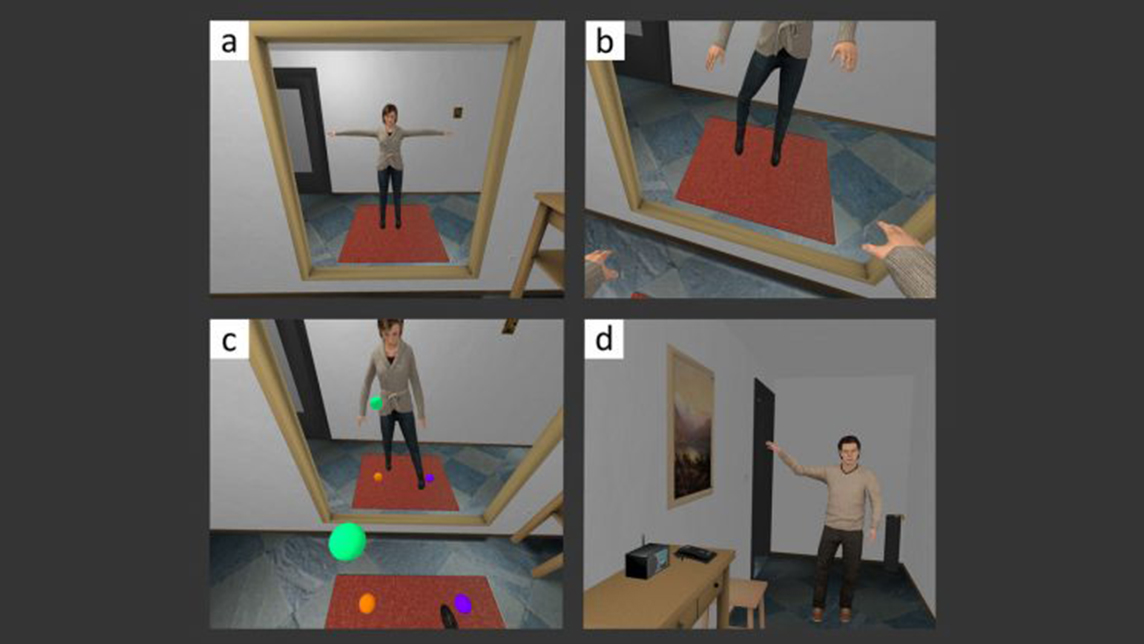

Virtual Bodyworks: VR psychotherapy to reduce crime and health issues

Applications created by the Barcelona-based startup could be used to track and influence human behavior

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Spain's gig and sharing economy startups flourish, despite barrage of restrictions

Startups like Glovo and Spotahome topped fundings raised in 2018 despite local regulatory risks, as Spanish tech firms conquer overseas markets

Sorry, we couldn’t find any matches for“Barcelona Tech City”.