Beyond Investing

-

DATABASE (131)

-

ARTICLES (254)

Italy's first impact investment fund is focused mainly on assisting Italian startups. Its investment size ranges from €200,000 to €6m. Oltre Venture was founded in 2006 as Oltre Venture I by Luciano Balbo and Lorenzo Allevi, both pioneers in Europe's impact investing ecosystem and each with extensive experience in investment banking, corporate finance and VC firms.In 2016, the company launched a second investment vehicle (Oltre Venture II) which currently has a portfolio of more than 22 startups.

Italy's first impact investment fund is focused mainly on assisting Italian startups. Its investment size ranges from €200,000 to €6m. Oltre Venture was founded in 2006 as Oltre Venture I by Luciano Balbo and Lorenzo Allevi, both pioneers in Europe's impact investing ecosystem and each with extensive experience in investment banking, corporate finance and VC firms.In 2016, the company launched a second investment vehicle (Oltre Venture II) which currently has a portfolio of more than 22 startups.

Founded in 1993, WI Harper Group is a venture capital firm investing in early to growth stage companies across the US, Greater China and Asia Pacific. The group has invested in more than 400 companies in the fields of healthcare, biotech, artificial intelligence, robotics, fintech, sustainability and new media. It manages seven venture capital funds with over 100 successful IPO and M&A exits. With three strategic offices in San Francisco, Beijing and Taipei, the group seeks investment opportunities both in the US and Asia.

Founded in 1993, WI Harper Group is a venture capital firm investing in early to growth stage companies across the US, Greater China and Asia Pacific. The group has invested in more than 400 companies in the fields of healthcare, biotech, artificial intelligence, robotics, fintech, sustainability and new media. It manages seven venture capital funds with over 100 successful IPO and M&A exits. With three strategic offices in San Francisco, Beijing and Taipei, the group seeks investment opportunities both in the US and Asia.

Carlos Gallardo is an industrial engineer with an MBA from Stanford University. He spent most of his career at the pharmaceutical company Almirall and was promoted through the ranks rapidly holding multiple C-level roles. He became the MD for UK and Ireland for over five years and joined Almirall’s board of directors in 2014.In 2015, he founded CG Health Ventures, a VC firm investing in early-stage digital health companies worldwide. He’s also an active angel investor and advisor for startups developing frontier technologies in the healthcare sector.

Carlos Gallardo is an industrial engineer with an MBA from Stanford University. He spent most of his career at the pharmaceutical company Almirall and was promoted through the ranks rapidly holding multiple C-level roles. He became the MD for UK and Ireland for over five years and joined Almirall’s board of directors in 2014.In 2015, he founded CG Health Ventures, a VC firm investing in early-stage digital health companies worldwide. He’s also an active angel investor and advisor for startups developing frontier technologies in the healthcare sector.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

The Rise Fund is a $2bn impact investing fund co-founded by U2 front man Bono, Bill McGlashan and Jeff Skoll. The fund has partnered with nonprofit consultancy The Bridgespan Group to develop an evidence-based model for quantifying the impact of the firm’s investments.The global impact investment vehicle is managed by TPGGrowth, part of the multibillion-dollar investment firm TPG that focuses on growth equity investments and mid-market buyouts. As of December 2019, the fund has deployed $1.4bn across its investment portfolio.

The Rise Fund is a $2bn impact investing fund co-founded by U2 front man Bono, Bill McGlashan and Jeff Skoll. The fund has partnered with nonprofit consultancy The Bridgespan Group to develop an evidence-based model for quantifying the impact of the firm’s investments.The global impact investment vehicle is managed by TPGGrowth, part of the multibillion-dollar investment firm TPG that focuses on growth equity investments and mid-market buyouts. As of December 2019, the fund has deployed $1.4bn across its investment portfolio.

Toyota AI Ventures, the venture capital arm of the Toyota Research Institute, is a Silicon Valley-based fund investing globally in startups with cutting-edge solutions in the AI, smart-mobility, autonomy, robotics, data and cloud spaces while leveraging the global expertise and technical resources of the Toyota Group.In 2015 Toyota created the Toyota Research Institute aiming to support the research on next-generation mobility, robotics and new materials. Toyota AI Ventures was founded in 2017 with initial funding of $100m.

Toyota AI Ventures, the venture capital arm of the Toyota Research Institute, is a Silicon Valley-based fund investing globally in startups with cutting-edge solutions in the AI, smart-mobility, autonomy, robotics, data and cloud spaces while leveraging the global expertise and technical resources of the Toyota Group.In 2015 Toyota created the Toyota Research Institute aiming to support the research on next-generation mobility, robotics and new materials. Toyota AI Ventures was founded in 2017 with initial funding of $100m.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

Established in 1996, SBI Investment is a venture capital firm that focuses on growth sectors such as information technology, biotechnology, life science, mobile, environment and energy. The VC arm of the SBI Group is developed to quickly find new, emerging technologies and investing in those technologies to further the development of the group. SBI Group then introduces the new technologies to existing businesses in order to help them stay ahead in the market, as well as to revitalize local industries in Japan, particularly in the financial and banking sectors.

Established in 1996, SBI Investment is a venture capital firm that focuses on growth sectors such as information technology, biotechnology, life science, mobile, environment and energy. The VC arm of the SBI Group is developed to quickly find new, emerging technologies and investing in those technologies to further the development of the group. SBI Group then introduces the new technologies to existing businesses in order to help them stay ahead in the market, as well as to revitalize local industries in Japan, particularly in the financial and banking sectors.

The late-stage venture capital and growth equity firm founded and led by Russian billionaire Yuri Milner manages about $10bn in assets. Among its well-known investments are Facebook, Twitter, Alibaba, Xiaomi, JD.com, Spotify, Flipkart and AirBnB.DST Global was founded in 2009 as a means for Milner’s Mail.ru to continue investing at scale, by separately managing investment activities from the Mail.ru primary business. In 2012, Milner stepped down from Mail.ru to focus on DST Global, and DST Global eventually became fully independent from Mail.ru.

The late-stage venture capital and growth equity firm founded and led by Russian billionaire Yuri Milner manages about $10bn in assets. Among its well-known investments are Facebook, Twitter, Alibaba, Xiaomi, JD.com, Spotify, Flipkart and AirBnB.DST Global was founded in 2009 as a means for Milner’s Mail.ru to continue investing at scale, by separately managing investment activities from the Mail.ru primary business. In 2012, Milner stepped down from Mail.ru to focus on DST Global, and DST Global eventually became fully independent from Mail.ru.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

Apostolos Apostolakis is a serial entrepreneur turned investor. He has a Civil Engineering degree from NTUA and an MBA from Columbia Business School. His entrepreneurial career started after working two years as a consultant for the Boston Consulting Group until 2004. He became a co-founder and board member of various companies including VentureFriends, InstaShop, Douleutaras.gr, e-food.gr, Doctoranytime.gr and Blueground (formerly Openfund and Taxibeat). In 2010, he started investing in other startups, focusing on e-marketplaces and SaaS.

Apostolos Apostolakis is a serial entrepreneur turned investor. He has a Civil Engineering degree from NTUA and an MBA from Columbia Business School. His entrepreneurial career started after working two years as a consultant for the Boston Consulting Group until 2004. He became a co-founder and board member of various companies including VentureFriends, InstaShop, Douleutaras.gr, e-food.gr, Doctoranytime.gr and Blueground (formerly Openfund and Taxibeat). In 2010, he started investing in other startups, focusing on e-marketplaces and SaaS.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Ajaib targets millennials with easy-to-use investment app

Y Combinator alumnus Ajaib recently acquired a local brokerage to add stock trading to its products

Tiger Brokers: At the right place, at the right time

China’s new middle-class elite is educated and tech-savvy – and they want to put their money in US stocks. A fintech app is cashing in on this

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

Bob Xu, one of China's first and most successful angel investors

Known for his whimsical investment style, Xu has caught a number of unicorns

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

Spotahome CTO: Room for more real estate disruption, beyond rentals

Bryan McEire, CTO and co-founder of the Spanish proptech startup, details their expansion plans this year and more, in a wide-ranging interview

Dronak looks beyond the skies to a future of robotics

Dronak CEO Fabia Silva wants to make the world a better place through robotics innovation, but needs funding so the company can spread its tech wings past drones

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

SWITCH Singapore: VCs urge startups to think beyond Covid-19

VCs also discuss prospects of a current tech bubble, and whether new working and hiring practices sparked by the pandemic could end Silicon Valley dominance

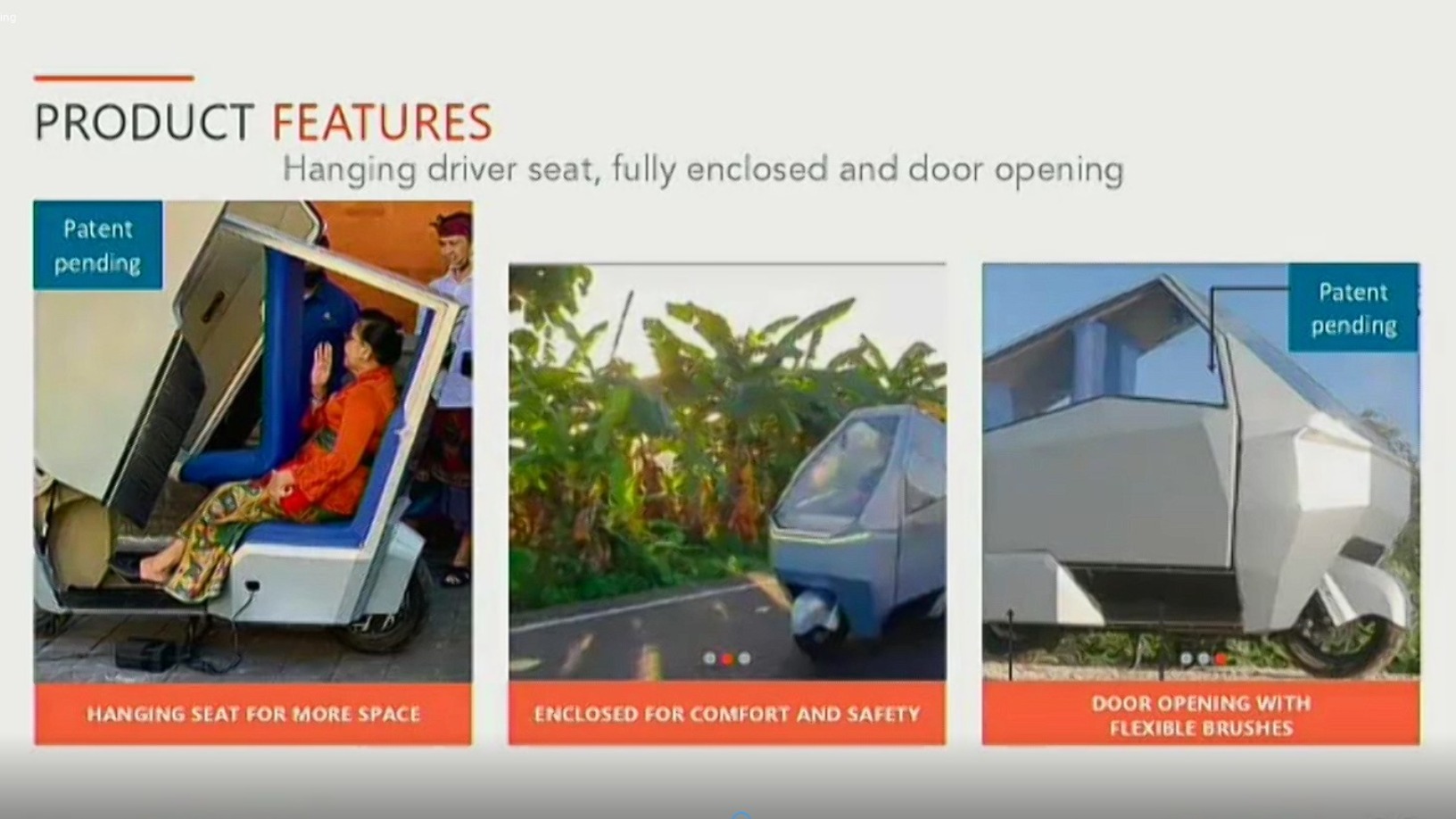

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Sorry, we couldn’t find any matches for“Beyond Investing”.