Barcelona Tech City

-

DATABASE (570)

-

ARTICLES (536)

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Jeroen Merchiers is a Belgian executive based in Barcelona. He has led Airbnb EMEA expansion over the past six years and he is currently Managing Director for Airbnb in Europe, the Middle East and Africa. A commercial engineer and executive MBA from the IESE Business School, Merchiers has over 10 years' experience in management consulting for international manufacturing and supply chain companies. He was COO at Groupalia He’s also an active angel investor. Standouts in his startup portfolio include: 21Buttons, Mr. Jeff and Trip4Real (sold to Airbnb).

Jeroen Merchiers is a Belgian executive based in Barcelona. He has led Airbnb EMEA expansion over the past six years and he is currently Managing Director for Airbnb in Europe, the Middle East and Africa. A commercial engineer and executive MBA from the IESE Business School, Merchiers has over 10 years' experience in management consulting for international manufacturing and supply chain companies. He was COO at Groupalia He’s also an active angel investor. Standouts in his startup portfolio include: 21Buttons, Mr. Jeff and Trip4Real (sold to Airbnb).

The IESE BAN was formed in 2003 by a group of angel investors and entrepreneurs bringing together both alumni and non-alumni of the IESE Business School. It creates and manages deal flow for investors while establishing synergies and collaboration among the network's members. It counts on more than 250 active investors financing technology startups in Madrid and Barcelona. To-date, IESE BAN has invested more than €50m in over 220 startups. It is also part of ACCIÓ’s Network of Private Investors, which fosters technology innovation and startups’ growth in Catalonia.

The IESE BAN was formed in 2003 by a group of angel investors and entrepreneurs bringing together both alumni and non-alumni of the IESE Business School. It creates and manages deal flow for investors while establishing synergies and collaboration among the network's members. It counts on more than 250 active investors financing technology startups in Madrid and Barcelona. To-date, IESE BAN has invested more than €50m in over 220 startups. It is also part of ACCIÓ’s Network of Private Investors, which fosters technology innovation and startups’ growth in Catalonia.

Asabys Partners is a VC firm based in Barcelona and invests mainly in the healthtech and biopharma industries. Backed by Sabadell Bank, the VC now has offices in Spain, UK, Switzerland and Israel. Asabys Partners aims to accelerate technology breakthroughs in the fields of science and medicine by supporting a network of industry experts and talent.Asabys started operations in 2019 and is currently fundraising its first fund, Sabadell Asabys Health Innovation Investments, with a target size of €70m and Banc Sabadell as anchor investor. Main areas of investment include Biopharma, MedTech and Digital Therapeutics.

Asabys Partners is a VC firm based in Barcelona and invests mainly in the healthtech and biopharma industries. Backed by Sabadell Bank, the VC now has offices in Spain, UK, Switzerland and Israel. Asabys Partners aims to accelerate technology breakthroughs in the fields of science and medicine by supporting a network of industry experts and talent.Asabys started operations in 2019 and is currently fundraising its first fund, Sabadell Asabys Health Innovation Investments, with a target size of €70m and Banc Sabadell as anchor investor. Main areas of investment include Biopharma, MedTech and Digital Therapeutics.

Co-founder of Wallapop

GerardOlivé is an entrepreneur based in Barcelona, Spain, who has co-founded numerous start-ups including Wallapop, Glovo, CornerJob, Deliberry, Shoppiday, Shopery, BePretty, Mascoteros, Marmota, Havet, Prontopiso, Medox and Trendier. He also founded BeRepublic, a leading strategic consulting firm specialized in digital businesses in Southern Europe and Latin America. In 2015, he co-founded BeAgency, an interactive marketing agency firm with offices in Barcelona and Madrid. He is also a co-founder and mentor of Connector Startup Accelerator. He is currently co-CEO and co-founder of Antai Venture Builder, where he is in charge of a multi-million euro advertising inventory. He studied Audiovisual Communication at Barcelona's Ramon Llull University.

GerardOlivé is an entrepreneur based in Barcelona, Spain, who has co-founded numerous start-ups including Wallapop, Glovo, CornerJob, Deliberry, Shoppiday, Shopery, BePretty, Mascoteros, Marmota, Havet, Prontopiso, Medox and Trendier. He also founded BeRepublic, a leading strategic consulting firm specialized in digital businesses in Southern Europe and Latin America. In 2015, he co-founded BeAgency, an interactive marketing agency firm with offices in Barcelona and Madrid. He is also a co-founder and mentor of Connector Startup Accelerator. He is currently co-CEO and co-founder of Antai Venture Builder, where he is in charge of a multi-million euro advertising inventory. He studied Audiovisual Communication at Barcelona's Ramon Llull University.

Co-founder, CEO. of HypeLabs

Carlos Lei Santos is the CEO and co-founder of P2P mesh network platform HypeLabs that was established in 2015. He graduated in Computer Science at the University of Porto in 2014 while working at Simbolo II. Lei has worked for seven years as an IT manager at tech agency Simbolo II, providing assistance to clients like IBM and Banco Santander. He was also a mentor for various tech and startup initiatives.

Carlos Lei Santos is the CEO and co-founder of P2P mesh network platform HypeLabs that was established in 2015. He graduated in Computer Science at the University of Porto in 2014 while working at Simbolo II. Lei has worked for seven years as an IT manager at tech agency Simbolo II, providing assistance to clients like IBM and Banco Santander. He was also a mentor for various tech and startup initiatives.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Established in 2012, Mountain Nazca is a Latin American VC with offices in Mexico, Chile and Colombia. Its operations are centered in México City, Santiago, Buenos Aires, and Bogotá to back startups willing to consolidate their market positions in Latin American countries. The firm also facilitates cross-border investments between Europe, Latin America and the US. It has managed two exits to date, Petsy and Nubelo, and was the lead investor in 35 of its more than 60 investments. Its recent investments include Destacame's US$3 million Series A funding round, and the Series A funding rounds of Albo and Crehana.

Established in 2012, Mountain Nazca is a Latin American VC with offices in Mexico, Chile and Colombia. Its operations are centered in México City, Santiago, Buenos Aires, and Bogotá to back startups willing to consolidate their market positions in Latin American countries. The firm also facilitates cross-border investments between Europe, Latin America and the US. It has managed two exits to date, Petsy and Nubelo, and was the lead investor in 35 of its more than 60 investments. Its recent investments include Destacame's US$3 million Series A funding round, and the Series A funding rounds of Albo and Crehana.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Founded in 1976, KKR is an American private equity firm headquartered in New York City, USA. The company currently oversees investment opportunities in various industries in America, Europe and Asia, ranging from venture capital to hedge funds. As of March 2021, it has $367bn assets under management, with more than 100 companies in their investment portfolio.Its investment portfolio in Asia-Pacific includes major corporations like Panasonic, COFCO Meat and GenesisCare, as well as startups like Gojek. Elsewhere, it has invested in companies like ride-hailing startup Lyft (which has gone for an IPO), historic guitar maker Gibson, and combat sport broadcasting company UFC (Ultimate Fighting Championship).

Founded in 1976, KKR is an American private equity firm headquartered in New York City, USA. The company currently oversees investment opportunities in various industries in America, Europe and Asia, ranging from venture capital to hedge funds. As of March 2021, it has $367bn assets under management, with more than 100 companies in their investment portfolio.Its investment portfolio in Asia-Pacific includes major corporations like Panasonic, COFCO Meat and GenesisCare, as well as startups like Gojek. Elsewhere, it has invested in companies like ride-hailing startup Lyft (which has gone for an IPO), historic guitar maker Gibson, and combat sport broadcasting company UFC (Ultimate Fighting Championship).

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Co-founder of Squirrel AI

Squirrel AI co-founder Jeff Wang Feng started as an academic. He received his PhD in instructional technology from the University of Georgia in 2006. He then conducted postdoctoral research at the University of Pennsylvania from 2006–2007 and the University of Virginia from 2007–2008.Wang was Director of Distance Education at Mount Saint Mary College in New York state from 2008–2011. From 2011–2014, he was Director of John Jay Online, in the John Jay College of Criminal Justice, part of the City University of New York, In 2015, Wang returned to China and joined Squirrel AI as a co-founder. In 2016, he left Squirrel AI and founded his own adaptive learning startup, Learnta Inc, of which he is CEO.

Squirrel AI co-founder Jeff Wang Feng started as an academic. He received his PhD in instructional technology from the University of Georgia in 2006. He then conducted postdoctoral research at the University of Pennsylvania from 2006–2007 and the University of Virginia from 2007–2008.Wang was Director of Distance Education at Mount Saint Mary College in New York state from 2008–2011. From 2011–2014, he was Director of John Jay Online, in the John Jay College of Criminal Justice, part of the City University of New York, In 2015, Wang returned to China and joined Squirrel AI as a co-founder. In 2016, he left Squirrel AI and founded his own adaptive learning startup, Learnta Inc, of which he is CEO.

Co-founder and CEO of CouncilBox

A physicist from Galicia with entrepreneurial experience, Víctor López García started his professional career as a sales support engineer at Telefónica. In 2002, he co-founded and became CEO of AVA Soluciones Teconológicas.He is the president of EGANET, the association of new tech and internet companies in Galicia. Since 2016, he has been the CEO and co-founder of Councilbox, a blockchain-powered legal tech SaaS that registers and validates certifications and remote corporate meetings.

A physicist from Galicia with entrepreneurial experience, Víctor López García started his professional career as a sales support engineer at Telefónica. In 2002, he co-founded and became CEO of AVA Soluciones Teconológicas.He is the president of EGANET, the association of new tech and internet companies in Galicia. Since 2016, he has been the CEO and co-founder of Councilbox, a blockchain-powered legal tech SaaS that registers and validates certifications and remote corporate meetings.

CEO and founder of Shiheng Tech

Fang Shihun is a serial entrepreneur who graduated with a BSc Applied Mathematics at Emory University in 2014. He founded Shanghai-based Pingyuan App-Ark Education Consulting and became its president from 2009 to January 2015. He also co-founded Shanghai Sanxin Investment Ltd in February 2015 and founded Puyang Food in July the same year. Shiheng Tech was founded in April 2017. Based in Shanghai, he is now the CEO at Puyang Food and Shiheng Tech.

Fang Shihun is a serial entrepreneur who graduated with a BSc Applied Mathematics at Emory University in 2014. He founded Shanghai-based Pingyuan App-Ark Education Consulting and became its president from 2009 to January 2015. He also co-founded Shanghai Sanxin Investment Ltd in February 2015 and founded Puyang Food in July the same year. Shiheng Tech was founded in April 2017. Based in Shanghai, he is now the CEO at Puyang Food and Shiheng Tech.

Co-Founder of Zhuazhua

In his nine years at Tencent, Jia Jinlin was at one time heading the operations of the tech giant’s most profitable gaming unit.

In his nine years at Tencent, Jia Jinlin was at one time heading the operations of the tech giant’s most profitable gaming unit.

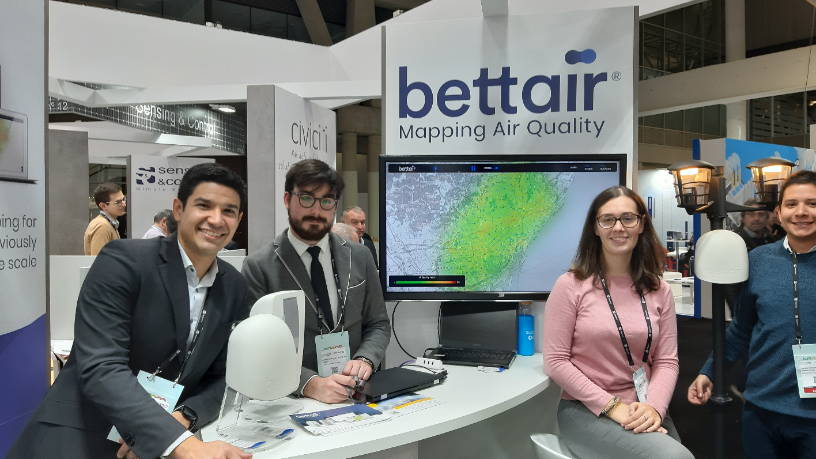

Bettair's air pollution monitoring system for cities promises over 90% accuracy

Combining smart sensors, AI and machine learning, Barcelona-based Bettair has developed a unique, affordable PaaS to accurately measure pollution levels in urban areas

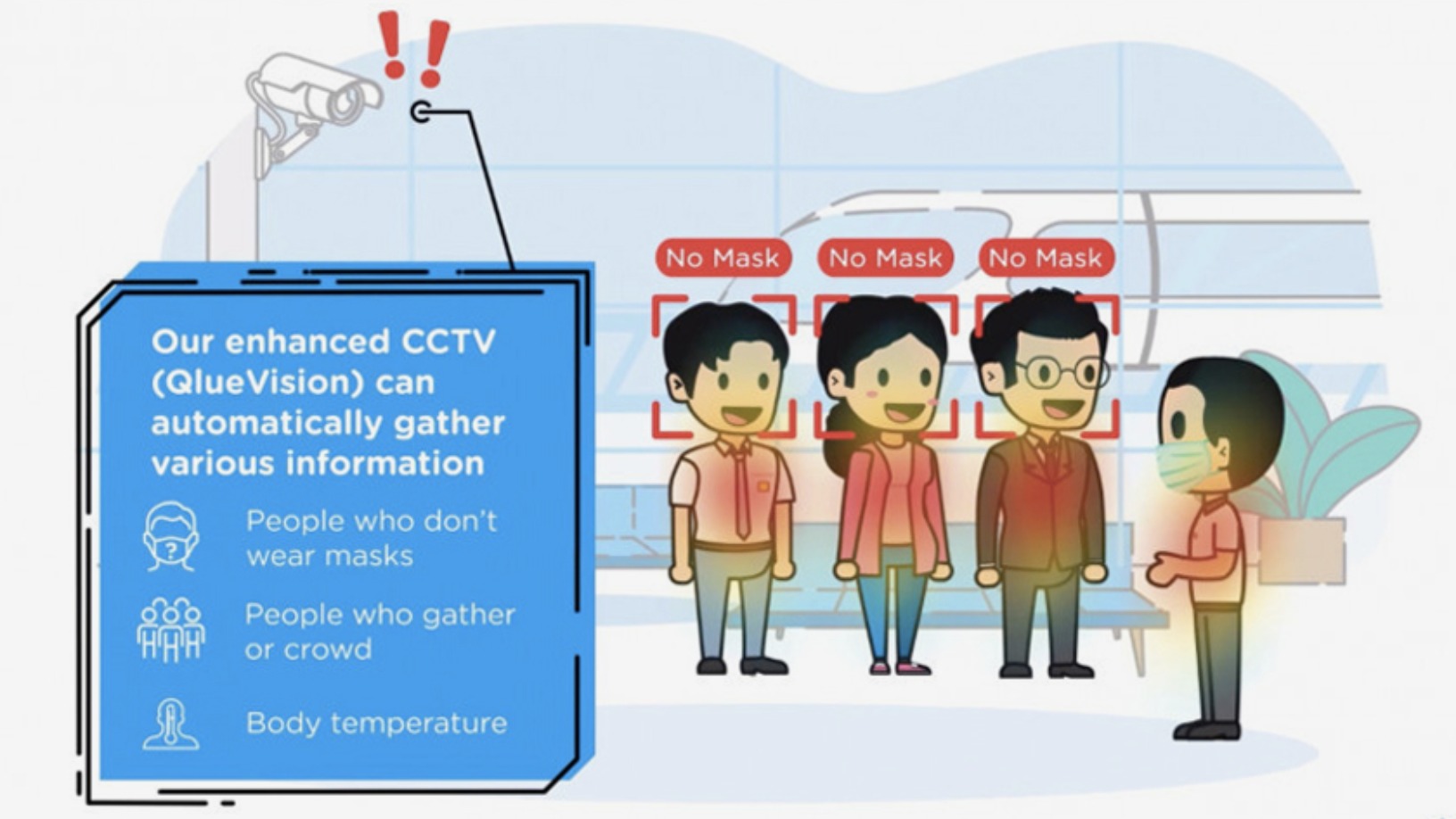

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Vadecity: Stop bicycle theft with an intelligent bike-parking system

The Barcelona-based startup wants more people to bike by offering flexible, affordable parking with its Vadebike solution

Automated marketing platform Frizbit reaches over 1bn end-users; seeks European, LatAm expansion

Using AI and proprietary technology, Frizbit aims to help clients retain customers with personalized and automated push notification campaigns

Cecilia Tham: the power of shifting paradigms

The embodiment of unconventional thinking and creativity, this female entrepreneur from Hong Kong has been pioneering social transformation within Barcelona's startup ecosystem since 2011

Iomob: Universal mobility app to help people find best route from A to B

Rapid growth in MaaS will boost revenue to over €1m by 2020 for Spanish transport app Iomob

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

Napbox: Sleeping capsule mania takes off in Spain

Napbox's on-demand and intelligent cabins give privacy and connectivity in public spaces and offices

Eliport: Friendly neighborhood robots for cheaper last-mile deliveries

The Spanish logistics robot maker has a solution to improve last-mile delivery, with community-based smart robots, parcel hubs and postboxes. CompassList spoke to its co-founders at the recent 4YFN conference in Barcelona

Qlue on international expansion, privacy concerns in smart cities

Qlue's CEO Rama Raditya and CCO Maya Arvini on protecting individual privacy when handling citizens' data in smart cities, the lack of clarity in regulation of use of facial recognition technology in Indonesia

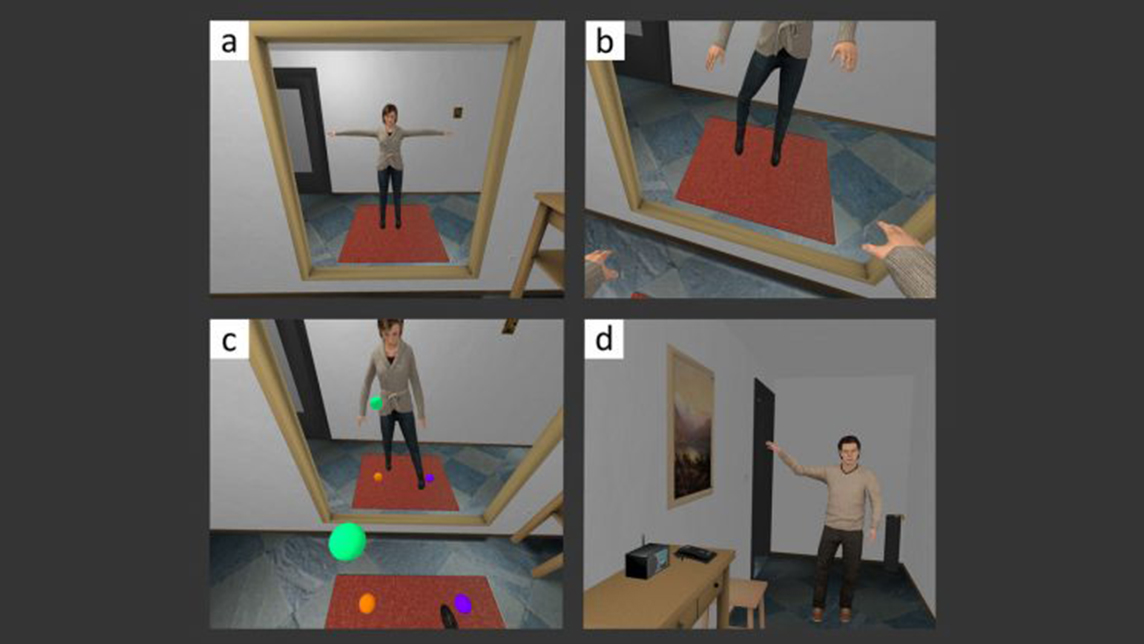

Virtual Bodyworks: VR psychotherapy to reduce crime and health issues

Applications created by the Barcelona-based startup could be used to track and influence human behavior

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Spain's gig and sharing economy startups flourish, despite barrage of restrictions

Startups like Glovo and Spotahome topped fundings raised in 2018 despite local regulatory risks, as Spanish tech firms conquer overseas markets

Sorry, we couldn’t find any matches for“Barcelona Tech City”.